Copyright © 2024 · OurPublicRecords.org · All Rights Reserved

Free New Hampshire Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Learn what happens to unclaimed property in the Granite State and the basics of claiming assets in our ultimate guide to New Hampshire unclaimed money.

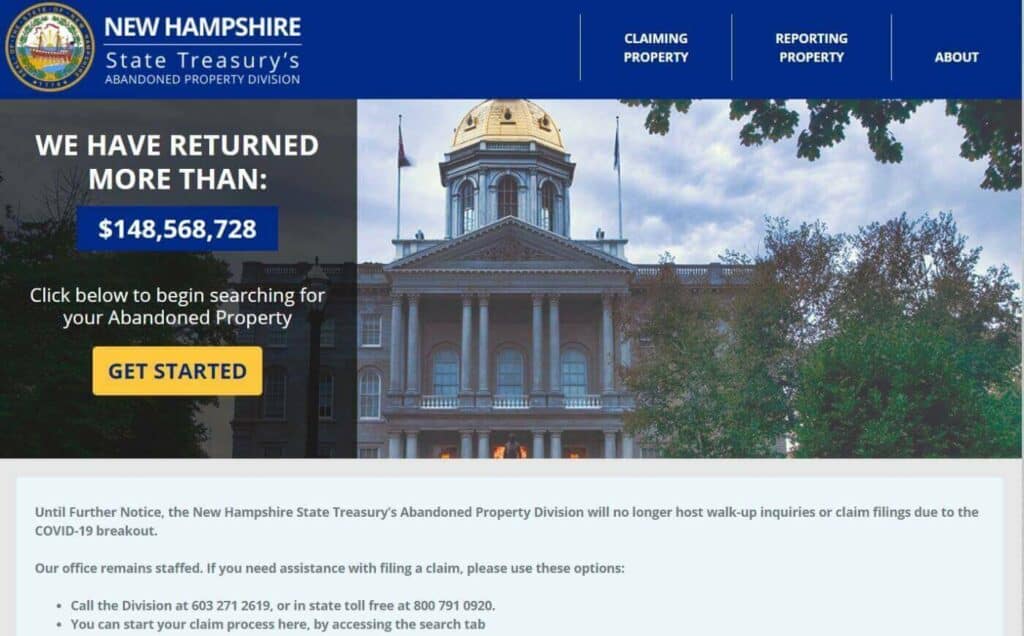

Known as the Granite State, New Hampshire is a small state in New England. The Abandoned Property Division is a branch of the State Treasury and responsible for helping owners find and claim any of their missing assets. This division returned more than $148 million to residents and others through May of 2021 and plans to return even more money in the future. Not only does the division host outreach events, but representatives also work with searchers over the phone and process claims as they arrive.

There are many reasons why your property might become abandoned without you knowing it. You might forget to update your phone number or address when you move or think that you closed an account that is still open. Though you may want to contact the organization or company that has your property, you can also go through the state database. The New Hampshire system is easier to use than you might expect. We’ll show you how to complete each step after looking at the types of unclaimed property found in the Granite State.

Almost any type of asset or account that has a monetary value is a type of unclaimed property in New Hampshire. This does not include vehicles such as boats or cars and does not refer to real estate. A common example is a life insurance payout. You only receive a payout check when you are a beneficiary on a policy and the person who bought the policy passes away. They may have a policy that they bought on their own or one that they got through their bank or employer. The money attached to the policy does not go away and is always available, but you may need to claim the policy through the New Hampshire database.

Banks accounts are also a type of abandoned property found in New Hampshire. This includes both checking accounts and savings accounts. Let’s say that you opened a joint account with your spouse and then opened a separate account after your divorce. If neither of you claimed the old account, the bank will hold the funds for up to several years after your last action or contact. The bank may send letters to both of you before telling the NH Abandoned Property Division, which will put your money in the system. You can also look for accounts that you shared with your parents and those that you had by yourself.

Unpaid wages are also available through the NH database. Any time that an employer owes you money for the time that you worked, it’s a type of unpaid wage. Take for example a job that you held for several years before moving to a different company. You may not realize that you had a final paycheck that included payment for the last few hours that you worked.

Some people find that they have checks from employers for the expenses that they paid for before they left. You can request that New Hampshire mail you a check once you complete the claim process.

If you ever put down a deposit, you should check the system for refund checks. A deposit is often associated with utility companies. The utility charges a fee that can climb to a few hundred dollars, which they use in case you fall behind on your bill. As long as you make all of your payments on time, you should get your deposit back either when the term ends or you end your service. Many people move and don’t get the checks that companies sent to their old homes. New Hampshire gives you an easy way to find and claim your refund checks online.

Though the NH system doesn’t list most forms of physical property, it does include most types of stocks and bonds along with safe deposit boxes. The contents of the box go to the treasury, which keeps it safe until it can find who rented the box. With stocks and bonds, you may have the chance to get the originals back and transfer them to your investment portfolio. The state may sell the originals and instead get you the money that they earned. You can claim any abandoned asset that belongs to you through the New Hampshire system.

New Hampshire currently has more than $220 million in unclaimed assets listed in the online system. This figure often changes as the state releases funds associated with new claims and receives new reports from holders. You should look at some of the other websites that help you find abandoned assets as there are more than $40 billion located across the country.

The Granite State operates the New Hampshire Find Your Unclaimed Property to help you find your assets. This site is a branch of the NH Abandoned Property Division.

Step 1: Head to the New Hampshire Find Your Unclaimed Property website, which can help you learn about state laws before you look for your property. Click on the “Search” button on the top of the page to find the search page.

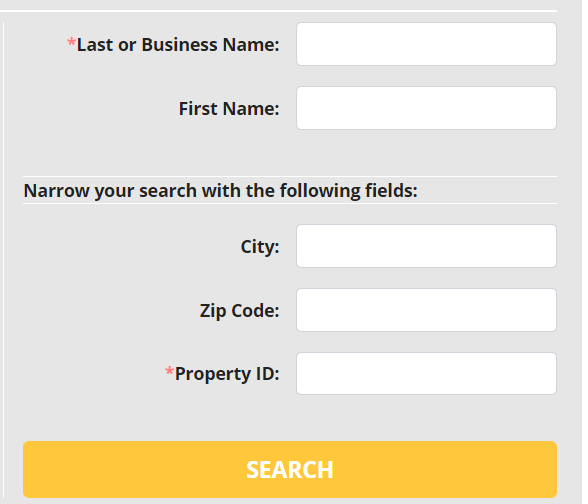

Step 2: To use the free system, add your last name in the marked box. If you received a letter from the New Hampshire Treasury, you can use the property number. NH will also accept your first name and/or city to narrow down your search results.

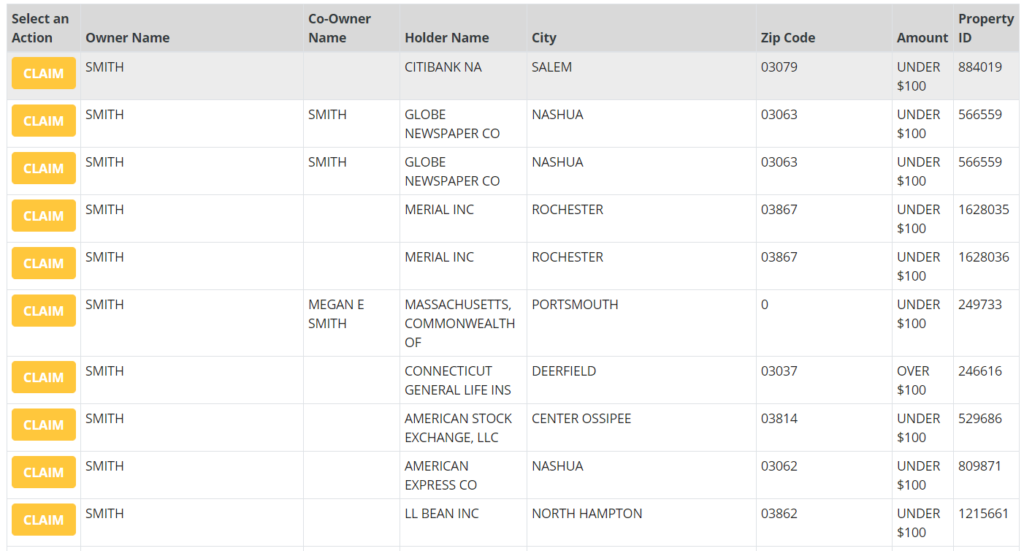

Step 3: Go over the search results to find which assets belong to you and which ones you want to claim. New Hampshire will show you the name of the reporter or holder along with the owner’s name and the co-owner’s name if there was one. You may want to see the value of the asset to see how much money you can get.

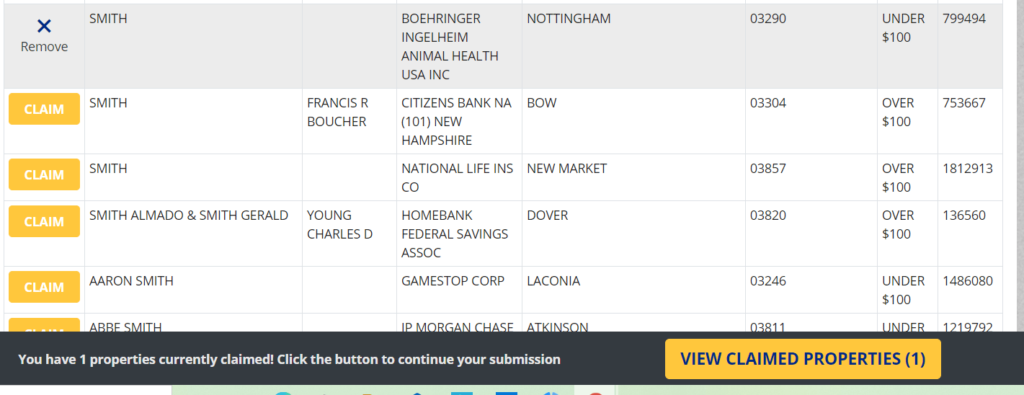

Step 4: Claim your property via the two yellow buttons on the page. You need to first click on the yellow “Claim” button under the left column. If you change your mind, click the button a second time to remove that asset. After claiming all of your money, click on the yellow button under the information to start your claim.

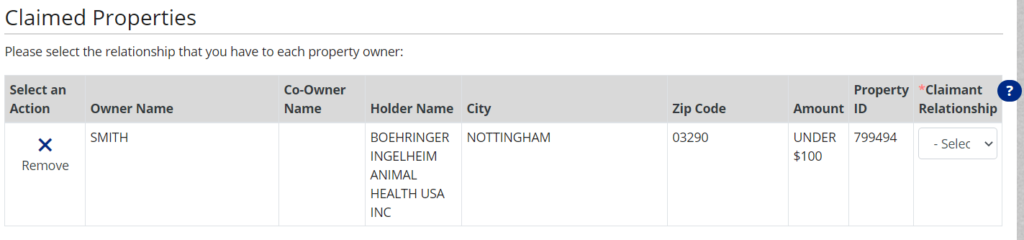

Step 5: Confirm that all the information shown matches your personal information. You then need to click on the “Claimant Relationship” box and select “Myself” before moving to the claim process.

There are a few reasons why you might claim a New Hampshire property that doesn’t include you as one of the owners. You can choose the “Owner or Authorized Signatory” to show that you own a business or are a signatory associated with the business and want to claim one of its assets. New Hampshire has another option designed for legal heirs and estate representatives, which you can use if you need to go through probate. There are other options designed for legal trustees and guardians.

After using the “Claimant Relationship” box, you’ll have the chance to complete other steps to help the Granite State process your claim.

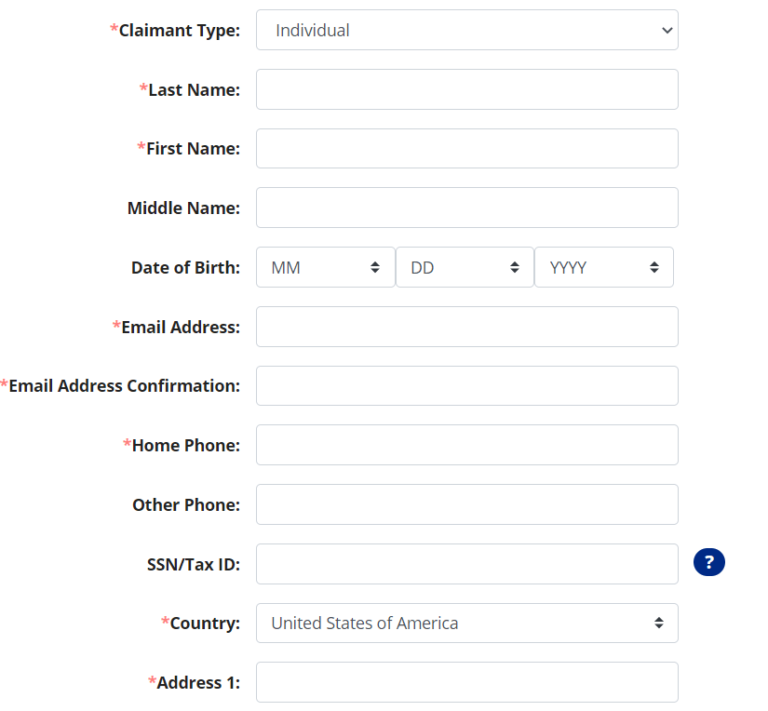

Step 1: Provide New Hampshire with all the contact information that the state needs. You need to include your email address, home address, home phone number and first and last names. Once you confirm your information, hit the “Next” button at the top of the page.

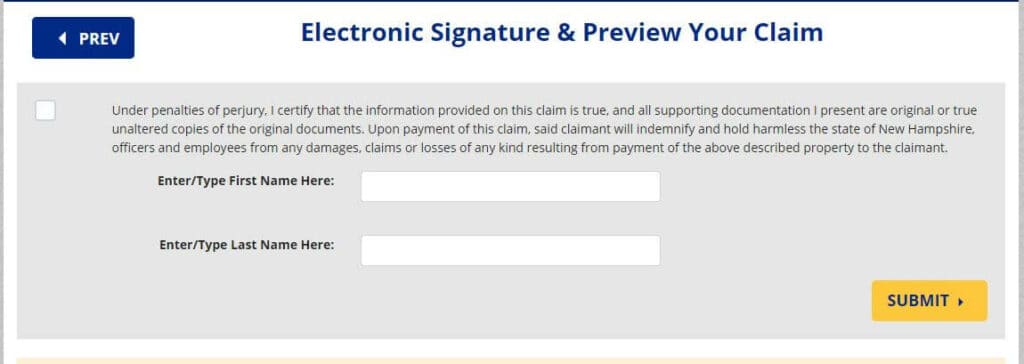

Step 2: Look over your claim to make sure it looks good. You will then type your first and last names in the top box and add them again in the bottom box. Once you hit the “Submit” button, the state will receive your claim. Check your inbox for an email that lists all the documents and other information that the Granite State needs from you.

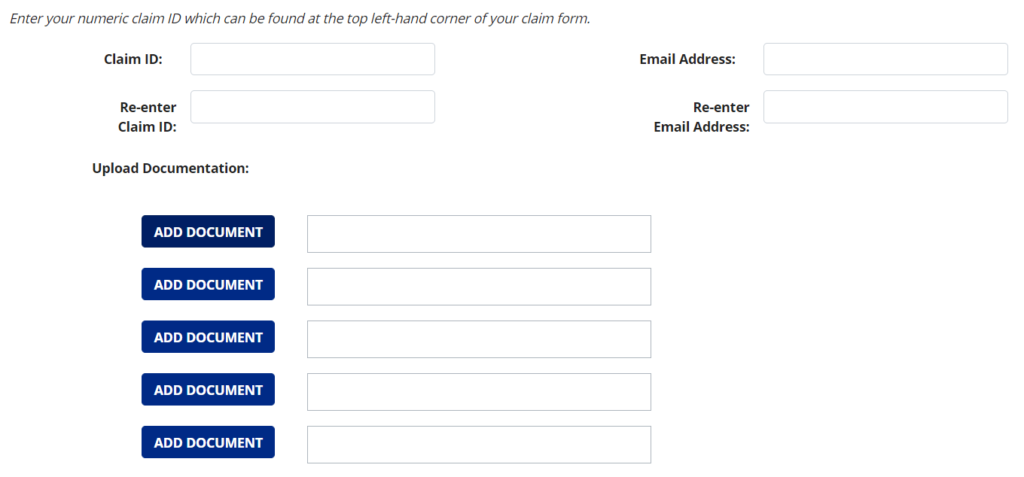

Step 3: Collect all of your required documents. You may need to scan or take photos that you save on your computer. Navigate to the upload page. Enter both your claim number and email address in the boxes on this page. You can then upload your documents and add up to five to your claim.

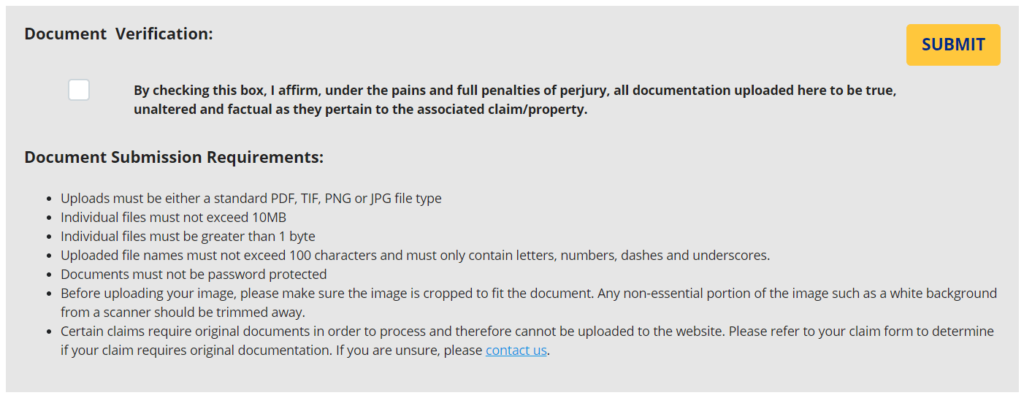

Step 4: Look for the paragraph at the top of the page and click on the box to the side. When you finish adding your documents, use the “Submit” button to send the information to the Treasury.

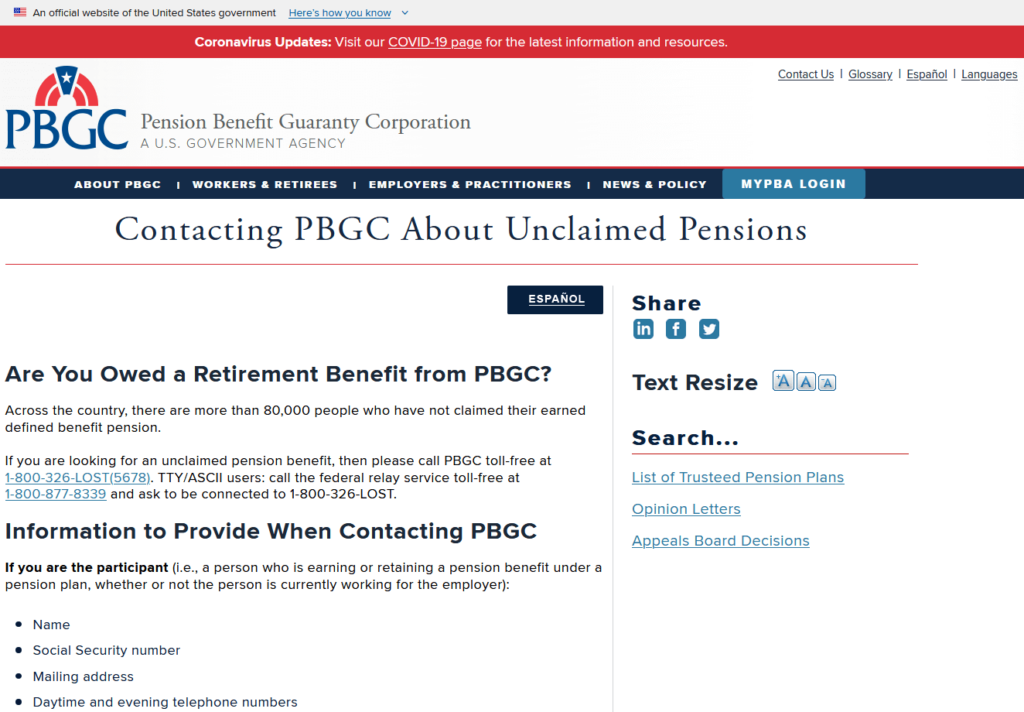

There are quite a few websites that can help you find abandoned assets that belong to you and your loved ones. The best ones to use depend on what you hope to find. Let’s say that one of your parents passed away and had a pension but didn’t write down their account number. The Pension Benefit Guaranty Corporation lets you search for their pension accounts with just their first and last names. You can also use U.S. Railroad Retirement Board if your loved one ever worked for the railroad. Both sites allow you to claim their accounts. You can then request a check for the total amount or fill out forms and have the money added to your pension.

When you want to look for an old bank account, turn to the Federal Deposit Insurance Corporation first. Often called the FDIC, this organization provides insurance for banks and makes sure that the money they hold goes to the rightful owners. The National Credit Union Administration tracks the money held in credit unions. Using either of these sites can help you see if a bank or credit union still has your money or if they sent your money to a state database where you can claim it.

Some of the other sites that can help you find different types of abandoned assets include:

New Hampshire unclaimed property laws are in place to protect those looking for their unclaimed property and the holders who report those assets. You can view the laws online to make sure that you have the right to claim an asset that you find.

One thing to keep in mind when filing a New Hampshire claim is that your money is only available in the form of a check. The state can send one in your current name if it changed since you created the asset and send it to the address that you choose. It can take up to two months for your check to get there. If you want to make sure that you did everything the state required, use the search for your claim’s status page. You just need to enter your claim number and find your asset in the system.

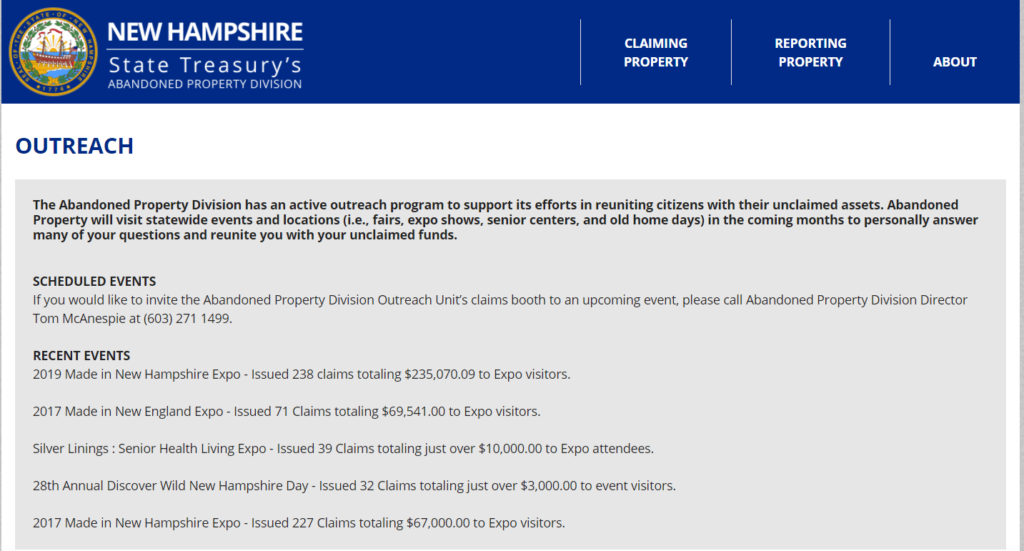

The New Hampshire Outreach Program refers to all the attempts that the state makes to locate the original owners of abandoned assets. This program often sends representatives to the New England Expo, which sees thousands of visitors pass through every year. In 2019, visitors filled out more than 230 claim forms and got back more than $235,000. Organizations can contact the treasury and request that representatives come to one of their events. New Hampshire also updates the online database several times a month and lists all assets worth a minimum of $50 with the owners’ names online. If you live in the state, you may get a postcard that tells you that you have money you can claim.

You may need a notary when claiming certain types of property such as those owned by a deceased person. New Hampshire recommends that you visit the Abandoned Property Division if you need notarized documents. The office does not charge a fee for this service. You’ll also find notaries at town halls and certain companies such as UPS, but they charge to notarize your documents. Some claims require an affidavit that details your relationship with the original owner.

The Granite State will retain all abandoned assets for an unlimited period of time. You don’t need to worry that New Hampshire will transfer your property to someone else or use it to support the local government. Once you start the claim process, you need to complete it and upload all of your documents by the date listed in the email that you get. If you do not complete the necessary steps. New Hampshire will return it to the database. It may take several days or longer for it to reappear in the system.

When a loved one passes away, you may expect to get certain things from them. Unless that person left behind a will though, you may not get everything that you want. New Hampshire often includes the deceased’s property in the online database. You need at least two things to claim that property: a death certificate and probate papers. The death certificate lists the deceased’s cause of death and other information. You can submit an original certificate or a copy of that certificate. The probate papers show that you opened a case and that it is either still going through the system or already closed.

You usually do not need original documents when filing claims because New Hampshire accepts copies or photos that you upload online. If you need to show proof of your social security number but do not have your card, you can use your 1099 or a W-2 along with a copy of your most recent tax return. New Hampshire will also accept copies of documents that show your original address such as a utility bill on old vehicle registration.

In New Hampshire, holders and owners must have a good relationship. If the holder reports that the owner had no contact and did not use the asset for five years, they can create a record and submit it to the state. This lets the treasury know that it should move the asset to the unclaimed property database. Keeping your accounts active is the best way to keep them from becoming abandoned. You may want to make a deposit or transfer money to a bank account or just log in and check on the account. Make sure that you notify each holder when any of your contact information changes.

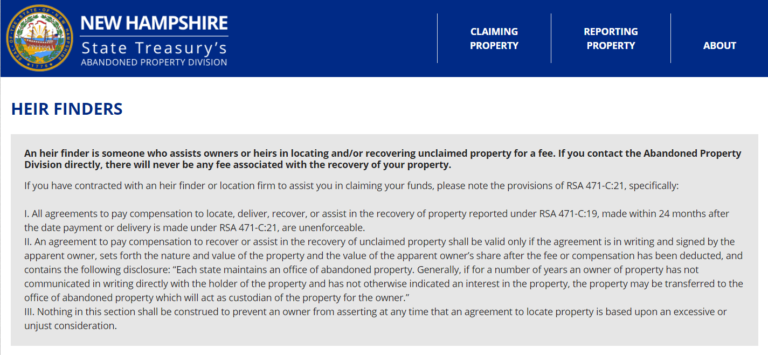

Though New Hampshire doesn’t have laws against heir finders, it recommends that you contact the treasury before working with one. An heir finder will use the online system to find money and property. They then promise that they’ll complete all of the necessary steps and send you the money. While some charge a flat fee for the work that they do, others will take a fee equal to a certain percentage of the amount that you get. You should not pay an heir finder until you check the website and see how easily you can claim your money. New Hampshire lets you do most things online and does not charge you any money.

There is never a bad time to use the New Hampshire system to find your property. You may find an old bank account that you forgot about or a paycheck that you thought you cashed. The state can also help you find money that you never knew existed such as a life insurance policy from years ago. Our ultimate guide to unclaimed money in New Hampshire makes it easy for you to find the system and use it. You no longer have any excuse to put off your search. Make sure that you check out our other pages to find abandoned assets and missing money across the country.

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.

Copyright © 2024 · OurPublicRecords.org · All Rights Reserved