Copyright © 2024 · OurPublicRecords.org · All Rights Reserved

Free North Carolina Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Are you in search of unclaimed funds or property in North Carolina but unsure where to begin? Today, we’ll provide you with a comprehensive guide on accessing the NC database and reclaiming your property.

This recently launched initiative by the Department of State Treasurer (DST) aims to streamline the return of unclaimed funds to their rightful owners, entirely free of charge! Through this matching program, owners of unclaimed assets do not need to take any action to recover their funds. The North Carolina Unclaimed Funds Division will proactively research records to identify all eligible claims totaling $250 or less. Weekly notifications will be mailed to eligible claimants, with checks issued within 6 to 8 weeks.

Claims requests are processed in the order they are received, with a standard processing time of approximately 90 days. However, due to the high volume of claims, processing times may slightly exceed 90 days. Once a claim is assigned to a claims processor, they may contact claimants for additional documentation or information if needed. Claimants will receive an email notification upon claim approval.

In North Carolina, unclaimed assets encompass various forms, including utility deposits, bank account balances, unclaimed insurance policy payouts, unpaid wages, bonds, stocks, and the contents of abandoned safe deposit boxes. These assets typically remain unclaimed for a period ranging from 1 to 5 years. Funds can become unclaimed when companies lose contact with their customers due to inaccurate information or incorrect addresses. North Carolina state laws mandate that these unclaimed funds are transferred or “escheated” to the Department of State Treasurer for safekeeping. The Cash database is regularly updated to include new unclaimed funds as they are received.

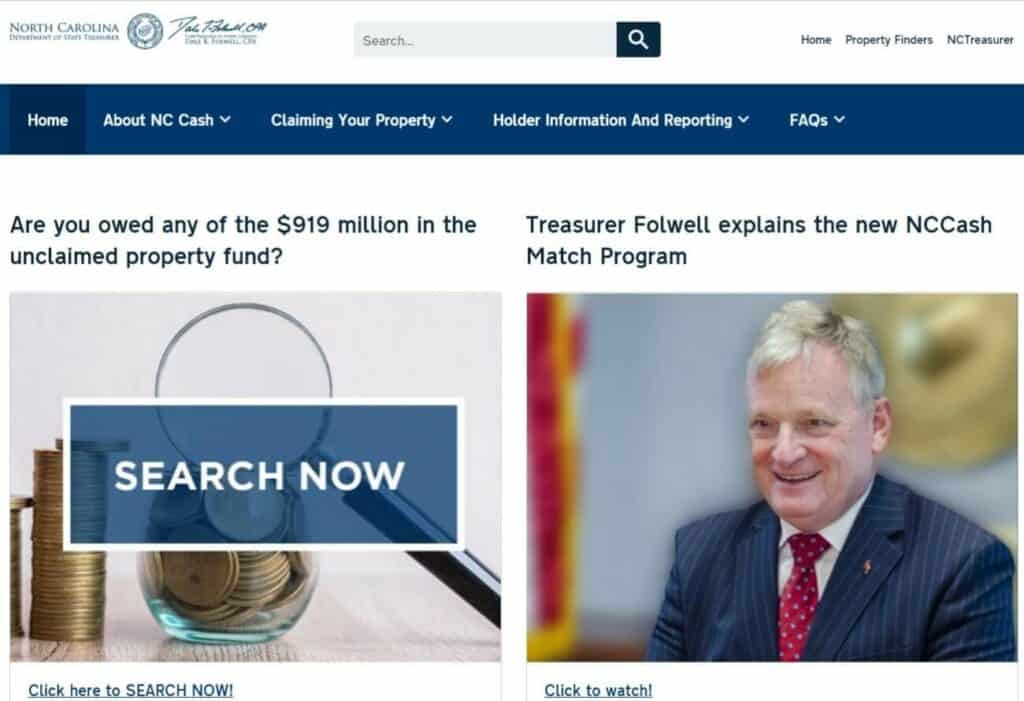

The total value of unclaimed property in North Carolina currently stands at over $1 billion. Within the unclaimed property fund, there are millions of dollars awaiting claimants to initiate the process for recovering their unclaimed property. This substantial sum encompasses a variety of assets, including goods, stocks, unclaimed cash, and more. To check if you have any unclaimed property, you can visit NCCASH.com and begin the process of reclaiming your assets.

Required Documentation for Claiming Unclaimed Property in North Carolina

When submitting documentation and claim forms for unclaimed property in North Carolina, please send them to the following address:

Unclaimed Property Division

PO Box 20431

Raleigh, NC 27619-0431

To establish ownership when filing an unclaimed funds claim form, the following documents are acceptable:

1. Proof of your Social Security Number (SSN)

Documents that display your SSN, including:

2. Proof of the Federal Employer Identification Number (FEIN) assigned to your personal business

A copy of any valid document confirming your FEIN, such as:

3. Proof of Address

Copies of legal documents displaying your name and specific physical address, including:

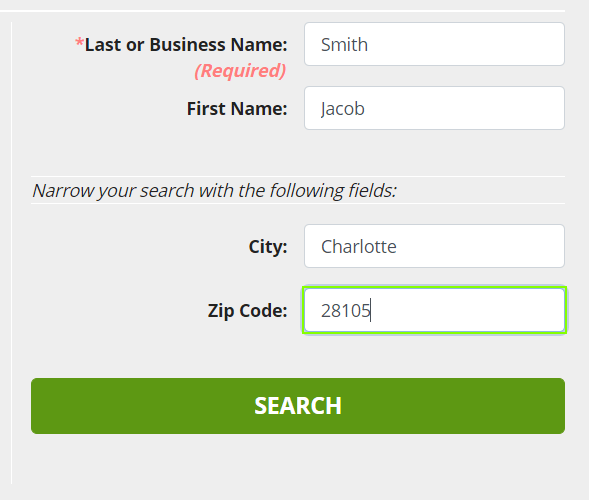

Searching for unclaimed property funds in North Carolina is a straightforward process. Simply provide your last name or your business name in the relevant field and your first name in the corresponding field labeled ‘First Name.’ To enhance the accuracy of your search, include your city name and zip code.

As an example, we’ve used the name Jacob Smith.

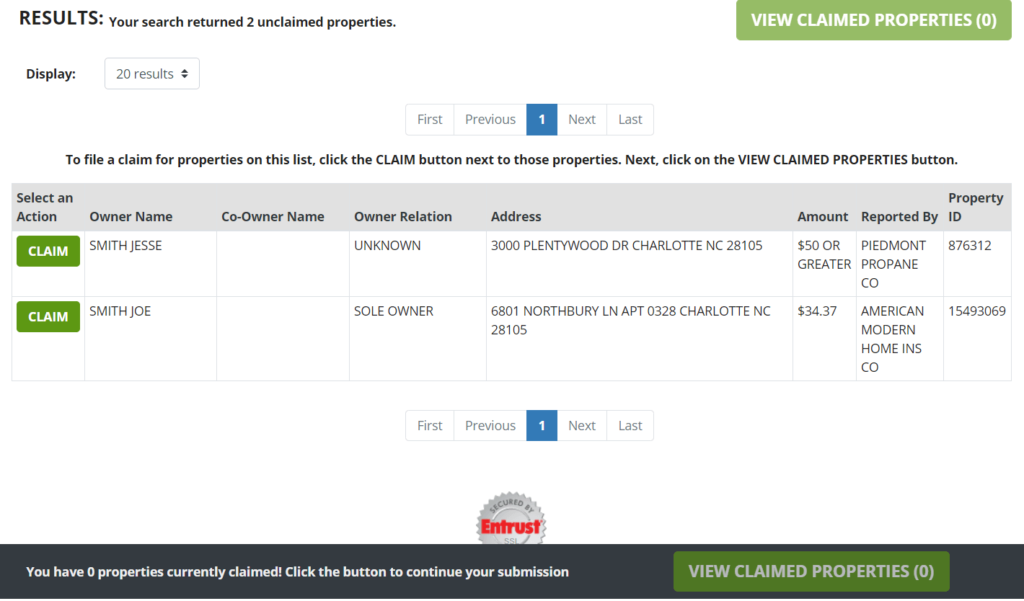

Step 1: Choose the Properties You Want to Claim

When initiating the process to claim unclaimed property in North Carolina, you have the option to select the specific properties you wish to claim. You can also conduct a new search to identify property that may be owed to you but registered under a different name, including nicknames, maiden names, or common misspellings.

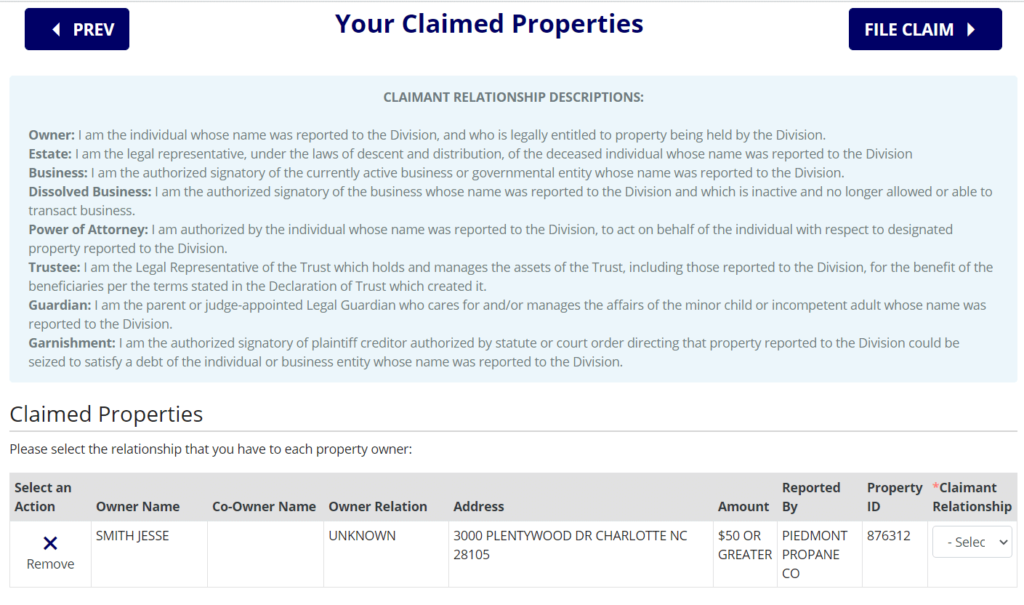

Step 2: View Claimed Properties

After selecting the properties you want to claim, click on the ‘View Claimed Properties’ icon.

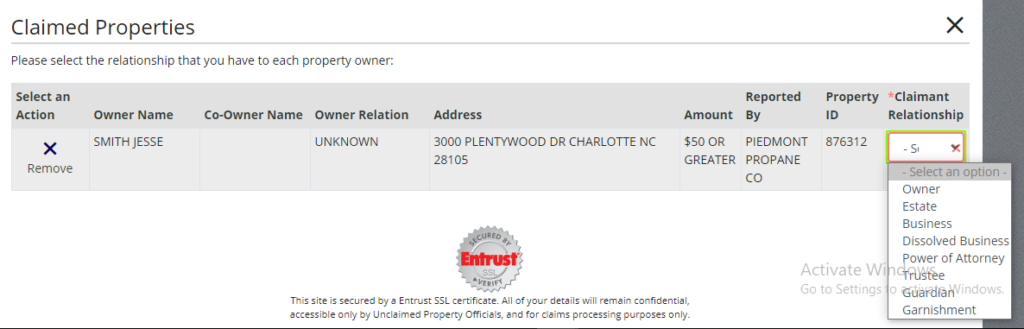

Step 3: Specify Your Relationship to Each Property Owner

For each property you are claiming, state your relationship to the property owner.

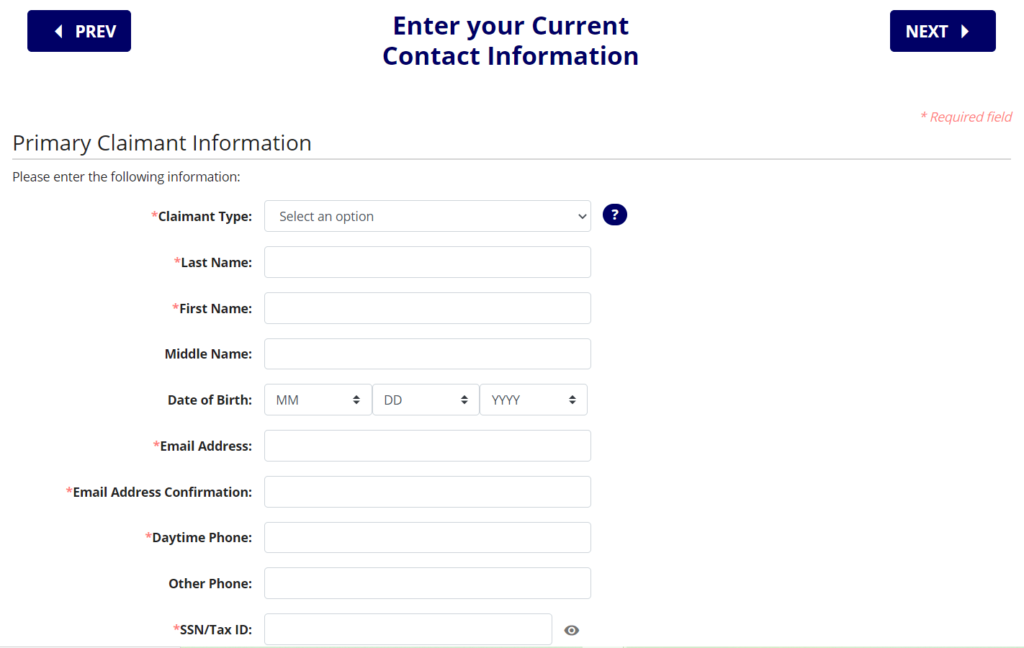

Step 4: Provide the Required Information

In the next step, you will be prompted to provide the necessary information, which includes:

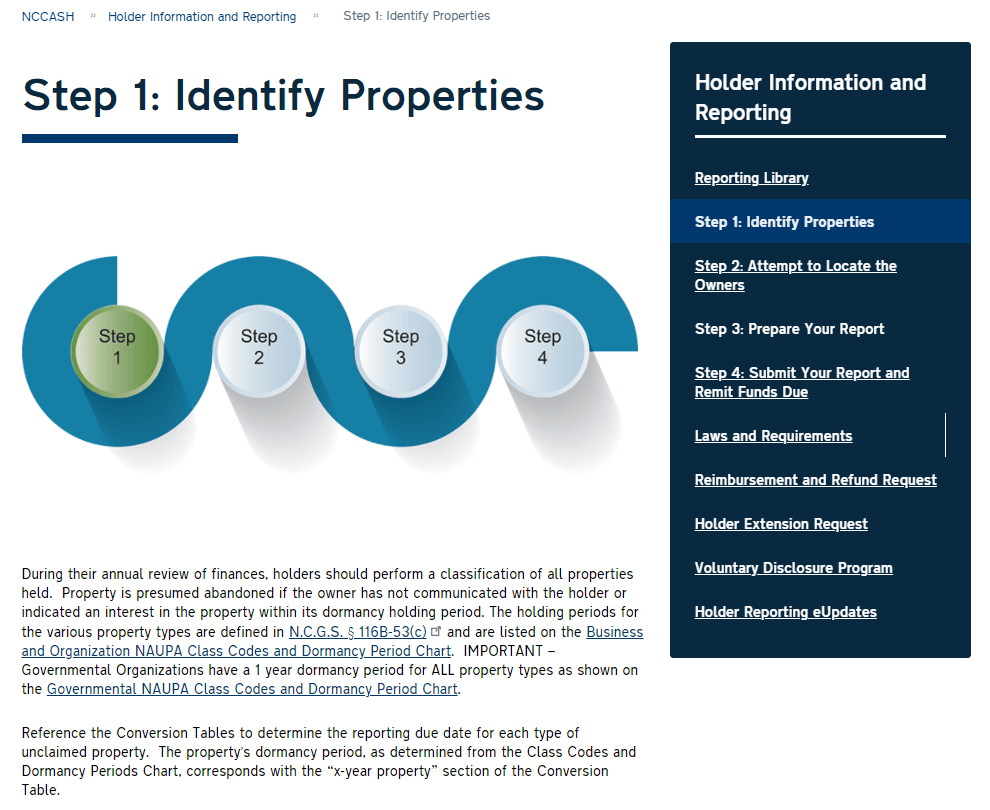

Step 1: Identify Properties

Property holders are required to classify all properties they hold during their annual financial review. Properties that owners have not shown interest in during the specified dormancy holding period are considered abandoned. You can refer to N.C.G.S § 116B-53(c) to see the holding periods corresponding to various types of property, as listed on the Business & Organization NAUPA Class Codes and Dormancy Charts.

Step 2: Try to Locate the Rightful Owners

Property holders are encouraged to make diligent efforts to locate the legal owners of the property. According to N.C.G.S. § 116B-59(b), for assets such as securities or equity valued at $25 or more and $50 or more for other property types, property holders must send a due diligence notice to the owner in writing. The notice should include the holder’s contact information and a statement that even if the property is reclaimed, all dividends, interest, gains, and income will remain in the treasurer’s custody. Notices must be sent between 60 and 120 days from the due date of the report to avoid penalties.

Step 3: Prepare Your Report

Holders can prepare their report using holder-reporting software to generate a NAUPA file in .rpt, .hrs, or .txt format (HDE format is not accepted). Alternatively, holders can input report data directly into the state’s Manual Online Reporting tool, and reporting forms are no longer required. Ensure that you select the appropriate NAUPA class codes and relationship codes for proper fund distribution.

Unclaimed property should generally be reported to the state where the claimant’s address is located. However, specific asset types like money orders and traveler’s checks should be reported to the states where they were initially purchased. For claimants with foreign or unknown addresses, the properties are due to the U.S. state where the rightful owner is incorporated. Holders should communicate with the authorized state to confirm reporting practices before sending unclaimed property to North Carolina.

Negative reports are not mandatory. If you choose to file a negative report, you can submit a $0.00 NAUPA file or manually report $0.00.

Securities require specific instructions and guidelines for reporting and remittance, detailed in Registering, Reporting, and Transfer Instructions for equities. Accurate completion of possession relationship codes and NAUPA class codes is essential to ensure property return.

To facilitate the return of property to rightful owners, accurately complete possession relationship codes and NAUPA class codes as per the state Reporting Library. Provide full name, Social Security Number (SSN), last known address, Federal Employer Identification Number (FEIN), date of birth, driver’s license number, state of issuance, and email address (if known) of property owners. Use Owner Type Codes such as ‘Aggregate,’ ‘Other,’ or ‘Unknown’ when required. Any applicable fees can’t be assessed unless there is an active contract or valid authorization by statute.

Step 4: Report Submission and Remitting the Funds Due

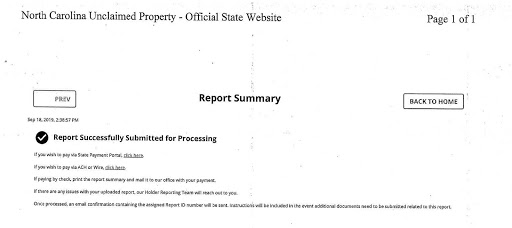

If you have created a NAUPA file, visit ‘Upload a Report,’ provide requested data, and upload your file. You will receive a Report Summary confirming successful submission. If you submitted your NAUPA via ETM, do not upload the file to North Carolina’s state website, as HDE files are no longer accepted.

Manual reporting forms are no longer valid. Holders without electronic files should use North Carolina’s Manual Online Reporting Tool to enter required holder or owner information. Refer to the state website for instructions and a step-by-step guide.

Holders can remit payments via Check, ACH, or Wire transfer. For check payments, make the check payable to “North Carolina Department of State Treasurer” and send it along with the Report Summary via mail to:

NC Department of State Treasurer

Unclaimed Property Division

3200 Atlantic Avenue

Raleigh, NC 27604-1668

For ACH payments, use the Holder Payment portal. Do not email or mail the ACH confirmation or Report Summary when using the state portal. EFT instructions can be found in the Reporting Library. When remitting via ACH or Wire without using the state portal, email a confirmation of report submission and EFT transfer to [email protected] with the subject “Holder Report Filing.”

Property holders must retain records containing required information for 10 years after filing the report, as mandated by N.C.G.S. § 116B-73(a).

North Carolina state law dictates that unclaimed property holders must report and remit unclaimed property on an annual basis once the dormancy period is met. Unclaimed property encompasses refunds, wages, bank accounts, utility deposits, bonds, insurance policy proceeds, stocks, or contents of safe deposit boxes that have been abandoned. Property is considered abandoned if there have been no documented transactions or contact with rightful owners during the dormancy period.

Efforts to Find Rightful Owners

Under the law, property holders, including insurance companies, banks, and credit unions, must make good faith efforts to locate the property’s legal owner. If locating the owner proves unsuccessful, holders should report the last known names and addresses of property owners to the North Carolina State Treasurer. The Department of State Treasurer posts notices in newspapers, offers public awareness and outreach efforts, and seeks assistance from the General Assembly and local governmental offices to locate rightful property owners.

Property can become “unclaimed” due to various reasons, including:

North Carolina state law mandates that public agencies, insurance companies, financial institutions, and businesses must surrender all unclaimed property to the state if there has been zero contact with the owners for the specified period.

No, claiming unclaimed property in North Carolina is a free public service provided to residents.

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.

Copyright © 2024 · OurPublicRecords.org · All Rights Reserved