Copyright © 2024 · OurPublicRecords.org · All Rights Reserved

Free Nevada Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Find out if any of the millions of dollars held in the Silver State belongs to you in our Nevada guide to unclaimed money.

Nevada is more than just Las Vegas and other big cities. Millions of people come to the Silver State every year for vacation, but many more people live there year-round. You might hear the term unclaimed money and think that it’s a scam because you can’t imagine a situation where you would lose money. That money can range from utility deposits and refunds to wages and insurance funds. The assets that the state holds include both small checks of a few dollars to accounts that are worth $1,00-2,500 or more.

As a way to help the owners find their assets, the Nevada Office of State Treasurer created an online database that you can search in seconds. The treasurer office updates the database as information changes to remove claims that people filed and add more claims as they arrive. You will usually see the social security number and name of the owner listed on each asset, which makes it easy to see if it belongs to you. In our updated guide to unclaimed money in Nevada in 2021, we’ll show you how to use the state database along with other information that you need to know.

The Silver State uses both the terms of abandoned property and unclaimed property to describe the same things. Assets are a type of property that either a business or individual owns. The holder who maintains or oversees the property needs to stay in contact with the owner. If they cannot contact or locate the owner within three years of their last contact, the state views the property as abandoned. The Nevada State Treasurer’s Office will then hold the property under the name and last known address of the owner.

Oil and gas royalties are examples of the unclaimed property found in Nevada. This is especially common in rural and desert areas of the state. The original claimant of the property works out an agreement with the gas or oil company. While the company gets the right to use the natural resources on the property, they must pay the owner a fee. As long as the property exists, the company will continue paying royalties. Nevada allows you to claim royalties that you never received and those that belong to your family.

Nevada is one of the few states to list court deposits in an online database. Courts may require that those involved in a case or trial pay a deposit until the end of the proceedings. You may come across this when opening probate for a deceased’s estate.

The court holds the money to make sure that you follow the instructions given to the executor and that the individual does not steal from the estate. At the end of the probate, the executor gets their money back. Courts require a deposit in cases that involve finding who is liable for an accident, too.

You can also look for unpaid checks in the Nevada database, which refers to a check written to a person that the person did not cash. You might have one from an insurance premium after you canceled your policy or if someone named you a beneficiary to a policy they bought. The owner does not need to tell you that you are a beneficiary before adding you to the policy. That money can come in handy if you’re trying to keep your family home or need to cover funeral costs. Employers often list unpaid checks with the state, too.

Some people think of abandoned property in terms of the empty houses that they see, but Nevada does not consider real estate as a type of unclaimed property. You also cannot file claims for a piece of land or a car/vehicle that you found. The only forms of tangible property that you might find are stocks and bonds. In most cases, the treasurer sells the bonds and provides the owner with the money raised. The same thing happens when an owner abandons a safe deposit box.

The Nevada Treasurer’s Office is the best place to find unclaimed money in the Silver State. You can often claim your money in just a few steps and qualify for Fast Track status.

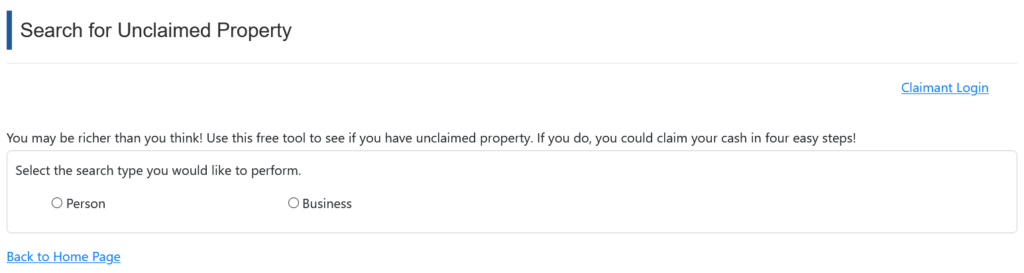

Step 1: Visit the official website of the Nevada Treasurer’s Office. Click the small box next to either “Name” or “Business” to show how you want to search.

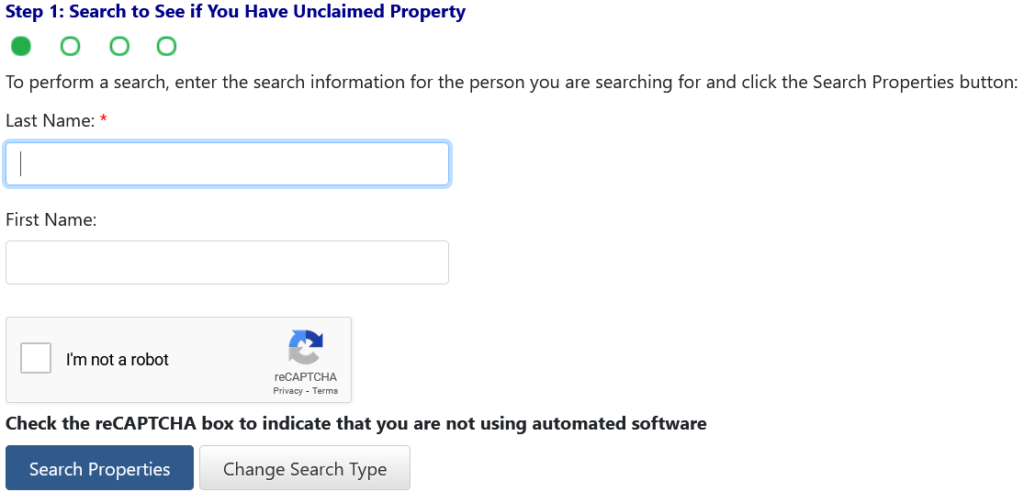

Step 2: Add your last name to the labeled box and your first name if you want to use it. The site also asks that you click a captcha box before you can continue.

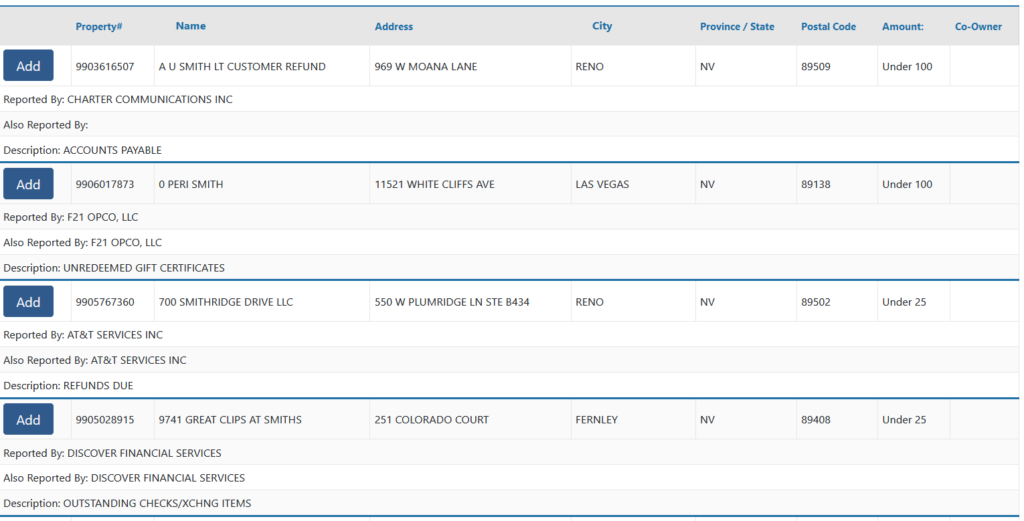

Step 3: Go over the results to see if there are any assets that you can claim. Nevada will show up to 1,000 results per search. If you have a common last name, you may want to add a city or your first name to view fewer results. As long as you lived at the address listed and have the same name, you can file a claim. The Nevada database also shows the name of the holder and their address as well as a description of the property and its value.

Step 4: Find and click on the blue “Add” button when you find a claim. This will bring up another button that lets you claim the property and file for it.

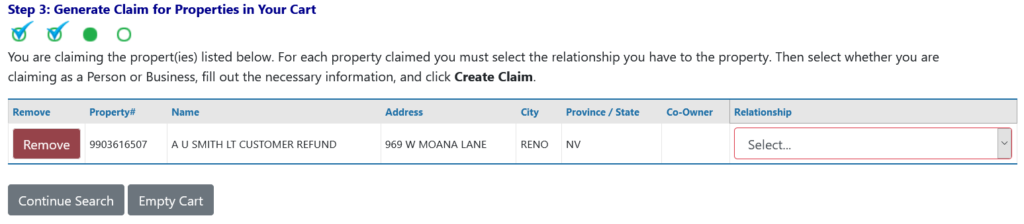

Step 5: Generate a claim for your property on the next page. Nevada asks that you pick from several options based on your relationship with the claim and that you verify the information is correct. You can then choose whether you want to sign in to an existing account or register a new account. The system also lets you file as a guest.

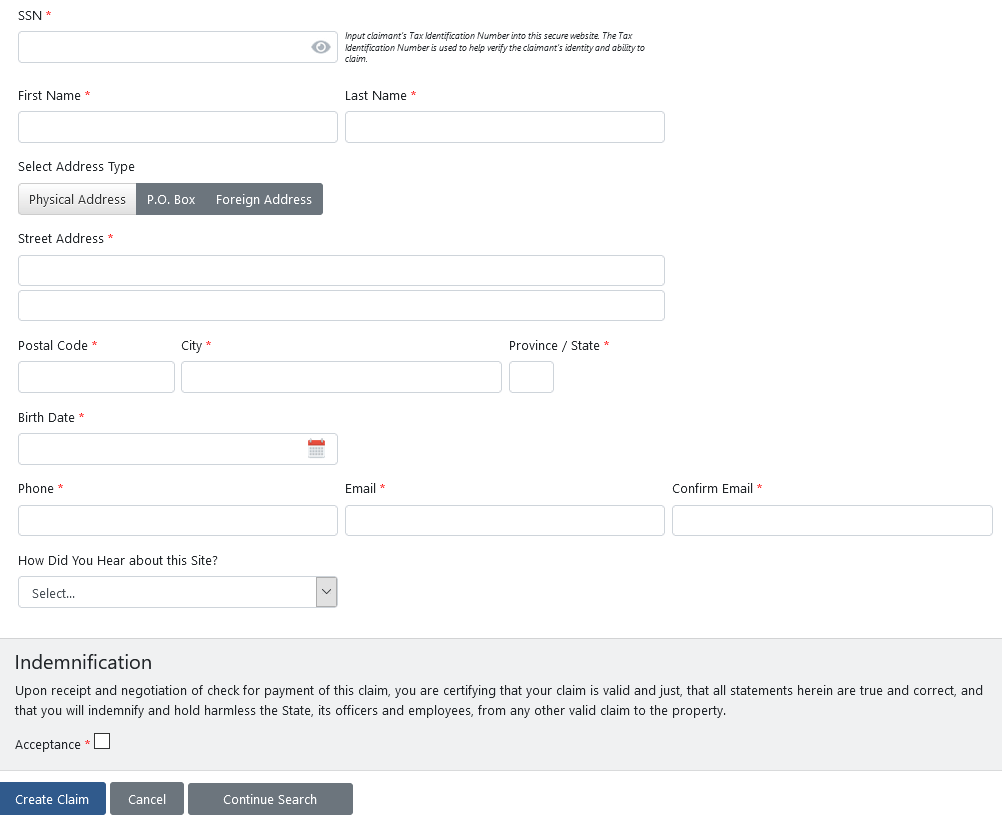

Step 6: Enter all the information that the system requires. You’ll see a small asterisk next to those boxes, which includes your social security number, home address, phone number and email address.

Step 7: Scroll to the bottom of the page and click on the box to show that you verify your shared information is true. This also gives the Nevada Treasurer’s Office the right to process your claim.

There are a few situations in which Nevada accepts claims from people not listed as the original owner. The most common is if you are the executor of a deceased’s estate. To file in this way, the court must have documents that show you opened a probate case and that you are the executor. If the estate does not require probate, you can file as a living heir. The guardian and custodian option is suitable for those named the legal representative of another person. Nevada also offers options for holders seeking refunds and the representative of a business. If none of these descriptions match your situation, you can choose “Other,” which may require that you submit more information.

To file a basic claim for property that you own, you need a copy of your government ID or driver’s license and proof of your social security number. Nevada asks that you copy them onto a standard piece of paper and submit the paper with your claim form. If the property has a value of $500 or more, you need to sign your claim in front of a notary and have them stamp it. The state lists all the unclaimed property forms that you might need online along with instructions on how to file.

You should check other databases because they can help you find money that the Nevada Treasurer’s Office doesn’t control. One example is the Pension Benefit Guaranty Corporation that helps individuals and their families find pension accounts that they thought went missing. You may even find pensions that started before you were born. The U.S. Railroad Retirement Board is helpful if you believe that a loved one still has a retirement account from when they worked for the railroad.

Many government agencies and departments are helpful such as the Internal Revenue Service (IRS). Though the IRS gets a bad rap, it offers tons of help for American taxpayers as well as those who now live outside the country. You can keep up with stimulus news and view your old tax records as well as see where an old refund went and claim it. U.S. Federal Investments is another popular resource that helps you locate and claim any treasury bond as long as you are the owner.

Other sites that we encourage you to check out on your hunt for missing money include:

NCA Code 120A covers all of the unclaimed property laws in Nevada, but you may want to check NRS 120A Codes, too. Both of these codes are available online to save you some time. One of the nice things about this website is that it lets you click on anything you find confusing in the code to learn more and quickly return to your original spot.

Nevada helps owners get back nearly $40 million in most years. The current value of the assets that it has as of March 2021 comes to more than $80 million. Some of the assets that you might find during your search are worth $5,000-10,000 or more and have different steps that you need to take when filing your claim. We recommend that you use the resources above, even if you spent your whole life in the Silver State. The federal government and different departments may have money for you or your family.

To file a claim for a deceased owner, you need to sign a claim form in front of a notary. You also need proof of your identity and social security number along with the individual’s death certificate and social security number. If the number appears on the death certificate, you do not need anything else. Nevada also requires proof of the deceased’s last known address such as a utility bill or driver’s license and proof of your relationship. If the estate has a total value of $25,000 or more, you must go through probate before you can file a claim. Once probate closes, you can present a copy of the deceased’s will or probate documents to show that you have a legal claim to the property. As an heir filing without going through probate, Nevada requires both a small estate affidavit that shows the estate was worth less than $25,000 and an heirship affidavit.

Both parents and legal guardians have the right to file claims through the Nevada system for property that belongs to children who are below legal age. You may need to file to get a life insurance policy that a deceased parent took out or to oversee a trust granted to the child. Nevada requires both proof of the child’s social security number and evidence that the child lived at the address shown on the claim. You also need copies of both the child’s birth certificate and the parent’s death certificate. If one or both parents are still alive, you need court documents that show you have custody of the child and the legal right to claim property for them.

Nevada law requires that holders keep track of their last contact with a property owner. If the owner does not contact the holder within three years, the holder then has the right to notify the treasurer. Before this can happen though, the holder must first send an official notice to the address that they have and let them know that the treasurer will take their property. They need to wait for a response before they can take steps to transfer the property to the state. Nevada will also send notices to the owners’ last known addresses once a year as well as put the property in the online database.

The Fast Track program is a program created by the Nevada Treasurer’s Office to make filing a claim faster. You only qualify for this option if the property has a value of no more than $5,000. Nevada will usually let you claim the property online and submit all of your documents through the system. To find out if you qualify, simply find an asset and start the claim process. If Nevada determines that you can use this program, it will tell you once you file the claim form. This reduces the time that it takes to get your cash.

Nevada knows that you want to get your old property as quickly as possible but cannot guarantee that your money will arrive in a few weeks or even a few months. The best way to keep an eye on your claim and speed up the process is with the Nevada status checker that you can use online. You need to enter both the zip code associated with the address you listed on the claim and your claim number. The site then shows you the updated status of your claim, including whether the state sent a notice because it needs more information or the treasurer will release a check soon.

There are several benefits to creating an account with the unclaimed property website in Nevada. The biggest is that it lets you automatically check on your claims without using the status checker. Once you log in, the site will let you click on a button to load all of your claims and show you where each one is in the process. You also have the option of entering your contact information once and letting the site automatically add it to any claims that you file in the future.

Nevada gives you the right to claim property in person and pick up any physical property that you own. You can only pick up items such as those left in a safe deposit box if you already completed the process and the Nevada Treasurer’s Office verifies your claim. The state will accept notarized and other documents through the mail.

Also known as an heir finder, a fee finder is someone who locates abandoned property and files for the owner. Nevada has several laws that state what finders cannot do, which the state created to protect its citizens. One of the key laws is that the finder and owner must sign a contract that gives the finder the right to act on the owner’s behalf. The state will void any contract created within 24 months of the owner leaving the property and the state getting it. Nevada also prohibits finders from taking more than 10% of the property value as their fee. For claims involving royalties, the finders cannot sign contracts that allow them to get a portion of the proceeds of the deal.

You don’t need to have millions of dollars in assets to take a few steps to protect them. You can easily contact the holders of your accounts when you get married or divorced and change your name as well as when you change email addresses or phone numbers. We recommend writing down account numbers and passwords on a list that you keep in a safe place and show your family. If you have a safe deposit box, set a reminder to pay your rental fee every month or year and take a few minutes to check out the box.

The biggest reason why people don’t look for abandoned property in Nevada is that they think that they won’t find anything or that the state makes the process too difficult. While you need to complete more steps to file as an heir or a guardian, most claims take only minutes to file through the system. You then get a claim form that you submit, which helps you get your money within a few months or less. Once you read through our guide to unclaimed property in Nevada, check our other guides to see how you can find missing money in other states.

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.

Copyright © 2024 · OurPublicRecords.org · All Rights Reserved