Copyright © 2024 · OurPublicRecords.org · All Rights Reserved

Free Indiana Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Discover the comprehensive guide to claiming unclaimed property in Indiana and learn how you can secure any funds that are rightfully yours.

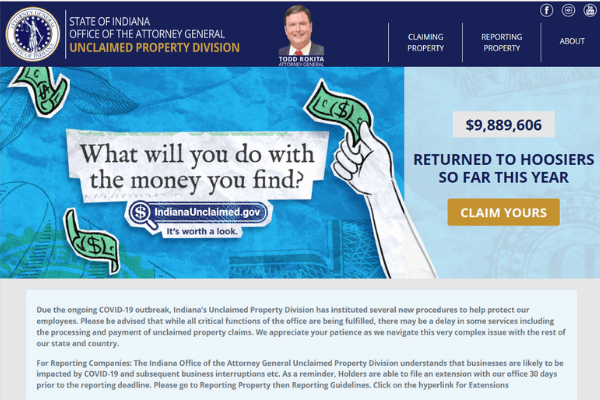

Indiana, the Hoosier State, holds over $800 million in unclaimed money and property, awaiting rightful owners to come forward. If you suspect that you might be one of these rightful owners, our guide is here to assist you in understanding Indiana’s laws pertaining to unclaimed property and the necessary steps to initiate a claim. The Office of the Attorney General has established the Unclaimed Property Division, simplifying the process for Indiana residents to recover their funds. In 2021 alone, this platform helped Hoosiers claim nearly $10 million, with millions more claimed in previous years.

The year 2020 witnessed a surge in claim filings, primarily due to the COVID-19 pandemic. While this led to some temporary delays, Indiana has since streamlined its processes. Today, most claims can be filed online in a matter of minutes. It may take a few days to gather required documentation and several weeks for the division to validate your claim. Our comprehensive guide to Indiana’s unclaimed property ensures you have all the knowledge required to locate and claim your funds.

Each year, the Indiana Attorney General’s Office receives millions of dollars from holders who are unable to locate the rightful owners. One prevalent form of unclaimed property is uncashed checks. Have you ever misplaced or forgotten about a check, such as a paycheck or payment from a store or utility company? Chances are, such checks are listed in Indiana’s database, awaiting your claim.

Another common type of unclaimed property includes dormant bank accounts. Banks typically do not close accounts immediately when they become inactive. They grant you one year to reactivate the account, during which it remains classified as inactive. After 12 months of inactivity, the account becomes dormant, and the bank alerts the Unclaimed Property Division.

Insurance proceeds are also a significant component of Indiana’s unclaimed funds, particularly unclaimed life insurance policies. Many individuals purchase these policies through banks or employers without informing their loved ones. In cases where the insurer is unaware of the policyholder’s demise, they may not contact the beneficiaries. Indiana’s database includes both these policies and those related to auto insurance claims. If you’ve never received an insurance payout following an accident, you may find your unclaimed funds today.

Indiana’s Unclaimed Property Division also holds stocks, bonds, and safe deposit boxes. If you own bonds with accrued interest, you can often claim the full value, inclusive of interest. For stocks, you can file a single claim to receive the stock’s value along with any dividends earned. Safe deposit boxes, however, present a unique challenge. While Indiana does not maintain the boxes themselves, they disburse the proceeds from selling their contents.

Recovering Unclaimed Funds in Indiana is a Seamless Process

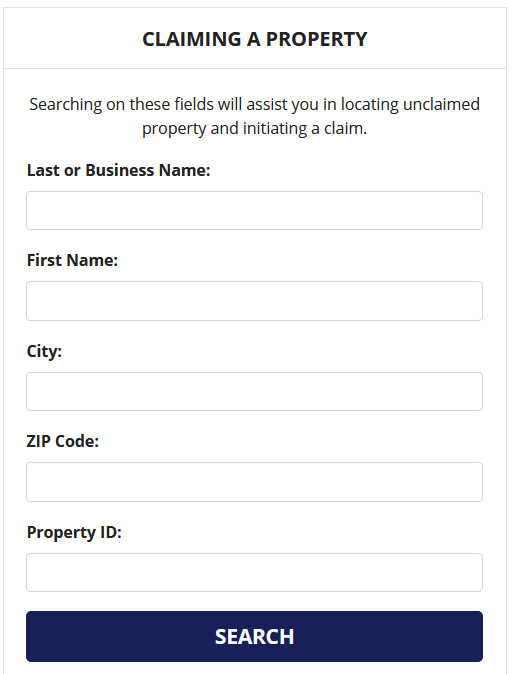

Step 1: Initiate your search journey by visiting the Unclaimed Property Division website, managed by the Attorney General’s Office. Locate the search initiation box by scrolling down on the website’s homepage.

Step 2: Begin your search by entering the relevant information. For optimal results, Indiana recommends including as much information as possible to refine your search. However, you can also initiate a search with just a name.

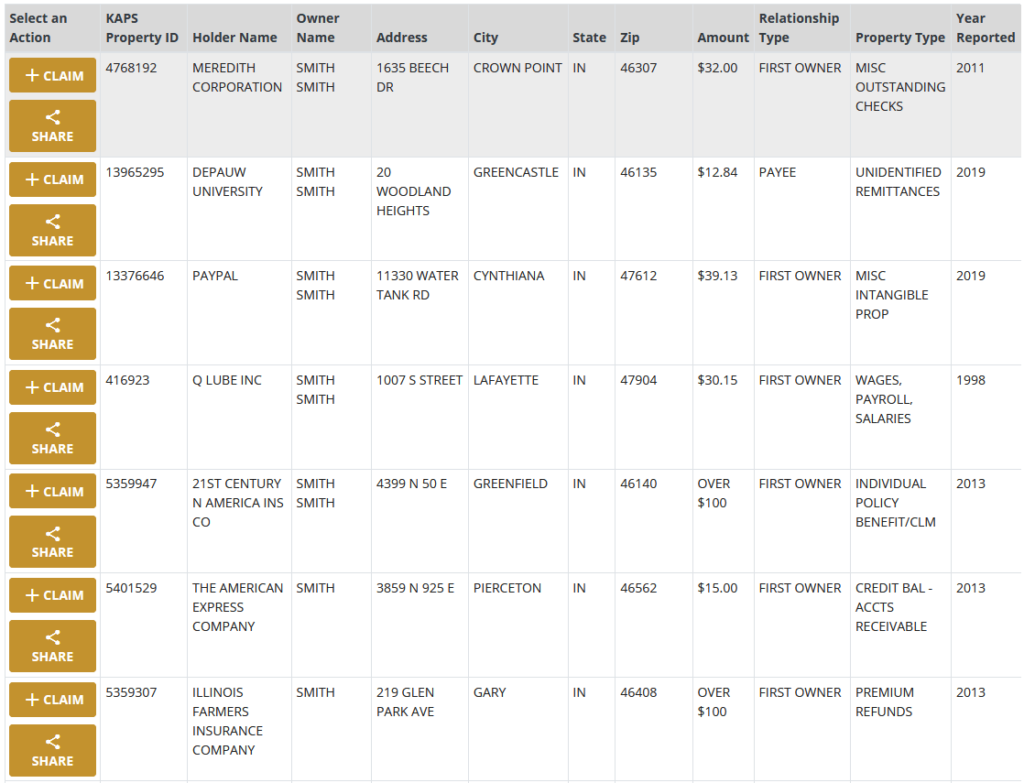

Step 3: Review the search results found in Indiana, which typically load within seconds. The results are displayed in groups of 20 accounts per page and may span multiple pages. Each listed account includes precise details such as the amount of money held, the account holder’s name, property type, and the year of reporting. Furthermore, you can identify whether you are listed as the original owner or a payee in the database.

Step 4: If you discover an account belonging to someone you know, click the “Share” button to inform them and assist in claiming their money. Additionally, you should utilize the button located above it to commence the process of claiming your property, marked as the “Claim Property” button.

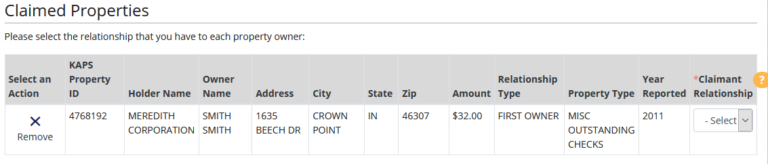

Step 5: On the subsequent page, opt for your preferred method to claim the property through the available drop-down menu. This step enables you to input additional information and proceed with filing your claim. You have the flexibility to file multiple claims simultaneously through the Indiana website.

The outlined steps mentioned above will guide you in discovering a claim and taking you to the subsequent stage in the process.

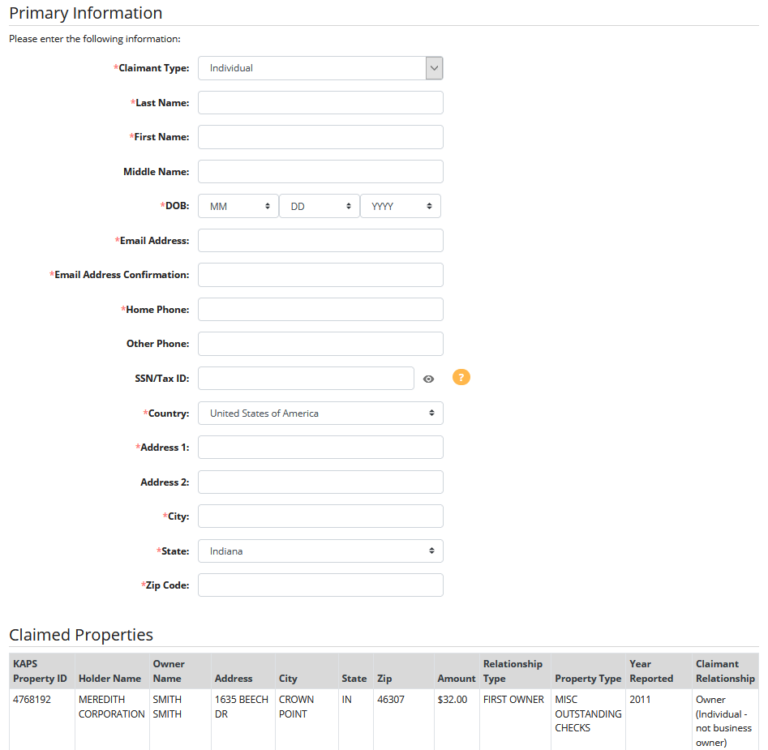

You will encounter a page resembling the one depicted below, requesting your contact details. Indiana mandates the provision of your email address, residential address, phone number, and date of birth. In certain cases, you may also be required to input your social security number or tax ID number.

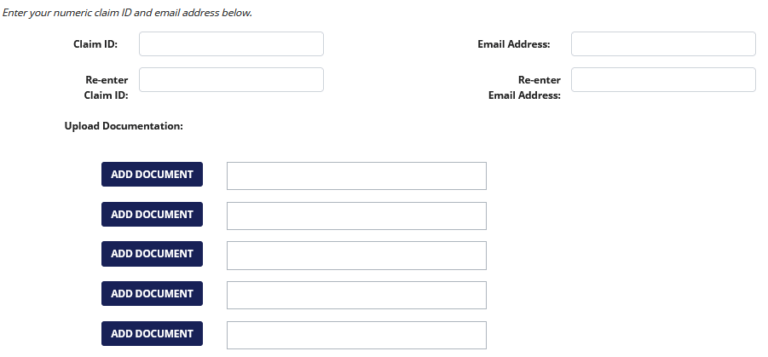

Should you prefer not to commence the claim procedure immediately, Indiana will send you an email containing your unique claim ID number. Additionally, you will receive a link to the document upload page, allowing you to upload all necessary supporting documents. While each page permits the upload of only five documents, you have the option of adding more documents at a later time as long as you possess the claim ID number. It’s important to note that your claim form may stipulate that the Unclaimed Property Division solely accepts original documents and not copies. Consequently, you will need to submit your documents via traditional mail.

The Indiana Unclaimed Property Division typically dispatches physical notices to your residence containing details pertaining to your claim. There is a possibility of missing one of these notifications, which is where the claim checker proves invaluable. So long as you possess your claim ID, you can search for it on the internet. This process enables you to ascertain whether the division has received any documents that you previously mailed and whether all your documents have been accepted. Indiana will also modify your status when it determines that your information aligns with the account, signifying that a check is en route to you.

Are There Other Sources to Search for Unclaimed Funds Besides the Indiana Database?

Certainly, there are numerous online resources where you can search for unclaimed funds beyond Indiana’s database. Some of these include:

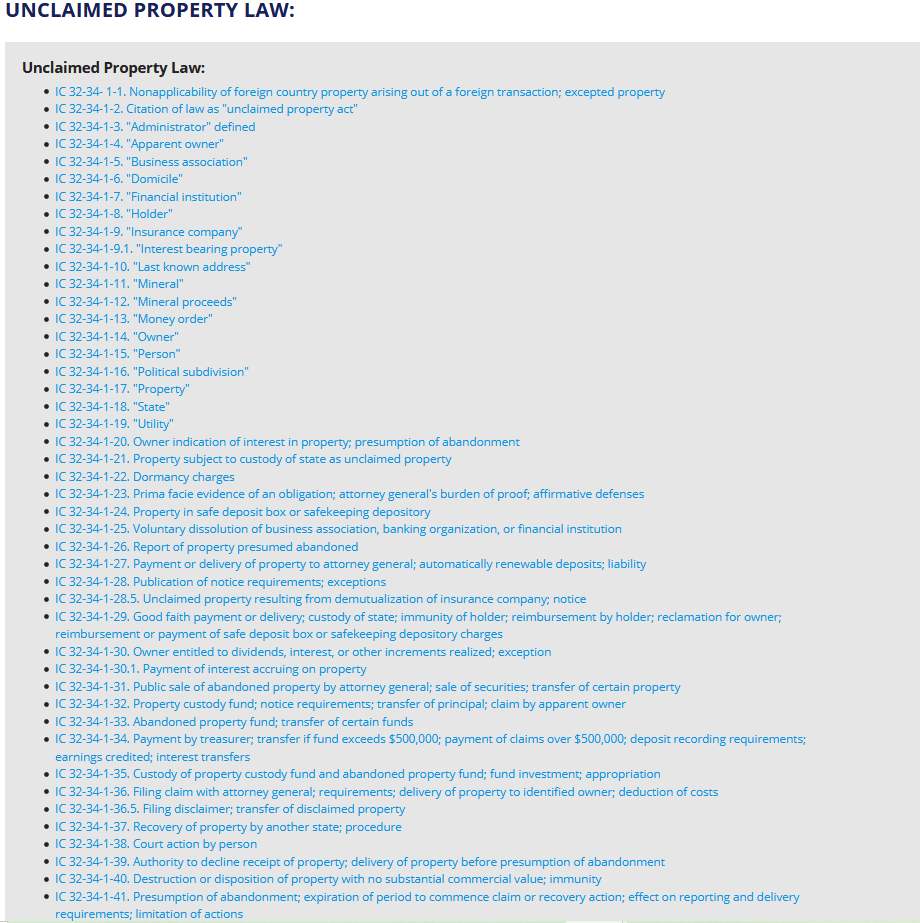

We advise you to review Indiana’s unclaimed property laws if you have any inquiries regarding your funds. These laws provide definitions for holders, which are organizations responsible for managing another person’s property, and owners, who are individuals with legal rights to the property. You can also find information on the treatment of valuable accounts and when the state permits holders to auction or sell properties. State laws outline the actions that a holder can take on behalf of another person and the circumstances under which you can claim property before it is transferred to the Division of Unclaimed Property.

In Indiana, claim filing is not limited to just the property owner’s name. Heirs of deceased individuals can file claims in several ways, including as heirs of small estates that don’t require probate, as heirs of open estates with court permission, and as sole heirs of closed estates. Additionally, business owners, government agencies, and legal representatives can also file claims.

As of the latest report in 2021, Indiana holds more than $800 million in unclaimed property. The amount fluctuates as claims are filed and new accounts are added. In the first quarter of 2021 alone, nearly $10 million was returned to claimants who filed online.

Indiana requires holders of safe deposit boxes to contact the owner within three years of the last payment made. If contact cannot be established, the state takes custody of the contents and auctions them on eBay. The proceeds from these auctions are credited to an account in the owner’s name, which can be claimed.

Indiana sends notices to owners through local newspapers, listing the names of unclaimed property owners by county. Owners have the opportunity to claim their property before the state takes possession, typically on November 30 of the following year.

Indiana has a 25-year statute of limitations for unclaimed property. If no owner comes forward within this time frame, the property becomes the property of the state.

Indiana’s Unclaimed Property Division does not charge fees for claim filing on their website. However, there may be fees associated with obtaining court records or notarized documents.

Money finders in Indiana search for unclaimed property and offer to help owners claim it, usually for a portion of the property’s value. Fees may vary, and some money finders charge an upfront fee, a percentage of the property’s value, or both.

To claim a court property, you must contact the relevant court or clerk’s office. Proof of ownership and payment of court fees may be required to take possession of the property.

Indiana allows legal adults aged 18 or older to file claims. However, if you are the legal parent or guardian of a minor child and find unclaimed property in their name, you can file a claim on their behalf with appropriate documentation.

Indiana advises claimants to allow a minimum of 90 days for processing after submitting all required documents. The processing time may vary depending on document verification and other factors. Additionally, it may take several days for the check to arrive once the claim is processed.

To ensure your property remains safe and out of the hands of the Unclaimed Property Division, regularly check on accounts and assets in your name. Notify holders of any changes in your contact information or name. Additionally, cash any checks promptly to avoid them becoming unclaimed property.

If you suspect that you have unclaimed property or money in Indiana, use the Unclaimed Property Division’s website to search for and file a claim. Indiana holds a wide range of accounts, from insurance payouts and uncashed checks to utility refunds and stocks, and our guide can help you navigate the process with ease.

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.

Copyright © 2024 · OurPublicRecords.org · All Rights Reserved