Copyright © 2024 · OurPublicRecords.org · All Rights Reserved

Free New Mexico Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Discover the fundamental steps for locating and securing various forms of unclaimed assets with our comprehensive guide on unclaimed funds in New Mexico.

Unclaimed funds totaling millions of dollars are safeguarded by the Land of Enchantment. Regardless of your vigilance, oversights can occasionally occur. Neglecting to update your address or change your phone number associated with your bank account, for instance, may lead to the inadvertent loss of your funds, only to rediscover them years later within the state’s database. Thanks to internet accessibility, you can now easily locate abandoned assets registered in your name in New Mexico.

New Mexico has entrusted the Taxation & Revenue Department with the management of its unclaimed property. This department extends assistance to individuals interested in searching for and claiming their unclaimed assets, as well as to the entities reporting them, which may encompass both individuals and institutions such as banks and utility companies. To comply with state regulations regarding abandoned property turnover, holders must adhere to New Mexico’s established laws. Our updated guide to unclaimed funds in New Mexico for 2021 offers detailed steps and essential information for retrieving your assets from the state.

Unclaimed property, according to the National Association of Unclaimed Property Administrators (NAUPA), encompasses any assets that an owner has made no effort to claim for a year or more. In New Mexico, holders are mandated by law to retain such property for up to five years before the state takes control. New Mexico’s regulations oblige holders, whether individuals or entities like banks and utility companies, to make multiple attempts to locate and contact owners, even tracing heirs in the event of an owner’s passing.

One example of unclaimed property in New Mexico is annuities. These contracts entail periodic payments to an individual, often arising from trusts set up by loved ones or compensation for accidents caused by others. When the annuity recipient passes away, designated beneficiaries have the right to claim and receive the payments.

Beneficiaries also come into play with life insurance policies. Suppose your parent named your other parent as the policy beneficiary, but they pass away before claiming the funds. In that case, the policy proceeds would pass to the heirs. Moreover, even smaller policies from different insurers can yield payouts as long as you are the named beneficiary. In cases where the insurer cannot locate the beneficiary, they may turn to the NM Taxation & Revenue Department for assistance.

Security deposits are another category of unclaimed property that can be uncovered online. Many service providers require deposits to secure their services. Even when you maintain the same energy provider, they may request a new deposit after a move. Landlords, too, may collect deposits from tenants, which should be returned minus any legitimate deductions. It’s not uncommon for individuals to discover unclaimed security deposits associated with previous residences, unbeknownst to them.

Although the NM Taxation & Revenue Department offers support for those seeking abandoned property, it does not host a searchable database. Instead, New Mexico relies on Missing Money.

Step 1: Visit the Missing Money website and select “Search” at the top of the page.

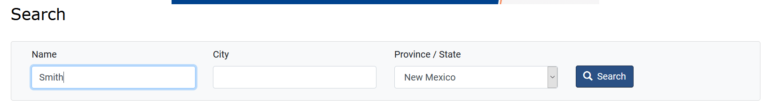

Step 2: Choose New Mexico from the dropdown list of states.

Step 3: Enter the name and, if desired, a city associated with the property.

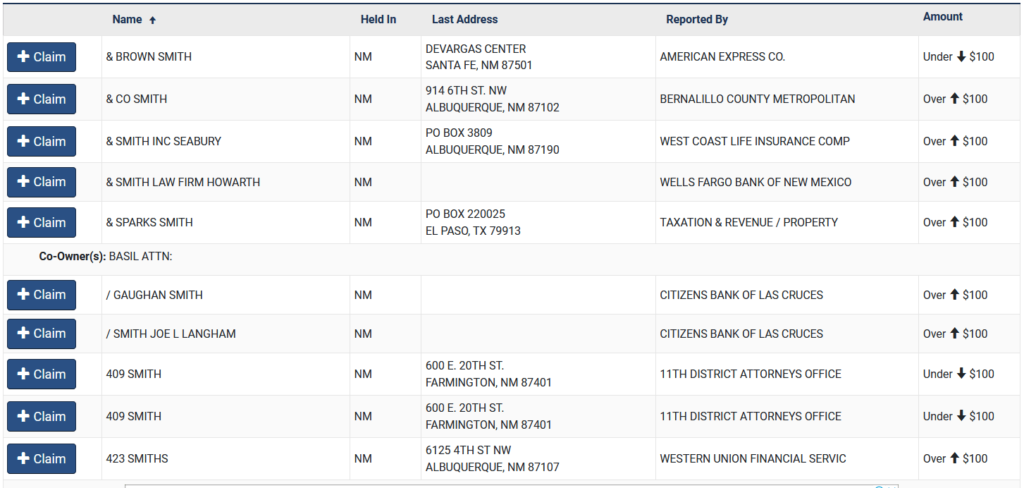

Step 4: Review the search results to identify your property, which will display the owner’s last known address, full name (if available), holder’s name, and whether the asset is valued over or under $100.

Step 5: Click on the “Claim” button to assert your right to the asset.

Step 6: A shopping cart icon will appear at the top of the page. Click on it to initiate the claiming process.

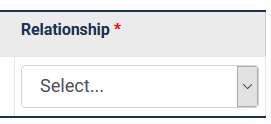

Step 1: Utilize the Relationship dropdown menu to specify your role as the property owner or an alternate claimant (e.g., executor, heir, or corporate officer).

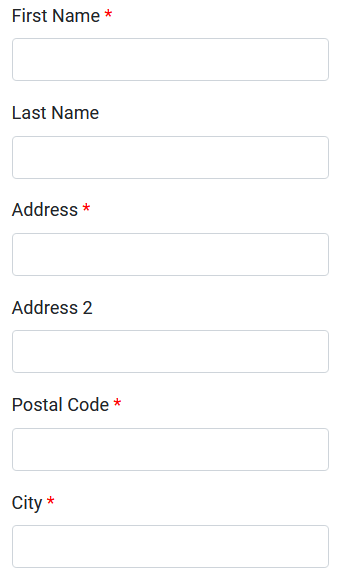

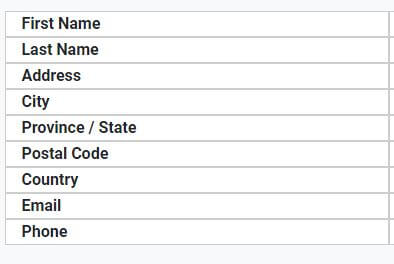

Step 2: Complete all required fields marked with a red asterisk, including your email address, current home address, and phone number.

Step 3: Review the claim form to verify the accuracy of your provided information.

Step 4: New Mexico will process your claim based on the details you’ve submitted, providing further instructions and necessary paperwork.

Upon discovering unclaimed property through Missing Money, you can initiate an initial claim with the NM Taxation & Revenue Department. The department will furnish you with a copy of the claim form and detailed instructions. Typically, you’ll need a notarized claim form, signed and dated in the presence of a notary public who verifies your identity and stamps the form. Additionally, copies of both your social security number and a government-issued ID (e.g., state ID or driver’s license) are required. In cases where your current address differs from the one on file, you’ll be asked to provide evidence of your past residence.

Recent data suggests that New Mexico holds an impressive sum exceeding $309 million in unclaimed funds and assets. Even if you’ve relocated from the Land of Enchantment, it’s worthwhile to conduct an online search through Missing Money, a process that typically takes less than 10 minutes. By harnessing this site and other recommended resources, you may uncover a substantial sum.

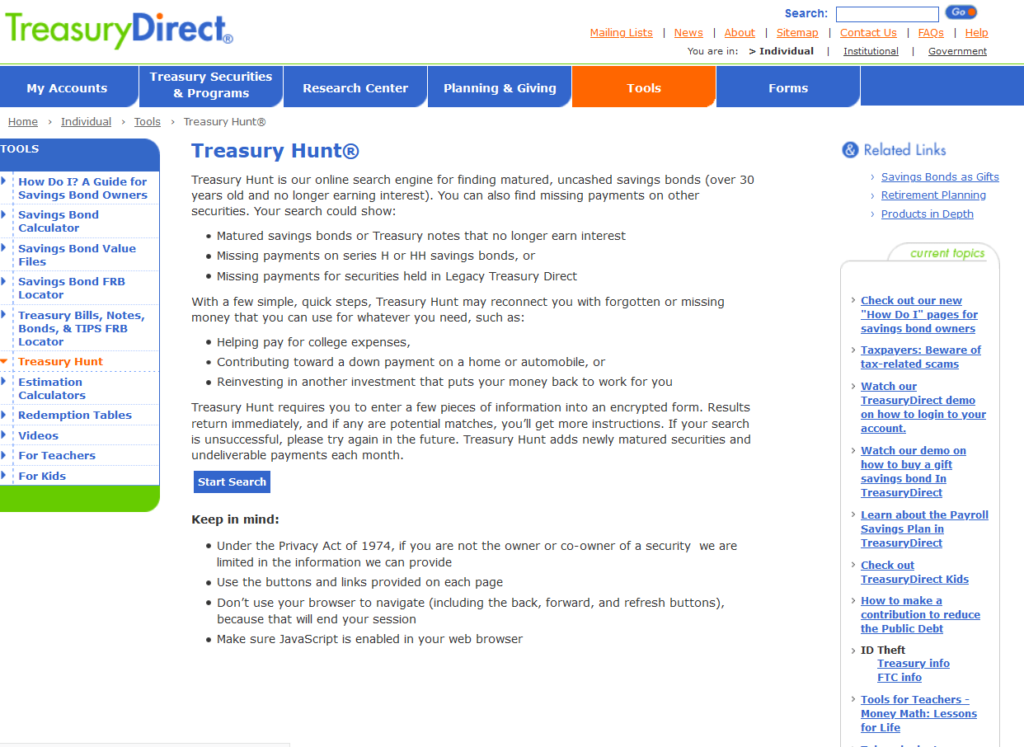

In addition to Missing Money, numerous web-based resources facilitate the retrieval of unclaimed property in New Mexico and across the United States. The U.S. Federal Investments website is a valuable platform for locating treasury bonds, often purchased for children to mature over time. The Department of Housing and Urban Development (HUD) may issue refunds to individuals who previously interacted with the department; always verify the authenticity of any such letters received via mail. The Department of Veterans Affairs can aid military veterans and their families in accessing various benefits and life insurance policies. To locate unclaimed pensions, the Pension Benefit Guaranty Corporation is an essential resource. If you hold money in a closed bank account, the Federal Deposit Insurance Corporation can assist. Similarly, the National Credit Union Administration helps recover funds from closed credit unions. The Internal Revenue Service (IRS) can help you retrieve missed tax refunds.

In New Mexico, unclaimed property laws date back to 1978, and the state offers an online platform to explore these regulations conveniently. The government website allows users to perform quick keyword searches for specific information.

How long does it take for New Mexico to process claims?

Processing claims in New Mexico may take slightly longer due to the Missing Money system. After discovering your property online and submitting your information, the site forwards your claim to the NM Taxation & Revenue Department. This department will assess your claim’s validity and determine if additional information is necessary. State law mandates that the department make a decision within 90 days of receiving your claim and send your funds within 30 days of approval. For claims involving notarized documents or other requirements, the process may be extended, potentially returning your claim to the system.

What happens if New Mexico doesn’t process your claim within the deadline?

If New Mexico fails to process your claim within the specified timeframe, two scenarios may apply. Firstly, if requested information is not provided promptly, the department may return your property to the Missing Money database. In this case, you’ll need to rediscover and file a new claim. Secondly, if the department requires additional information from another division, the same process may occur, ultimately leading to the property’s return to the database.

New Mexico permits filing from any location, regardless of address changes. You’ll need to provide evidence of your previous address that matches the asset’s records, such as old car registrations, school transcripts, insurance policies, or court documents. Alternatively, a notarized document indicating your ownership of the property may be accepted. In the event of a change of address, proof of your former residence is necessary.

Chapter 7 of the NM Uniform Unclaimed Property Act addresses safe deposit boxes. Holders are required to enter rental or lease contracts detailing payment terms and due dates. Contents must be safeguarded for at least five years following the last contact with the owner or the last payment. Abandoned boxes are reported to the NM Taxation & Revenue Department. New Mexico conducts annual auctions, typically in late July, to sell valuable items from boxes relinquished within the past year. This practice is advertised to help heirs and others claim their property. In cases where an abandoned box is confirmed to belong to you or a close relative, the department may return the contents upon verifying ownership and meeting any necessary fee requirements. For boxes already auctioned, a trust is established in the owner’s name, containing the proceeds from the sale.

New Mexico establishes specific timelines for various types of assets to be considered abandoned. Paychecks and refund checks from employers and utilities are deemed abandoned after one year of no contact with the owner. Checking and savings accounts fall under this category if left untouched for five years. Gift certificates are considered abandoned after three years, while other assets offer a three-year window before being labeled as abandoned.

Close living relatives, such as children, can file as heirs in New Mexico. You’ll need copies of both your photo ID and the deceased’s photo ID. If the deceased lacks a photo ID, an official death certificate or a copy may suffice. Records or documents reflecting the deceased’s former address, including utility bills, bank records, official paperwork, or vehicle registration, are required. Proof of your relationship, such as a marriage or birth certificate, must also be provided. The option to file as an heir exists if probate for the deceased’s estate was not initiated or if the estate has already closed.

New Mexico encourages residents to compile a comprehensive list of assets and inform their families about its existence, keeping a copy in a secure location. This list should encompass retirement or pension accounts, property deeds or mortgages, account numbers, and passwords. Update this list to reflect personal information changes, such as adopting a spouse’s name after marriage or changing residences when necessary. Many funds held by the state are unclaimed final paychecks from workers who failed to collect them.

While you can independently locate unclaimed property in New Mexico as demonstrated, you may opt to enlist the services of a locator. These professionals handle all aspects of the process, from locating claims online to gathering the necessary information for filing. Typically, you’ll need to provide basic information and agree to pay the locator’s fees. New Mexico mandates that locators submit RPD-41343 along with a contract signed by the property owner. Locators have a four-year window to file claims on behalf of others, but for claims older than 48 months, only owners, heirs, or legal representatives can file.

Finding unclaimed property in New Mexico may not yield vast riches, but it can unearth assets, each potentially valued at $50 or more, held by the NM Taxation & Revenue Department. By leveraging the Missing Money website, the process becomes swift and efficient, requiring just minutes of your time. Following your successful retrieval of unclaimed property, consider exploring our additional guides to uncover more hidden treasures in the Land of Enchantment and beyond.

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.

Copyright © 2024 · OurPublicRecords.org · All Rights Reserved