Copyright © 2024 · OurPublicRecords.org · All Rights Reserved

Free Minnesota Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

See what types of unclaimed property exist in Minnesota and what steps help you file a claim for your money.

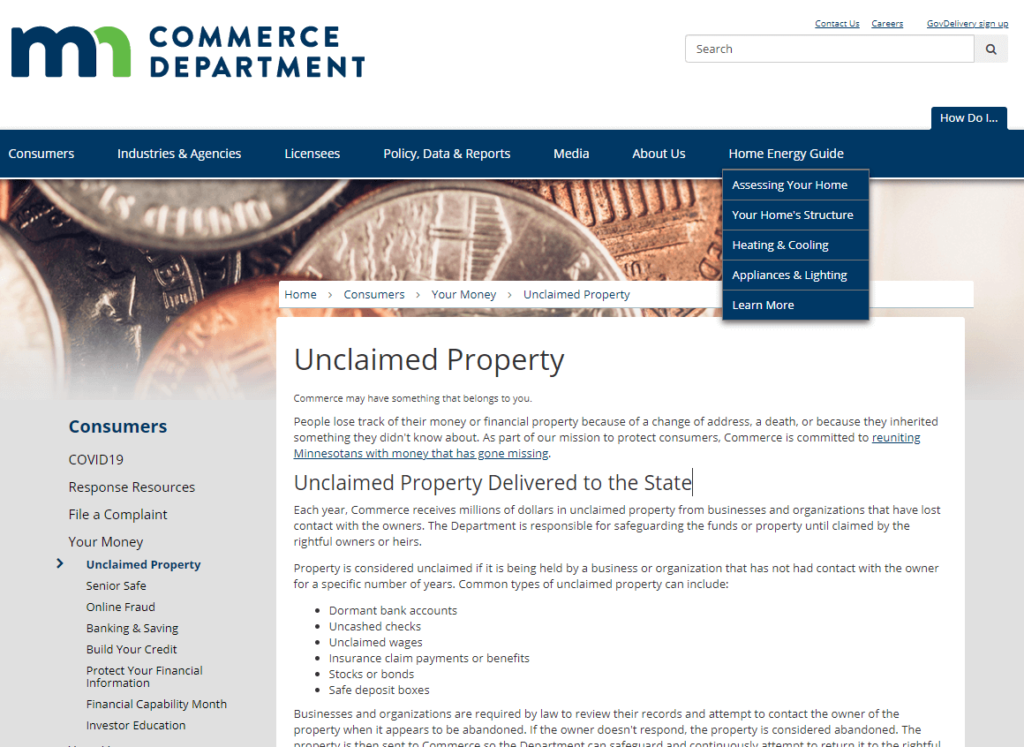

The Commerce Department in Minnesota is responsible for looking over all types of unclaimed money and property until the rightful owner can hopefully step forward. Both holders who have property and owners looking for money can use the Unclaimed Property Division website to find more information. It tells holders how they can let the state know about the property that an owner abandoned and helps owners both search for those accounts and file their claims.

Minnesota refers to holders as the person or organization that has money/property that belongs to someone else. If the organization loses contact with the owner or cannot find the individual for any reason, it must turn the property over to the state. Minnesota will then hold the funds and place information about it in the online database. You have the option of filing a claim in one of two ways, which we’ll cover below. Before looking for accounts and funds, you may want to learn more about unclaimed property in general.

The Land of 10,000 Lakes uses both abandoned and unclaimed to describe the same thing. An organization that has property owned by a specific person needs to use the contact information that they have on file to get in touch with the owner. Only if the organization cannot contact the owner does the state consider the property abandoned. The organization must then inform the state and turn the property over to the Commerce Department. Minnesota may attempt to find and contact the owner or simply add the information to its database and hope that the owner files a claim.

One example of unclaimed property in Minnesota is a dormant bank account. A bank account becomes dormant when it has no activity for a period of 24 months. If you have a bank account that you didn’t use for 12 months, the bank will consider it inactive. After another year passes, it can remove the account from its network and send the funds to the Commerce Department. The account can still incur interest on the funds that you have. It’s possible that you have a dormant bank account from your younger days such as an account that your parents opened for you.

The Commerce Department may have unclaimed wages in your name, too. Have you ever left a job without picking up your last paycheck? Employers are legally responsible to make sure that the money employees earn gets to them. You might find out that the company issued a last paycheck and then found that you had paid time off that you never received. If it sends a check to your old address, there’s a chance that you might miss it. Minnesota has other types of checks in its database such as deposits and refunds from utility companies.

Other examples of unclaimed property in Minnesota can include stocks and bonds as well as insurance payments. Let’s say that you were in a car accident and got payment from the other driver’s insurance in the form of a paper check to cover the damage to your vehicle. You may not realize that the company issued another check to cover your medical bills or other expenses. Insurance payments can include life insurance policies that a loved one bought in the past. If you are an heir or listed as a beneficiary, you may find that the insurer has a check for you.

You’ll also find physical and tangible unclaimed property in Minnesota such as safe deposit boxes. Designed to keep your valuables safe, these boxes allow you to keep important things stored in a secure facility. Banks usually will not release the contents of those boxes unless the account holder stops making payments. The financial institution can then give the contents of the box to the Commerce Department, which will usually sell the items and place the money raised in an account that the holder can then claim. Even if the box belonged to a loved one who passed away, you may have the right to claim its value.

The Minnesota Unclaimed Property Search from the Commerce Department is the best way to find all types of unclaimed property in the state.

Step 1: Visit the State of Minnesota Department of Commerce.

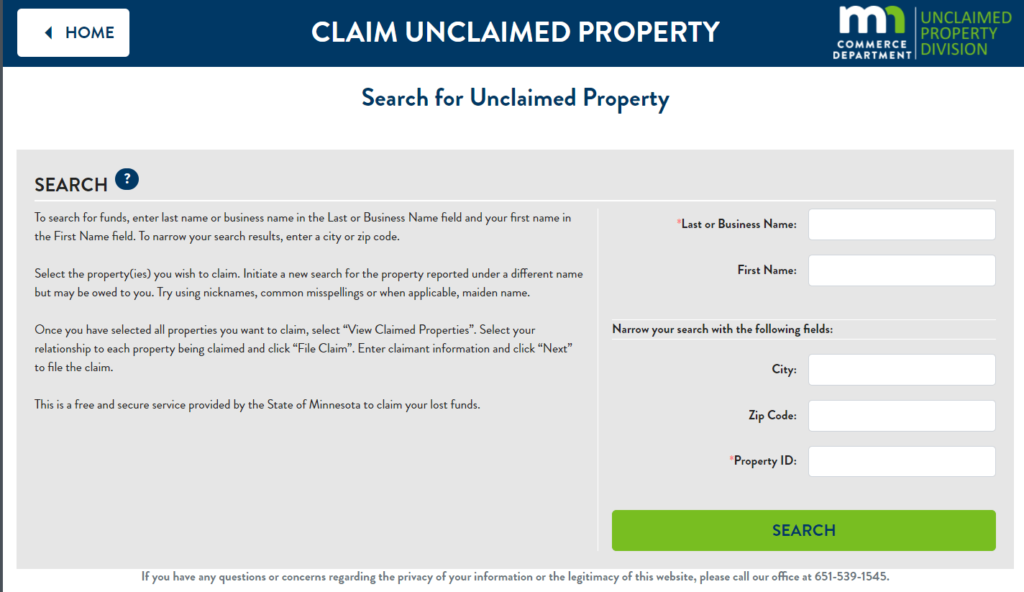

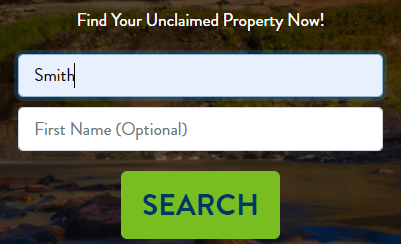

Step 2: Look for the search box, which has two blank spots that you need to fill out. The first box asks for either the name of a business or your last name. You can then add your first name to the second box or leave it blank. Hit the green “Search” button to see your results.

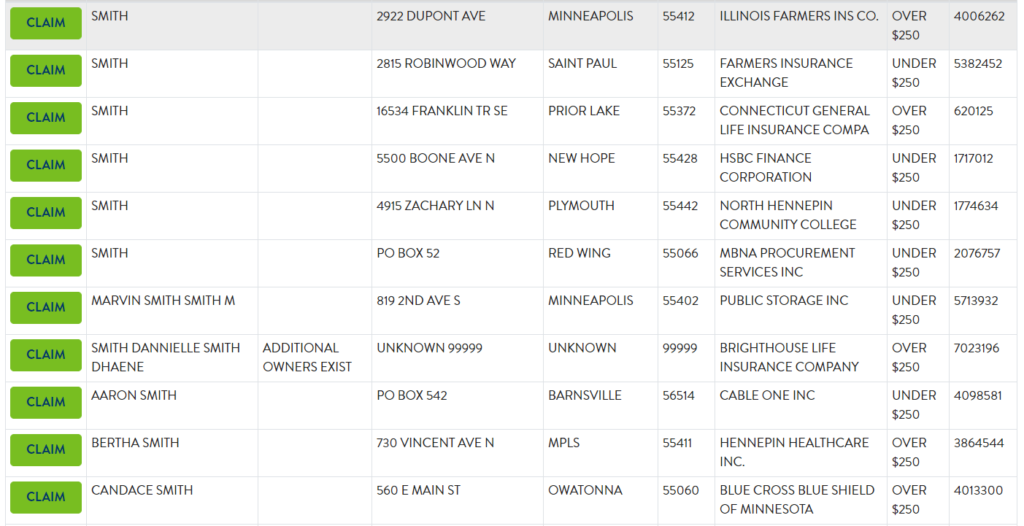

Step 3: Find all the unclaimed money and property that belongs to you in the search results. The Commerce Department shows the name of the owner and any co-owners along with the last known address of the owner. You also get to see the ID number of the property and the name of the holder along with a general amount of the available money. The database might show that an account has less than $100 or more than $250.

Step 4: When you find a property that belongs to you, click on the green “Claim” button. You may need to scroll through several pages to find all of the money listed in your name. Scroll down to the bottom of the page and click on the green button found here to view any claims that you selected.

Step 5: Choose whether the claim belongs to you or you need to file for another person. The Commerce Department will ask if you are a personal representative or the type of relationship that you have with the person. You need to click on the “File a Claim” button to finish your claim.

The most common reason to file a Minnesota unclaimed property claim is that you are the owner listed on the account. You may file a claim on the behalf of another person. Minnesota allows you to file as a personal representative if the owner passed away and there is an estate in their name. If you did not need to go to probate court and are a legal heir of the individual, you can file. Minnesota allows individuals to file as the representative of an open or closed business as long as they can prove that they range the business. There is also an option for fee finders and those filing due to issues with previous claims.

A fee finder is someone who charges a fee to file claims for their customers. They often look through death records to find the names of heirs and then search for money in the name of the deceased. The finder will then contact the heirs and offer to find missing money in the name of their loved one in exchange for a certain amount. Though some take a percentage of each claim that they file, other finders charge an upfront amount that covers their research costs and other expenses. As long as you can follow the steps that we outlined above, you can find money and file claims in Minnesota without the help of a finder.

Many states will simply send a form to your home address and ask you to fill it out. Those states do not update you on the status of your claim. Minnesota offers a claim status search feature that makes it easy for you to track your progress. All you need is the property ID number found on the claim, which you enter in the box on this page. You can then see if the state requires more documents or information from you or if your claim is on its way. If you lost your property ID number, the Commerce Department allows you to get it over the phone or through email.

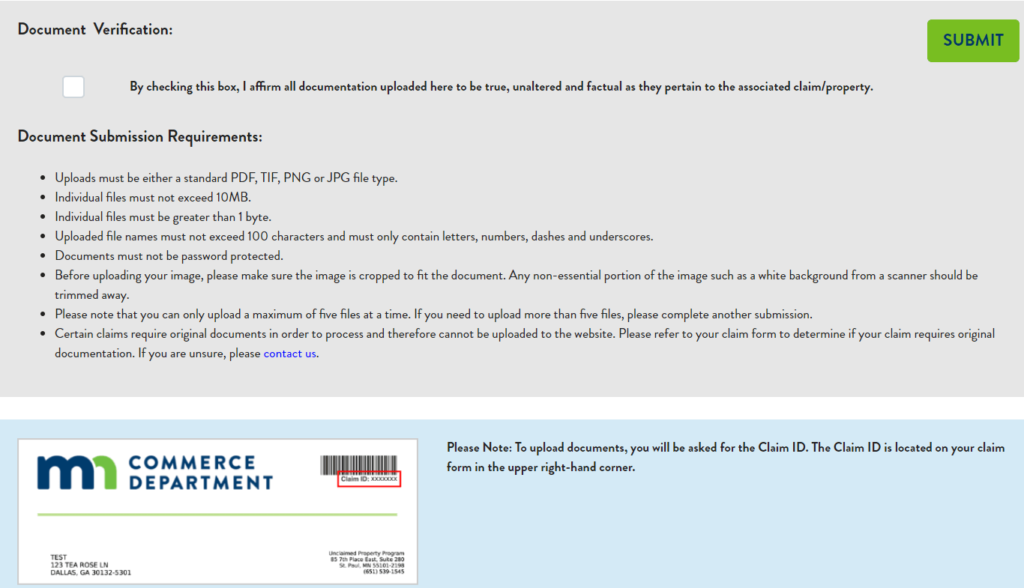

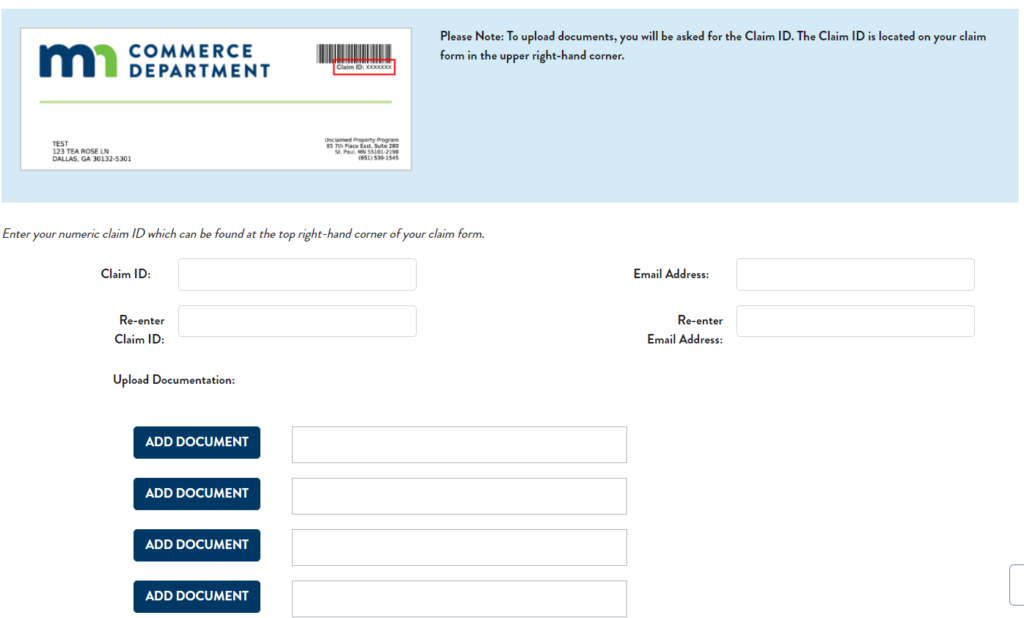

The most important thing that you need when filing a claim in Minnesota is the property ID number. You will need to visit the Upload Claim Documentation page to add any required documents. This page asks you to add and then re-enter your ID number along with your email address. It has five boxes that allow you to upload other documents, too. You usually need to upload a copy of your photo ID such as your state driver’s license. Minnesota may ask for proof that you owned a bank account or lived at an address. If you need to upload more than five documents to file a claim, you will need to use the same information on a separate page. Minnesota also requires proof that you have a social security number and that it matches the one on the account.

While you should start at the Commerce Department to find unclaimed money in Minnesota, you may want to expand your search to include resources outside the state. Some top sites to check include:

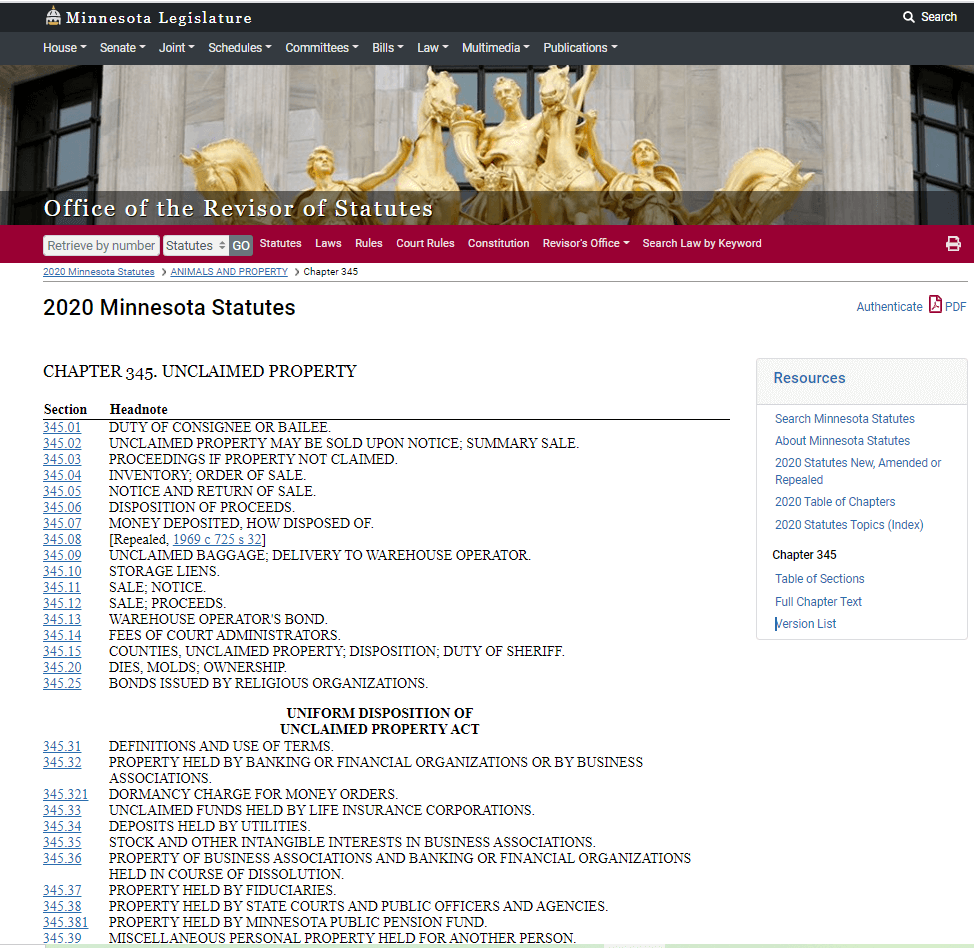

Many of the unclaimed property laws in Minnesota cover what holders need to do. One law states that the holder must send written notice to the owner that a property is abandoned or dormant if it has a minimum value of $100. They must send this notice to the address that they have in their records. If the owner does not come forward within 120 days, the holder is then responsible for filing the property with the Commerce Department. There are other unclaimed property laws that you can check out if you have any questions.

The Commerce Department reports that it returned more than $570 million in unclaimed funds to people over the years. Roughly 5% of all people who live in Minnesota have some type of unclaimed money that belongs to them, which comes out to more than 200,000 people. Even if you don’t find money waiting for you in Minnesota, you should still expand your search to include other states. Recent estimates put the total amount of unclaimed funds in the country at more than $40 billion. Though you may only find a handful of accounts with a total value of a few hundred dollars, that’s more money than you had before you searched.

Minnesota law requires that the Commerce Department act as the new holder for your money. When the original holder fills out the proper forms and releases your money, Minnesota will hold it for you. The state does not have a limit on how long it will hold the funds. Even if you decide to file a claim years from now, you will find that your money is still available. You may even find funds listed in the names of your grandparents who passed away decades ago.

Minnesota allows you to file claims, even if your name does not appear on the account. A good example is when you are the heir to that account. Most financial institutions allow customers to add names to their accounts. If they pass away, the money automatically goes to the named beneficiary. You may find that your mother or father had a bank account with a small amount of money in it that they never told you about. Minnesota law allows you to file a claim if you can prove that you are the heir to that individual. This may require a copy of your birth certificate that lists your parents’ names along with a copy of their will if one is available.

You may need to file for a child or minor, too. Many parents need to file claims for children who cannot legally claim the money. This might include a life insurance policy that lists your child as a beneficiary. Though Minnesota lets parents file, it requires that they provide documents that show they have the legal right to file on the behalf of the child and that they are the child’s parent. You can go through the website and upload scanned copies of those documents to file claims faster.

As you search the Minnesota database, you may find accounts that list you and someone else as co-owners. The steps that you need to file to claim that account depends on the status of the other person. Let’s start with an account that lists two living co-owners. Minnesota requires that you file together and submit the same information and documents. The website allows you to submit your information at different times if you no longer live together. If you have a shared account with your former spouse, you can usually submit documents that show you are the legal owner. Many courts will provide you with documents that show how you divided your shared accounts, which will let you claim funds that you own.

When it comes to shared accounts with deceased owners, there are a few situations that apply. One is something called joint tenants with the right of survivorship. This refers to accounts where you share property equally with another person. Minnesota law states that the account automatically reverts you when the other owner dies. You can provide documents that show you had this type of account when filing a claim. Even if the co-owner had a will that gave the property to another person, this agreement overrides the will and makes you the sole owner. If you’re the legal heir to the account, you can often submit an affidavit that the state will accept before giving you full access to the account.

One thing to keep in mind when looking at the Minnesota Commerce Department for unclaimed money is that the database does not include any physical properties. Even though owners can abandon their homes, those buildings will not appear in the database. If you have a family home that passed through different branches of your family tree and wants to show that you’re the owner, you cannot use the database. You will need to go through other departments and likely pay any back taxes due on the property before you can take ownership.

Keeping your money safe and ensuring that it doesn’t wind up in the state database is easier than you might think. We recommend that you write down the numbers and other information associated with all of your accounts. If you have a refund coming to you, write down the name of the company sending it and the expected arrival date. You can then contact them if the check does not arrive. No matter how old you are, make sure that your family knows the location of your valuables along with your account information. This helps them find that money when you pass away, which they can use to pay estate expenses and your funeral costs without worrying about where they’ll find the money they need.

Why spend time dreaming about what you would do with some extra cash when you can find that money today? The CT Biglist makes it easy for current and former residents of Connecticut to track down the money that belongs to them from anywhere in the world. Our ultimate guide to unclaimed money and property in Connecticut provides you with all the information that you need to find your money.

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.

Copyright © 2024 · OurPublicRecords.org · All Rights Reserved