Copyright © 2024 · OurPublicRecords.org · All Rights Reserved

Free Maryland Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

If you think that you have unclaimed money in Maryland, use our ultimate guide to find out what type of money there is and how to claim it.

It often seems like most people struggle with money, especially in today’s world. Something as simple as a few hundred dollars can help you pay your utility bills and cover any unexpected bills that might pop. Whether you live in Maryland now or once lived in the state, there’s a chance that one or more holders might have unclaimed money in your name. This can include a refund from a utility company that you once used to stocks that were part of an old retirement fund. Our ultimate guide to unclaimed money in Maryland makes it easy for you to find any type of money or property that you can claim.

A report released in the summer of 2019 claimed that the Maryland government helped people claim more than $1.6 billion in money and property in a single year. The same report found that the state had more than $1,6 billion in unclaimed funds. Though you might imagine a briefcase with crisp bills inside, the Comptroller of Maryland holds both tangible funds and intangible property. As a way to reach more people, the Office of the Comptroller set up at the state fair and county fairs to let visitors search the records for their names and file claims on the spot. Thanks to the internet, you can now easily search the office records and file a claim when you find your name listed.

The term “unclaimed” can refer to almost any type of property in Maryland except for real estate. If you have a family home or a piece of undeveloped land that belonged to someone in your family, you usually need to pay any back taxes on the property and show who originally owned it to claim it. The process for claiming other types of accounts is much easier and something we’ll go into a little later.

Maryland unclaimed property can refer to any account that you opened or one that had your name on it. Intangible property refers to property that has value but something that you cannot touch. Take for example your bank account. Though you know that you have money in that account, you cannot physically touch it unless you go to the bank or ATM and take out your cash. Maryland uses this term to describe stocks and bonds such as those that you bought through a digital app and those that were part of a larger account. If you bought stocks or bonds in the past and later lost the password to view your accounts, you can go through the Comptroller.

Bank accounts are also examples of unclaimed property in Maryland. You might have a bank account that a parent helped you open as a child or teen that you forgot about as well as those that you used in college or on previous jobs. The Maryland Comptroller can also help you find deposits and refunds that are in your name. If you ever had utilities turned on at a previous address and never received your deposit back, the office may have those funds. You can find refunds from companies that cut checks that never made it to you, too.

There are millions of dollars in Maryland from insurers as well. If you were ever in a car accident, there is a chance that an insurer has money in your name that you never claimed. They can also have money for those listed as a beneficiary on a life insurance policy. Though many people use those policies to cover funeral or burial expenses, you may not know that a loved one had a policy. Even if that individual passed away years ago, you can still file a claim.

You also want to consider the tangible property that Maryland holds. Safe deposit boxes are one of the more common examples. Most banks require that you pay for your box and will keep the contents safe as long as you stay up to date on your payments. If you fall behind, the bank will make several attempts to remind you and then block your access to the box. Maryland law requires that the bank eventually turn over the contents to the Comptroller. Your claim allows you to either get back the contents of the box or the value of those contents.

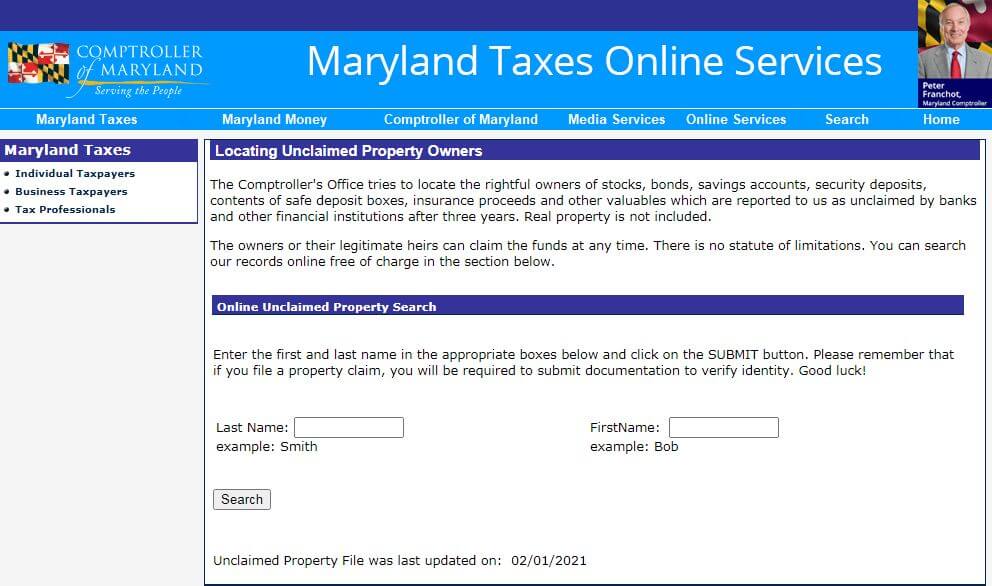

Finding unclaimed property in Maryland is as easy as visiting the website of the Comptroller of Maryland.

Step 1: Visit the link to the website shown above. The Maryland Comptroller usually updates this website at the beginning of the month but may update it more often.

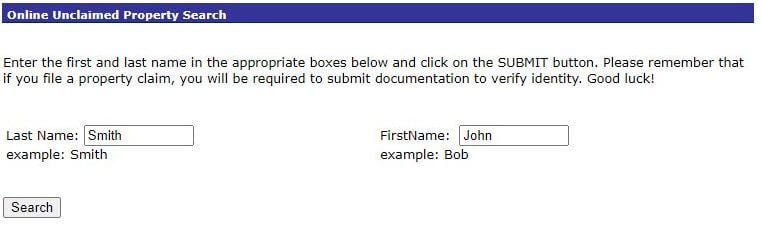

Step 2: Enter both the first and last names of the person you want to search for in the unclaimed property database. We recommend that you be as specific as possible if you have a common name to narrow down the overall results. If you have a less common name or worry that the database misspelled your name, you can add an initial for your first name.

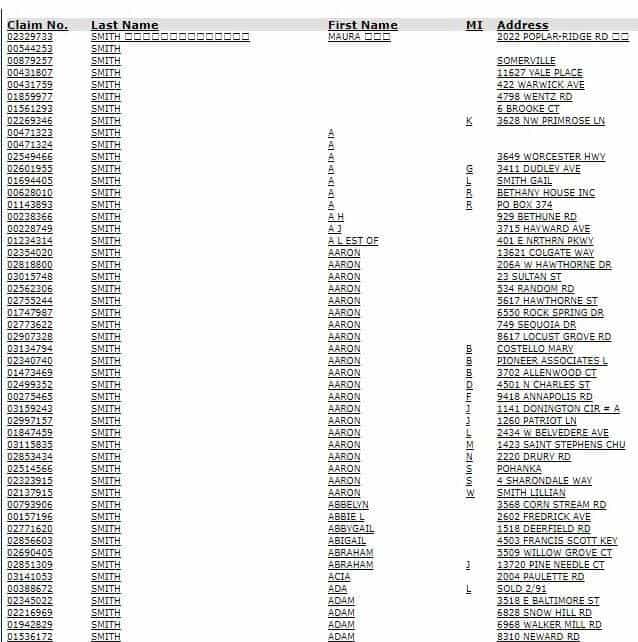

Step 3: Use the Comptroller’s search results to find any claims that you can follow. The website shows you both the last name of the claimant along with their first name if one is available. You will also see the person’s middle initial along with their address. Maryland lists the claim number as well. Maryland is unique because it does not let you automatically file a claim online nor does it tell you the value of the claim. You should write down the claim number because you will need it to file.

Now that you have your claim number, you can file a claim as long as you have the information required on the form. Maryland requires that you download COT ST912, which is available as a PDF. This form has several parts that you need to fill out along with parts that the Comptroller’s Office will complete.

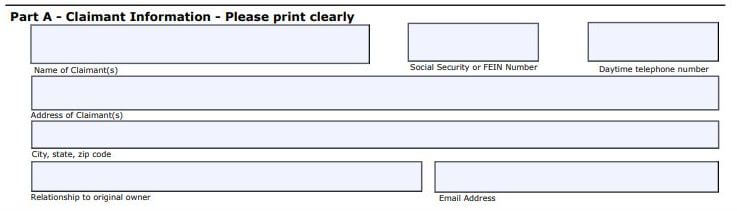

Part A of the form allows you to enter personal information. You need to add the name of the claimant, their social security number, a daytime telephone number and home address. The bottom of this section asks for your relationship with the claimant. Though you’ll usually file for claims that you own, you may need to file on behalf of a loved one.

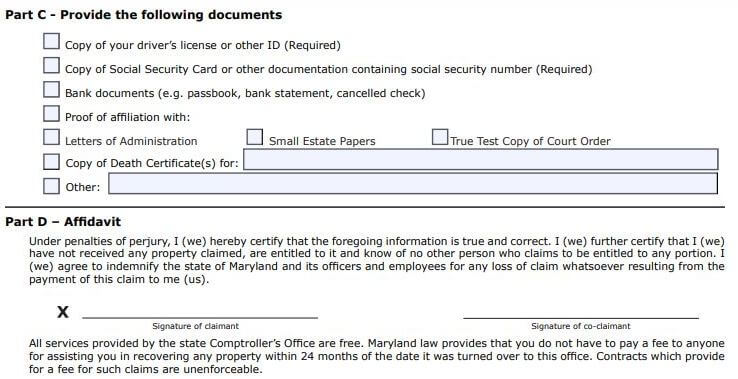

The form also has Part C that you must complete proving your identity. Maryland requires a copy of your driver’s license or another photo ID along with a copy of your social security card or another document that shows your social security number. You may need to provide proof of a bank account in your name, to such as a recent account statement. If you scroll down to Part D, you’ll find a short affidavit. When you sign on the line, you state that all the information that you shared is correct. Though you can use a PDF editor to fill out some parts of the form, you need to print a copy and sign it before sending it to the Comptroller’s Office.

In addition to two forms of ID, Maryland requires other information depending on what type of property you want to claim. For paychecks and other wages owed to you by an employer, you need proof that you worked for the company in question. To claim funds held by a bank, you need proof that you had an account with that financial institution. Not only can you use a copy of a former bank statement, but you can also use a canceled check or passbook. Dividends that an organization holds in your name require proof of your affiliation with that organization. If you want to claim stocks or bonds, you need the original certificates associated with them

Maryland also allows you to claim uncashed money, even if the original form of payment expired. This includes money orders and certified checks along with travelers’ checks. You can file claims for insurance benefits, too. The tricky thing about insurance benefits is that you need some proof of the original policy that shows you as a beneficiary. If a loved one passed away without telling you about that policy, you might not have any proof. You can try getting in touch with the insurer and asking for a copy of the policy. Maryland does not require original copies of any documents that you need to submit but does require clear and legible copies.

The amount of time that it takes for Maryland to process your claim and cut a check depends on many factors. Though the state begins looking at claims as soon as they arrive, certain times of the year are busier than others. It also depends on the type of claim that you file and the size of the account, with larger accounts taking more time to process. If you do not attach all of the required documents to your claim, it will take longer to get your money. The state will need to contact you and ask for those documents. It may require that you start the claim over again, too.

Though you might assume that you can only file claims listed in your name, Maryland allows you to file claims of businesses and organizations that you owned. You can use the same website and search for the organization’s name. Though you need to submit the same form, Maryland asks for other information to prove that you owned the organization. You can submit tax forms that list you as an owner or co-owner along with proof that you dissolved the business or that it merged with another company. Maryland also asks that you sign your claim form in front of two officers or individuals associated with the organization.

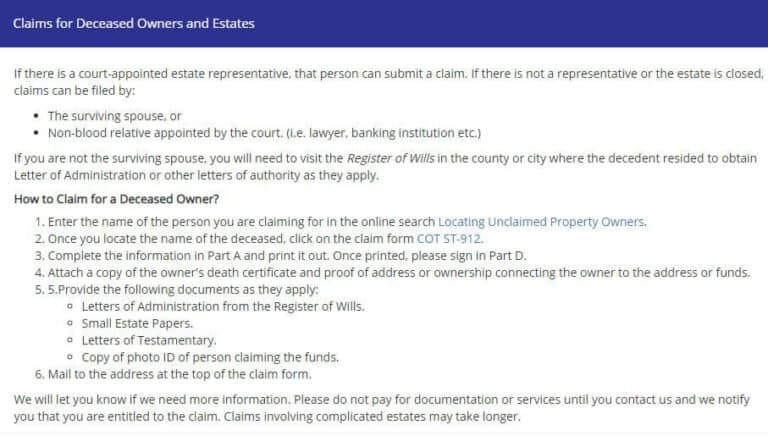

Maryland allows the representative appointed by the court to file a claim on the behalf of a deceased person. You usually need to go through probate to make sure that you meet the last wishes of the individual. Even if your loved one died without a will, you typically need to go through probate to make sure that you become the rightful owner of a different property and that you pay any debts owed by the person. If you already closed the probate or do not have a representative because the estate had a low value, you can file a claim as either the individual’s spouse. Maryland also allows you to seek a Letter of Administration from the county where the person lived to file a claim.

In addition to the claim form that lists your relationship with the deceased person, you need a copy of the individual’s death certificate and proof that the person lived at the address associated with the account. You also need to attach proof that you have the legal right to claim on the behalf of the deceased person and a copy of your photo ID. Maryland also allows you to file claims as you settle the deceased’s estate.

You might wonder if you can file a claim for a living person who cannot handle the process. Maryland allows you to do so in certain circumstances. You can often file if you are the parent of a minor child or have legal custody of a child. A good example is a parent who passes away with a life insurance policy that named a child under the age of 18 as the only beneficiary. To file this type of claim, you must have legal proof that you can file a claim such as a letter from the court or a copy of your guardianship papers. You also need copies of both your and the child’s social security numbers along with the child’s birth certificate. If you need to file a claim for an adult, you usually need evidence that you have the person’s power of attorney.

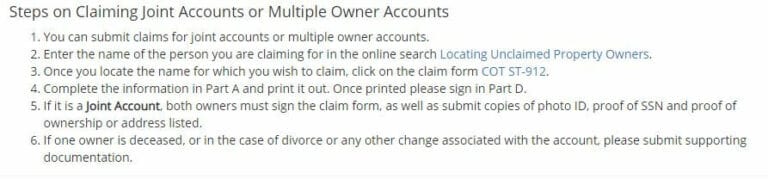

As you search the Maryland database, you may find a property that belongs to both you and one or more other people. This often occurs when you shared property with someone who you later divorced or property that belonged to both you and your parents. Unlike other states that allow you to file for your percentage of the property, Maryland requires that all owners listed on the account complete the claim form. They both need to submit their social security numbers along with proof of where they live and a photo ID.

If you find an account that lists both your name and the name of another person, you can submit other documents to claim the full property. In the case of a co-owner who passed away, Maryland asks for a copy of their death certificate and proof of your relationship. When filing a claim after a divorce, you can provide a copy of your divorce transcript or the official court record. The record must show that you became the legal owner of the property after your divorce.

While you should start your search for unclaimed property in Maryland at the Comptroller’s Office, you can also use other sites such as Missing Money. Used by multiple states, Missing Money lets you enter your name and find unclaimed funds in all of those states. Some of the other sites that we recommend include:

Whether you live in a rural part of the state or worry that you won’t have time to file a claim, Maryland gives you the option of working with a money finder. Most finders will do all the paperwork for you in exchange for a portion of the money that they find. Before you decide to go this route, keep in mind that they can take a large percentage of what belongs to you or a loved one. To protect its residents, Maryland now prohibits finders from accepting payments for funds that they find if the state took ownership within the last two years. While you can still work with a finder, this law prevents them from taking your money.

The best place to read up on the laws regarding unclaimed property in Maryland is via the PDF guide that the state created. It goes over all of the laws that anyone filing a claim needs to follow.

Maryland has laws on the books that allow the state to keep any type of unclaimed money. There is no limit to how long it can hold your money, but it will use eBay to sell the contents of safe deposit boxes if it cannot find the owner. When you file a claim, you only have the right to the proceeds raised by the auction. There are ways to prevent you and your loved ones from losing their money and property. We recommend apps that help you keep track of your accounts. Many also find it helpful to keep detailed records of their financial and property accounts that they pass to their heirs.

We hope that you found our ultimate guide to unclaimed money in Maryland helpful and that it encouraged you to get out and start looking. As long as you can connect to the internet and had an address in Maryland, you might find money or property that you can claim. Make sure to check out our other guides to find unclaimed money

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.

Copyright © 2024 · OurPublicRecords.org · All Rights Reserved