Copyright © 2024 · OurPublicRecords.org · All Rights Reserved

Free Missouri Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Explore Unclaimed Money in Missouri: Your 2024 Guide to Discovering and Claiming Lost Funds

Residing in the Midwestern state of Missouri, you may have come across the concept of unclaimed money or unclaimed property within the region. You might be pondering whether you possess any unclaimed property and if there’s still a chance to recover it.

In broad terms, unclaimed property encompasses finances and various assets that have been left unattended. Beyond cash, unclaimed property can encompass bonds, stocks, the contents of safety deposit boxes, government refunds, unclaimed insurance policy proceeds, previous employment wages, and more.

In simple terms, unclaimed properties denote assets that owners have either forgotten or lost track of. For instance, if your account has remained dormant for an extended period, it could fall into the category of unclaimed money. Astonishingly, the total value of unclaimed properties in the United States exceeds 70 billion dollars. Consequently, it might be prudent to investigate whether you possess any unclaimed properties.

So, what leads to the classification of these assets as unclaimed properties?

Assets can attain the status of unclaimed property when the financial institution responsible for them can no longer establish contact with the original owners within a legally specified timeframe. This designated timeframe is often referred to as the “dormancy” period.

The length of the dormancy period is subject to variation from one state to another, ranging from as brief as one year to as lengthy as five years. However, once this dormancy period elapses, the state’s escheatment laws come into play.

Escheatment laws mandate that financial institutions transfer these unclaimed assets to the state, which then assumes responsibility for record-keeping and the eventual return of these properties to their rightful owners.

The process of reclaiming unclaimed property is contingent on state regulations, often limited to a specific timeframe. Beyond this point, certain states, such as California, opt to auction off the unclaimed asset to the highest bidder in a public sale.

So, how does the process of unclaimed money work in Missouri?

In Missouri, the legally stipulated dormancy period typically spans around five years, although this duration can fluctuate depending on the type of property. Nevertheless, once this predefined dormancy period concludes, Missouri’s escheatment laws come into play.

This entails that institutions such as banks, businesses, public agencies, and insurance companies are obligated to surrender these assets to the State Treasurer’s office as unclaimed property. Typically, escheatment involves retaining these assets or their monetary equivalent for a specified period, after which the state proceeds to liquidate them to acquire the sales proceeds.

However, in Missouri, the State Treasurer’s office retains these assets in trust indefinitely. On occasion, they may auction valuable non-monetary assets, including those originating from safety deposit boxes, if storage space becomes limited.

The sole exceptions to this rule pertain to military medals or honors that were relinquished to the state as unclaimed property. Nonetheless, any revenue generated from these auctions remains in the possession of the State Treasurer’s office for an undetermined period.

This means that they retain the proceeds until the original owners or their heirs come forward to make a claim. As a result, you need not be concerned about specific deadlines when it comes to claiming your unclaimed property in Missouri.

As previously mentioned, the dormancy periods vary depending on the type of asset and can differ from state to state. In Missouri, the dormancy periods are as follows:

It’s important to note that these dormancy periods serve as a guideline, and the exact duration can vary depending on the specific circumstances and state regulations.

Unclaimed property in Missouri amounts to millions annually, with the Missouri State Treasurer’s Office currently holding over 1 billion dollars’ worth of unclaimed property. Approximately 1,000 of these properties come from safety deposit boxes.

The average claim in Missouri is around 300 USD, although the value of unclaimed property can vary, and some claims may be lower or higher.

Missouri state laws require that if the unclaimed property is worth 50 USD or more, the financial institution responsible for the property must make efforts to locate the owner before turning it over to the state. This typically involves sending a letter to the owner’s last known address, providing details such as the amount owed, and requesting confirmation of the account. Financial institutions may also use alternative methods to contact the owner.

These legal requirements are in place to ensure that owners have the opportunity to claim their property before it becomes unclaimed and subject to escheatment to the state.

The Missouri State Treasurer’s Office actively works to raise awareness about unclaimed properties by sending postcards and advertising in local newspapers to reach out to owners. However, if you haven’t received a postcard or missed the newspaper advertisement, there is a convenient way to search for unclaimed money in Missouri through their official database, which can be accessed on the State Treasurer’s website.

Here’s how to find and file a claim for unclaimed money in Missouri:

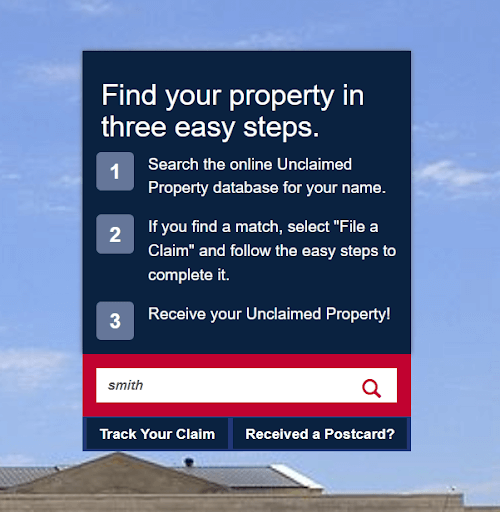

Visit the State Treasurer’s website and locate the search tool, typically found on the right side of the page.

Input your name in the “Last Name, First Name” format, although searching by your last name alone is also an option. This search function allows you to check for unclaimed properties not only for yourself but also for relatives.

Click the small magnifying glass icon or press Enter on your keyboard to generate a list of results.

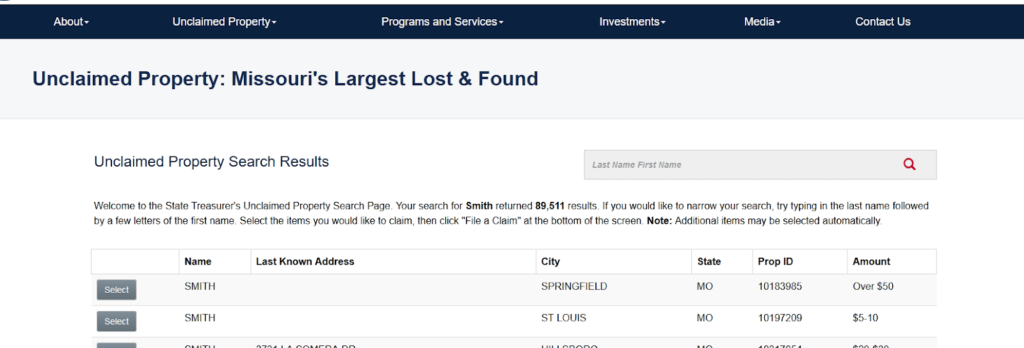

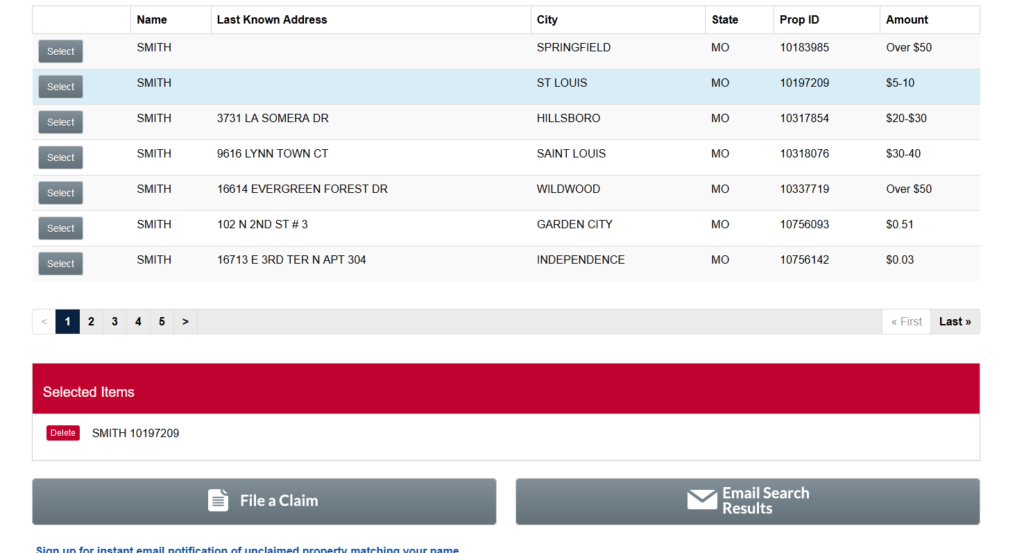

The results will display information such as the owner’s name, property ID, city, and, when available, the owner’s last known address. Any amount exceeding 50 USD is generally listed as “over $50” to prevent false claims.

To claim a property you believe belongs to you, click the “Select” button located on the left side. Your selected claims will appear in red below the results.

After you’ve added the claims to your list, you have the option to either send the results to your email by clicking “Email Search Results” or initiate the claiming process by clicking “File a Claim.” If you choose to file a claim, you will be directed to the next page, where you need to provide the necessary details to begin the process.

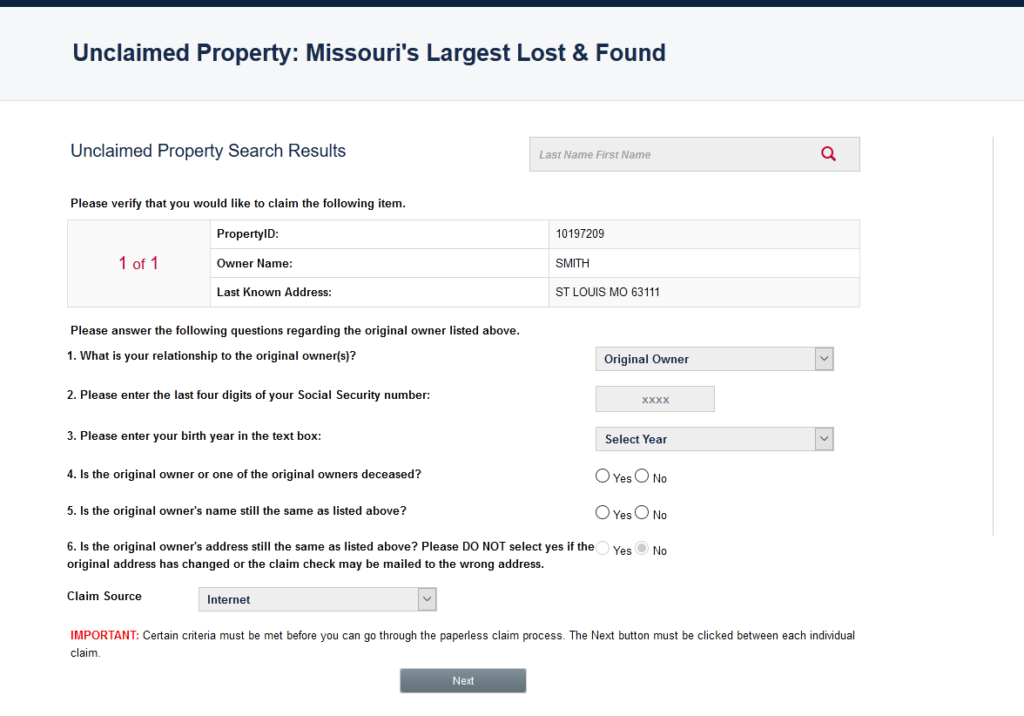

Required information may include your relationship to the original owner, your birth year, the last four digits of your Social Security Number, and other relevant details. Be prepared to provide additional documentation as proof of ownership if requested by the state.

The entire claiming process is paperless and available 24/7, making it convenient to reclaim your property in case it has been turned over to the state.

In addition to the Missouri State Treasurer’s official website, there are alternative sources you can use to search for unclaimed property in Missouri:

National Association of Unclaimed Property Administrators (NAUPA): NAUPA is an organization dedicated to reuniting unclaimed properties with their rightful owners and has jurisdiction over all 50 U.S. states, the Commonwealth of Puerto Rico, the District of Columbia, as well as some provinces in Canada and Kenya.

Their official website provides a convenient platform to search for unclaimed property in multiple states simultaneously. If you’re searching for properties in several states, you can use the “Missing Money” feature on their website to check for unclaimed money in Missouri and other states.

On the NAUPA website, click on the “Search” option, which will take you to a page where you can input your details, including your name, city, and state, to check for unclaimed money. If you’re looking for unclaimed properties in multiple states, you can leave the province/state option blank.

The search results will display the original owner’s name, where the amount is held, the last address, and the amount. Please note that not every state participates in this database, so the list may be incomplete. If you want to check for unclaimed properties in a state not listed on the website, you can visit that state’s individual State Treasurer Office’s official website.

Using these alternative sources can broaden your search for unclaimed property in Missouri and potentially help you identify properties in other states as well.

Only the original owners have the right to reclaim their assets in Missouri once they have been surrendered to the state as unclaimed property. If you are the rightful owner of unclaimed funds in Missouri, all you need to do to initiate the claim process is provide proof of identification, such as a government-issued ID.

In cases where the original owner has passed away, their legal heirs can retrieve the unclaimed assets, provided they can provide the necessary documentation to establish their relationship with the deceased owner. However, it’s important to note that filing a claim on behalf of a deceased next of kin can be a more complex process.

You don’t need to worry about a time limit for reclaiming abandoned assets in Missouri since the State Treasurer’s office holds them in trust indefinitely. Additionally, if you file a claim for interest-bearing property within seven years of it being declared as abandoned, you may also be eligible to receive the accrued interest.

Any business operating in Missouri, including banks, credit unions, retailers, insurance companies, and more, is required to report presumed abandoned or unclaimed property to the State Treasurer. Before classifying an asset as abandoned, the holder of the property must attempt to locate and contact the original owner, often through written correspondence sent to the owner’s last known or currently listed address.

If no response is received, the holder can report the account or assets as unclaimed or abandoned. These reports are submitted to the Missouri State Treasurer by November 1st each year, covering the period up to June 30th of the same year. However, life insurance companies have a different deadline, submitting reports by May 1st each year, covering the period up to December 31st of the previous year.

These businesses are also required to maintain records of these abandoned properties for up to five years after reporting them. If the properties have a dormancy period of seven years, the records must be kept for up to twelve years after the initial report.

Failure to report abandoned properties can result in penalty fees, typically five percent of the total value, not exceeding $10,000.

To prevent your assets from being classified as abandoned and becoming unclaimed property, consider the following steps:

The processing time varies, but the State Treasurer’s office aims to expedite claims upon receiving the required verification documents.

Yes, if you find unclaimed property under a family member’s name, you can file a claim and specify your relationship with the original owner.

Yes, you have the option to donate unclaimed property to approved charities and organizations designated by the Missouri State Treasurer’s office.

Unclaimed properties are not subject to local taxation while they remain unclaimed. However, once reclaimed by their original owners, they may be considered taxable income.

Even with careful organization, it’s possible for some assets to slip through the cracks and become classified as abandoned or unclaimed property. These assets could include forgotten bank accounts or undelivered paychecks from past employers. To check for unclaimed funds in Missouri, utilize the State Treasurer’s local database. Rest assured that Missouri’s policy ensures your unclaimed property is held in trust indefinitely, eliminating the worry of time constraints for reclaiming your assets. We hope this guide has provided you with valuable insights into unclaimed money in Missouri, including the process of searching for and filing a claim.

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.

Copyright © 2024 · OurPublicRecords.org · All Rights Reserved