Unclaimed Money Lookup - Montana

Free Montana Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

(advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Montana Unclaimed Money -

The Ultimate Guide 2025

- UPDATED February 2025

Use our easy guide to unclaimed money in Montana to find any type of abandoned property in Big Sky Country that you own.

Contents

- Your Ultimate Guide to Unclaimed Property in Montana

- What is Unclaimed Property?

- How to Find Unclaimed Property in Montana

- Claiming Your Property Through the Montana System

- What Other Databases Can You Search?

- How Much Unclaimed Money Does Montana Have?

- Checking the Status of a Montana Claim

- Unclaimed Montana Mining Trusts

- Montana Unclaimed Property Auctions

- Unclaimed Property Laws in Montana

Your Ultimate Guide to Unclaimed Property in Montana

Often called Big Sky Country due to the large open spaces across the state, Montana is heaven for those who love the great outdoors. The state is home to tons of ranches and farms as well as quiet spaces where you might not see your neighbors for months. Montana wants to make life easier for its residents, which is why the state designed a website that lets you apply for permits and do other things from the comfort of your home. The site also helps you search for unclaimed property that you lost or forgot that you had.

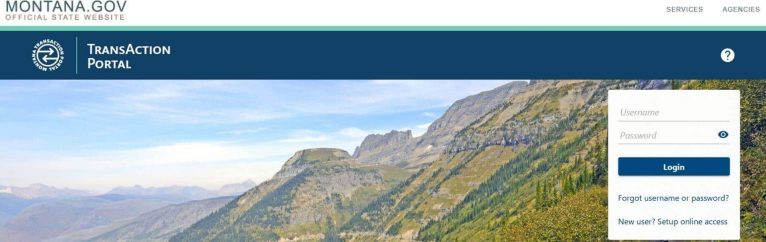

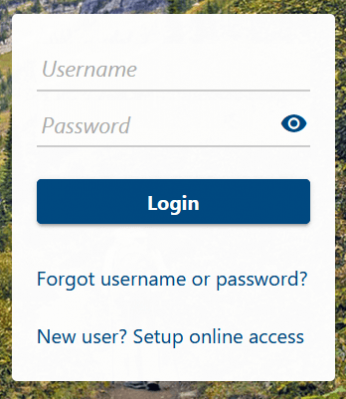

The Montana Department of Revenue lets you search for your property in two different ways. You can use the TransAction portal and set up an account to search for claims that you can file and do other things. We recommend using this site because of how often the portal updates with new information. You can also search the Missing Money: website to view claims sent over by Montana along with records from other states. No matter which website you use, you can easily find all of your property and file claims to get your assets within a few months or less. In our ultimate guide to unclaimed money in Montana, we’ll show you how to use the Montana website.

What is Unclaimed Property?

The Montana Department of Revenue calls unclaimed property as any type of asset that the organization that holds it cannot give to the owner for any reason. This commonly occurs when the owner moves without updating their contact information. Though some people forward their mail through the local post office, they may miss letters or notices that alert them to problems with their accounts. Holders also have problems finding owners when they pass away, especially if they didn’t designate anyone to get or take over their assets. Not only can you search the TransAction portal for accounts that you own, but you may find some that belong to your deceased parents or other loved ones.

A credit balance is one example of an unclaimed asset. When you open a credit card, you can spend money today and pay off what you owe with monthly payments. If you pay more than you owe, you have a positive balance on the card. The credit card company may encourage you to spend more money or send you letters about your balance.

You might close the account with the balance still available, which will result in the creditor sending a check. Depending on where you live in Montana, your mail may not always get to you. This results in the creditor turning the check over to the Montana Department of Revenue.

Another example of unclaimed property is an insurance proceeds check. The most common reason why you would get one of these checks is that you are the designated beneficiary of a life insurance policy. When a loved one buys a policy, they can name a beneficiary without telling the person. Checks can range from $5,000 to more than one million dollars depending on the policy that the individual bought. That money can come in handy if you want to keep their home in your family or you have trouble paying their funeral and burial costs.

Other examples of unclaimed assets in Montana include unpaid checks and bank accounts. Printed checks are often valid for up to six months after their issue date, but other checks are only good for three months. If you do not cash a check sent to you within this time frame, it becomes void. Though some will send a new check to you, others will send the money to the Department of Revenue and let the state deal with it. You can also search the TransAction Portal for stocks and bonds, certificates of deposit and money orders.

How to Find Unclaimed Property in Montana

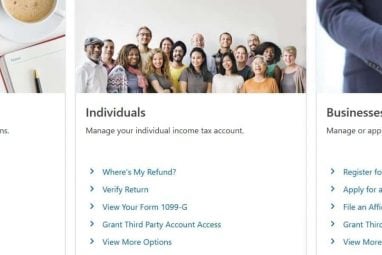

The State of Montana offers the TransAction Portal to help residents find everything that they need. It has options for both business owners and individuals as well as those looking for unclaimed assets.

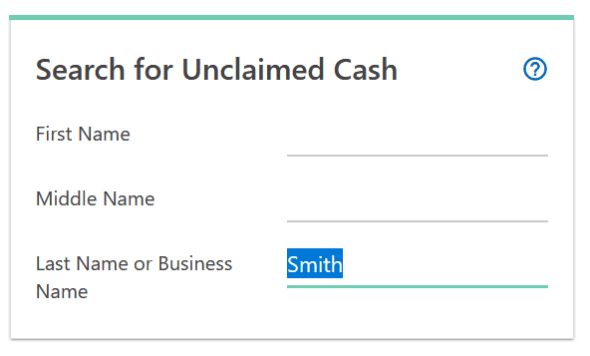

Step 1: Visit the TransAction Portal to search for unclaimed money. Look for the Unclaimed Property box on the bottom of the page. Click on the “Search for Unclaimed Cash” link.

Step 2: Locate the “Search for Unclaimed Cash” box near the top of the page. You will need to add your last name to this box. Montana also lets you add your first and/or middle name to narrow down your results or search with the name of a business.

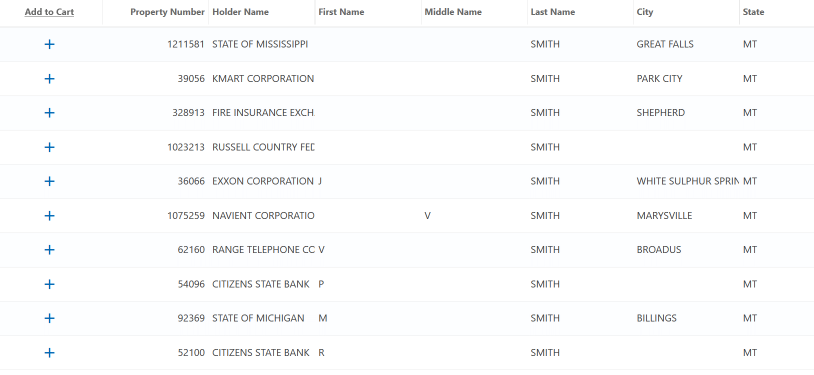

Step 3: Scroll down to find your matches. The Montana database lists the name of the owner and the city where they lived when they owned the asset. You will also see the property number that you may need later and the holder’s name. Adding more information to the box labeled “Filter” to narrow down the results.

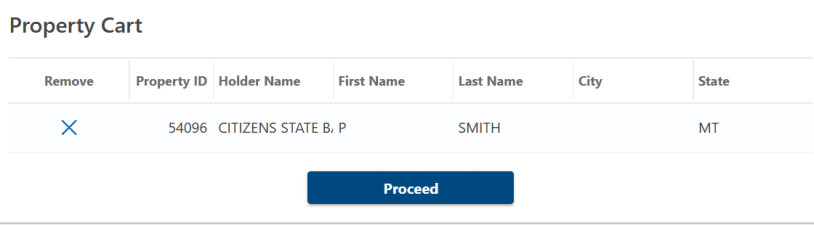

Step 4: Click on the blue plus (+) sign when you find an asset. You then need to move back to the top of the page to view the claim and select the “Proceed” button to continue.

Claiming Your Property Through the Montana System

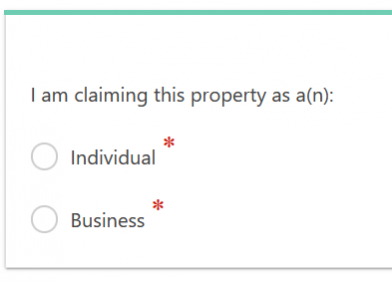

Step 1: Click on one of the boxes shown to state whether you want to file as a business owner or individual. This page will load after you follow the above steps. You need to click “Next” to load the next page.

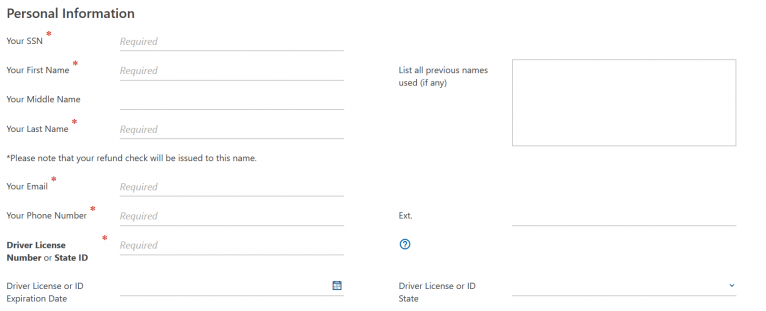

Step 2: Fill out the personal information form, making sure that you complete each line labeled “required.” Montana requires your social security number, first and last name, email address and driver’s license with both its number and expiration date. You can also list any previous names that you used.

Step 3: Add your current address to the box on the next page. Montana does not require that you list the address that you lived at when you lost the asset because the Department of Revenue wants to know how to get in touch with you today.

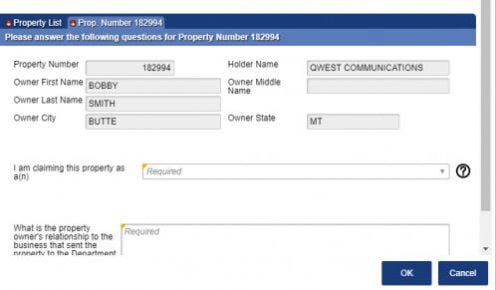

Step 4: Answer some simple questions about the property that you want to claim. The site will automatically add any of the information available in the database but may ask that you fill out one or more sections. You will also need to let the department know if you are the property owner or filing for the owner.

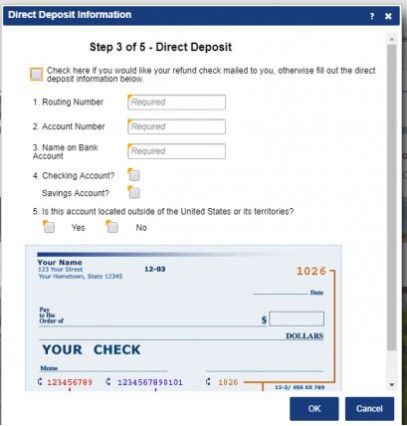

Step 5: Enter your bank account in this optional step. Montana is one of the few states that will let you set up direct deposit to get your money faster. You need to know both your routing and account numbers. The site also asks for the name on the account and whether it’s a checking or savings account. If you skip this step, the Montana Department of Revenue will send you a check when it processes the claim.

What Other Databases Can You Search?

As helpful as the Montana database is for those looking for unclaimed property, there are plenty of other sites that we recommend you check out such as U.S. Federal Investments. The United States Treasury issues bonds to children that mature in as little as 10 years up to 30 years. You can then cash the bond and get the total face value. Many families lose track of the bonds that they buy during moves and for other reasons. This site gives you the chance to search for bonds in your name and claim them.

People often spend years saving money for their later years, but not everyone has the chance to spend all the money in their retirement accounts. The U.S. Railroad Retirement Board helps you find retirement accounts that railway workers opened and learn if there is any money left for their families. You can also work with the Pension Benefit Guaranty Corporation to find pension funds owned by those who worked for other employers. We like that this site offers all the information that you need as soon as you search for an individual’s name.

Government departments such as the Department of Housing and Urban Development (HUD) also let you search for abandoned assets. HUD helps people qualify for affordable home loans and secure mortgages with lenders. You should check with HUD if you believe that the department issued a refund after you bought a home. The Department of Veterans Affairs lets veterans and their families apply for benefits to buy a home and start a business or get health insurance. You can also work with the VA to see if you are a beneficiary on an unpaid life insurance policy.

You probably don’t look forward to April, which is when you need to file your taxes. Even if your employer takes money out, you may still owe some next year. The Internal Revenue Service (IRS) lets you estimate the taxes that you owe and set up installment plans. You can also set up an account that lets you check on the status of an upcoming or previous refund. The IRS lets you set up direct deposit online, too.

We also recommend checking with organizations that are responsible for keeping track of banks. The Federal Deposit Insurance Corporation insurers the funds that banks hold, which gives those with accounts the right to get their money back when a bank folds. With the National Credit Union Administration, you have the chance to look for accounts you had with former credit unions. Both websites give you the option of claiming your funds as long as you had a positive balance when the institution closed.

How Much Unclaimed Money Does Montana Have?

The Montana Department of Revenue claims that it holds more than $8 million in assets for owners. This includes both those who still live in the state and those who moved away. Montana usually awards assets worth more than $3 million a year. As holders keep turning over assets, the size of the database will grow. Between all of the assets found in nearby states and others across the country, the nation has around $45 billion in unclaimed funds. Don’t focus so much on the TransAction Portal that you forget about the other websites that you can use. You can search for money held by any state in the country as well as assets held by the government and other organizations.

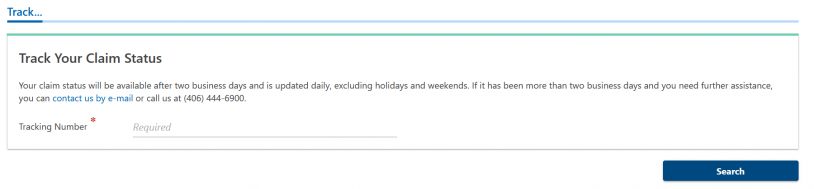

Checking the Status of a Montana Claim

Thanks to the TransAction Portal, you can now keep an eye on a claim after you file it. Click on the “Track Your Claim” status to load the search function. The site asks for the claim number on your form. If you do not have the original form, check for the copy sent to your email. All claims update within two days of the owner filing but do not include weekends or holidays. You should see the status of the claim listed. The TransAction Portal recommends that you call the Department of Revenue or send an email if there isn’t any information available.

Unclaimed Montana Mining Trusts

The rural areas of Montana combined with its natural resources make it the perfect spot for mineral mining. Holders are usually the mining companies that work out deals with the landowners. Montana allows a holder to lease the property from the owner or set up a royalty deal where the owner makes money off the resources found on their property. If the holder cannot locate the owner, they will contact the county court, which will usually assign the clerk of courts as the trustee of the property. The Department of Revenue becomes the trustee later. This allows the state to maintain the property and trust until the department finds the owner or an heir. If you are the heir to the trust, the state will let you claim it and resume the payments. You’ll also receive half of the interest earned on the trust. The state will take the other half to support the Department of Revenue.

Montana Unclaimed Property Auctions

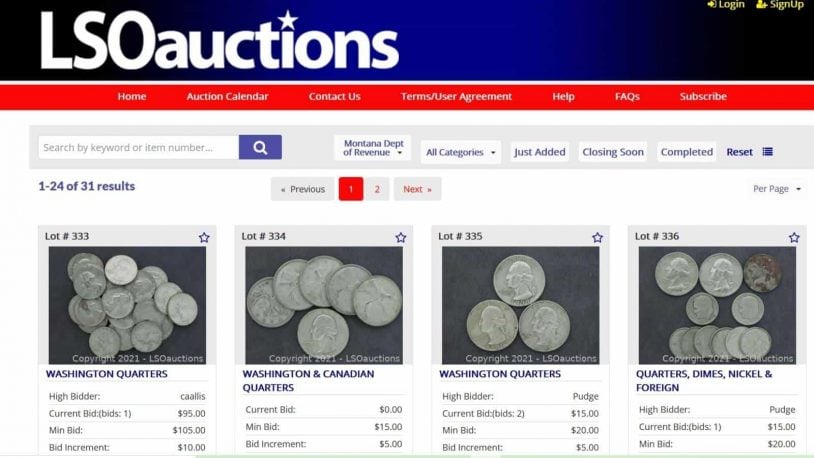

Though many assets remain in the hands of the Montana Department of Revenue, it does not hold onto physical property forever. Those items will go onto an online auction site that allows users from around the world to bid on them. This includes most of the items found in abandoned safe deposit boxes. You can check out the online auction to see the current high bid and name of the bidder. Once you set up an account and add your payment information, you can bid on anything up for auction. Unlike some states that hold an auction only once a year, Montana runs a few auctions annually. The Department of Revenue will hold all items for a period of three years during which time it will send letters to anyone who can claim the box as an owner or heir. Only if no one claims the contents will they go on the Lone Star Auctioneers website.

Unclaimed Property Laws in Montana

To view the unclaimed property laws in Montana, read through the Uniform Unclaimed Property Act, which includes any updates or revisions added over the years. One law that you need to know is about the dormancy charge that the state allows holders to charge. They can take this fee out of the account before the state receives it. In cases where you file for your property before the state gets it, you need to pay the dormancy charge and all other fees before getting your property back.

Montana Unclaimed Money FAQs

How Do You Claim Property for Deceased Owners?

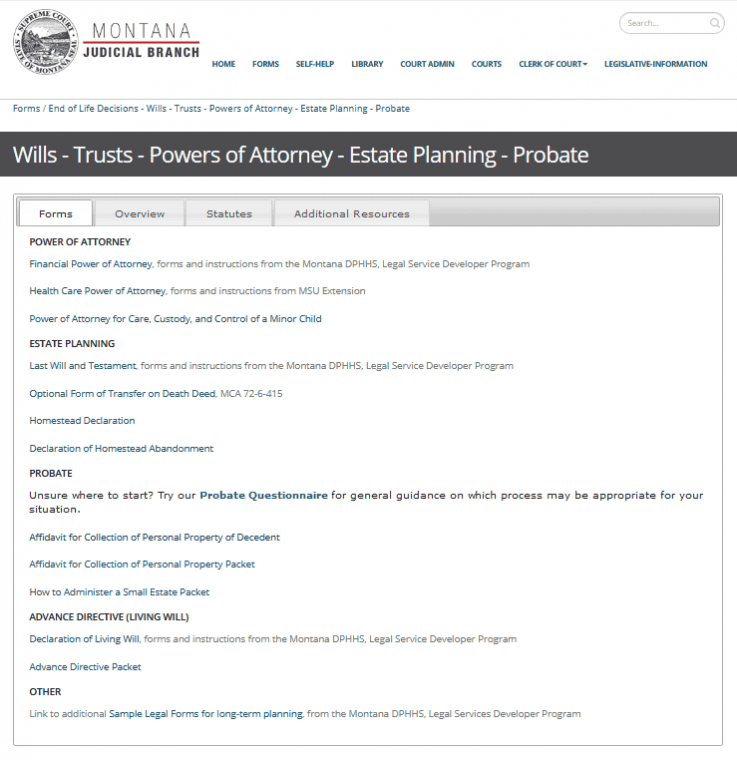

Montana requires that all estates go through probate if they have a value of $50,000 or more. This will require that you go before a judge who appoints an executor. The executor is responsible for using the will to determine who receives the deceased’s items and making sure that the estate can pay any necessary bills or expenses. If you are the executor, you can file in Montana and add the assets that you find to the estate. For estates that do not go through the probate court system, Montana allows heirs to file claims. You need proof that the estate did not require probating or that the court named you the person responsible for the estate.

What Steps Does Montana Take to Find Property Owners?

The Montana Department of Revenue wants to return as many assets to their owners as possible, which is why it makes several attempts to find their owners. You will see ads in newspapers across Big Sky Country that remind people of the database and tells them how they can use it to find their money. The department will also look through safe deposit boxes to find papers that include the names of the owner’s relatives, which they use to locate the heirs of those who passed away. Though the state doesn’t have a database for military medals and ribbons or other awards, it will hold those items for a few years and work with volunteer organizations to find the rightful owners or their heirs.

Can Montana Fee Finders Help You?

Fee finders often target the deceased’s heirs and claim that they can make the process of filing claims easier. They look through recent death certificates along with obituaries and death notices to find the heirs. The finder will then search the TransAction Portal to identify any property that belonged to the deceased before sending letters to their loved ones. You may find that they claim that they will handle the application fee and all other associated fees for a large charge that is worth more than the property they find. Montana does not charge any fees to file a claim and will hold the property indefinitely to help you get your property without a fee finder’s help.

Should You Create a TransAction Portal Account?

When you visit the Montana Department of Revenue website, you’ll find that it offers the option of creating a new account. Though you do not need an account to claim property, it comes in handy. That account will keep track of all of your claims and show you the most recent status update without requiring that you enter the property number first. You can also use your account to automatically add your contact information when filing a new claim and get your money sent via direct deposit to your registered bank account.

Tips to Prevent Montana Property from Becoming Abandoned

All the property that you own in Montana only becomes abandoned when the holder cannot find you and you don’t use the property. This might include a bank account that you didn’t use after opening a new one or a safe deposit box that you thought you cleared out. Staying in touch with all the holders of your assets is the best way to keep them in good standing and to prevent holders from getting in touch with the Montana Department of Revenue. You should also appoint a loved one or close friend to manage your assets if you become sick or pass away.

Conclusion

As someone who owns assets in Montana, you have the right to claim your property, even years after you abandoned it. This includes both stocks and bonds as well as bank accounts and royalty agreements. Our ultimate guide to unclaimed money in Montana makes it easy for you to see what you need to do and all the steps that you can take to claim money through the system. We encourage you to look over our guides to finding unclaimed property in other states once you use the Montana system.

Quickly Search For Unclaimed Money

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.