Unclaimed Money Lookup - Washington

Free Washington Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

(advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Washington Unclaimed Money -

The Ultimate Guide 2025

- UPDATED February 2025

See what Washington does with unclaimed funds and assets in our guide along with how to claim all of your property.

Contents

- Your Ultimate Guide to Unclaimed Property in Washington

- What is Unclaimed Money?

- How Much Unclaimed Money is in Washington?

- How to Find Unclaimed Property in Washington

- Claimant Relationships and What They Mean

- How to Claim and Get Your Washington Property

- What Information Do You Need to File Claims in Washington?

- Is the Washington Database the Only Place to Look for Unclaimed Money?

- Unclaimed Property Laws in Washington

Your Ultimate Guide to Unclaimed Property in Washington

The Department of Revenue in Washington State is responsible for helping property owners find their missing funds and reuniting them. Though you might see ads on television or in the local paper, you may not realize that this department opened in 1955 and helped locals get back more than $1 billion in funds over the years. Finding your property is easy because the Evergreen State has an online database that you can use from anywhere in the world.

Did you live in Washington for college or when you had your first job? Maybe you lived there with family and later moved for a different job. Whether you still live in Seattle or Tacoma or moved away from Washington, the state may still have money in your name. Once you find a piece of unclaimed property, you can fill out a short form to show that you’re the owner and wait for the funds to reach you in the form of a check. In our ultimate guide to unclaimed money in Washington, we’ll look at what the Evergreen State does with some property types and answer the most common questions that we get.

What is Unclaimed Money?

The Washington Department of Revenue lists unclaimed property as any type of intangible property that the original owner abandoned. This doesn’t mean that you walk away from your property though. Property can become abandoned when the owner does not take steps to claim it within a specific period of time. This can range from a single year if your employer has a paycheck that you never cashed to more than a decade for other types of checks. Washington refers to the organization that oversees the funds as the holder.

A good example is a bank account. Let’s say that you open a checking account and agree to round up the money that you spend. The bank takes the extra money and places it in your savings account.

If you close your checking account, the bank will still have a savings account in your name. You may also find that a parent or another family member added your name to a bank account. When that individual passes away, the bank may not know how to find you and inform you of the money.

Another example is a refund check. Commonly associated with utility companies, refund checks come from those companies when you close your accounts. Most checks are worth around the same amount that you would spend on a utility in a single month. You may receive refunds from clubs and other organizations such as a gym, too. If you pay for a year of service and then cancel your plan, the company needs to pay back the amount due to you. Companies that cannot find you are apt to contact the Department of Revenue.

You may want to check the Washington database for insurance checks, too. Were you ever involved in an auto accident that led to an insurance payment? If you didn’t get the total amount that the insurer promised, you may have another check waiting for you. Insurance payments can also include checks awarded to a beneficiary when the policy owner passes away. While you might find a small policy from the deceased’s bank for a few hundred dollars, you may also have thousands of dollars listed in your name as an insurance beneficiary.

Washington also holds certain types of tangible property such as stocks and bonds. In many cases, the Department of Revenue will leave your stocks and bonds open for a portion of time, which allows you to claim the dividends that they earned. If you find the property in time, you may have the chance to get your stocks and bonds back. With safe deposit boxes, the state holds auctions to sell the contents left behind in abandoned boxes. Our ultimate guide to unclaimed money in Washington will look at those auctions later and how you can avoid them.

How Much Unclaimed Money is in Washington?

The Evergreen State holds more than $300 million in unclaimed assets that belong to others, which does not include the more than $1 billion that others claimed. Roughly one out of every seven people who live in Washington have some type of unclaimed property listed in the database. It’s worth looking outside of Washington, too. All states along with government agencies hold more than $40 billion in lost and abandoned funds.

How to Find Unclaimed Property in Washington

The Evergreen State helps you find unclaimed property through the Department of Revenue. You can use the official website to find all of your lost funds.

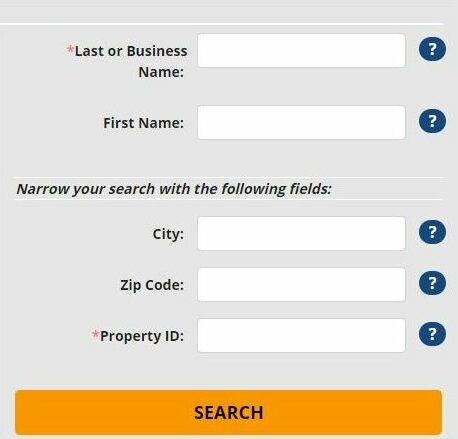

Step 1: Visit the Search for Unclaimed Property page on the Washington Department of Revenue website. Our link takes you right to the search page.

Step 2: Use the search box to enter some basic information. You need to use your last name but have the option of adding your first name. Washington also allows you to search the database for a business that had assets along with searches by property number or zip code.

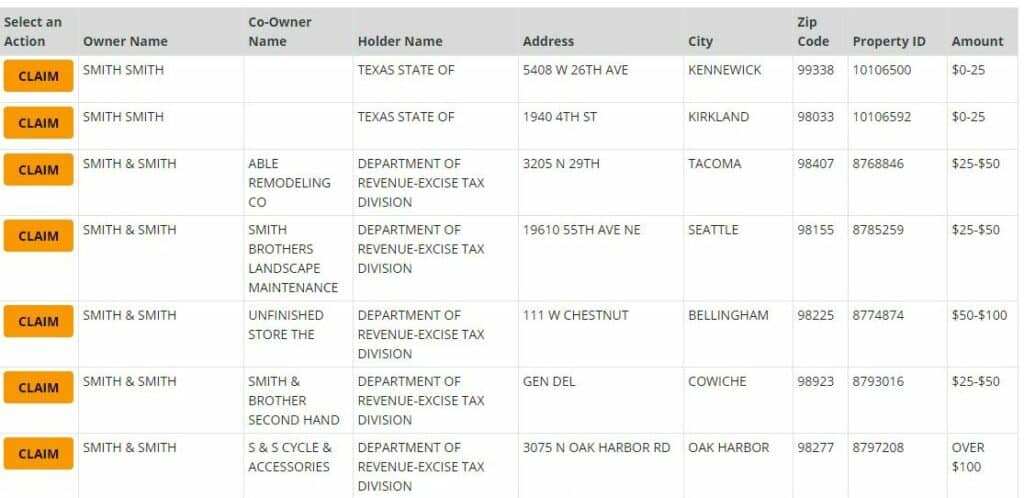

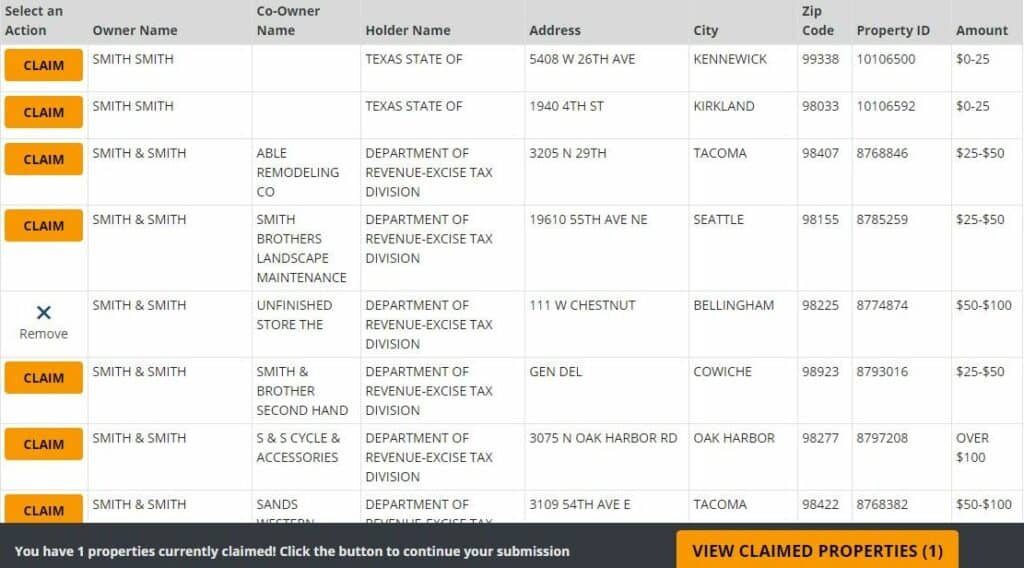

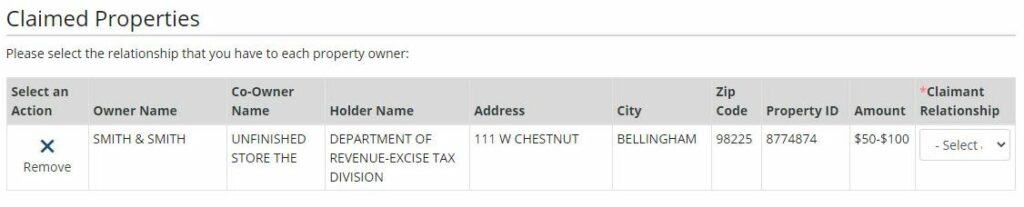

Step 3: Look for your property in the search results. You should start with the “Owner Name” column, which will list any names associated with the fund or asset. Washington also lists the owner’s last known address and the holder that reported the funds. If you look under the “Amount” column, you’ll see whether the asset is worth up to $50 or more than $100.

Step 4: To claim property and get the asset, you want to click on the yellow “Claim” button. If you want to claim more than one asset, click the “Claim” button next to each one. You then need to click the button at the bottom of the page to verify that you’re the owner.

Step 5: Make sure that you can claim the unclaimed asset through the box shown on the next page. This asks if you have a claim that matches the information shown and requires that you select a claimant relationship.

Claimant Relationships and What They Mean

To claim any property listed in the Washington database, you need to state your claimant relationship. One option that you can select is “owner,” which means that you are the owner listed on the asset. If you need to claim a business asset and the business is still open, you can select the open business option to show that you are a legal representative of the organization. The closed business option is available if you have the legal right to the assets owned by a closed business.

Washington also has several options designed for the heirs of deceased individuals. You can select the open probate option if you opened a case in probate court for the deceased’s estate. The heir option is available for those who are either a beneficiary or the next of kin in a case that will either not go through probate or already did and was closed. You’ll also find options that allow you to claim funds as the legal representative of another person or if you are a trustee.

How to Claim and Get Your Washington Property

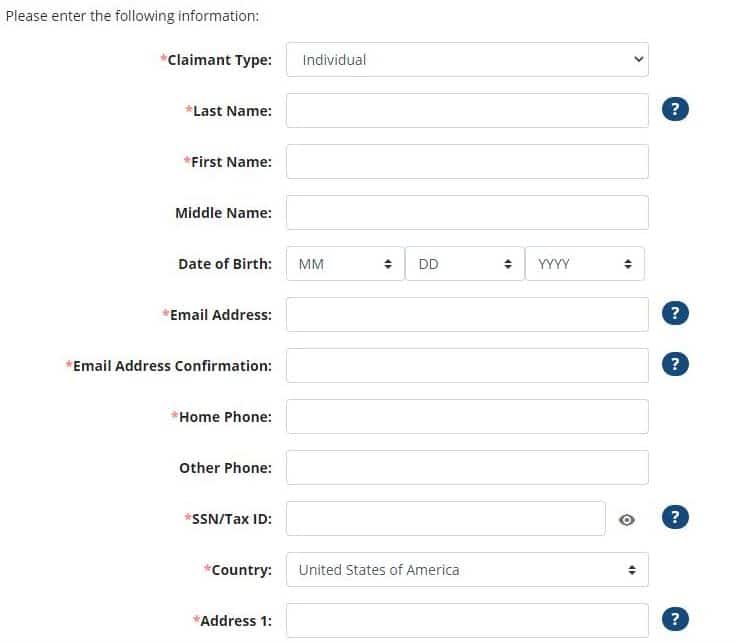

Claiming and getting your Washington property is easier than you might think. Once you select your claimant relationship via the drop-down menu, you just need to complete a few more steps.

Step 1: Enter your personal and contact information in the boxes on the Washington site. The site asks for your first and last names, email address, social security number, home phone number and home address.

Step 2: Preview your Washington claim to make sure that you filled out each section correctly. You will also need to type your first and last names, which will serve as your signature. As soon as you click on the orange “Submit” button, the claim will go to the Department of Revenue. It will process your claim and contact you for more information or release your check.

What Information Do You Need to File Claims in Washington?

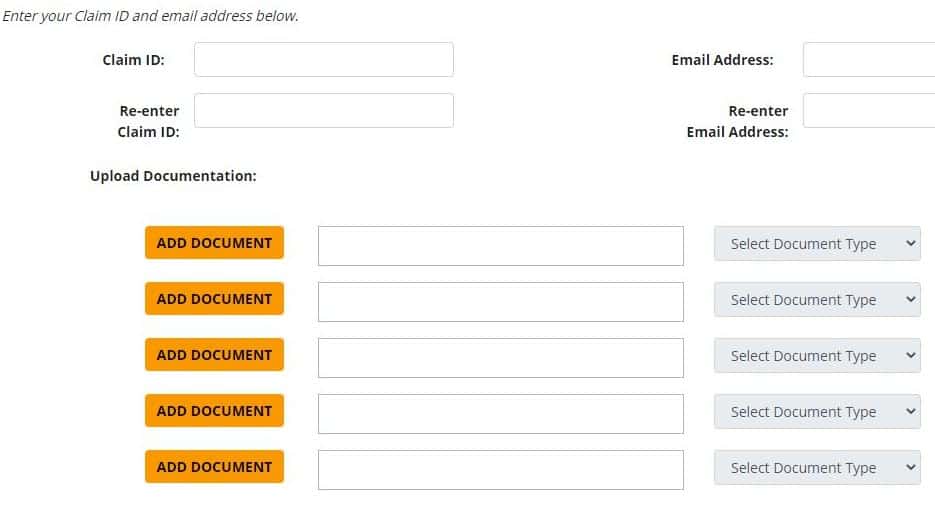

Washington often requires different information based on how you file your claim. Make sure that you check your email for the official form that the Department of Revenue sends, which will state everything that you need. You usually need to provide copies of both your social security number and driver’s license. Washington accepts other types of photo IDs and any evidence that shows your SSN. It takes just a few minutes to upload your required information.

Step 1: Visit the Washington upload claim page. Type your claim ID number and your email address in the two boxes on this page. If you cannot locate your claim number, you can contact the Department of Revenue for help.

Step 2: Click on the orange “Add Document” box and search your computer for the right documents. You can add up to five documents or files per claim.

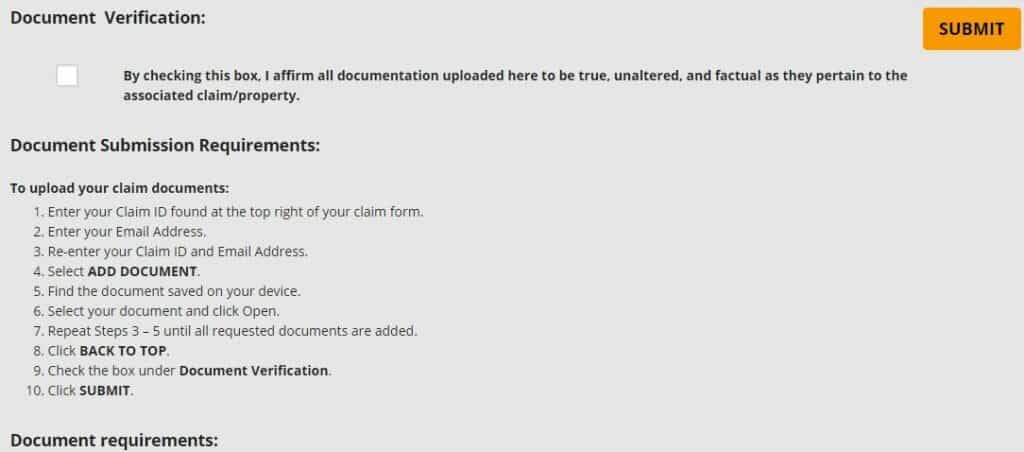

Step 3: Check the box at the top of the page to show that you agree that you have a legal claim to the property and that you shared the correct information. You can then click the orange “Submit” button to send the information to the Department of Revenue.

Is the Washington Database the Only Place to Look for Unclaimed Money?

Don’t assume that the Washington unclaimed money website is the only place to find abandoned property. There are many websites that specialize in different types of assets or funds. One example is the Department of Veterans Affairs, which many know for the help they offer to veterans. You can contact the VA if you think that you have benefits as the child of a veteran. The VA can help you find life insurance policies purchased by your loved ones, too.

Another example is U.S. Federal Investments, which is a federal government website operated by the Treasury Department. You can get help claiming treasury bonds that others got for you. The Department of Housing and Urban Development (HUD) can also help if you want to find out if HUD has a refund check associated with your mortgage. Other helpful sites to check include:

- Federal Deposit Insurance Corporation: Work with the FDIC if you lost money held in an account at a closed bank. You can find out if another bank has your money or if it’s held by a state database.

- Missing Money: Missing Money lets you find unclaimed property in Washington without using the state database. While you’re there, you have the chance to look for abandoned property in any of the listed states.

- Pension Benefit Guaranty Corporation: Check with this site if any elderly loves ones or loved ones who passed away opened pension accounts. You can even find out who has the right to claim any money left in the accounts.

- Internal Revenue Service (IRS): The IRS can help you file a claim to get back a refund check that you lost after filing your taxes or if you never got one. You may want to check out some of the scams that the site goes into as well.

- U.S. Railroad Retirement Board: Anyone who had a retirement account through the railroad can find their accounts through this site. As an heir or beneficiary, you also have the right to search for those funds and claim them.

- National Credit Union Administration: We also recommend that you check with this website if you lost money that a credit union held. It can help you see where the money went and if you still have a right to it.

Unclaimed Property Laws in Washington

If you have questions about Washington’s unclaimed property laws, you can find those laws online. All laws are part of Chapter 63.29 and cover both the owners of unclaimed property and the holders of those assets.

Washington Unclaimed Money FAQs

Does Washington Let You Track Filed Claims?

Yes. Not only does Washington let you track a filed claim, but it helps you easily see the status of your money. You need to visit the online status checker and enter the claim ID number. Once the system searches and finds the claim with that number, it will give you a progress report. If everything looks good, the site will tell you that it’s in the process stage and that you’re on your way to getting your money. The site may show you a message that lets you know you need to provide a better image of your photo ID or other information.

What Does Washington Do with Unclaimed Safe Deposit Boxes?

Safe deposit boxes are different from the intangible property that the state holds. Washington will only accept the contents of an abandoned box if the owner stopped making rent payments and the holder gives them five years to catch up on their payments. Most contents go to the state for storage in a vault. Washington will not accept papers or other items that have little to no value. It holds auctions to sell the items and then sets aside money for the box owners. As of April 2021, the last auction held in Washington was in November of 2020. That sale raised more than $730,000 for the listed owners.

Can You Claim Assets if Your Information Changed?

Depending on when you lost an asset, you may find that one or more pieces of your personal information changed since then. Washington allows you to file claims if you changed your name as long as you have proof of your original name. You might want to use a divorce decree issued by a court or a copy of your marriage license. If you no longer live at the same address, you should look for old bills or records that show you lived at the one attached to the asset. Washington will accept old utility bills and bank statements as well as tax returns.

How Long Does it Take to Get Your Funds?

It usually takes 60 to 90 days for Washington to process your claim. Representatives will compare your information to that listed on the asset and determine if you are the owner. They may need to contact you for additional proof, which can extend the process. Once Washington determines that you deserve the money, it will send a message to the email address that you used. It can then take up to three weeks before a check reaches you.

Where Can You File Claim Forms?

Depending on the type of asset that you want to claim, you may need to use some of the other documents that Washington offers. One is an appeal request, which you can use if the Department of Revenue denied your claim. It allows you to submit more information to show why you deserve the money. Another form is available if you need to claim money that someone else claimed such as a joint account that your former spouse received. You should get an email from the state if you need to use any of these forms.

Can You Claim Abandoned Gift Cards?

Washington law prevents companies from issuing gift cards or certificates that expire. You may find an old one that has an expiration date from before this law took effect, but all certificates and cards must follow the new law. The only exception is if you received the card as part of a loyalty program. If you have a certificate from a closed business, you can take photos of the front and back. Washington asks that you send those photos in an email along with the name of the store and your name. As long as the card is in the system, you can claim its full face value.

Can You Keep Washington from Listing Your Property?

There are several things that you can do to keep your property secure and out of the Washington database. Holders usually wait three full years before they contact the state. As long as you make some attempt to show that you own the property, it should not go into the system. Not only do you need to access or use the asset, but you also need to make sure that the holder has accurate contact information for you, including your home address and phone number. It’s also helpful to use one email address for all of your online accounts. When you check your inbox once a month, you can keep an eye on any potential problems.

Should You Use a Washington Heir Finder?

Washington heir finders are asset locators. The term can refer to both individuals who work on their own and organizations that have multiple employees looking for unclaimed property. An asset locator can search the Washington database and file a claim on your behalf. They can also file claims for the heirs of deceased property owners. Washington requires that locators charge no fees until they find and turn over a property to the rightful owner. Even then, they cannot charge more than 5% of the property’s total value. You do not need to work with an heir finder just because you got a letter or phone call from one. Washington makes it easy to file claims online on your own.

Conclusion

You don’t need to spend hours trying to find your unclaimed assets and even more time filling out forms to get your money back. Washington lets you file your initial claim online and upload any required information or documents through the system with the claim ID listed on your form. You can find everything from uncashed money orders and paychecks to utility refunds and stocks. Use our tips to easily search for unclaimed money in Washington.

Quickly Search For Unclaimed Money

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.