Copyright © 2024 · OurPublicRecords.org · All Rights Reserved

Free Kansas Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

With our guide to unclaimed property in Kansas, you can find out how to search for money and file claims on your property.

No matter how much money you bring home every month, you probably wish that you had a little more. Thanks to the Kansas State Treasurer, you can get help finding money and different types of property that you lost through the state’s database. As of March of 2021, Kansas helped users find and get back more than $60 billion. The average size of the claims that individuals filed is more than $200, too. What would you do with $200 that fell into your lap? You might use the money to treat your family to a night out or to catch up on a bill.

Known as The Wheat State and The Sunflower State, Kansas has set laws that govern what the holders of property can do. A holder is an organization that stores or keeps your property safe and often includes banks and insurers. There are also laws that focus on what owners can and should do to get their property. In our ultimate guide to Kansas unclaimed money, we’ll go over those laws and tell you how to file a claim.

Unclaimed property in Kansas often includes dormant bank accounts. As long as you check the balance on your accounts once a year, the bank will continue letting your money earn interest. If you forget to check the account for 12 months, the bank will make a note that the account is inactive and later declare it dormant. Once an account becomes dormant, the bank can then file a form with the treasurer and let the treasurer add the account to the online database. It takes a minimum of two years for a checking or savings account to enter the database after the last time that the owner touched it.

Court deposits are another type of unclaimed money. When an individual faces criminal charges, they may need to pay a bond that releases them from custody until their trial. If the court cancels the trial or finds the individual innocent, they have the right to get their bond back.

Some assume that the money goes away when their trial ends and do not attempt to get their money back. You may find court deposits that belong to you or others in the Kansas database.

Oil and gas payments appear in the Kansas database, too. Companies that sell gas and oil to others use the natural deposits found in the state, some of which are on private property. Those companies agree to royalty deals in which they pay the owners a small amount for all the natural resources found on their property. If you inherited a home or piece of land in Kansas that has an existing royalty deal, you should inherit the payments also. The database will tell you how to claim the deal and transfer it to your name.

Other examples of unclaimed property in Kansas include wages and utility deposits. If you ever worked in The Sunflower State without getting a check for all the hours that you worked, check with the database for uncashed checks from your employer. Employers must also list checks for expenses that employees paid out of their pockets. With utility deposits, you might find that the state received a report from a utility provider that you didn’t cash a refund or deposit check. Kansas can also help you find stocks and bonds as well as insurance benefits and safe deposit boxes.

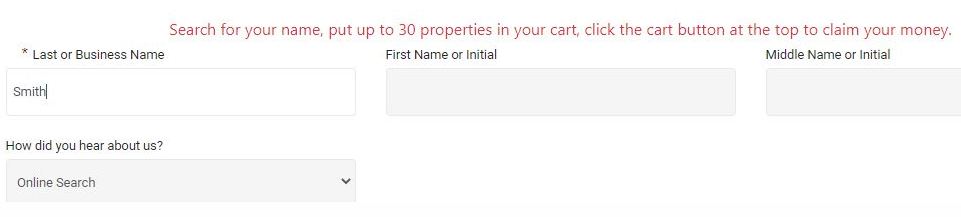

The Kansas State Treasurer created the state’s unclaimed property search to get money back to the owners. You can easily search for any funds that you think might belong to you.

Step 1: Visit the Kansas unclaimed property search website. Add your last name or the business name that you want to search for in the first box. You can also use a drop-down menu to show how you heard about the site and add one or more of your initials.

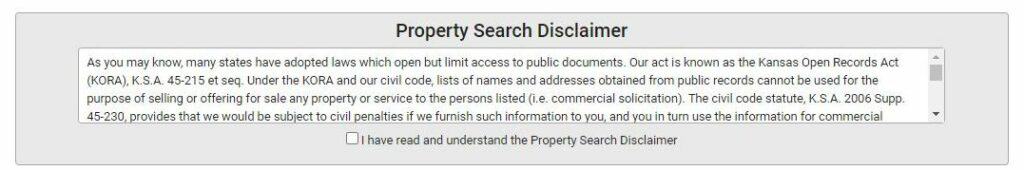

Step 2: Read through the property search disclaimer to make sure that you understand how the search works. You need to click to show that you read this section before you can proceed.

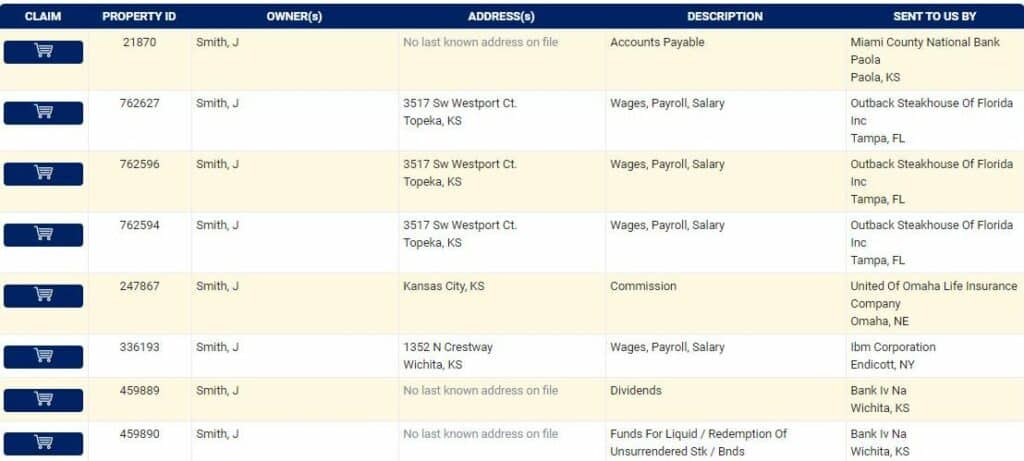

Step 3: Look over the funds that match your information to find accounts that you can claim. The Kansas database lists a short description that tells you what the account is and who sent it. You will also see the name of the holder and their address. In some cases, Kansas does not have the last known address of the owner.

Step 4: Locate the blue button on the left that has an image of a shopping cart in it. You need to click on that button to claim an account. A matching button in the upper right-hand corner allows you to file that claim and any others you find.

Simply finding an account in Kansas isn’t the only thing that you need to do to claim that property. We’ll go over the steps that you should take once you find and claim an online Kansas property.

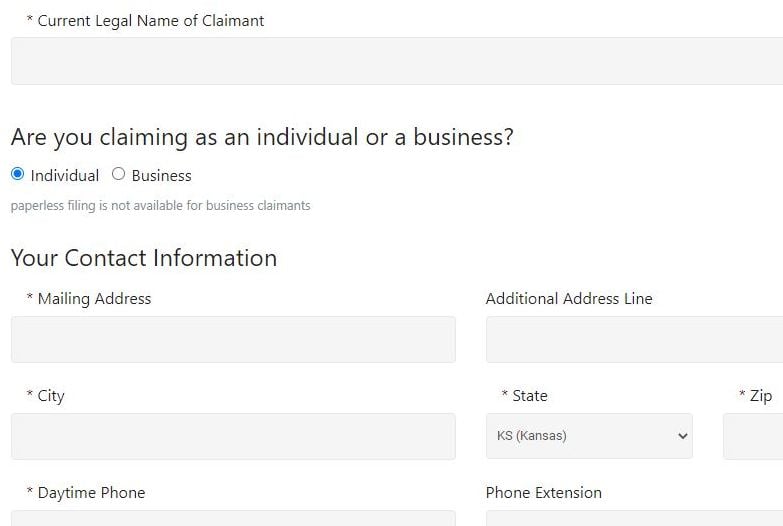

Step 1: Verify that you are the person listed as the owner. You will also need to show that you want to file a claim as the owner or for another individual who is living or deceased.

Step 2: Add some general information to the form. Kansas asks that you type out the full name of the legal owner. You also need to add your phone number and home address as well as your email address.

Step 3: Use the comments box to share any helpful information that you might have. This is where you might add your social security number or let the treasurer know that you can file an affidavit of heirship if needed.

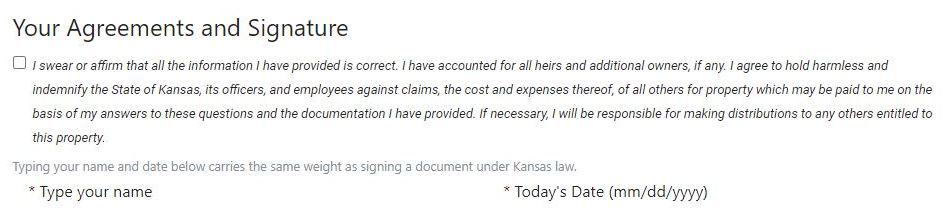

Step 4: Click the box on the bottom of the page to show that you shared valid information. You also need to add the current date and type your name, which serves as your signature.

Step 5: Check your inbox for an email from the Kansas State Treasurer. This email will include a PDF attachment that serves as your claim form. You need to print this form and sign the bottom before mailing it to the treasurer. If the treasurer determines that you cannot file your claim online, it will send an email that lets you know the form will come through the mail. This is common when you file for a deceased person or a business.

You can find unclaimed money through the databases that other states do. Google makes it easy to find those sites, but you can also check out the guides that we made for other states. Missing Money is another website that you might find helpful because it partnered with multiple states. This online database lets you search for money outside the country, too. Other resources that we recommend checking with include:

Kansas has laws that tell holders how long they can maintain accounts before they need to turn them over. It takes five years before most types of unclaimed property will go into the database. This includes bank checks and safe deposit boxes. Employers must turn over the wages and checks that they have of employees after only one year of trying to send the funds to the workers. Insurers usually only have three years to hold policies before they need to give the treasurer the funds. You may want to check some of the other Kansas unclaimed property laws before you search the database.

The Kansas State Treasurer found that the database features more than $400 million in unclaimed funds. This figure often changes near the end of the year when holders file reports. Holders need to file reports by the beginning of November for most types of property. You’ll also notice that the figure changes as people file claims throughout the year.

When you look through the Kansas database, you may find two or more accounts that you own. Kansas lets you file claims for up to 30 pieces of property at the same time. Unlike other states that ask for a claim for each account, Kansas gives you the chance to fill out one form and claim all of the accounts that you selected. You will then get an email that lets you know the treasurer received your claims. Kansas will only send you one email, no matter how many claims you filed.

Most of the unclaimed property found in the Kansas database includes intangible property such as bank accounts and utility deposits. The Kansas Treasurer also receives tangible property in the form of stocks and bonds as well as safe deposit boxes. To make things easier for the owners, the treasurer will liquidate or sell the property and retain the money for the owner. The treasurer often uses eBay to sell valuable items found in safe deposit boxes. You can file a claim that gives you the total amount that the contents brought at auction. Kansas takes steps to ensure that it gets the highest prices possible for those items.

You only need notarized documents when filing claims for certain things. Kansas requires a notarized form if you file a claim for a property with a value of $2,000 or more. This includes any stocks or bonds that have a high value and safe deposit boxes that the treasurer liquidated. To get a document notarized, you need to make an appointment with a notary and present both the document and a photo ID. The notary will make sure that your name matches your signature before stamping the page with an official seal. You must sign the document in front of the notary.

It takes an average of two weeks for you to get a check once the treasurer receives your claim and verifies that you are the rightful owner. If you do not use the online system and submit only paper forms, you can expect the process to take longer. The treasurer needs to first compare your claim to the database and then look over your information. Kansas is one of the only states to offer ACH deposits. As long as you include the routing and account numbers of your current bank account, you can get a direct deposit rather than a check. This can help you get your money in just one week.

Kansas does accept claims from heirs but does not let them file online. If you file a claim for property owned by a deceased parent and select the deceased option, the site will flash a message that stops you from filing. You can call the treasurer at (785) 296-4165 and request a claim form. The treasurer will send a full packet to your home address that shows everything that you need to have as an heir. You need a minimum of a death certificate that shows the deceased’s name and address. This certificate should also list any known next of kin. Kansas also requires an affidavit of heirship, which is a simple form that lists all assets owned by the deceased and any known heirs. If you are the only person who can file a claim, you may need to submit documents that show the other heirs who passed away. Kansas asks for only one copy of the heirship affidavit and death certificate, even if you file multiple claims.

When you owe money to a lender and default on your loan, the lender has the right to seize your property until you pay. This often requires a court order and allows the lender to take your bank account or other funds. If you later work things out, the lender should release your account and send you a letter that shows the account once again belongs to you. Kansas will not list those accounts in the unclaimed property database. You may need to contact the original owner and the holder of the account.

There is no statute of limitations on unclaimed property in Kansas. As long as the state puts your money in the database, you can claim it decades from now. One thing to keep in mind is that this statute does not apply to all types of property. The Kansas State Treasurer will only hold stocks and bonds for six months before it liquidates them. If the treasurer receives the contents of a safe deposit box, it will hold the contents for three years before selling them. The treasurer allows you to file a claim before this period passes to get back the original items that you owned. During the COVID pandemic, the state extended the limits for both holders and owners. You may find that the state still has your contents, even if it received your safe deposit boxes more than three years ago.

When you visit the Kansas unclaimed property search website, you’ll notice that it requires only your last name but gives you the option of using your first/middle names or your initials. We recommend that you use at least your first initial along with your last name, especially if you have a common name such as Smith or Williams. The database can only provide a set number of results per search. If you have a common last name, you may get an error message. You can save time by adding more information the first time that you search.

A growing problem in Kansas is that money finders use the database to find property owners and contact them. They often contact the heirs of people who passed away and those who own accounts worth large sums of money. You may think that working with a finder is your best option because you moved out of Kansas or think that you don’t have time to deal with the claim process. Money finders may charge fees that take up to half of your money in exchange for filling out a few papers and getting your signature. You can do everything that Kansas requires for claims without a money finder and sometimes without even leaving your home.

There are some simple ways that you can make sure the Kansas Treasurer doesn’t take your property. Checking your accounts is one of the best things that you can do. Set a reminder in your phone to log into all of your banking and other accounts once a year to show the holders that you’re alive. You may want to transfer a few dollars or make a deposit as well. If you get married or divorced and change your name, update all the holders. You also want to update them if you move to make sure that they can contact you.

Claiming unclaimed property in The Sunflower State doesn’t take as much time as you might think. As long as you have a device that connects to the internet, you can use the database set up by the Kansas State Treasurer and find your money. It’s then a simple matter of sending back your signed forms and waiting for a check. Use our guide to find all types of unclaimed property in Kansas and then check out our guides to all the other states in the country.

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.

Copyright © 2024 · OurPublicRecords.org · All Rights Reserved