Copyright © 2024 · OurPublicRecords.org · All Rights Reserved

Free Ohio Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Do you have unclaimed money in Ohio and don’t know how to get it? Here is a comprehensive guide on how to get your unclaimed money and property in The Buckeye State.

Researchers estimate that at least one in 10 people nationally are owed unclaimed money and property. This means that potentially millions of Ohioans may be owed by the state; or the federal government.

The law states that money owed to you must be turned over to the state if you don’t claim it within a given period. For example, businesses are required to turn your wages over to the state after one year, and rebate checks after three years.

Reports released since 2020 revealed that Ohio has about $3.2 billion in unclaimed money and property. The reports also suggest that the average claim ranges around $1,400. These funds have been reported by more than 81,000 organizations. The funds also come in a range of assets.

Common types of unclaimed funds and property in Ohio include:

Paychecks are the most common type of unclaimed funds and property. In most cases, employees don’t collect or cash in their last paychecks for a range of reasons, including a bitter fallout with the employer. Safe deposit accounts also account for a sizable amount of unclaimed funds. In most cases, people die without informing their next of kin about their bank and safe deposit accounts.

Akil Hardy, the superintendent of the Division of Unclaimed Funds, under the Ohio Department of Commerce, says, “The money stays here forever until the rightful owner comes to claim it.” Consequently, this money is locked waiting for its owner, as the state cannot use it for public projects.

The State of Ohio has mechanisms for finding the owners of unclaimed funds in the state. However, these solutions locate only a fraction of the beneficiaries. Consequently, most of the people with unclaimed funds don’t know about it, and some funds go unclaimed for generations. This is why it is advisable to personally check whether you are entitled to any unclaimed funds.

This is the easiest platform to use to find out whether you have unclaimed funds in Ohio (and other states). Our platform has a comprehensive and up-to-date database of unclaimed funds in Ohio. You can use the search boxes at the top of this page – simply put in your first and last names in the first and second boxes respectively, and then select Ohio as your intended search location/state. You can also narrow your search down to a city or zip code.

Our platform also has a national database, so feel free to search for unclaimed funds in any state on the list. You can also search unclaimed funds for your relatives, especially if you have deceased relatives who may have left behind undisclosed financial assets. The platform also supports queries for funds owed to businesses using the company’s name.

Other platforms that you can use to search for unclaimed funds and property in Ohio include:

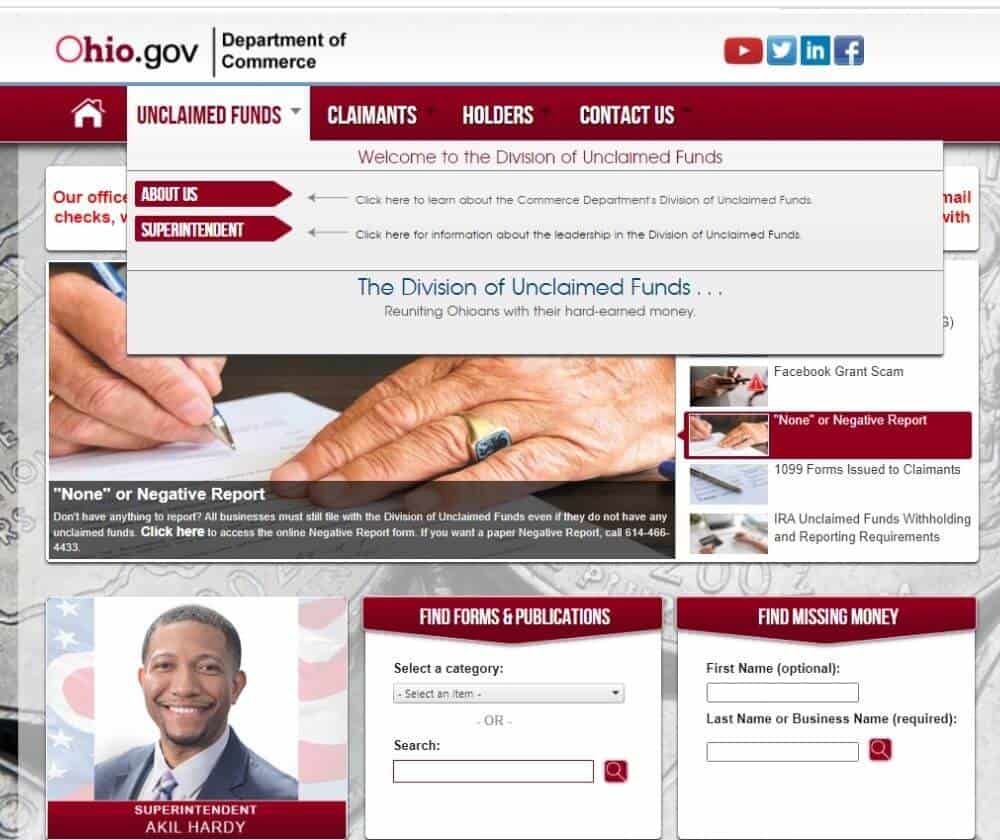

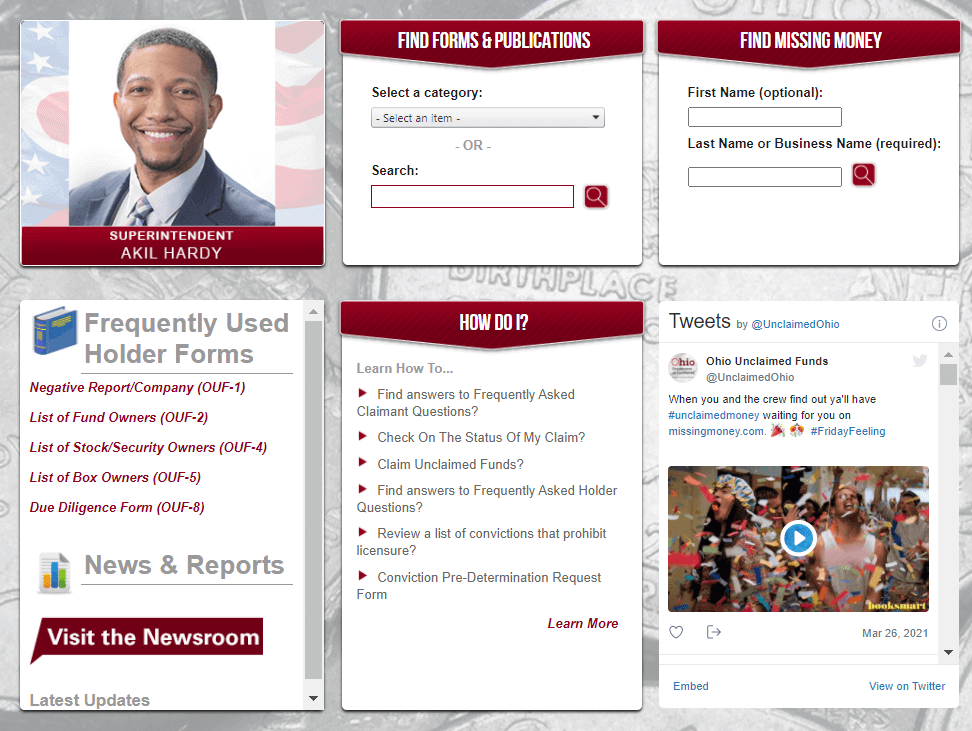

Ohio has a state-run platform that keeps an up-to-date database of unclaimed funds and property: https://www.com.ohio.gov/unfd/. The platform has a simple user-interface, as shown below:

This website is easy to navigate, and there is a search box where users can input their details when searching for unclaimed funds and property, as shown below:

There are two search portals on the website: one for forms and publications, and the other for missing money and property. Users searching for unclaimed funds should use the second search portal.

The search portal has two fields. The upper field requires your first name (optional), while the lower field asks for your last name (mandatory). Type your names in both fields and click on the search glass icon or press enter on your keyboard. The website will bring you a list of all unclaimed funds and properties under your name; or a black page if none exist.

You can also use a company’s name to find any unclaimed funds and properties associated with it. The company’s name should be written in the second field in full.

The IRS also has billions worth of unclaimed money, mostly worth of tax refunds. The agency also has an easy-to-use platform, including a My Refund page that only requires the users’ names for refund searches. State departments of taxation also have unclaimed money and property in the form of state tax refunds and other financial assets.

The U.S. Treasury has more than $17 billion worth of unclaimed savings bonds. Users can use the U.S. Treasury website to find out whether they have a stake in the unclaimed funds. However, it is worth noting that this platform is not easy to use. Fortunately, users can also write to the Bureau of Public Debt or call the department for assistance.

You can also check for unclaimed funds through federal platforms. It is important to note that there is no central database where users can perform a comprehensive search. Instead, each government agency maintains its records, according to the U.S. Treasury Department. These federal government agencies include:

Consequently, it is advisable to narrow down your search to finer details when using these federal agencies. For example, identify the type of payment that lies unclaimed, when the payment was expected, the expected mode of payment, and more.

However, the National Association of Unclaimed Property Administrators is easier to use. The platform works in collaboration with state officials actively looking for owners of unclaimed property, including in Ohio. The platform also doesn’t require elaborate details, making it ideal for users with no clue about their statuses.

You can also hire a lawyer or professional finder to look for any unclaimed funds or property under your name. Finders do all the digging through all relevant federal government, state government, and third party websites.

Hiring a finder has its benefits and shortcomings. The greatest benefit is that the finder will explore every avenue and their vast resources and networks to find your unclaimed funds, guaranteeing success where you would fail.

Other benefits include legal services, whereby the finder helps you stake a legally abiding claim on the unclaimed funds and property. Consequently, professional finders are especially recommendable in cases where the unclaimed funds are considerable, and when attempts to access them may face legal hurdles. However, the cost may not be worth it if the unclaimed funds are negligible.

The Ohio state government is always looking for the owners of its growing unclaimed money depository. The state treasurer has a team of officials who administer the claims program. The state also employs a range of methods to find claimants, including:

The state has a website dedicated to matching unclaimed funds with its rightful owners: https://www.com.ohio.gov/unfd/. Anyone can use this website, as illustrated earlier, and it is the easiest way to find out if you have unclaimed funds.

The state also has agents who actively crosscheck public databases to find the rightful owners of unclaimed funds. Consequently, you may get mail notifying you of unclaimed funds and public under your name.

The state also offers opportunities for residents to find out if they have unclaimed funds and property through outreach events. Outreach events are usually launched during other public events that attract large crowds, such as local festivals and state fairs. The state also regularly launches outreach events at local malls.

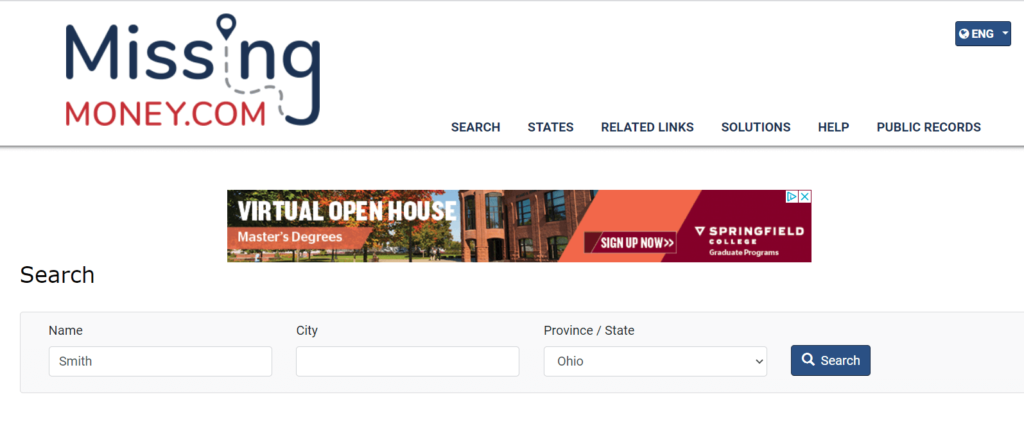

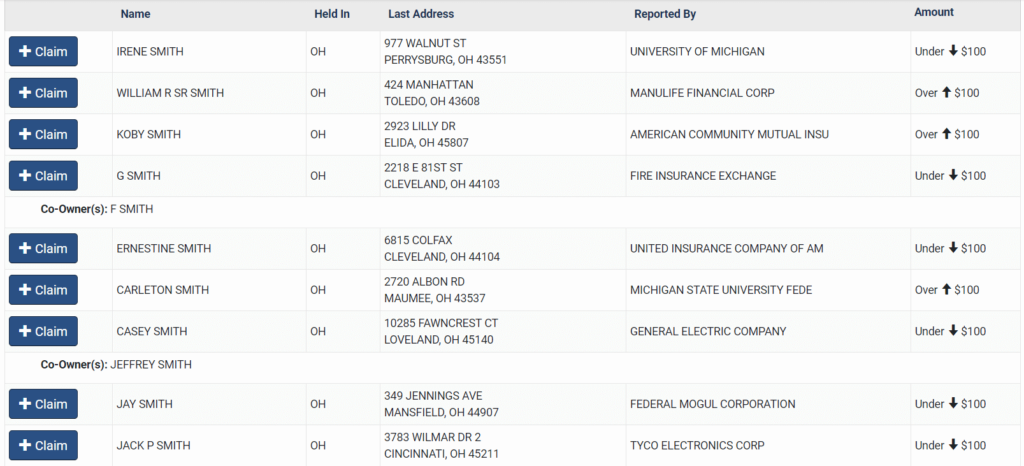

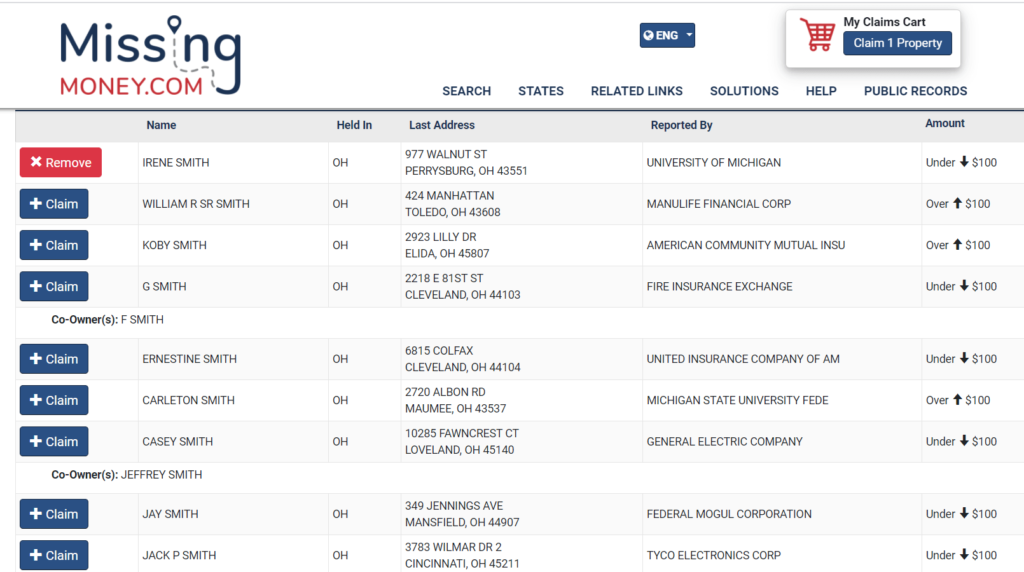

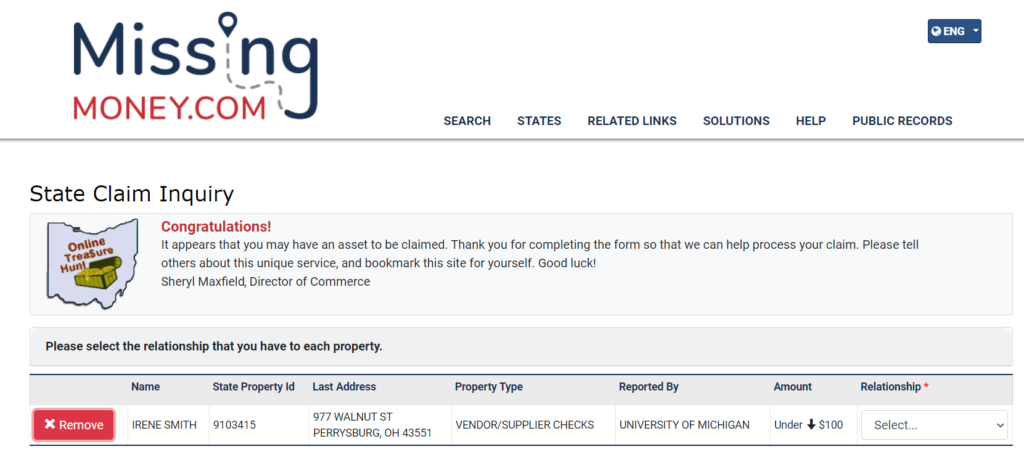

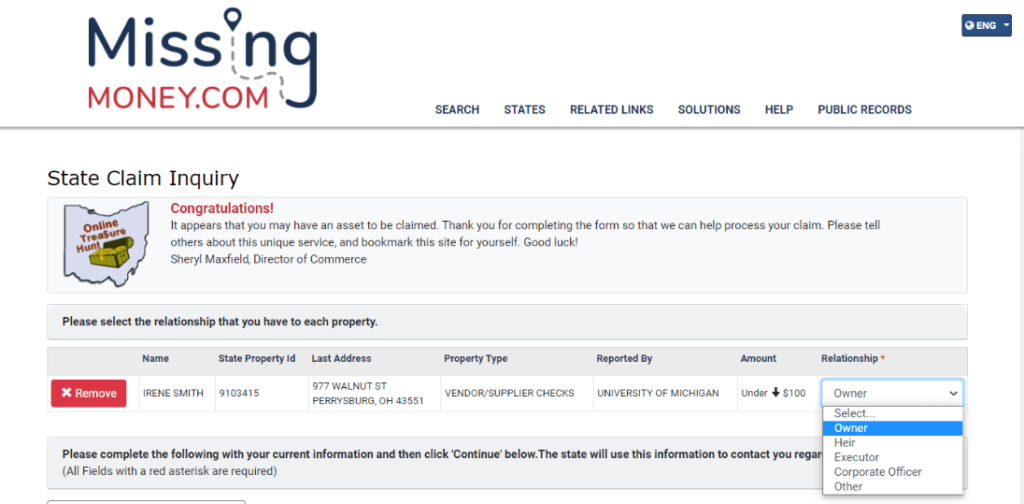

Ohio and most other states also submit their public records for unclaimed funds and property to a national database: www.missingmoney.com. Anyone around the country can use this database to find out if they have unclaimed property in Ohio or any other state.

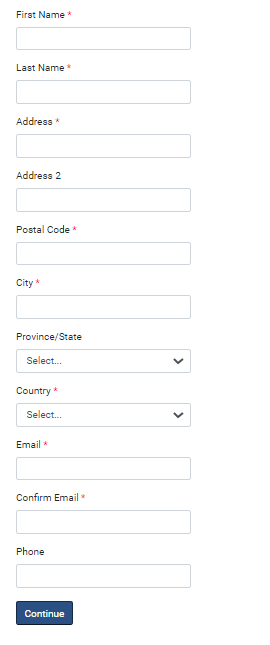

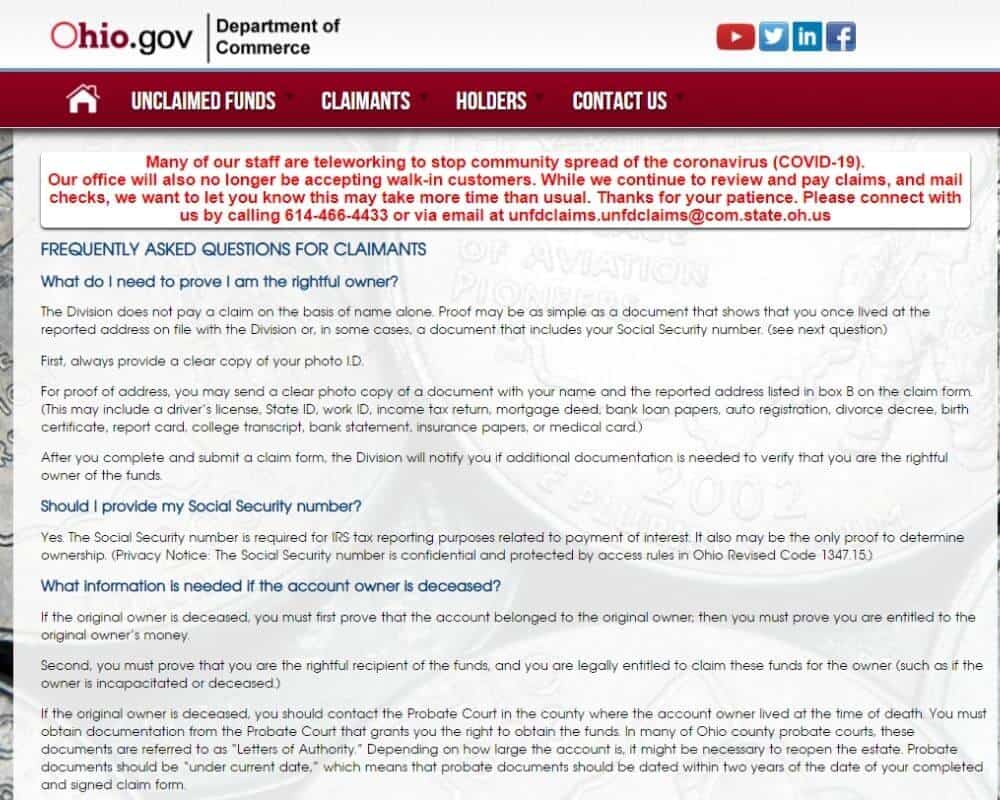

Finding out whether you have unclaimed money or property usually requires only your name or other basic identification details. However, claiming these funds necessitates an irrefutable proof of your identity. Consequently, claimants are required to meet several requirements to unlock their funds.

For starters, you will be asked for a copy of your photo ID with your picture and other details clearly visible. You may also be required to provide proof of your residence. This should be a copy of any legal document with your name, picture, and address, such as a driver’s license or medical card.

You may also be required to provide your social security number in some cases. Your SSN is especially necessary if you are claiming tax refunds. However, it is worth noting that your social security number is confidential, so don’t provide it unless it is required by law.

The volume of unclaimed funds and property has been rising consistently over the past. However, you can prevent your funds from getting lost or going unclaimed using several simple solutions:

Keep Accurate, Up-to-Date Records

Many people simply forget that they have funds or property. For example, low-value bank accounts and properties are easy to ignore, and ignorance eventually leads to forgetfulness. Consequently, it is advisable to keep an updated record of all of your funds, properties, and other financial assets.

It is also advisable to update your accounts and addresses. This is because payments paid to your former accounts or addresses will go back to the payer and submitted to the state as unclaimed assets. However, updating your address when you move will ensure that you get the checks and other relevant documents.

Be Active on Your Accounts

Money in dormant accounts and other contents in deposit boxes are handed over to the government after a given period of inactivity. This is why it is important to maintain activity across all of your accounts. It can be something as simple as logging in or checking your balance – as long as it proves that you are still using the account.

Different accounts and financial institutions require varying levels of activity. To this end, some accounts may necessitate only one activity per year, while others necessitate regular activity over much shorter periods.

Prepare a Will or Disclosure

A significant amount of unclaimed funds and properties are left behind when their owners die. In most cases, the deceased owner’s relatives don’t know about these funds, leaving them unclaimed. Consequently, it is advisable to disclose your property to your next of kin as regularly as possible. It is also advisable to leave a will disclosing and assigning your funds and property to your heirs.

The main legal requirement for accessing your unclaimed funds in proving your identity. You can do this by providing a copy of your photo ID and other legal documents proving your residence. Some claims may also require you to provide your social security number.

Your unclaimed funds may or may not accrue interests, depending on when they were filed as unclaimed. Unclaimed funds valued at $25 or more filed between 1968 and 1991 accrue interests of up to 6%, while those filed after this period do not. Some types of unclaimed funds and property filed after 2000 may also earn interests from various state government agencies.

Banks are required to turn over the contents of safe deposit boxes to the state if the box is not claimed after the contract ends. However, the state can only take cash and other cash-convertible financial assets, such as stocks and bonds. However, the state cannot personal items such as jewelry. It is also worth noting that the state organizes periodic auctions in which it sells these assets for cash, so claimants get a cash equivalent of their funds and property claims.

The claims process for unclaimed funds and property left behind by deceased people are a bit different. The main requirement is proving that you are legally entitled to the funds and property. Consequently, you will be required to consult with the deceased person’s local probate court to get the right to claim these funds. You will also be required to obtain documents known as Letters of Authority authorizing the state to release the funds to you. Large estates may require re-opening.

Joint accounts are claimed based on the joint agreement. Accounts set up as JOHN AND JANE are paid to both owners proportionately, depending on how much each person put it. Accounts set up as JOHN OR JANE are paid out to either owner. Additionally, joint accounts whereby one of the owners is dead are paid out to the surviving owner.

Your sign on the claims file must be notarized if the claim is valued at $1,000 or more. Getting your sign notarized is easy, as you can find a Notary Public at a range of financial institutions, your local city and county offices, and police and the local sheriff departments.

Claims can be rejected for a range of reasons, such as the lack of legal proof or legal contests by other claimants. There is a range of legal solutions, including filing a petition with the Pension Benefit Guaranty Corporation. You can also hire a lawyer to present your case in court.

Unclaimed money and property in Ohio is worth more than $3 billion. All this money is lying idle, as the state has no authority to use it. However, you can claim this money and use it however you like by following the claims process outlined above.

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.

Copyright © 2024 · OurPublicRecords.org · All Rights Reserved