Copyright © 2024 · OurPublicRecords.org · All Rights Reserved

Free Colorado Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Learn more about the more than $600 million in unclaimed property held by Colorado and how to claim your property.

Do you live in The Centennial State and keep hearing about unclaimed property? Maybe you wonder if there is any money that you can claim and how much you can get. While some people file claims that put thousands of dollars in their bank accounts, others file claims that are worth smaller amounts. We created the ultimate guide to Colorado unclaimed money as a way to help you get all the cash that is waiting for you.

Before we look at how to search the database and file claims, we wanted to make sure that you understand the types of unclaimed money found in Colorado. Though you might think of the abandoned homes in your neighborhood, Colorado does not list real estate as a type of unclaimed property. This term instead describes money and property held by one entity for another. Banks are among the more common of holders. They are responsible for holding the contents of safe deposit banks along with cash and checks that their customers deposit.

Payroll checks are another example of unclaimed property in Colorado. Federal law requires that an employer pay an employee the total amount that they made for the hours that they worked. This includes any overtime hours that they worked and vacation time that they accumulated. When you change jobs, your employer may have one final paycheck that you never claimed. They can send it to your old address and see it come back, but that doesn’t mean that the money went away. It still exists in your name and should appear in the Colorado database. Any check that you never cashed should show up in the database, too.

Another example is a utility refund. Utility providers often offer refunds to customers when they pay more than they owe. Let’s say that you need to shut off the power to your old home when moving and send a final check to pay off your balance. If you sent more than you needed to pay, the provider will issue a refund check. Refund checks also go to those who paid utility deposits and never got their money back.

You might find insurance checks in the Colorado database, too. When you’re in a car accident, an insurer may cut a check to the shop that repairs your car. That shop may not use the full amount and send back the balance to your insurer. The insurer is then responsible for sending you a check for the remainder. You’ll also find insurance checks associated with policies that you no longer have and policies that loved ones bought. If a relative such as a parent or a grandparent listed you as a beneficiary on an insurance policy and you didn’t know it, that policy is still waiting for someone to claim it. Stocks, bonds, and money orders are other examples of unclaimed property.

The most recent report found that The Centennial State holds more than $600 million in unclaimed money. This includes both assets and money. Most unclaimed property comes in the form of money such as a check, but you may have some forgotten assets, too. Did you have a safe deposit box that you used for a few things and then forgot to visit? The bank will eventually contact the state about your box and turn over the contents. Colorado helped return more than $520 million to people since launching its online database.

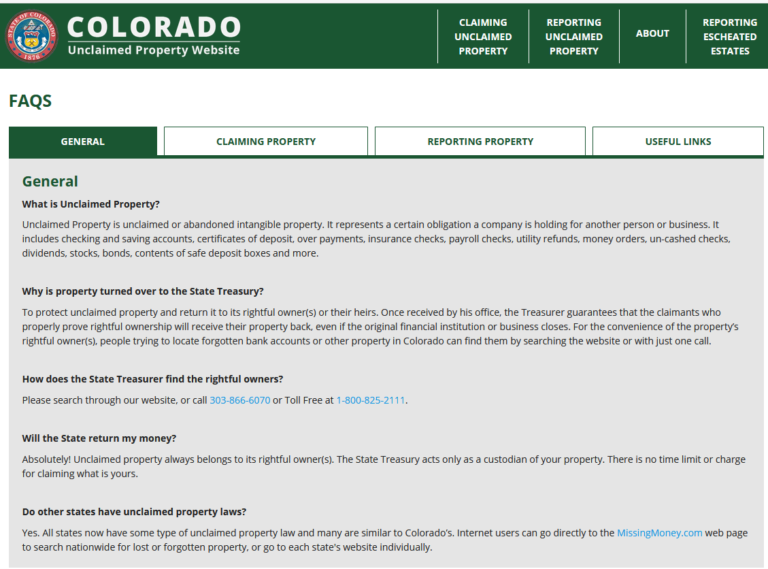

Finding unclaimed property in Colorado is a breeze. The Office of the State Treasurer created the Unclaimed Property Website to help you find any claims that you can file.

Step 1: Click this link to visit the Unclaimed Property Website.

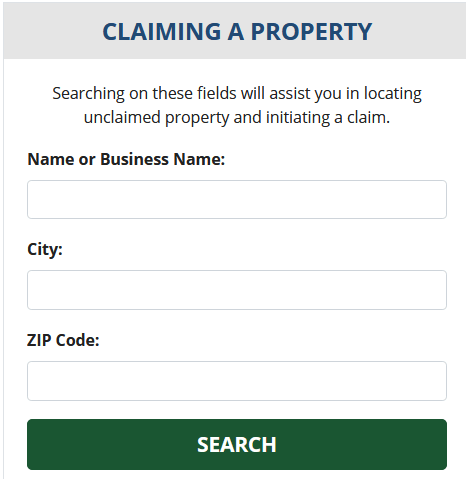

Step 2: Scroll down until you see the “Claiming a Property” box, which has several fields that you can use. We recommend adding just your last name to the search box before hitting the “Search” button. This allows you to view all of the accounts associated with those who share your last name and may help you find funds that belong to your loved ones.

Step 3: Wait a few seconds for your results to load. You may need to click on photos or fill out a captcha box to show that you are not a robot. The Colorado database will list all accounts that match the name that you entered along with the full name and address of the holder. You can also see the name of the holder and a general idea of the available funds. Colorado simply tells you if the amount is over or under $50.

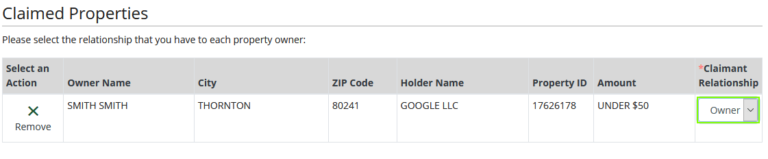

Step 4: When you find an account that matches your information, click on the “Claim” button that you see on the left. You can claim as many accounts as you want at the same time and fill out the required information on all claim forms. Once you find at least one property, click the blue button at the bottom of the page to view it.

Step 5: Use the drop-down menu on the next page to select how you want to file the claim. Though you’ll usually choose the option that shows you are the owner of the property, Colorado also has options for heirs and estate representatives as well as business representatives.

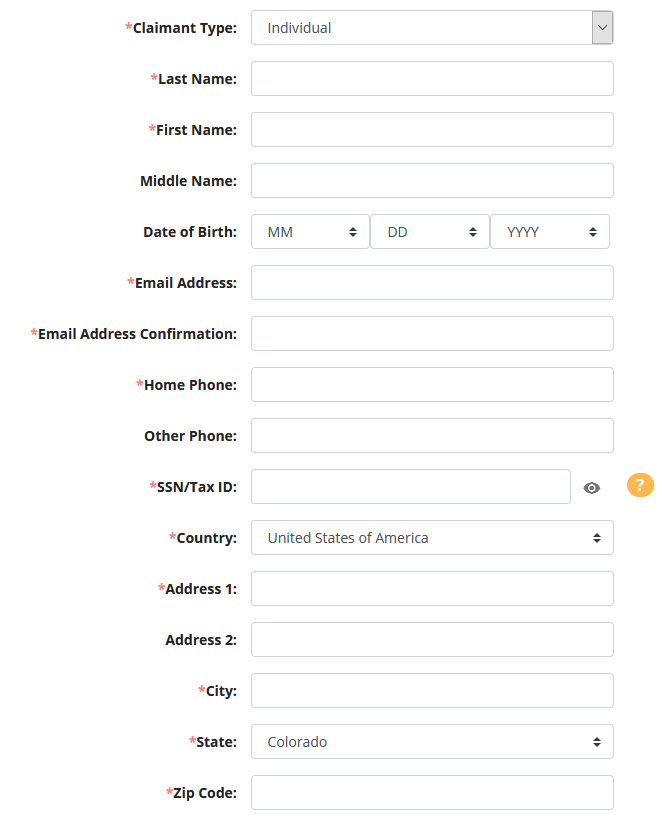

Simply find unclaimed property in Colorado does nothing unless you also file a claim. Once you find a property using the steps above, click on the “Claim” button to fill out your information. Colorado asks if you are a business or an individual. Individuals need to provide their full names and social security numbers. You must also add your email address and home address. Adding your date of birth and middle initial can quickly help the state verify your information and process the claim. The image below shows you what this form looks like on the site.

Most of the claims that you file require several types of documents. Colorado will list the documents that you need when you begin the process. Instead of printing those documents at home or an office store and sending them through the mail, you can use the document upload page to quickly attach them to your claim. You need to enter both the email address associated with your claim and the claim ID. Colorado allows you to attach up to five documents at a time. If you need to submit more information, you can simply enter your information again and use the upload buttons. Colorado asks that you crop any images that you take to make sure that the photos show your documents.

Once you file a claim, Colorado allows you to check on the status without talking to a person on the phone. The Search for Your Claim’s Status page asks for just the property ID shown in the database. You enter this number in the box and click search. When you find your claim, click on it to see the progress made since you filed. Colorado will let you know if the Office of the State Treasurer received your claim and processed it or if the Office needs additional information. This site also shows you when the state cut a check and sent it to you.

There are lots of ways to find unclaimed property beyond the Colorado borders. We often recommend that you look at the databases in other states or simply visit Missing Money. Missing Money works with Ohio and multiple states to act as their databases. When you enter a name in the search box, the site will find all of the claims that match that name in all the states that use it. You can then add your information and have the paperwork sent to you to complete it.

The Internal Revenue Service offers quite a bit of information and resources for those in need. Not only can you estimate how much you will owe or get back at the end of the year, but you can see what happened to your past refunds. The IRS also includes an option that lets you add your bank account information. This ensures that future refunds reach your bank and do not get lost in the mail.

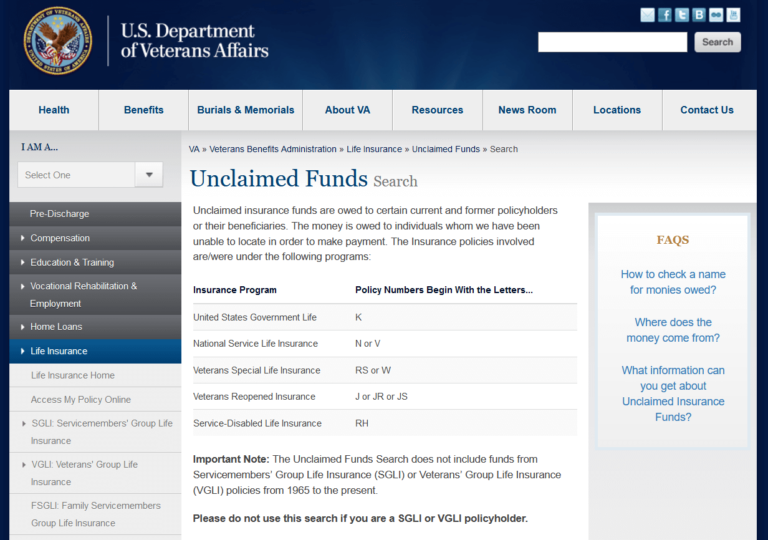

Pension and retirement accounts help people pay for their golden years once they stop working. Did you know that many of these accounts let the owners name a beneficiary who will inherit the money when they pass? Two of the resources that we recommend checking are the Pension Benefit Guaranty Corporation and the U.S. Railroad Retirement Board. On top of seeing if any of your loved ones had retirement accounts and pensions, you can easily see if you can claim the remaining funds.

Other sites that can help you find unclaimed property at the state and federal levels include:

Though you’ll find some sites that cover the basic laws associated with unclaimed property in Colorado, the best place to find the info that you need is the Unclaimed Property Act. Available from the State Treasurer Office, this PDF covers all acts relating to unclaimed property. You can see when you can and cannot file a claim and what holders must legally do before sending your property to the state.

In Colorado, the holder of unclaimed property is the organization responsible for holding it for the owner. A hospital is one type of holder that may have funds from when you overpaid on a bill or if someone in your family left behind personal property. Holders often refer to corporations and organizations such as a former employer who owes you a last paycheck or a water company that owes you money from an account that you once had.

One of the more common types of unclaimed property in Ohio is an inactive bank account. Though banks have different rules regarding how long it takes for an account to become inactive, it generally ranges from 12 to 24 months. When you go a full year without touching the account, the bank will send a letter to remind you of it. If another year passes, the bank will mark it as an inactive account, which gives it the right to contact the State Treasurer Office. Interest will continue building on your account as long as the bank holds it but will stop when the Treasurer takes over the property. Colorado banks will often let you reopen your bank account with the money that the state holds for you. This may require that you add more money to the account or that you fill out the paperwork with your current address.

The laws regarding abandoned safe deposit boxes in Colorado are different from those relating to other types of property. Colorado considers the box abandoned when the bank holds it for five years after the last rent payment. When you open one of these boxes, you can pay by the month or pay for months/years in advance. Some abandon their boxes because they do not realize that their payment methods expired. Boxes also become abandoned when the original renter passes away and does not notify their heirs. You should contact the bank first and find out if it still has possession of the box. If the bank turned over the box, you need to check the database. Colorado may still have possession of the contents from the box or have money gained from selling the contents.

You don’t need to worry that Colorado will take your money or use it for other things. The state will hold any abandoned or unclaimed property in a trust to keep it safe. You have the right to claim that property whenever you want. Even if you worked for a company 10 years ago and never got your last check, the State Treasurer will still have it.

In most cases, we do not recommend hiring a professional finder to track down money in Colorado. Though some states have laws that block these people from claiming for others, Colorado allows finders to work with both individuals who have money in the database and the heirs of listed owners. You do not need to hire a finder or respond to notices that they send you. Colorado allows you to complete most of the claim steps online.

The Colorado Unclaimed Property Division launched the Great Colorado Payback program as a way to reach unclaimed owners found in the database. This program allows workers to identify the names of individuals and organizations and find their current contact information. Workers will often go through the tax department to find their location. You may receive a postcard that lets you know you have unclaimed property in Colorado. This postcard should have a claim ID number that helps you find your property in the database. If you have an email address on file in a state department, you may receive an email about your property, too. Colorado does not contact property owners who live outside the state.

When filing a claim in Colorado, you need both your social security card and a photo ID. The state accepts both military IDs and passports as well as your driver’s license. If you do not have your social security card, you can use your tax returns or other official paperwork that shows your name along with that number. Some individuals may need notarized documents when they file, which will extend the time it takes to process their claims. This will require that you visit a notary public and show proof of your identity. When you sign the document, the notary will stamp the page. You will then need to upload the document with any other required information.

Though you can file a claim for property in Colorado that belongs to another person, you can usually only file if the person passed away. The form that you file asks if you are the heir of that person or a representative of their estate. Estate representatives are usually family members or friends appointed by the court. They are responsible for notifying lenders and others the deceased owed money to and making sure that the estate can pay the debts. If you are an heir, you can file if the person has a small estate that does not need to go through probate. You also have the right to file while going through probate. Colorado has options for the parents and guardians of minor children who need to claim property, too.

Though Colorado will never spend any money that belongs to you, you will likely want to take steps to keep organizations from turning your property over to the state. Using your accounts at least once a year is one of the best things that you can do. You can set alarms and reminders if your phone that tell you when to check. You don’t need to add funds, but you may want to log in and show that you are still active. It’s also helpful to make a list of those accounts and check them every 6-12 months to ensure that your information is valid. If you use debit or credit cards to make automatic payments, make sure that the cards still work, too.

No matter how smart and careful you are, you can slip up and make a mistake that costs you money. You might get a check and put it on your desk and forget to cash it until the payment expires. Many property owners in The Centennial State also lose money when they change addresses or lose track of their old accounts. Our ultimate guide to unclaimed money in Colorado makes finding your money and getting it from the state easy.

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.

Copyright © 2024 · OurPublicRecords.org · All Rights Reserved