Copyright © 2024 · OurPublicRecords.org · All Rights Reserved

Free Hawaii Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Now is the perfect time to find out more about unclaimed money in Hawaii and how you can claim the funds in your name.

Located in the Pacific Ocean, Hawaii is a dream vacation destination. If you’re lucky enough to live in The Aloha State rather than visit there, the odds are good that you have unclaimed money listed somewhere in your name. Unclaimed money is the term that state departments use that can refer to both money and property. Some assume that this means the funds are abandoned and that no one owns them. This isn’t necessarily true because someone owns that property or those funds. It just means that the person or party in charge of the money cannot locate this owner. This often happens because you moved without leaving a forwarding address.

The Department of Budget & Finance in Hawaii is responsible for overseeing unclaimed property until the owner steps forward. Not only can you claim any funds that list your name, but you can often claim funds owned by someone who passed away. As long as you are the heir of the deceased person or in charge of the individual’s estate, you can claim the money. We’ll go over how to use this website and get your money later.

When looking at unclaimed property and money in Hawaii, you’ll find that the state uses the terms abandoned and unclaimed to describe the same things. The state also uses the term holder to describe the person who holds the funds. This can be a former employer or a financial institution such as a bank. Anyone listed on the funds as the owner is the person who can claim them.

One thing to keep in mind is that unclaimed money in Hawaii usually refers to intangible money. This is money that exists in an account somewhere but funds that you cannot get until you request a deposit or hold the money in your hand. A good example is a utility deposit. Most utility providers require that you put down a deposit to turn off service at your home, including water and electricity. Many will apply the deposit to your account after a year of service where you make your deposits on time. If you moved before that could happen, the provider may apply your deposit to your balance. However, if you paid off your bill, the provider must hold your deposit and return it to you.

Stocks and bonds are other examples of unclaimed money in Hawaii. You might have paychecks from a former employer that you never cashed, too. Employers must pay you for any time that you worked and any paid time off that you accumulated such as vacation and mental health days. If you did not give your employer your contact information, they may have a final paycheck waiting for you. Other examples of intangible property and funds found in Hawaii include certificates of deposit and traveler’s checks.

We also hear from readers who believe that they might have insurance payments waiting for them. Insurance payments can include both life insurance payouts and insurance refunds. Let’s say that you bought an insurance policy and canceled the policy before it came to term. You may find that the insurer has a refund check in your name. When someone you love passes away, you might appear on the policy as a beneficiary. The insurer is responsible for issuing you a check in your name that covers the benefits that you deserve.

Those who live in Hawaii may qualify for tangible goods through the unclaimed money department, too. If you opened a safe deposit box and forgot about it, your items still exist. The bank will make attempts to locate you before turning the property over to the state. Another example of tangible unclaimed property can include a piece of land. When the owner passes away and has heirs who live in other states, it’s often hard to locate the rightful owners and inform them of what they inherited.

Every state in the country has unclaimed money registers or departments. Though you might think that holders maintain ownership or the rights to the money until the owner comes forward, this isn’t true. The holders have a set amount of time to locate the owner, or they will need to turn the money/property over to the state. States use their registers to hold onto the funds and keep them safe until they find the rightful owners. Whether it’s less than $100 or thousands of dollars, Hawaii will keep the money safe for you.

It’s hard to put a number on the amount of unclaimed property that there is in the United States. Many experts believe that there’s $5 to $10 billion in unclaimed funds and property in the entire country. The National Association of Unclaimed Property Administrators found that all states combined give back more than $3 billion in funds every year.

Even if you no longer live in Hawaii, you still have the right to search for unclaimed money. The best place to start is at the National Association of Unclaimed Property Administrators. Also known as the NAUPA, this association makes it easy to check for states that have online databases and file claims on the web. You can also use the Department of Budget & Finance from the state of Hawaii to locate your missing money.

There are many places on the web that help you search for unclaimed property beyond state databases, including:

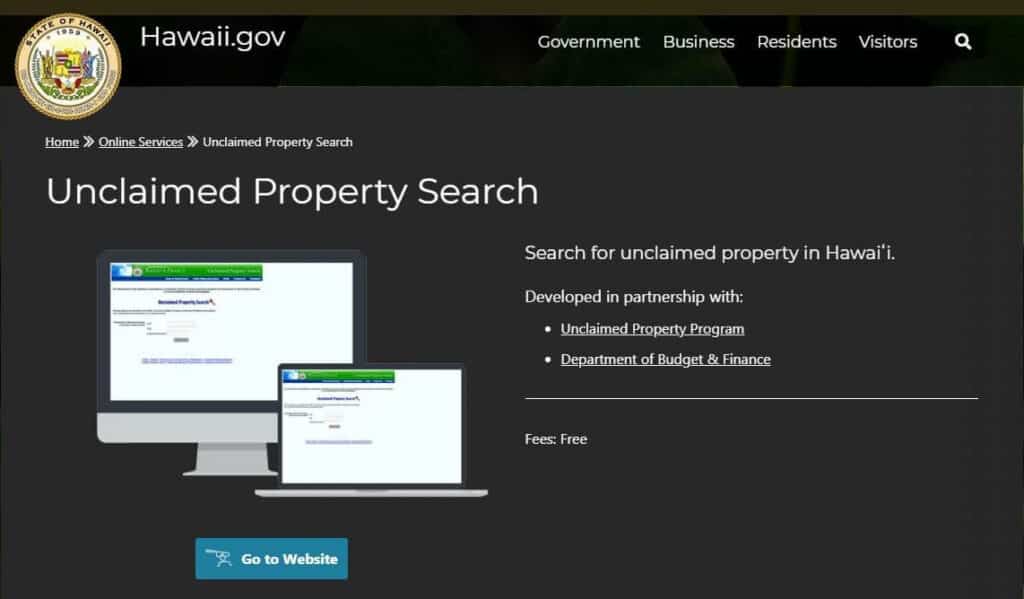

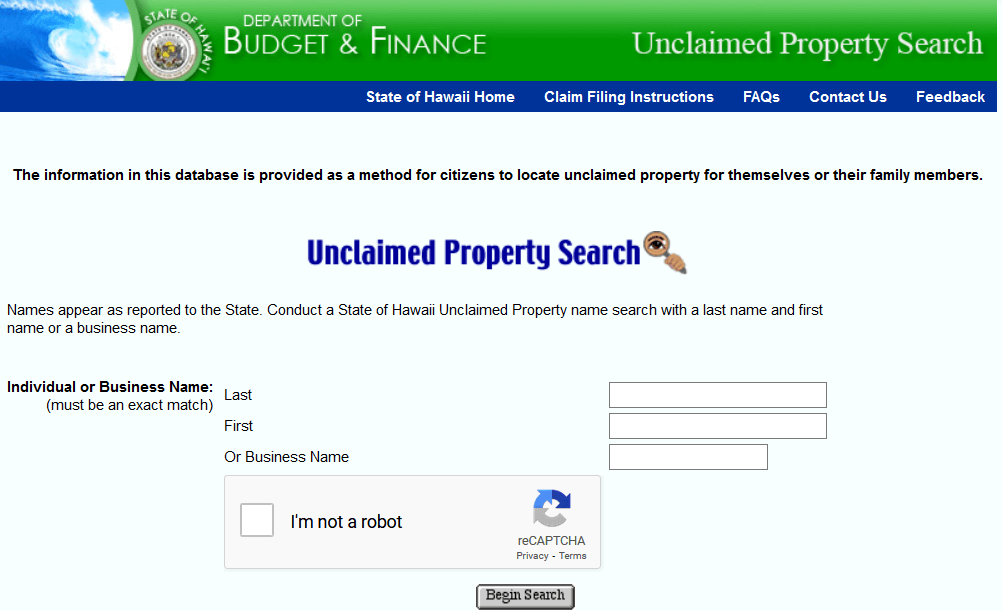

Hawaii has rules and regulations in place to help current and former residents claim any money owed to them. It takes just a few minutes to use the Unclaimed Property Search created by the State of Hawaii Department of Budget & Finance. You can search with both your name and the names of your loved ones along with a business name. Hawaii allows you to complete all the necessary steps to file an online claim through the system, too.

A common reason why some neglect to do an unclaimed property search is that they think it takes a lot of time and/or effort. You never need to pay to do an unclaimed property search, but you may need to pay for an envelope to return a claim that you print at home. Hawaii asks for just the name that you want to search under and lets you use a person’s name or the name of a business. You also need a device that allows you to connect to the internet. Though many people file online with a computer, you can also use a mobile phone or tablet.

The steps to making an unclaimed money claim in Hawaii are easier than you might think.

Step 1: Visit the State of Hawaii Department of Budget & Finance.

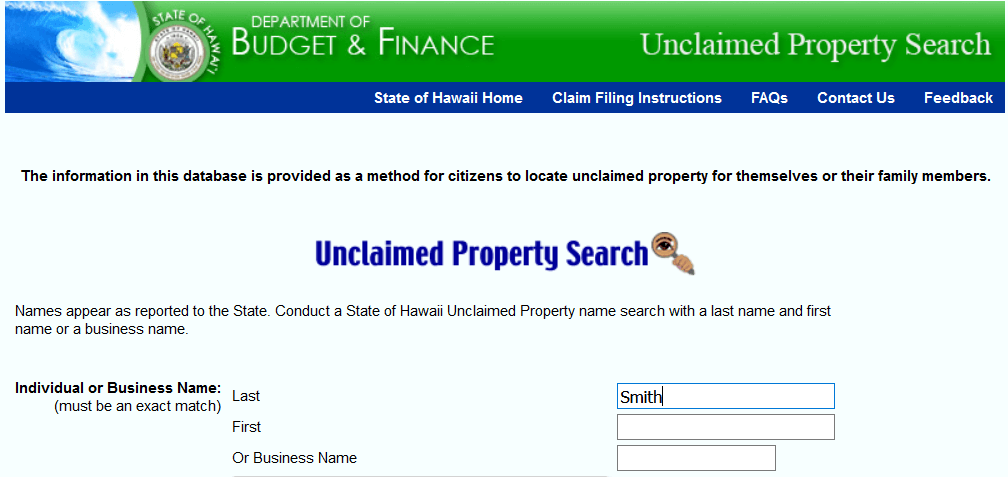

Step 2: Decide how you want to search the Hawaiian database. Whether you search for the name of an individual or business, you need to type the name in the appropriate box. If you use an individual’s name, you must enter both their first and last names.

Step 3: Click the box below the search form to show that you are not a robot.

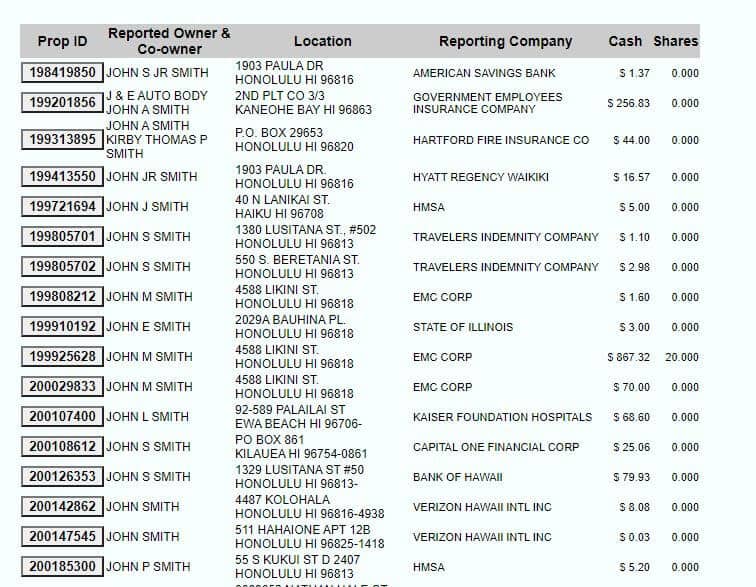

Step 4: Look over the results to see the unclaimed money and property in Hawaii that matches your name. Hawaii is unique because it shows the exact amount of money shown in each account. Many states will only tell you whether the amount is higher or lower than a certain range. You can view the address associated with the owner and the name of the original holder, too.

Step 5: Click on the Property ID number on the left side of the page. This will show you what you need to do to file a claim.

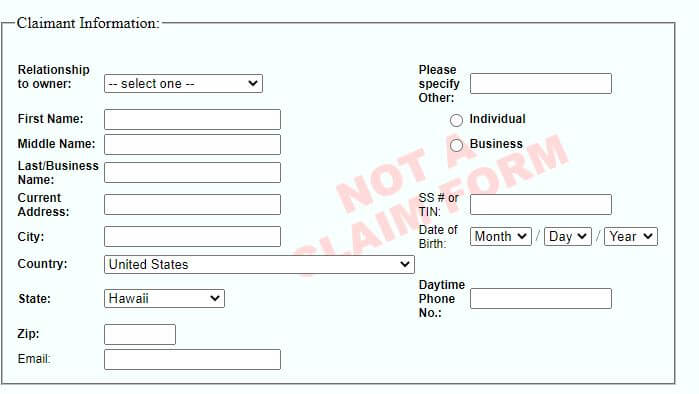

Step 6: Fill out the claimant information section to file your claim. Hawaii asks for your relationship with the owner if you are not the person listed on the account. You also need to list your full address and email address along with your social security number and date of birth. Hawaii requires a phone number to contact you, too.

Step 7: Click the “Next” button on the bottom of the page once you complete the form. You then have the option of submitting the form online or having it sent to you to complete at home.

Recent estimates put the amount of unclaimed money and property in Hawaii at around $150 million. Though you might think that this figure should be higher, keep in mind that Hawaii is only home to around 1.5 million people. That comes to roughly $10 per person without including the people who once lived there. You never know when you might see a paycheck worth hundreds of dollars or a life insurance policy that earned you even more money.

Hawaii has laws that require the state to hold any funds handed over by holders. There is no limit to how long the state will hold those funds. Though some states will only hold unclaimed money for five years, Hawaii will hold the funds indefinitely.

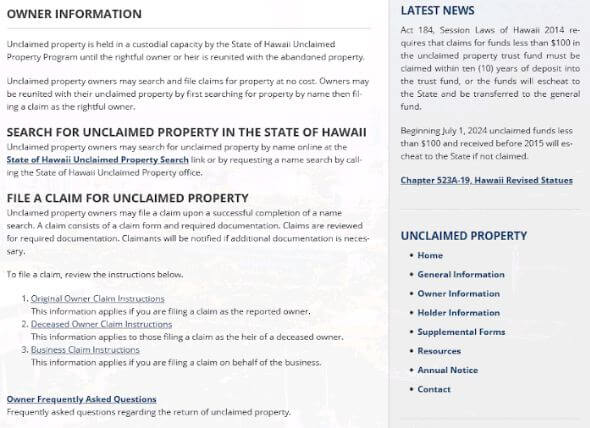

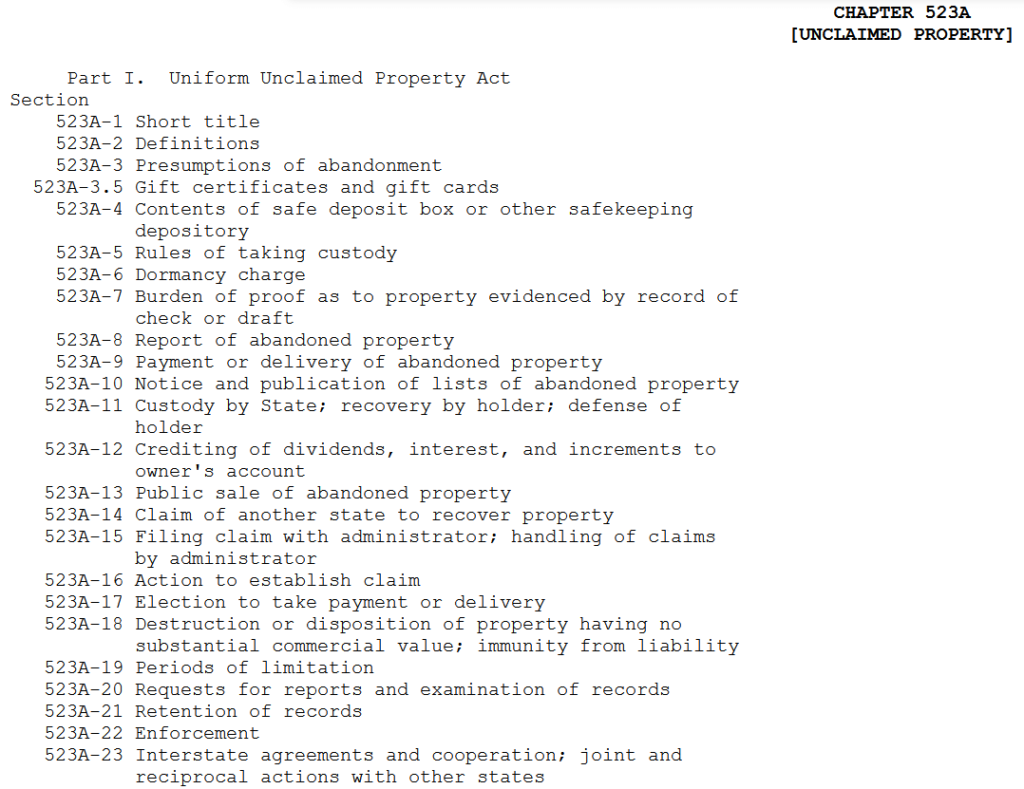

The unclaimed property laws in Hawaii make it clear what holders can and cannot do. As this page is somewhat confusing, we’ll go over some of the more important laws that you need to know.

Though Hawaii has an indefinite hold on unclaimed money, it has an exception for funds with a value of $100 or less. The holder must turn those funds over to the state, which will place the money in a trust. If the owner does not come forward within 10 years of the establishment of the trust, the funds revert to the state.

Hawaii also has laws regarding the presumption of abandonment, which refer to how a property becomes abandoned. These laws state that the holder must attempt to find the owner at the address listed on the account. Only if those attempts fail can the holder refer to the property as abandoned. The holder is then responsible for turning the property over to the state.

When you file a claim for any type of property in Hawaii, you can use the website and search the database for free. The state does not charge any fees for this service but requires that you show you’re an official claimant. You may need to complete additional forms when filing a claim for mutual fund shares or stocks. Hawaii asks for a copy of IRS form W-8 or W-9 along with your claim form.

Also known as locators, finders are professionals who make money finding unclaimed money for others. They often look for the names of heirs listed in obituaries and search on their behalf. A finder can then contact you and request payment in exchange for the information that they found. If you live outside of Hawaii, you might decide to work with a finder. As you can do everything that you need to do online without visiting Hawaii, you might decide to use the database to find money rather than working with a locator.

Many people want to know what they can do to prevent their property in Hawaii from becoming unclaimed or lost. A good tip is that you should make sure that any accounts you have in the state have updated contact information. Whether you get a new mobile phone number or move to a different island, take a few minutes to update your info. You can usually do this online without visiting the holders. We also recommend that you monitor any properties that you own. Many identity theft services will monitor all of your accounts and update them as needed.

No, you never need to pay a fee to file a claim in Hawaii. The database lets you file most claims online and allows you to search for free. You can also search the Department of Budget & Finance database if you live in a different state.

You can absolutely file a claim for someone else. When filing on behalf of another person, you need to show your relationship to that individual on the claim form. Hawaii often sees children file claims for their elderly parents and other family members.

You have the right under Hawaiian law to file a claim for someone who passed away. This commonly occurs when you have a parent who passed away. The claim form lets you show that you are the deceased individual’s heir when filing it. Hawaii also lets you file a claim if you are responsible for the owner’s estate. You may need to claim the funds to cover the costs of the estate.

Some states ask for an affidavit to prove ownership of unclaimed money or properties. You often need to sign this form in front of a notary before returning it to the state. Hawaii does not require an affidavit. It only asks that you fill out the online form to show that you are the owner. As long as your social security number and other information match the money, it reverts to you.

The Department of Budget & Finance uses a first come and first serve basis. Though the department processes all claims, it processes them in the order that owners filed them. It can take a few weeks until you receive confirmation that you submitted a form online or until you get a copy of your claim and another few weeks before Hawaii will disperse the funds to you.

If it takes longer to receive your claim than you expected, you may find that your contact information changes. You might need to move to a new address or change your phone number. The post office has a change of address form that will forward mail to your new home, but it can take weeks before it starts. Hawaii encourages those who filed claims and need to change their information to contact the Department of Budget & Finance. You can also contact the department if you moved or changed banks before your funds arrived.

To claim a safe deposit box, you need to get a letter from the holder or financial institution. Hawaii will accept a letter that states you paid any fees owed to the bank or one that shows you do not owe any fees. This is common if you inherited a safe deposit box from a family member.

The Aloha State is home to more than 1.5 million people and millions of visitors who travel there every year. You can have unclaimed money and properties in the state due to loved ones who passed away and jobs that you held in the past. The Department of Budget & Finance makes it easy for you to search for your unclaimed funds even if you no longer live in Hawaii. Search today to see how much money holders have in your name.

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.

Copyright © 2024 · OurPublicRecords.org · All Rights Reserved