Copyright © 2024 · OurPublicRecords.org · All Rights Reserved

Free Illinois Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Find out what unclaimed property in Illinois is and the easiest ways to claim it in our ultimate guide to unclaimed money in Illinois.

With a nickname of the Land of Lincoln, it should not surprise you that Illinois has billions of dollars in unclaimed funds. This name comes from the deep connection that the state has with former President Abraham Lincoln. You may find more than just pennies when you search the state system. The database that Illinois uses is under the guidance of the Illinois State Treasurer. Though the treasurer doesn’t often send letters or make other attempts to contact property owners, the state does make it easy for people to get their money back.

Illinois doesn’t distinguish between abandoned and unclaimed funds. When you do not have any contact with the organization that oversees your money, that organization will determine that you abandoned the property. They will then alert the Illinois State Treasurer, which receives the property and becomes the new holder. As the official holder, the treasurer will keep your money safe and list it online to help you find it. We’ll show you how to claim different types of property through this system and cover the important things that you need to know in our ultimate guide to unclaimed money in Illinois.

Any type of property that has a listed owner who has no contact with the holder is a type of unclaimed asset in Illinois. Illinois allows the holders to hand over the property in just one year if they cannot find who owns it. This can happen if you change your email address or switch to a different phone number or even if you move. As long as you lived in Illinois and the company or organization that held the money is in Illinois, you should find it in the state database. It’s worth looking at the databases of other states to find even more money.

One thing that you may want to look for is an uncashed check. Let’s say that you accepted a new job but decided that it wasn’t right for you and quit after your first shift. You may not realize that your employer must legally pay you for the money that you earned. The same is true if you worked a few shifts or even longer. Employers often send final paychecks that include the last hours that you worked as well as money that you earned in the form of paid time off or employer reimbursement. They usually send the money to your last known address, which might not be where you now live.

Uncashed checks can also include refunds and overpayments. Take for example an old credit card that you closed. You might look at the balance on your card and pay the total amount due. The credit card company can later add a refund to your card, which gives you a negative balance. They are responsible for making sure that you get the money you overpaid, even if it’s just a few cents. Refunds can come from a variety of sources such as your old electric company. Many of these companies charge a fee when you open your account that they call a deposit. You should get your deposit back if your account is in good standing. If you lost a deposit, you might find it in the Illinois system.

We also encourage you to check the Illinois database for different types of tangible property such as safe deposit boxes. While banks agree to keep the contents of your box safe, they do not need to keep the property permanently if you stop paying for your rental. Illinois will accept jewelry and other expensive items stored in the box and let you claim it later. Depending on how much time passed, you may get a check for the total value of your box. The Land of Lincoln also holds onto stocks and bonds when the owners abandon them. It’s worth taking some time to check the system for property that belongs to loved ones who lived in Chicago and other cities, too.

To find unclaimed money in Illinois, head to the Illinois State Treasurer website. You’ll find a button on the top of the page that takes you to the search feature or you can use the link below.

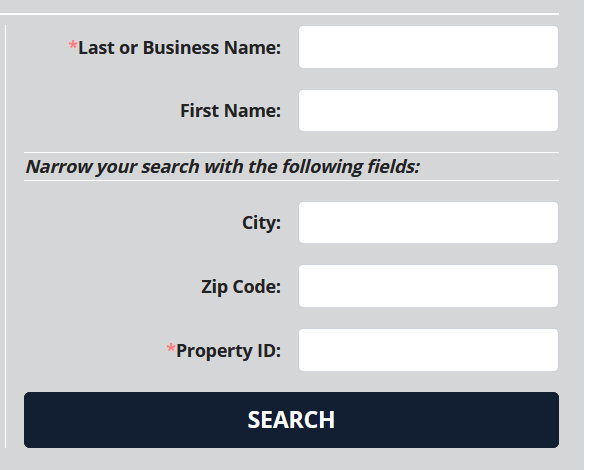

Step 1: Visit the claim search page on the Illinois State Treasurer website. If you look on the right side of the page, you’ll see the search box.

Step 2: Type your last name in the box on the top of the search section along with your first name if you want to use it. You have the choice of looking for assets owned by a business through this box. Illinois will also accept your zip code/city name or property ID number.

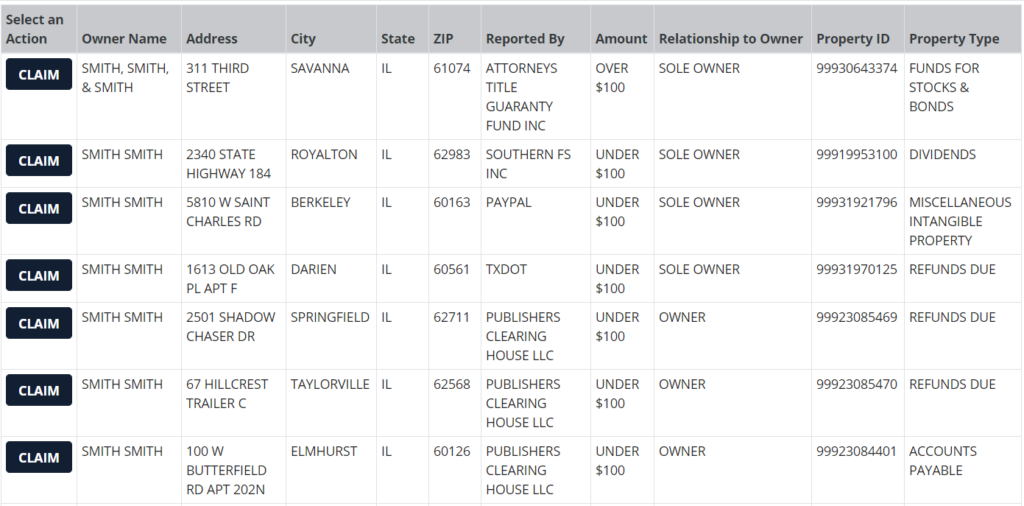

Step 3: Use the search results to find your property. You’ll see the owner’s name and address listed next to the property number. Illinois shows you both the holder’s name to let you know who reported it and the property type such as an insurance premium or stock. If you look under the “Amount” column, you’ll also see a general value of the asset.

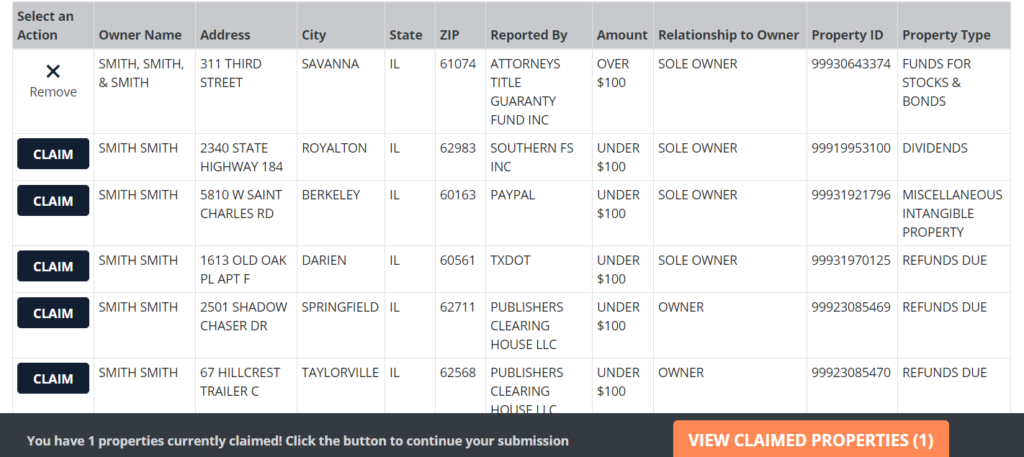

Step 4: Click on the dark blue “Claim” button to show that you want to claim the property. You can click on it a second time if you chose the wrong property. Look for the orange button on the bottom of the page and click on it to file your claim.

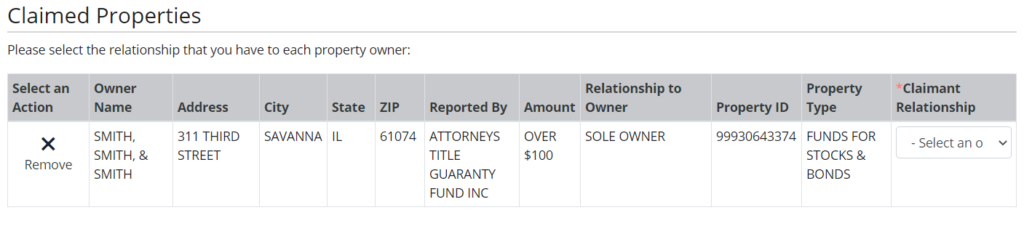

Step 5: Make sure that you can claim the property through the information found on the next page. Once you verify the information, click on the “Claimant Relationship” drop-down menu to show that you’re the owner. You may want to select one of the other options if you’re not the official or listed owner.

The Illinois State Treasurer has more than $3.5 billion in assets owned by current and former residents of the Land of Lincoln. This figure does not include the more than $1 billion that the treasurer returned to Illinois citizens since the site launched in 2015. You might think that you only need to use this site, but other states and websites have more than $42 billion in unclaimed assets.

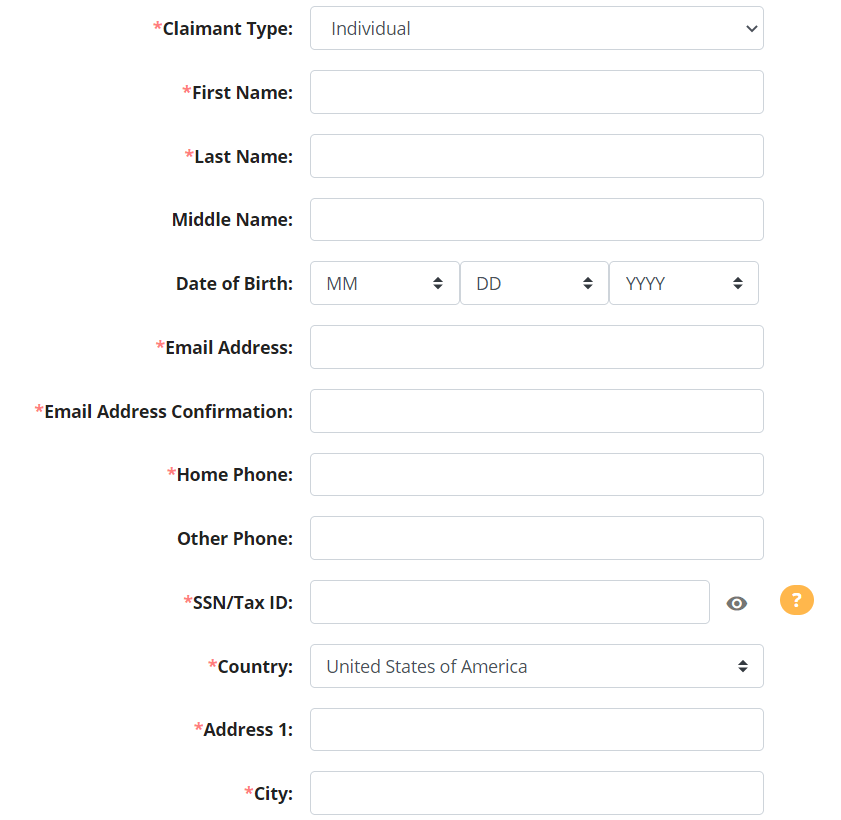

Illinois lets you complete the claim process from your home computer. Once you finish the steps we described above, you’ll reach the contact information page, which lets you complete your claim.

Step 1: Fill out all the marked boxes on this page to show that you have the right to the property. Illinois requires your social security number and full name as well as your home address. You can add your home phone number or a mobile number.

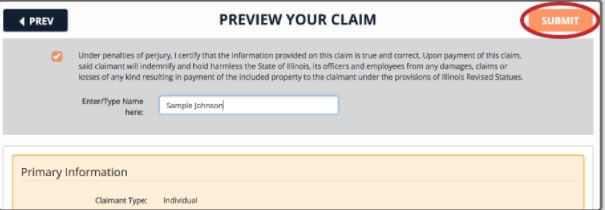

Step 2: Preview your Illinois claim to make sure that you used the correct information. You also need to type your name in the marked box to serve as your digital signature before clicking on the “Submit” button.

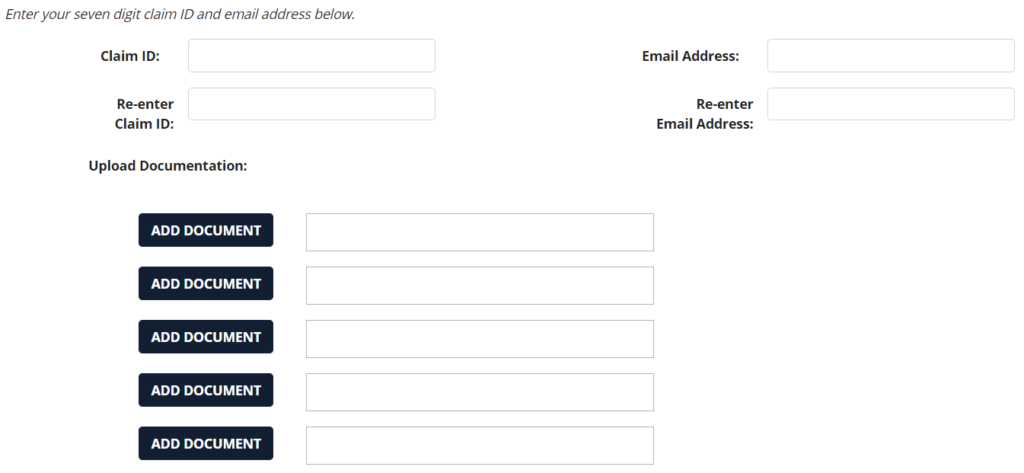

Step 3: Check your inbox for an email from the Illinois State Treasurer that details all the documents that you need. Gather those documents and visit the upload claim site. Enter both your email address and claim number in the marked boxes.

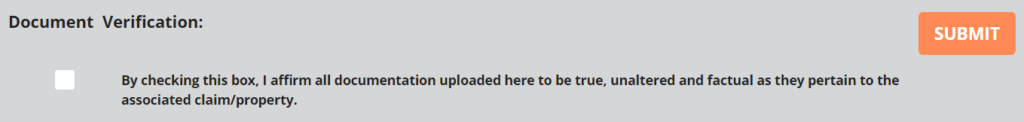

Step 4: Click on the “Add Document” button to find the documents or files that you want to add to your claim. Illinois will accept up to five files per claim. Go back to the top of the page to click on the box next to show that Illinois will receive accurate and valid information before you submit your claim form.

As you search the Illinois system for your last name, you may find money that belongs to a parent or grandparent. The Prairie State allows people to claim unclaimed property in some situations. One example is a claim filed by an heir. Heirs have the legal right to take property if they have a will or other proof. You may want to use the active probate option instead. This shows the state that you opened the deceased’s estate in probate court and have the legal right to take their property as the administrator or executor.

Illinois has two options for business owners. The first is for the owner of an active business and requires proof that the individual is the owner. If you owned a business that closed, you can file the closed business option. As a beneficiary of a trust, you have the right to file whether the trust is closed or still open. You’ll also find options for filing as the guardian of a minor child. Illinois lets you file if you are the listed owner of a property as a minor but are now an adult, too.

There are many places to look for unclaimed money outside of Illinois such as the Internal Revenue Service (IRS) website. The IRS gives you information and helps when you file your taxes. You’ll also find a search feature that lets you track a refund check that you never got. If you have a bank account, you can link it to your tax account and have the missing refund check and future refunds sent to your bank.

Many people think that they lose any money held in banks when those banks close. The Federal Deposit Insurance Corporation can help you claim the money that you lost. Though you might find that a state database has your money, you may also learn that it went to another bank. You can find the same information through the National Credit Union Administration, which keeps track of the accounts and funds held by credit unions, even after they close.

We also recommend checking the Missing Money website because it has information from dozens of states. You can easily run your name through each state to see if there are funds that belong to you. This site even lets you search for assets in Canada. You’ll also find that you can easily search for missing money that belongs to your friends and family.

Some of the other sites that help you easily find unclaimed property include:

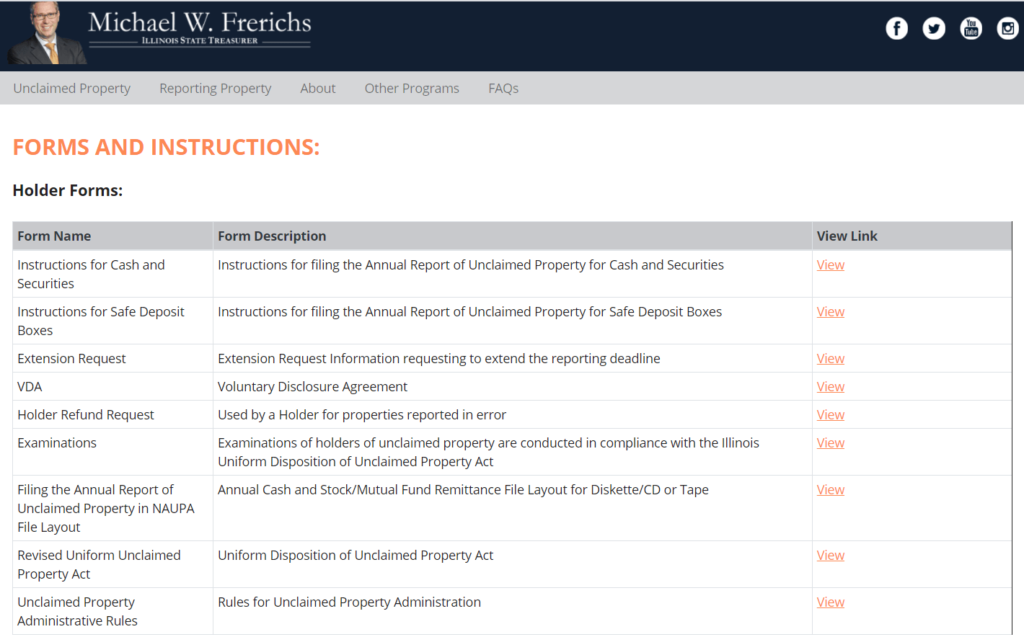

The Land of Lincoln has many laws that state what holders must do when they have unclaimed assets. You can check out all of those laws online to make sure that your holders acted in a legal manner. It’s helpful to read through the unclaimed property laws in Illinois before you search for assets.

You can easily check on your Illinois claim after you file it on the status checker page. Pull up the email that you received from the treasurer to locate your claim number. You need to enter this number in the box on the page to find your claim. Illinois will then show you what happened to your claim. You may find that the treasurer needs more documents to process your claim or that it sent a check to your home. It can take up to eight weeks before you get your money.

Illinois requires either a social security number or an employer identification number when you file a claim. If you do not have your SS card, you can use any official documents that show the number such as paperwork from your employer or your tax return. You also need to list your first and last names along with a valid email address and home address. Illinois allows you to file even if you no longer live in the Prairie State. You can look online for other documents that the state might require. Once you print the document, you can fill it out and scan it to upload the document to the site. Illinois will also accept documents sent through the mail.

The Land of Lincoln makes a few attempts every year to locate the owners of abandoned assets. In the cases of safe deposit boxes and stocks or bonds with a minimum value of $100, Illinois will add their names to the system and publish notices every six months in local newspapers. All other property with a lower value simply goes into the database. You may see outreach events taking place at different festivals and concerts that let you find out if you have property in the system. Illinois recently announced plans to contact owners who still live in the state. The treasurer will use tax records to find the owners and contact them through the mail.

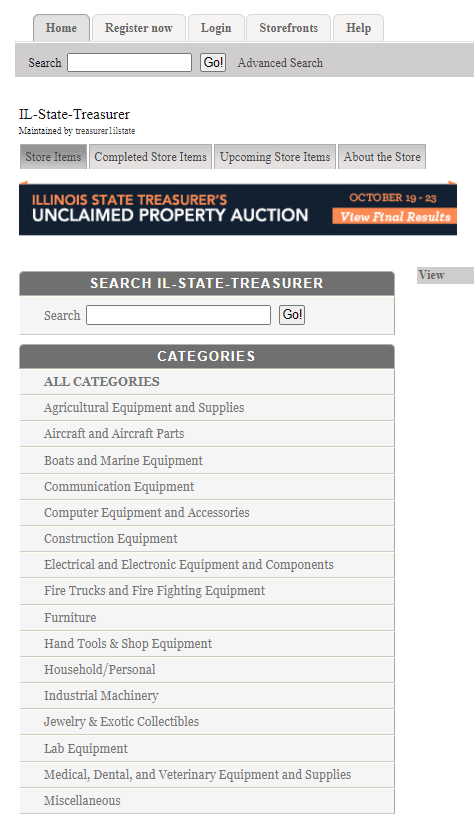

Due to limited space, the Illinois State Treasurer hosts auctions to dispose of certain tangible property. Banks that hold safe deposit boxes can only get in touch with the owner after five years of no contact or rental payments from the owner. The state will often hold the contents for several months in the hopes of finding the owner. Illinois will publish the names of the owners in local newspapers to notify them before the auction happens. Both owners and their heirs can claim the contents before the auction.

No. Illinois encourages you to file a claim if you see your name listed in the newspaper before an auction. Instead of filing an online claim form, you can contact the state treasurer and fast-track the process. You may need to provide paperwork that shows you are the legal heir of the deceased who opened the safe deposit box. If the items already sold at auction, you can request a check for the amount that the sale raised. Illinois will let you file up until the day of the auction to get the contents back. As soon as you initiate a claim, workers will remove the items from the auction. Though the state accepts anything of value such as coins and jewelry, it will not accept military medals. Illinois attempts to return abandoned medals to the owners and their families through outreach events. It also allows organizations to display the medals in the hopes of finding who can claim them.

Also known as a locator, a money finder agrees to help you find assets that you can claim as an owner or an heir. Heirs often need to go through different steps to claim property, including submitting a small estate affidavit for estates that are worth a lesser amount and gathering evidence of their relationship with the deceased. An heir finder can handle most of the paperwork that you need and help you complete the process faster. Illinois has no limit on how much they can charge, which may result in them taking a large percentage of your money. Most people find that they don’t need an Illinois money finder.

Most property in Illinois does not become abandoned until three years after the holder and the owner’s last contact. As long as you stay in touch with your holders, you can keep an eye on your assets. It’s helpful to use one email address for all of your online accounts to make sure that you get the messages that holders send. This email can work with offline accounts, too. We recommend that you reach out to your holders at a minimum once every 12 months. You’ll also want to make sure that you change the name on your account if your name changes and that you use updated contact information.

Illinois has more than just a few pennies for those looking for unclaimed money. When you use the state’s official system, you might find checks that range from $10-50 as well as checks for $100 and more. The Prairie State holds money for anyone who lost contact with the organizations and companies that held their money, including banks and insurance companies. Our ultimate guide to unclaimed money in Illinois shows you just how easily you can find your property and get checks from the state.

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.

Copyright © 2024 · OurPublicRecords.org · All Rights Reserved