Copyright © 2024 · OurPublicRecords.org · All Rights Reserved

Free Connecticut Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Discover the details about unclaimed property in Connecticut and learn how The Nutmeg State facilitates the process for you to claim it as the rightful owner.

The Connecticut Office of the Treasurer is the custodian of unclaimed property and funds within the state, having successfully returned over $973 million to rightful owners. While the option to file a claim in person exists, geographical constraints or relocation may limit this choice. Fortunately, the Office of the Treasurer offers an online platform for both searching and filing claims, including the convenient upload of necessary documents.

Unclaimed funds can provide a financial boost when unexpected expenses arise. Whether facing a hefty utility bill or an unforeseen car repair, a swift search on the website enables you to uncover funds associated with your name. From banks and mortgage services to former employers and utility providers, our comprehensive guide to unclaimed money in Connecticut walks you through the process of searching and claiming any identified property.

Like many states, Connecticut has regulations governing unclaimed property, though its database specifically excludes real estate while encompassing various other property types.

In instances where the legal owner is unreachable, holders are required to notify the state and complete documentation designating the Office of the Treasurer as the custodian of the property. Unclaimed funds received by the office are cataloged in the database for public access.

Ever misplaced a check and thought the money was lost with it? In Connecticut, expired checks don’t nullify your legal claim to the funds. The database enables you to locate unclaimed money, covering items like returned deposits from utility providers, paychecks from employers, and even insurance checks, including overpayments and benefits as a policy beneficiary.

If you’ve had a bank account in Connecticut, it’s worthwhile to check whether you’ve moved cities or simply forgotten about the account. Banks typically categorize unused accounts as internally inactive after a year, with dormant accounts remaining untouched for two years. Notably, dormant bank accounts accrue interest, ensuring you receive the full amount, plus earned interest, when reclaiming your account.

The CT Biglist is Connecticut’s official database to locate unclaimed money. Here’s a simple guide to help you through the process:

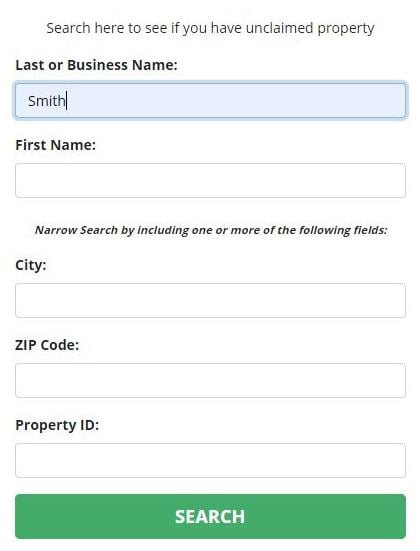

Step 1: Visit the CT Biglist: Start by going to the CT Biglist to search for unclaimed property.

Step 2: Use the Search Box: Find the search box at the bottom of the page. Enter your business name or just your last name. For more accuracy, add your zip code or city.

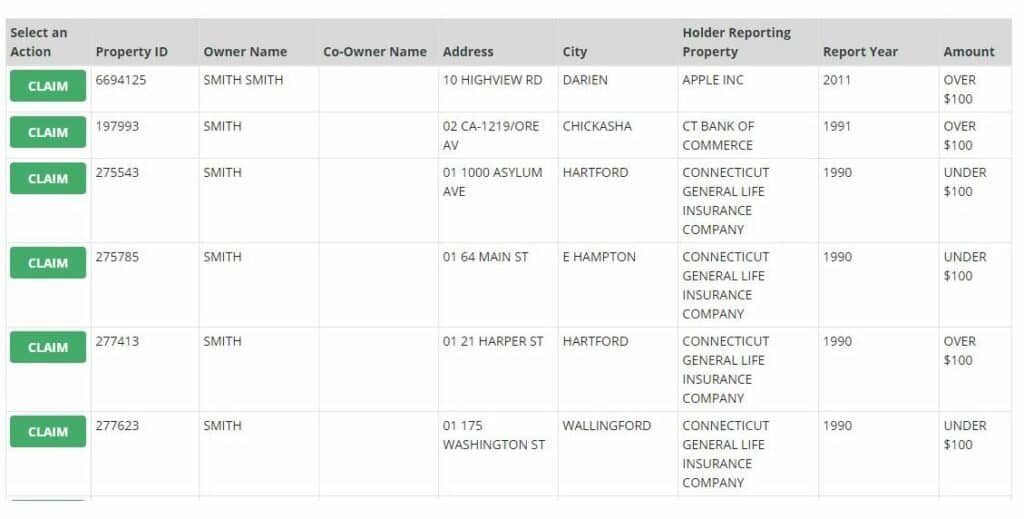

Step 3: Review Matching Claims: On the next page, review claims that match your search. Details include the holder’s name, reporting year, estimated value, and the owner’s name with possible co-owners. The owner’s address is also provided.

Step 4: Claim Your Money: When you find a matching claim, click the “Claim” button. You can claim multiple accounts if listed as the owner. At the bottom of the page, click the button to file your claims.

Upon completing the outlined steps, CT Biglist will prompt you to review and validate the claim’s accuracy. As the listed owner, ensure you have proof of residency at the displayed address. Connecticut requires specifying your relationship with the claimant; while typically selecting the owner option, you can also claim on behalf of another person. Utilize the “File Claim” button at the top of the page for online filing.

This action directs you to a new page where you input your details, including first and last names and your current address. Connecticut residency is not mandatory for filing. Confirm the validity of the provided information and affix your digital signature in the designated box.

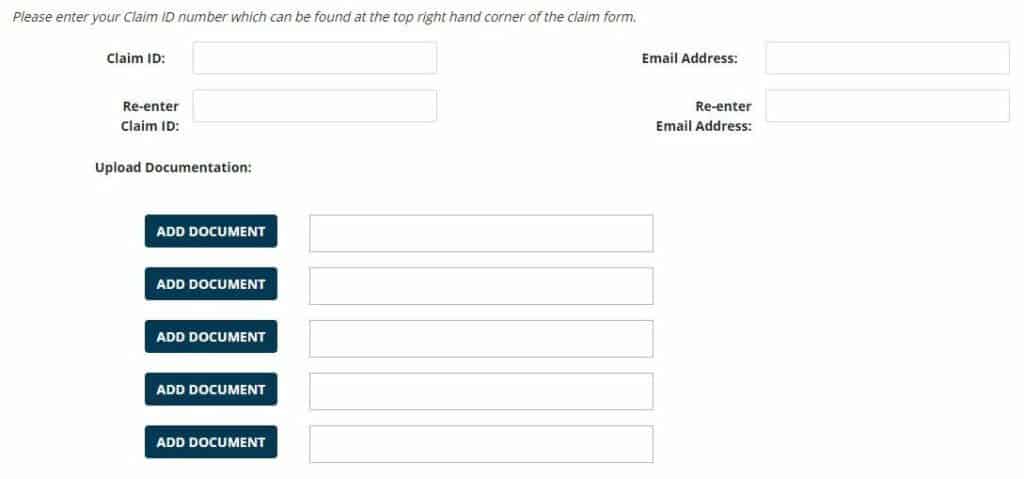

In addition to the claim, Connecticut mandates documents verifying your status as the listed owner and legal entitlement to the unclaimed property. A secure link facilitates the safe upload of your documents, or you can opt to mail legible copies. Required documents include a copy of your driver’s license or alternative photo ID and proof of your social security number.

Remember to include the claim ID and the email address used for filing, attaching up to five supporting documents for your claim.

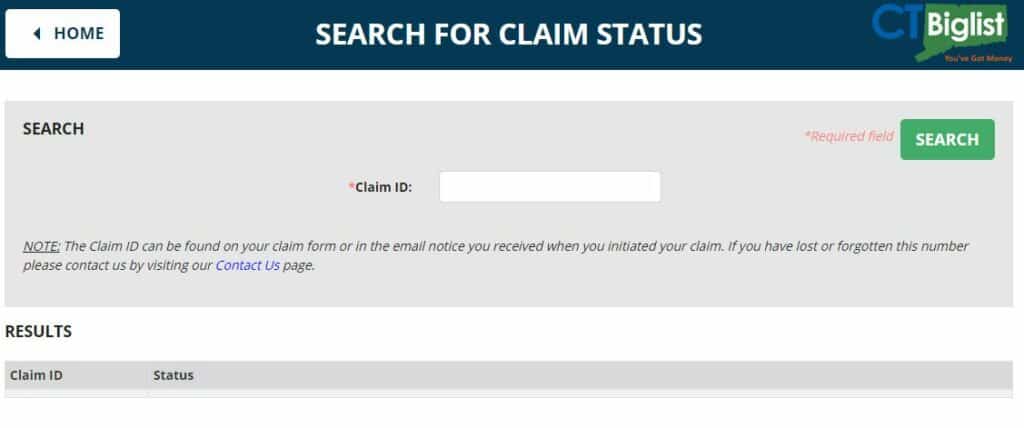

While receiving a check from the Connecticut Treasurer can take as little as a few weeks, the overall process may extend. To address any uncertainties, utilize the status checker. Simply input the claim number, and the checker will display the current status of your claim. This tool allows you to track whether the Treasurer has received your claim and its progress in the processing pipeline. If additional information is required, the status checker may indicate so before you receive an official notice from the state.

Connecticut currently holds over $1.4 billion in unclaimed property. Claims vary in value, with some as low as $100, often stemming from checks issued by stores. Other claims can range from $100 to $250 or more, potentially reaching thousands of dollars. It’s essential to note that the CT Biglist may display multiple claims associated with your name. For each filed claim, the state will issue a separate check.

Every state across the nation offers unclaimed property databases to help you locate lost funds. These resources simplify the search process for individuals who have lived in those states. In some cases, states utilize a centralized database like Missing Money for easier access. By entering your preferred name in the search box, you can view results from multiple states and file claims through Missing Money.

The Federal Deposit Insurance Corporation (FDIC) is another valuable resource, responsible for monitoring the country’s banks. If you had an account with a bank that closed, the FDIC holds records detailing the funds’ whereabouts. Similarly, the National Credit Union Administration tracks funds held by closed credit unions.

Other useful resources include the Department of Veterans Affairs, U.S. Federal Investments, Department of Housing and Urban Development (HUD), Pension Benefit Guaranty Corporation, Internal Revenue Service (IRS), and U.S. Railroad Retirement Board. Each serves different purposes, from life insurance policies to mortgage refunds.

Filing for unclaimed money in Connecticut isn’t limited to the listed owner. Representatives, such as those with power of attorney or guardianship over a child, can file on behalf of others. Even those involved in estates can file claims, especially during probate or small estate processes.

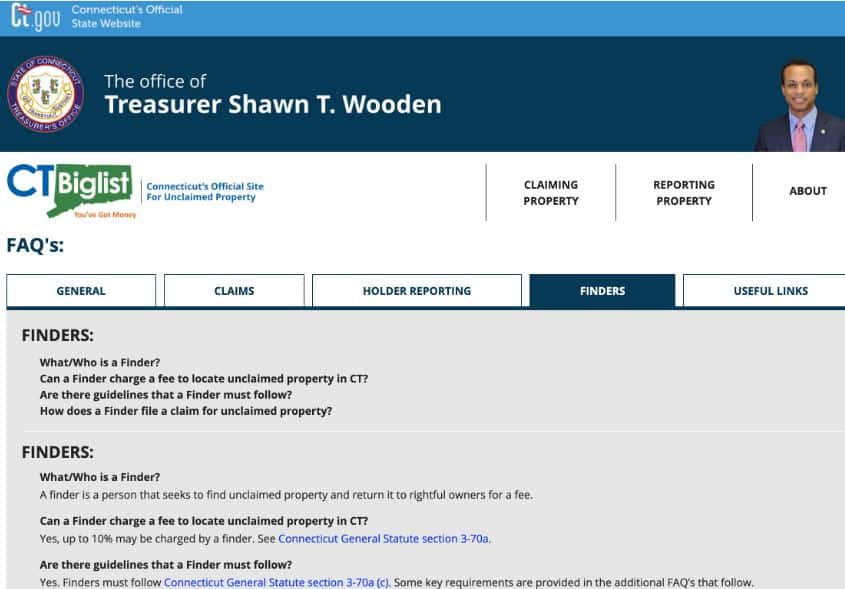

Connecticut allows for “finder” claims, where individuals represent others in filing claims. However, this process requires a written contract with the owner. Holder reimbursement is also possible, allowing property holders to file a claim, provided they return the property to the original owner.

Connecticut’s Treasurer relies on the CT Biglist, and while there’s no direct effort to locate owners, the state regularly updates the list on its official website. There’s no statute of limitations for filing claims in Connecticut, and the state acts as the custodian until the owner steps forward.

When filing a claim, necessary documents include your social security number, a photo ID, proof of ownership (e.g., old bank account statement), and proof of residence at the listed address (e.g., utility bill). It’s crucial to prevent the Treasurer from taking over your property by keeping your accounts updated and responding to notifications.

If you’re unable to use the online system due to a weak internet connection, Connecticut allows claims to be filed via phone at (800) 833-7318 during specific hours.

Connecticut has specific laws regarding gift cards, prohibiting issuers from deducting money or canceling cards without notifying the Treasurer after three years of inactivity. Checking the unclaimed property laws in Connecticut provides detailed insights into regulations for both owners and holders.

There are many laws in Connecticut that relate to both owners and holders. To find out more about those laws, check out this report. Available as a PDF, the document goes over what holders need to do to track down owners and when they can turn over accounts to the Connecticut Treasurer. You’ll also find out more about filing claims for property that you own and those owned by others.

In conclusion, the CT Biglist offers an accessible way for current and former Connecticut residents worldwide to reclaim their unclaimed funds. Our ultimate guide provides comprehensive information to help you locate and claim your money.

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.

Copyright © 2024 · OurPublicRecords.org · All Rights Reserved