Unclaimed Money Lookup - Alabama

Free Alabama Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

(advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Alabama Unclaimed Money -

The Ultimate Guide 2026

- UPDATED February 2026

Are you looking for unclaimed money in Alabama and don’t know where to turn? We’ll show you how to access the database in the state and get your money.

Contents

- What is Unclaimed Money?

- What Are Some Examples of Unclaimed Property or Money?

- Why Do States Have Unclaimed Money Registers?

- How Much Unclaimed Property Is Out There?

- How Do I Find Unclaimed Money?

- Sources for Unclaimed Property Other Than the State Databases

- Alabama’s Unclaimed Property Database

- What Information Do You Need to Run an Unclaimed Property Search?

- What Are the Steps to Making an Unclaimed Money Claim?

- How Much Unclaimed Money is in Alabama?

- Does Alabama Keep All Unclaimed Money Until the Actual Owner is Located?

- Alabama Unclaimed Money Finder

- Unclaimed Money Laws in Alabama

- Should I Hire a Finder to Conduct the Search?

- How Can I Prevent My Property From Becoming Lost or Unclaimed?

What is Unclaimed Money?

Unclaimed money is a term that experts use to refer to money that the original owner abandoned. It can also refer to property that someone owned. Both money and property only become abandoned in Alabama if there was no activity on the account for a minimum of one year or 12 months. It’s easy to see how funds go unclaimed when you consider everything that you did in the last few years. You might move to a new home or change jobs without leaving a forwarding address.

When you switch banks, you risk employers and others trying to deposit money into an account that no longer exists. As long as the funds are in your name, they still belong to you. You have the legal right to request it.

What Are Some Examples of Unclaimed Property or Money?

One thing to keep in mind is that unclaimed property and money can be both tangible and intangible. Tangible funds include things that you can put your hands on and touch. Intangible funds include things that you cannot touch such as a paycheck from an old employer. Paychecks are among the more common unclaimed funds in the state.

Not everyone leaves a job on a good note. You might leave after an altercation with a new supervisor or because your boss denied you a promotion. Though you expect to get your last paycheck, there’s a chance that you didn’t get all the money that you made. An employer may later realize that you didn’t get money for your vacation and sick days. Employers can also make mistakes and lose the contact information needed to get in touch with former employees.

Paychecks are far from the only unclaimed funds that are out there. Let’s say that opened a bank account and later moved to a different bank without changing over your account information. The bank might get one or more deposits sent to a closed account. It’s also possible that you had a bank account that you forgot about.

This might include one that you opened as a child with your parents or one that you had when you started your career. Those accounts might still be out there and earning you interest without you knowing

Trusts are another example of when you might have unclaimed money in your name. Many people set up trusts as a way to protect their assets. They name their heirs who will benefit from their estates. When a loved one passes away, there is a chance that they left either money or property to you. If the lawyer in charge of the estate could not locate you, they cannot tell you about what you inherited.

When someone passes away, you may not know that they listed your name on other accounts, too. A good example is a bank account with a payable on death note. This note states that when the person listed on the account dies, the funds in the account go to the receiver. Though the receiver is usually the person’s next of kin, it can include a friend or distant relative. The same thing can happen to life insurance policies. Though the insured should name a beneficiary, the insurer doesn’t always have contact information for them. You might have thousands of dollars or more listed in your name somewhere in Alabama. Other examples of intangible funds include certificates of deposit, utility deposits, traveler’s checks, annuities and stocks.

You can also inherit tangible property when someone dies. A good example is a safe deposit bank. Many financial institutions allow customers to open safe deposit accounts and store property in small boxes that are safely secured in the bank. If your name is on the account, or you are the person’s next of kin, the property belongs to you. The same holds true for physical property such as your family home.

When an individual dies without a will, Alabama law requires that you go through probate if the estate has a value of $25,000 or more. The probate court will assign someone to serve as the executor of the estate. That individual is responsible for making sure that the bills are paid. Even if the deceased left a will, you need to go through probate. The executor needs to make sure that everyone in the will gets what the deceased wished. Though state law gives you five years to open probate, there is no guarantee that the executor will find you. You may learn years later that the deceased left a piece of property to you.

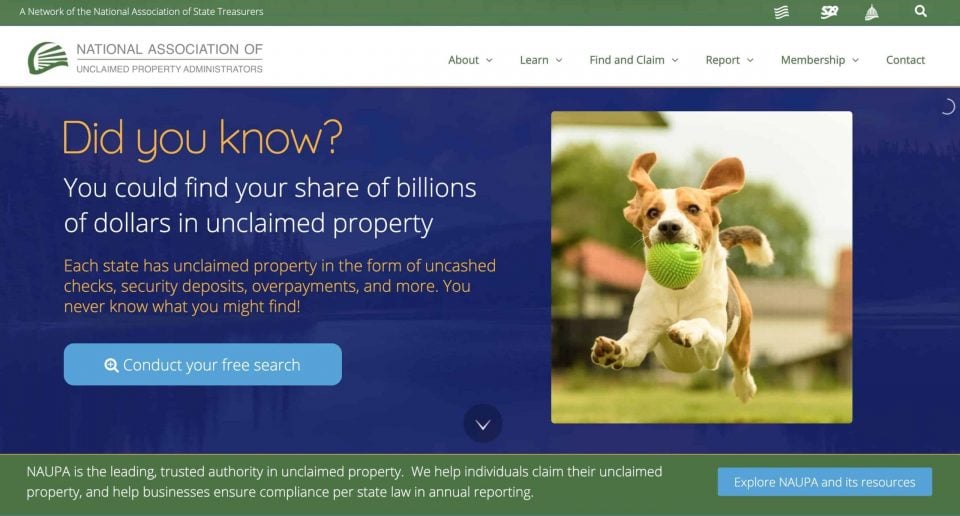

Why Do States Have Unclaimed Money Registers?

The National Association of Unclaimed Property Administrators is an organization devoted to helping people find lost money and unclaimed property. This organization found that all 50 states have unclaimed money registers. If you lived in more than one state over the years, you can search each state to find unclaimed money and property in your name. You will then need to follow the rules in each state to get your funds.

How Much Unclaimed Property Is Out There?

There is approximately $58 billion in unclaimed money and property in the United States. This equates to around $180 for each person living in the United States. When you search for your money, you have the chance to see roughly how much is in your name.

Many states will tell you if the amount is less than $100 or above $500. While you might think that it’s not worth your time or money to claim smaller funds, the money can add up. You can often have the money sent to your current bank account to get it quickly, too.

How Do I Find Unclaimed Money?

The easiest way to find unclaimed money in Alabama is with our search box, which you’ll see on the top of the page. You just need to enter your first and last name before choosing Alabama as the site that you want to search. We’ll then show you all the money that we found and what you can do to claim it. You can also search for money held in the name of a business. Let’s say that you opened a small business when you finished college and later closed your doors. A simple search can help you find funds that your business lost over the years such as a deposit from a utility company or money that a vendor sent. You can also search with the names of your living or deceased relatives.

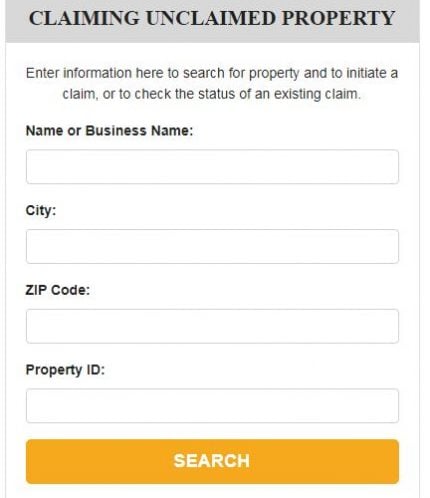

Alabama has a money register that lets you search in several ways. The easiest way is through the name search. You simply enter your name or the name of your business and search. Alabama will then show you all funds and properties that match your search. If you have a property ID, you can search for it, too.

This is helpful if you know that someone in your family owned a piece of property, but you don’t know what happened to it over the years. You can also narrow down your search by the zip code or city where you lived or worked.

Sources for Unclaimed Property Other Than the State Databases

You have more chances to search for unclaimed properties and funds beyond the state database. The Federal Deposit Insurance Corporation is responsible for keeping track of deposits sent to financial institutions. It allows you to search for funds held by a closed bank.

The National Credit Union Administration is similar and lets you search for money from credit unions that shut down. If you or a loved one had a federal mortgage, check with the US Department of Housing and Urban Development.

This helps you find refunds issued by the federal government and its agencies to those with certain types of mortgages.

You’ll also want to check the undeliverable federal checks website. If the IRS ever tried to send you a check and saw it come back, you can use this site to find and claim the money.

The Pension Benefit Guaranty Corp is the best place to look for pension funds if worked for a company that shut down or had a pension fund that went missing. Other resources that can help you find unclaimed funds include the US Department of Veterans’ Affairs and the US Railroad Retirement Board.

Alabama’s Unclaimed Property Database

The Alabama Office of State Treasurer maintains the unclaimed money database for the state. Called the Unclaimed Property Division, it has a simple search form to help you find your money.

You need to enter your name or the name of your business and your zip code. If you want to view all the results, you can use just your name. We recommend using both your last name and first initial. This helps you find funds that went missing because someone spelled your name wrong or had the wrong address for you. Once you find money or property, you can follow the steps to get it.

What Information Do You Need to Run an Unclaimed Property Search?

Despite what you might think, you don’t need a lot of information to run an unclaimed property search. As long as you have a name, you can search the database. We often recommend that you start with just your last name.

If the database finds too many results, it will give you an error message. You can then add more information to narrow down your search. Alabama also lets you search for unclaimed money and property listed in the name of a business.

What Are the Steps to Making an Unclaimed Money Claim?

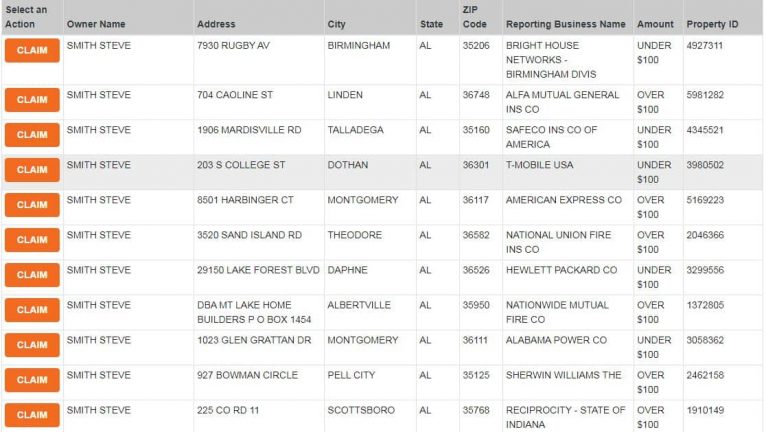

Once you search the database, you need to look through the results to find money that is for you and not someone with the same name. Alabama shows you both the full name and address associated with each account. This ensures that you find funds connected to your previous addresses.

You can also see the name of the company or business that holds the money, which allows you to see if the money came from an old employer or utility company. You also get to see roughly how much money is there.

You will then need to click the orange “Claim” button. Alabama allows you to claim multiple items at the same time and view them on a new page.

If you look to the right, you will see “Claim Relationship” with a drop-down menu. When you click this menu, you can choose whether you are the owner of the funds or an heir to a deceased owner.

The state also has options for estate and business representatives. You then need to click the “File Claim” button and fill out a form that shows you are the person on the account. Alabama will issue a preliminary claim summary and then send paperwork to your address. You need to complete the paperwork to have the funds released.

How Much Unclaimed Money is in Alabama?

In February of 2021, State Treasurer John McMillian announced that his department had reports of more than $1 billion in unclaimed funds in Alabama. This includes valuables that financial institutions found in safe deposit banks and physical properties along with insurance benefits and stocks and bonds. His department is responsible for helping owners find and claim the money.

Does Alabama Keep All Unclaimed Money Until the Actual Owner is Located?

Alabama requires that the holders of properties and money attempt to notify the owner. If 120 days pass with no response from the owner, the holder can then contact the State Treasurer. The state will then take custody of the money and hold it until finding the rightful owner. Alabama also keeps all unclaimed money until the owner or someone on behalf of the owner files a claim. It makes attempts to find the owner through the use of postcards sent to their previous addresses. If you receive one of these cards, you can fill it out and return it to get your money.

Alabama Unclaimed Money Finder

The Alabama Unclaimed Property Division makes it easy for you to find both money and property in your name. General searches let you view unclaimed funds in the name of anyone who shares your last name. With a specific search, you can view the funds attached to your former home or business. If you have a loved one who passed away, you can also search for their names. Alabama allows you to file a claim for their funds if you are an heir or an estate representative.

Unclaimed Money Laws in Alabama

Alabama has set laws regarding unclaimed money in the state. The holder is the person who holds the funds and may include a bank that has a checking account or a lawyer who oversees a trust. The Alabama law requires that the holder attempt to locate the owner who is the person who has a rightful claim to the money. The holder must report the funds no more than 120 days and no less than 60 days after trying to locate the owner.

A holder can take possession of the funds if it has a value of more than $50, they have an accurate address for the owner, and they can file a claim that meets the state’s statute of limitations.

When the holder files a report with the State Treasurer, they must present the funds when they file. The only exception is with physical items such as the contents of a safe deposit box. They then have up to 120 days after filing a report to present the items. Alabama requires that the holder keep all documents relating to the case for a minimum of three years up to 10 years. Those who do not deliver the funds to the department face fees of $1,000 a day or up to $5,000 until they comply.

If you file a claim through the Unclaimed Property Division, you have up to 120 days to complete your filing. Alabama will use the information that you share to send a claim form to your home. This form asks for your driver’s license number or other information to confirm your identity. If you do not file a claim within 120 days, the funds will return to the State Treasurer. You will then need to go online and start the process over. The same rules apply if you file a claim on the behalf of another person.

Should I Hire a Finder to Conduct the Search?

Many sites claim that you need to hire a finder or a lawyer to help you with your search. While some charge a flat fee to search and file claims for you, others take a percentage of the money that you get. When you have $500 in old paychecks waiting for you, you probably don’t want to spend $50 or more to have someone claim it for you. The resources that we provide make it easy for you to find unclaimed money in Alabama and claim it.

How Can I Prevent My Property From Becoming Lost or Unclaimed?

There are several things that you can do to prevent your property from going unclaimed or becoming lost. You should always make sure that your information is up to date. When you move to a new place, update your accounts with the new address, even if you just move to a different apartment or a new neighborhood in the same town. It’s also important that you update your accounts if your name changes, including if you get married or divorced. Name changes can make it harder for you to claim your money.

You should also keep records that list the names of institutions that hold your funds and your account numbers. We recommend storing those documents in a fireproof box and telling your family about them. You can do the same thing with your elderly loved ones and encourage them to keep their documents safe. Another helpful tip is to use each account at least once a year. Even something as simple as logging in and viewing your balance shows that you are alive. If you do not use your accounts regularly, some institutions will think that you abandoned them.

Alabama Unclaimed Money FAQ

How Long Does Alabama Hold Unclaimed Property?

Alabama will indefinitely hold any unclaimed property or money turned over to the State Treasurer. The Treasurer will keep both tangible and intangible properties until it either locates the owner or the owner comes forward.

How Long Does it Take to Get Your Money?

Once you file a claim online, Alabama will send the claim form to your listed address within two weeks. You should complete and return the form as soon as possible. In most cases, you will get a check in your name within another two weeks.

What Happens if I File a Claim and Forget?

You don’t need to worry about your money disappearing if you don’t submit the claim. Alabama will remove the listing from its database when you file. You have 120 days to complete the form and send it back. If you forget to return the claim, the state will return the listing to the database. You can then file a new claim for your money.

Conclusion

No matter how old you are, you might have thousands of dollars waiting for you in unclaimed money. Those funds can include old bank accounts that you had, paychecks that employers never delivered to you, life insurance policies that list you as a beneficiary and safe deposit boxes that loved ones held. No matter what type of unclaimed money or property is in your name in Alabama, you can easily claim it and have it transferred to you.

Quickly Search For Unclaimed Money

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.