Copyright © 2024 · OurPublicRecords.org · All Rights Reserved

Free California Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Explore our comprehensive guide to uncover the process for claiming unclaimed property in California and discover the various types of funds waiting to be reclaimed.

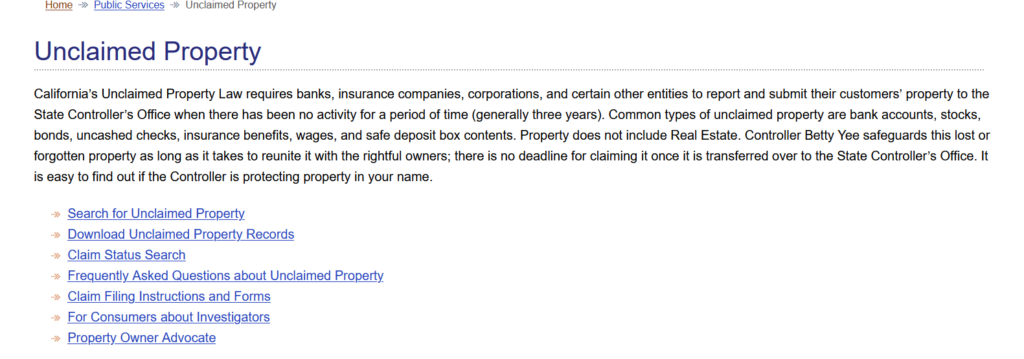

The California State Controller’s Office diligently oversees unclaimed property annually until its rightful owner claims it. Distinguished as one of the few states nationwide, California takes the proactive step of sending notices to property owners. Even without a notice, you can access and search the California database for unclaimed property. This resource encompasses a wide spectrum of property types, from insurance refunds and utility deposits to paychecks and business funds. Explore our comprehensive guide to unclaimed money in California, which provides insights into navigating the database, understanding unclaimed property laws in the state, and eligibility criteria for filing a claim.

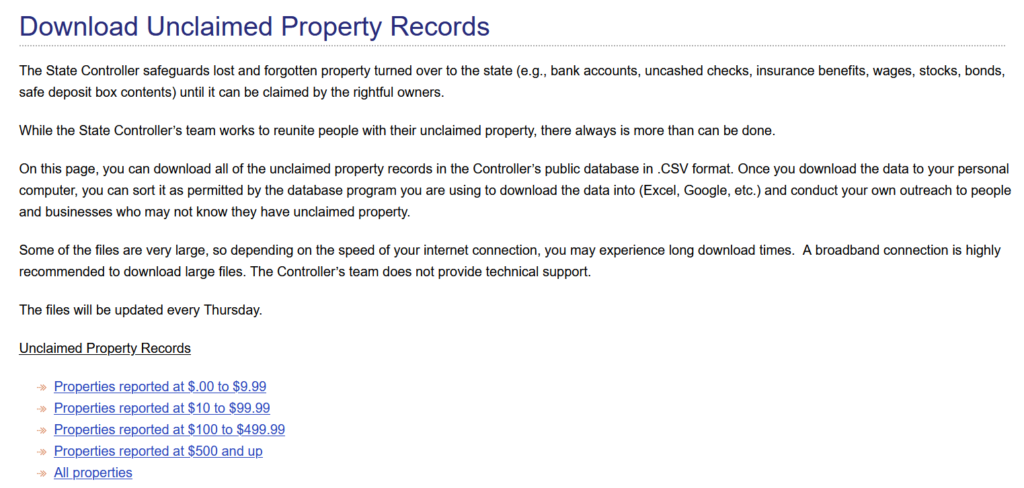

California’s unclaimed property database includes listings for both the property owner and the property holder. The owner, typically the original owner of the property, is eligible to file a claim. While your name may appear in the database, it’s possible to find accounts that also list co-owners.

The holder, on the other hand, is usually an organization or business that safeguarded the property for you, such as a bank or company. Among the types of unclaimed property featured in the database are stocks and bonds. If you’ve purchased stocks, you should have received a certificate detailing your purchase. In case you lose this certificate, you can still reclaim your stocks. California also provides assistance for recovering lost stocks and bonds when you’ve lost access to your account used for stock transactions.

Unclaimed property extends to include any uncashed checks bearing your name. If you’ve ever operated a website and participated in ad programs, there may be checks from platforms like Google waiting for you. Although Google now requires a minimum earnings threshold of $50 before issuing a check, earlier stages of the ad program issued checks more frequently, even for smaller amounts. Employers you’ve worked for and utility companies you’ve used may also have unclaimed property listed in the California database.

Additionally, financial institutions often hold unclaimed property for individuals. Did you once have a bank account as a child that you thought disappeared when you switched banks? If you leave the account untouched for a year or more, it remains active. The bank, as the official holder, eventually transfers it to the Controller’s Office. Banks can also possess unclaimed safe deposit boxes that are eventually handed over to the state.

Several insurers offer policies that allow family members to purchase coverage for infants or young children. These policies can be cashed out to cover funeral expenses if the child passes away, or when the child reaches the age of 18, they can be redeemed for college funds. It’s possible that a family member purchased one of these policies, and you may find thousands of dollars or more in the database. Insurers also use the database to list any refunds due to you for your home or auto insurance.

Step 1: Begin by visiting the official California State Controller’s website to access the Unclaimed Property Search feature.

Step 2: In the search section, enter your last name into the designated field. California offers the option to include additional details such as your first name, middle initial, or city. For your initial search, we recommend using only your last name, as the database may contain variations, misspellings, or omit your first name. The site may also prompt you to verify your identity by clicking a checkbox.

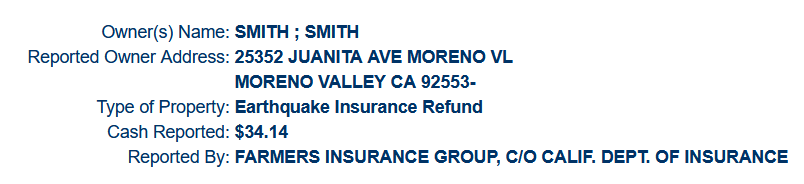

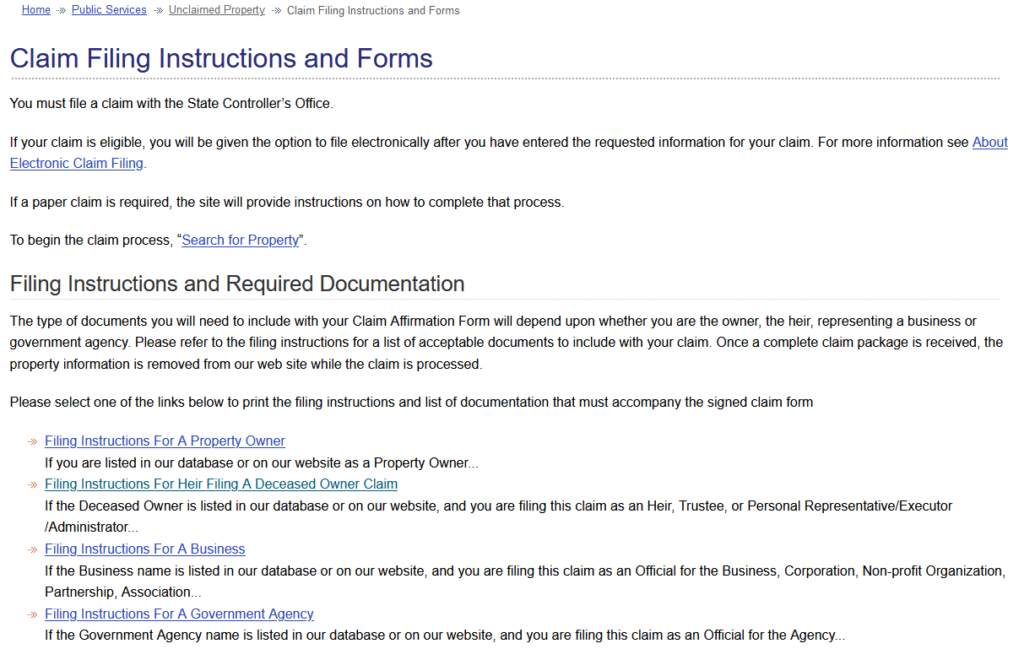

Step 3: Examine the search results to identify any unclaimed property in your name. If a property displays a “P” next to it, this indicates that you can file your claim electronically. Some properties may have different letters indicating that online filing is not available.

Step 4: To learn more about a specific property, click on the property ID link. This will provide additional details, including the property’s value or amount, the name and address of the holder, and the type of property associated with your name.

Follow these steps diligently to ensure you can successfully locate and claim any unclaimed money that rightfully belongs to you in California.

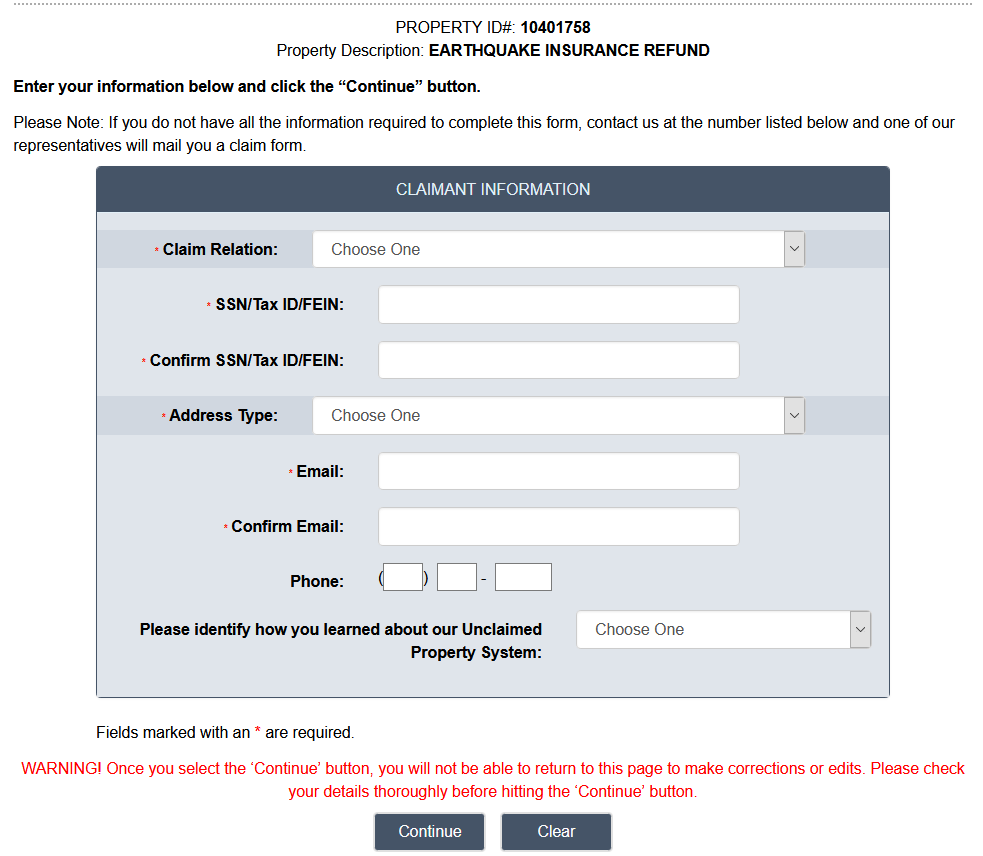

At the bottom of the property page, you’ll find a convenient “Claim” button for initiating your claim process directly through the site. When you click this button, the property ID number is automatically populated into the claim form. Within the form, the initial box prompts you to specify whether you are the primary claimant or claiming on behalf of another individual. It’s important to note that filing as an official agent or officer for an organization or as the heir of the individual is a prerequisite.

The subsequent fields in the claim form will request essential information, including your social security number, residential address, phone number, and email address, as mandated by California regulations. Additionally, there’s an option for you to indicate how you initially discovered the website.

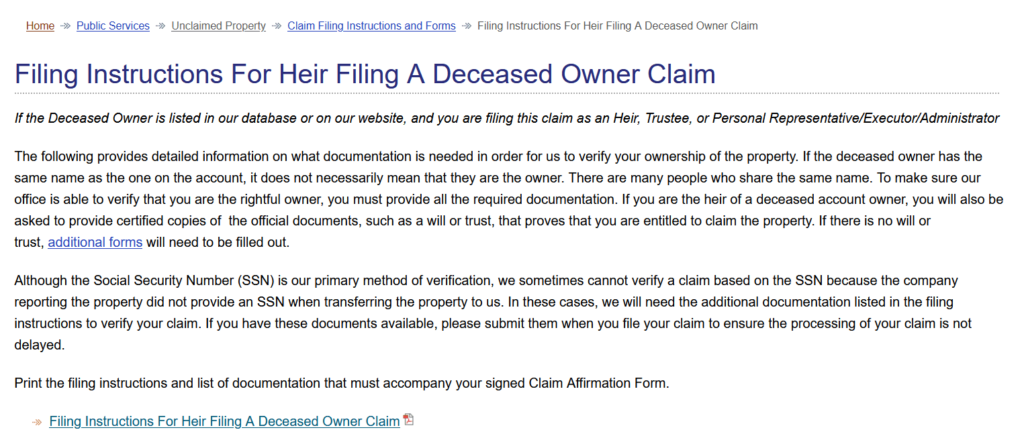

If you come across money listed in the California database under the name of a deceased parent, you have the opportunity to file a claim on their behalf, provided you are a legal heir or had power of attorney for them. Here’s a summary of the necessary steps:

As long as you diligently complete these required steps, the Controller’s Office will facilitate your claim for the property associated with the deceased individual.

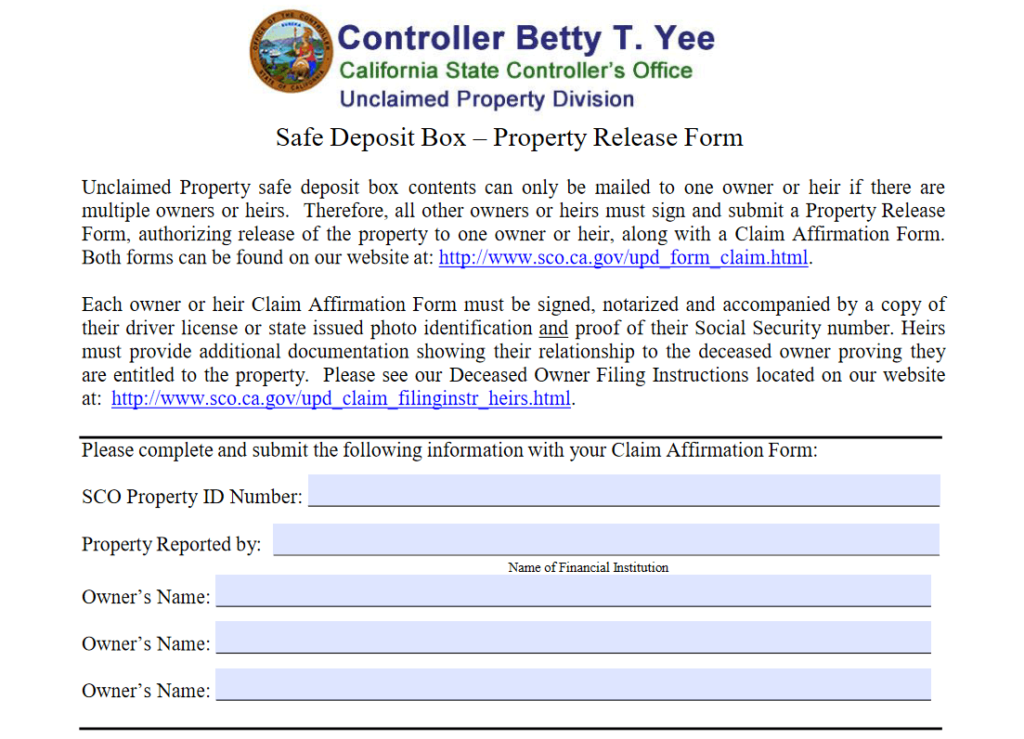

If you maintain a safe deposit box but haven’t accessed it for three or more years, the bank is obligated to inform the Controller’s Office. They will contact you, providing an 18-month window to claim your property before it is auctioned. Proceeds from the auction are used to settle any past due balances with the bank, with the remaining balance placed in a separate account. You can file a claim to recover this balance.

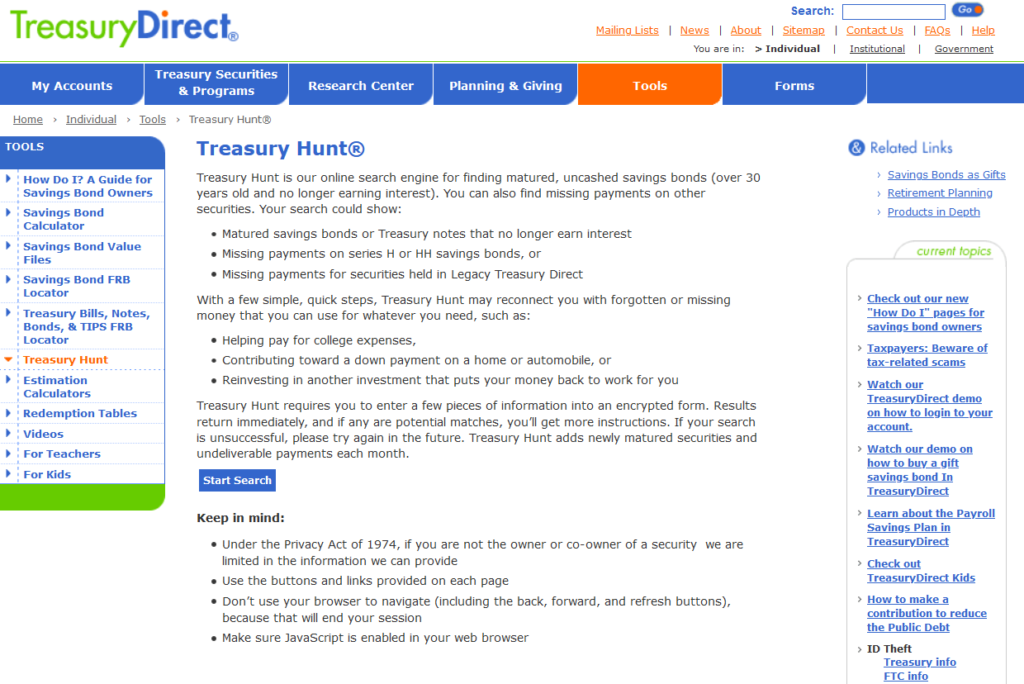

If you have lived outside California at any point in your life, there is a possibility that other states may hold unclaimed money for you. Our guides covering various states and online resources can assist you in finding unclaimed property and lost funds. For instance, the U.S. Federal Investments website, maintained by the Treasury Department, is particularly helpful in locating bonds purchased for you by loved ones.

The Federal Deposit Insurance Corporation (FDIC) and the National Credit Union Administration (NCUA) can also provide information regarding funds held by banks and financial institutions. The Internal Revenue Service (IRS) can assist with tax-related refunds. Other online resources include the Department of Veterans Affairs, Department of Housing and Urban Development (HUD), Missing Money, Pension Benefit Guaranty Corporation, and U.S. Railroad Retirement Board.

The Unclaimed Property Laws and Regulations, accessible as a PDF guide on the Controller’s Office website, offer valuable insights. This comprehensive resource covers the responsibilities of insurers, holders, and claimants. It also provides guidance on the claims process, including scenarios involving children and deceased individuals.

Electronic filing of claims is exclusively available for properties labeled with a “P.” If you encounter properties marked with “N,” it signifies that the holder retains possession. In such cases, you should contact the holder directly to initiate your claim. While the Controller’s Office lists these properties in the database and provides contact details, it does not reveal their value.

Properties with an “I” designation are in the process of transferring from the holder to the state. Although these properties are listed in the database, claim filing is only possible once the Controller completes the transfer process, which may take several weeks to months.

California law obligates holders to maintain accurate records of account activity. If an account remains inactive for three years, the holder must report it to the state and commence the process of relinquishing the property to the Controller’s Office. The holder must also make diligent efforts to notify the property owner via mail to the address on the account. In cases where individuals pass away without informing their heirs about the property, the state may assume responsibility.

Both holders and the Controller’s Office make concerted efforts to contact property owners through letters and notices. While the Controller’s Office collaborates with the Tax Board to locate current addresses, individuals who have moved out of California may not receive letters. The state is not responsible for tracing heirs of those who inherit property through relatives.

If you’re listed as a joint owner on a property in California, you may wonder whether you can file a claim for it. The possibility of doing so hinges on how the property was divided. In cases where the other owner has passed away, you typically need to provide proof of their death. Some individuals file claims following a divorce, requiring court documents to establish their sole ownership of the property. It’s important to note that California generally does not allow you to claim full ownership of the property in such cases. Alternatively, you have the option of asking the other owner to submit a claim form simultaneously with yours. The Controller’s Office will then release the property to both of you.

A common issue arises when the name on the property differs from your current name. This situation can occur due to marriage, resulting in a change to your spouse’s last name, or after a divorce when you no longer use your ex-spouse’s last name. To address this, California requests that you file a claim with your current information while providing official records documenting your name change. Suitable documents might include a copy of your divorce decree or your marriage certificate.

Under California law, the Controller’s Office has a maximum of 180 days to disburse funds to individuals who file a claim. In most cases, you can expect to receive your money within 60 days or less. However, if your claim involves multiple heirs, it may take the full six months before the state releases your funds. You can estimate the processing time by using the claim status checker, with most claims appearing on the site within 30 days of submission.

When filing a claim online, you have the convenience of submitting it electronically, which can save you time. The system will automatically include your information in the claim, along with the property ID, and forward it to the Controller’s Office. If you prefer not to file electronically, you can request a paper claim form. Once the state receives your request, they will send the claim form to the address you provided. Regardless of your filing method, you will receive a paper check.

An investigation by the LA Times revealed that California holds over $11.9 billion in unclaimed property. This encompasses proceeds from auctions, interest on stocks, uncashed checks of various types, and insurance payments.

To avoid the Controller’s Office taking custody of your property, ensure that you use all accounts in your name at least once annually. Respond promptly to any letters or notices you receive from the office, as these notices often help you claim the property before it’s transferred. Additionally, cash all your checks as quickly as possible and review your financial records at least once a year.

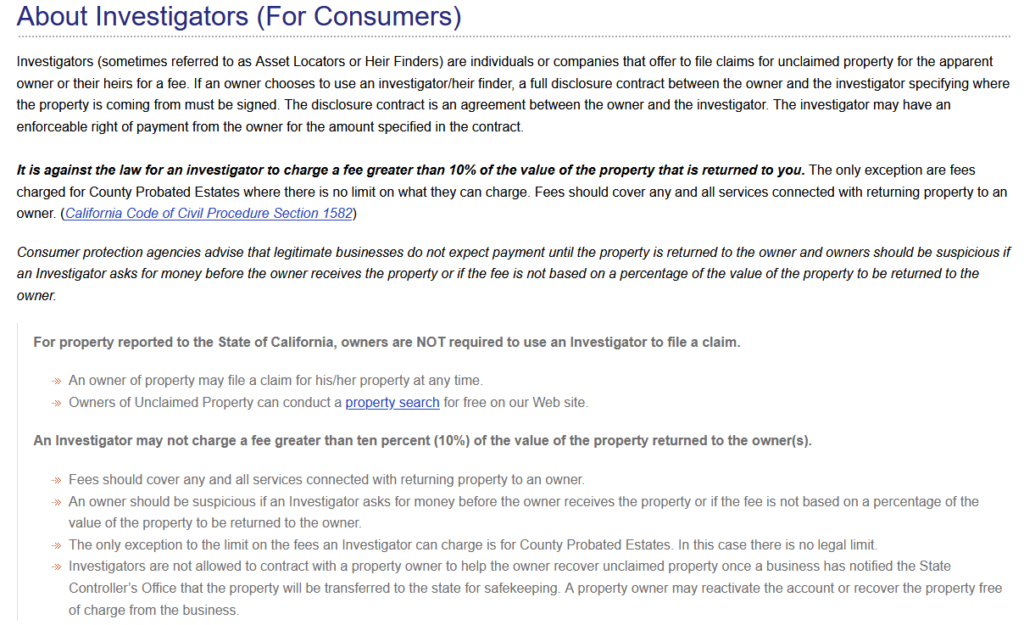

Heir finders specialize in scouring death records to locate the heirs of deceased individuals. They seek out money owed to these heirs and offer to file claims on their behalf. In California, heir finders are not permitted to work directly with heirs and file claims for them. Their role is limited to notifying heirs of discovered accounts before the funds are turned over to the state. Once the Controller’s Office becomes the custodian, it exclusively interacts with the heirs, not professional finders.

Having a little extra money each month can make a significant difference in your financial well-being. It can help you cover bills and provide some discretionary spending during challenging times. The California State Controller’s Office simplifies the process of finding unclaimed money and expedites its retrieval. Our guide offers valuable insights into filing claims for unclaimed property in The Golden State and locating missing funds online.

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.

Copyright © 2024 · OurPublicRecords.org · All Rights Reserved