Copyright © 2024 · OurPublicRecords.org · All Rights Reserved

Free South Carolina Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Learn the basics of finding and claiming all types of unclaimed property in our guide to unclaimed money in South Carolina.

South Carolina has an Unclaimed Property Program under the South Carolina Treasurer’s Office. The program recently reported that it received more than 600,000 new entries for unclaimed money and property.

The State Treasurer’s Office reports that unclaimed money and property in the state exceeds $700 million. This includes a wide range of financial assets, ranging from cash, paychecks, rebate checks, trusts, inactive bank accounts, and more. All of these monies and properties were turned over to the state because their owners were unavailable.

Many people don’t know that the state has an Unclaimed Property Program, let alone that they may have a stake in it. Additionally, many people don’t know where to start when claiming their money or property from the state. Many assume that the laws and rules are too complicated to be worth the work.

Fortunately, we have all the answers to your questions, and we are more than happy to guide you on how to claim your money and property. Here is an overview of everything you need to know.

The latest report by the State Treasurer’s Office reports that most of the unclaimed money reported this year is in the form of $50 rebate checks of the 2019 Mega Millions lottery. However, there are many types of unclaimed money and property in the state. The common categories include:

Paychecks

Uncashed paychecks are one of the most common types of unclaimed money. These can be uncollected checks from past jobs, checks that owners considered too little to cash or checks that got lost. These checks are turned into the state after some time, and you can always collect and cash yours.

Safe Deposit Accounts

Some people open safe deposit accounts and forget about them. Others die without telling anyone about the accounts or including them in their wills. Whatever the case, banks operating in the state are required to turn the account’s contents over to the State Treasurer if the account becomes dormant or goes unclaimed for a set period.

Inactive Bank Accounts

Many people also open bank accounts, fund them for a while, and then lose interest and forget all about it. Additionally, some people die with multiple bank accounts that no one knows about. These accounts are reported and turned over to the State Treasurer after a set period of inactivity. Owners (or the owners’ heirs) can then claim them whenever they wish.

Trusts

Trusts are designed to safeguard the owner’s property and ensure that it is transferred to the heir upon their death. These trusts may be reported as unclaimed if the owner dies and the heir cannot be found. Death insurance benefits whereby the heir cannot be found are also treated the same.

Other common types of unclaimed property in South Carolina include:

However, the state’s unclaimed property laws exclude real estate and vehicles from the list of unclaimed property. There are also other requirements and limitations, as discussed below.

South Carolina enacted its unclaimed property laws in 1971. However, records go as far back as the 1940s. The law is precise about how the property’s owners can access their property – and how holders of unclaimed property should remit them to the state.

Holders (people, companies, or organizations possessing unclaimed money and property) are required to remit them to the State Treasurer after a set period. The period for most properties is five years, but some have shorter deadlines.

The holders are also required to write to the owners notifying them of their unclaimed property at least 120 days before turning the property over to the state. The holders are required to use the address on their records, which may not always be accurate or op to date.

The holder will then remit the property to the state if it is still unclaimed. The South Carolina Treasurer’s Office also has a responsibility to find the unclaimed property’s owners. They can do this actively by tracking the rightful owners down. Unfortunately, some owners aren’t easy to find.

The unclaimed property’s owner can find it via several channels, as will be discussed later. However, they are required to provide proof of ownership. This can be as simple as providing their identification documents or as complicated as going to court to prove that they are the heir to the dead property’s original owner.

The South Carolina Treasurer’s Office has a responsibility to find unclaimed properties’ owners. They have agents who actively search for the property’s owners as soon as the holder makes an entry. They locate some of the property’s owners and notify them through mails, telephone calls, and other communication channels. However, they don’t find most of the property’s owners.

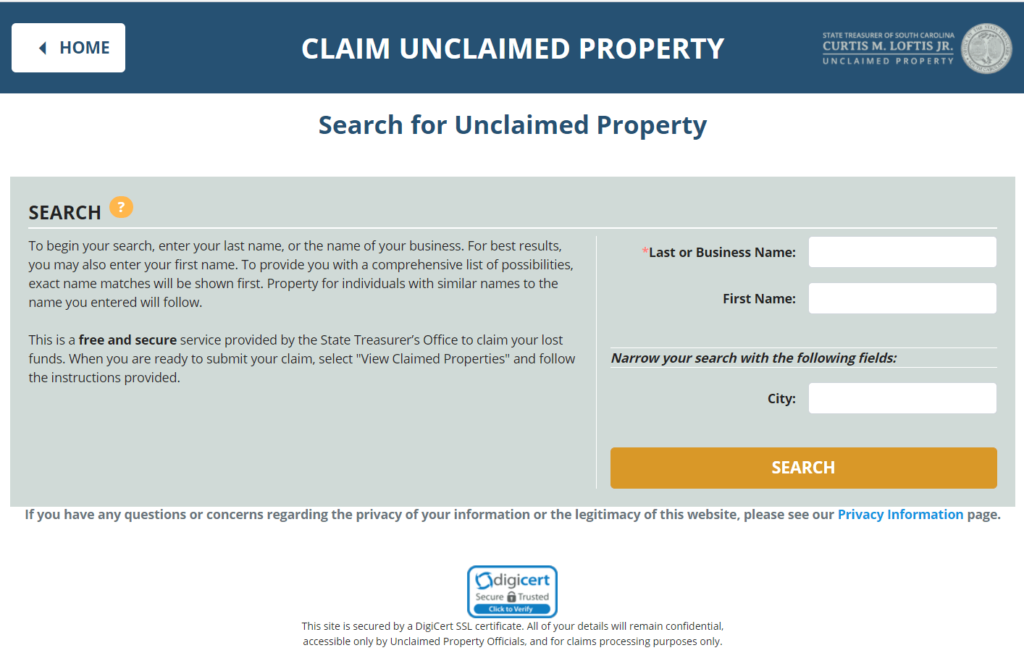

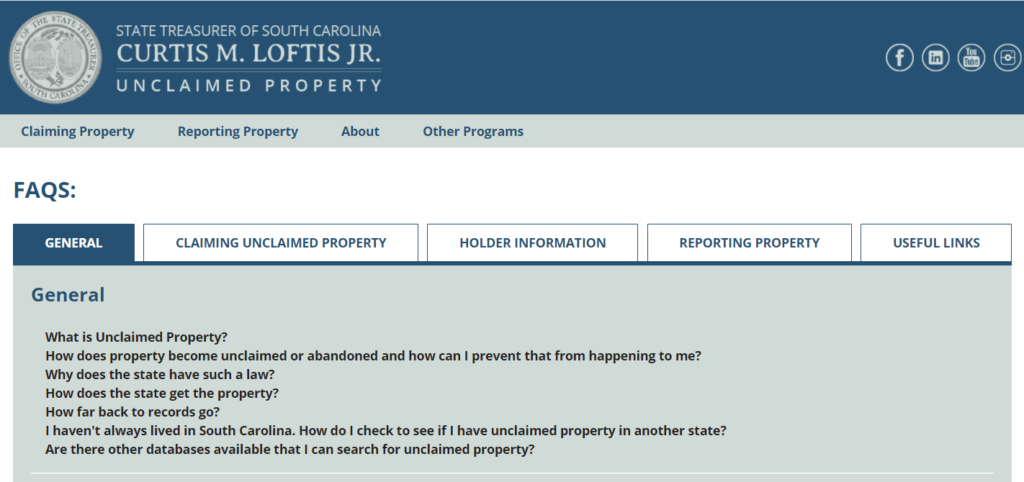

Fortunately, anyone in the U.S. can find out whether they have unclaimed money in South Carolina through a variety of channels. The easiest is the State Treasurer’s official website. Here is a step-by-step guide on how to go about it:

1. Access the Website & Search

The first step should be accessing the State Treasury’s official website, which is available here.

However, you will need to find the page dedicated to unclaimed property. You can find the page in the top-left corner of your website under the tab labeled Claiming Property > Search Unclaimed Properties. Click on the second tab to go to the page. Alternatively, you can click on the big yellow tab labeled Get Started.

You will be redirected to a page with a search portal where you can execute your search. There are two fields in the search box: one requires you to enter your name, and the other asks for a city. You can enter whichever name you like, including a business or company name. However, entering the city name is optional – you can leave the field empty and still make the search. Finally, select the type of unclaimed property.

The website will generate a list of the types of lost monies and property in the state with tabs labeled Claim next to each entry. Click on the Claim button for the type of unclaimed property you are looking for. You can select as many types of property as you wish for a comprehensive search if you are not sure of what you are looking for.

2. Submit Your Claim

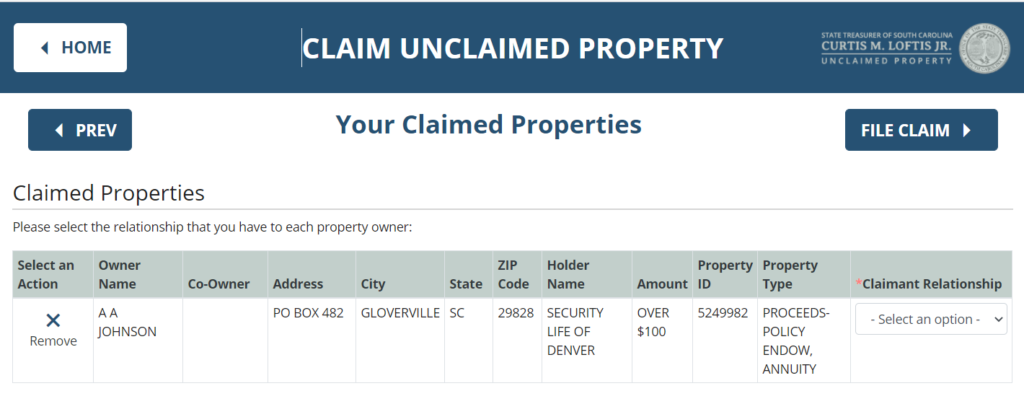

It is important to verify your claim and personal information before submitting it. As such, double-check that you have clicked on the right type of unclaimed property. Click on the tab labeled Next after verification.

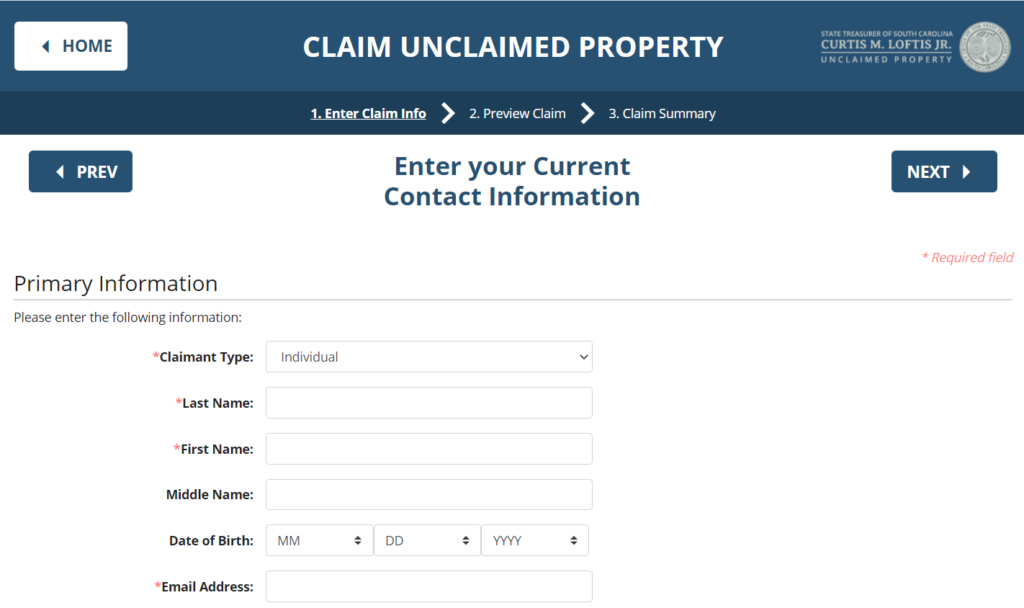

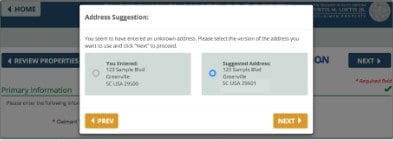

You will then be redirected to a box requiring you to enter your contact information. Ensure that the contact information is current and comprehensive. Some of the details required include your current mailing address and your relationship to the owner. You will also be required to verify the information before submitting your claim, as shown below.

You will then be redirected to a final box where you can preview all the details in your claim. Verify the details again and then click on the button labeled Submit. The platform will process your claim and generate a claim number that you can use to track results.

Tip: Be specific when providing your details. The website will generate as many results as fit your category, and it may take a lot of time to comb through the results. However, providing a specific name, city, and type of unclaimed property will help narrow down the results, making your search easier.

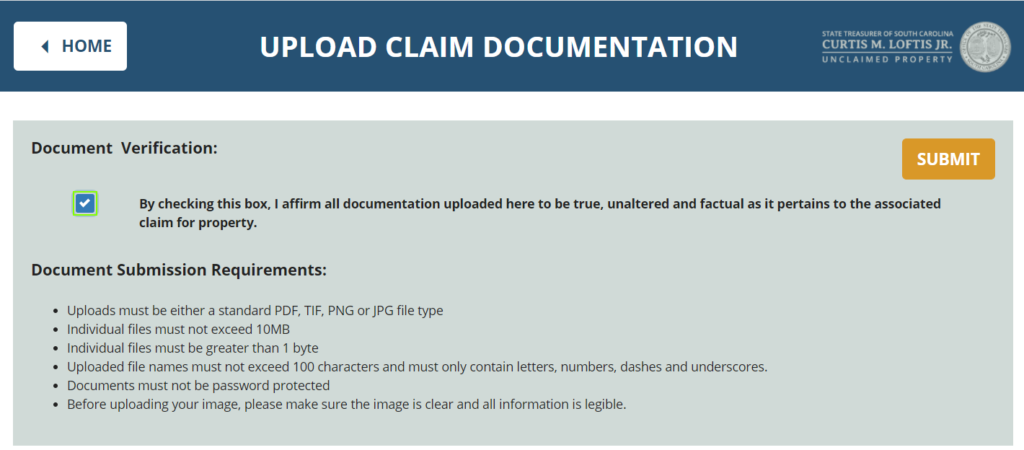

3. Prove Your Claim

You are required to prove that your claim to the unclaimed property is legitimate before the state can release it. The process varies depending on various factors, such as the type of property and its original owner. For example, proof of relationships is necessary when claiming a deceased person’s property.

The Office of the Treasurer requires the following details and documents to verify your claim:

These are the standard requirements. However, you will receive an official email listing out all the requirements and verification procedure. Ensure that you meet all the requirements before submitting your documents.

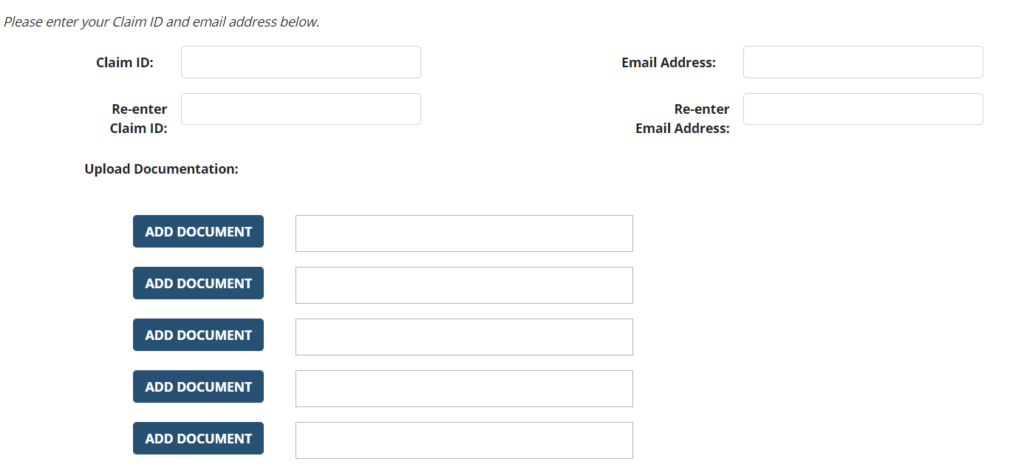

You can easily submit your verification documents online using the secure link here. Alternatively, you can mail your documents to the state. The mail should be sent to the Unclaimed Property Program under the South Carolina State Treasurer. Their address is 1200 Senate Street, Suite 214 in the Wade Hampton Building (Columbia, SC 29201).

Ensure that you use the correct information when verifying your claim to avoid unnecessary delays. You may also face legal challenges if your claim cannot be verified, but you can always get a lawyer to overcome them.

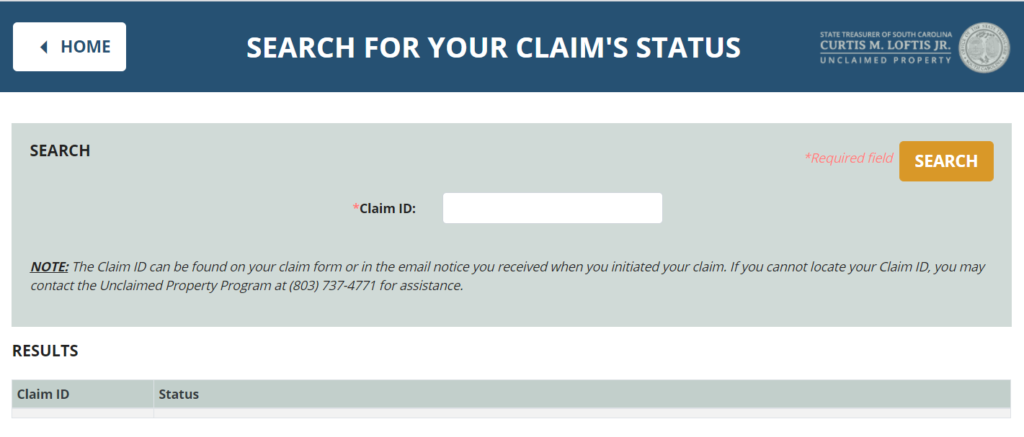

4. Track Your Claim

You will be issued a claim number after submitting your claim, as mentioned earlier. The claim number will also be included on the claim form and in the mail. You can use this claim number to follow up on your claim’s status via the Status Page.

Your claim can take varying periods of time to be processed, depending on the complexity of your search. The standard time is between four and 12 weeks. However, it may take longer if the claim cannot be verified.

The state keeps a comprehensive and up-to-date record of unclaimed money and property. However, there are alternative channels that are just as helpful. These include federal platforms and NGO sites. Some of the best include:

The U.S. Treasury

The U.S. Treasury also receives and keeps track of unclaimed money and property. It mostly handles unclaimed savings bonds. However, you should be forewarned that the platform is not as easy to use as the state Unclaimed Property Program.

The Internal Revenue Service

The IRS is also an important database for finding unclaimed money. The department has billions of dollars in unclaimed refund checks. Tracking these checks is easy, and all you have to do is contact the IRS. You could also have some tax refund money with the South Carolina department of taxation. It is also advisable to update your address and other financial details with the IRS and state department of taxation to ensure that your refund checks reach you.

Life Insurance Policies

Life insurance benefits go unclaimed often because the beneficiaries don’t know about them. In most cases, the beneficiaries are usually former employees of demutualized companies. In some cases, beneficiaries don’t know about their dead relatives’ death insurance policies. You can find out whether any insurance company owes you by searching on www.demutualization-claims.com.

National Association of Unclaimed Property Administrators (NAUPA)

The National Association of Unclaimed Property Administrators (NAUPA) is one of the largest platforms for finding unclaimed money and property across the U.S. The platform contains links to every state’s unclaimed money programs. It also offers access to federal platforms such as the U.S. Treasury.

Other platforms deal with specific types of unclaimed and lost property. Here is a list of the common types of lost property and links to platforms that can help with your search:

It is also worth noting that you can hire a professional unclaimed property finder to conduct the search on your behalf. This is especially recommendable when you face obstacles or legal challenges in your search. However, it is worth noting that the finder will charge you a fee for their services – and positive results aren’t always guaranteed.

Tracking your unclaimed property can be either easy or complex, depending on a variety of factors. However, you have the option of hiring a professional finder to track the money/property for you.

A professional finder will perform a comprehensive search for your unclaimed money/property on all known databases. They will also help you navigate legal challenges, such as proving that you are the unclaimed money’s rightful owner.

However, it is worth noting that the professional finder will charge you for their services. The finder may also require you to share some of your private information for verifying your claim.

Millions of Americans across the country don’t realize that they have unclaimed money or property for generations. You can prevent your money and property from getting lost or becoming unclaimed by taking several practical measures, as explained below:

Keep Accurate, Up-to-Date Records

Many people simply forget that they have funds or property. For example, low-value bank accounts and properties are easy to ignore, and ignorance eventually leads to forgetfulness. Consequently, it is advisable to keep an updated record of all of your funds, properties, and other financial assets.

It is also advisable to update your accounts and addresses. This is because payments paid to your former accounts or addresses will go back to the payer and submitted to the state as unclaimed assets. However, updating your address when you move will ensure that you get the checks and other relevant documents.

Be Active on Your Accounts

Money in dormant accounts and other contents in deposit boxes are handed over to the government after a given period of inactivity. This is why it is important to maintain activity across all of your accounts. It can be something as simple as logging in or checking your balance – as long as it proves that you are still using the account.

Different accounts and financial institutions require varying levels of activity. To this end, some accounts may necessitate only one activity per year, while others necessitate regular activity over much shorter periods.

Update Your Address

Paychecks (and other documents related to money or property) sent to the wrong address eventually become unclaimed property. Additionally, any notices meant to inform you about your unclaimed property (holders are supposed to notify you some time before turning your property over) sent to the wrong address will not help.

This is common because may people forget to update their addresses when they move. As such, it is recommendable to update your address with all of your acquaintances when you move.

Prepare a Will

A significant amount of unclaimed funds and properties are left behind when their owners die. In most cases, the deceased owner’s relatives don’t know about these funds, leaving them unclaimed. Consequently, it is advisable to disclose your property to your next of kin as regularly as possible. It is also advisable to leave a will disclosing and assigning your funds and property to your heirs

A: The state of South Carolina has been running its Unclaimed Property Program for more than five decades now. The state holds all unclaimed properties indefinitely, and owners can claim them whenever they wish.

The State of South Carolina usually takes between four and 12 weeks to process claims. The exact period depends on the claim’s complexity. Claimants can call the program’s administrators via (803)737-4771 to follow up on delayed claims.

However, the process may take longer if the unclaimed money is disputed by another party. For example, multiple relatives may claim a deceased relative’s property.

You are required to prove that you are the rightful owner of the unclaimed money before the state can release it to you. As such, the state requires copies of your identification documents, such as a passport, driver’s license, or social security number. You can upload these documents via the State Treasury’s website or mail them to the State Treasurer’s office.

No, the state does not charge anything to process claims. However, third party actors, such as professional finders and some NGO platforms, may charge a small fee for their services.

You will be required to prove your relationship to the deceased to get their unclaimed money and property. The standard requirements include a copy of the deceased’s death certificate, documents proving their ownership of the property, and a currently dated Probate Order.

Yes, uncollected money from credit card rewards qualifies as unclaimed money. However, you may not find this money at the State Treasurer’s website. However, you can find out by checking your credit card’s account. The credit card provider may also call to notify you about their rewards, but this isn’t always guaranteed.

Many people go for years without realizing that they have unclaimed money or property. You could be one of these people, but you can find out by making a quick search online, as explained in this guide. You may also have unclaimed money in other states or with the federal government, and you can find out by utilizing some of the other platforms recommended in this guide.

It doesn’t matter how long it takes you to claim your unclaimed money or property – you will get it when you submit a claim. This guide answers all of your questions.

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.

Copyright © 2024 · OurPublicRecords.org · All Rights Reserved