Copyright © 2024 · OurPublicRecords.org · All Rights Reserved

Free Mississippi Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Our guide to unclaimed money in Mississippi shows you how to find missing property and claim it through the state’s system.

Known as the Magnolia State for the beautiful flowers that grow there, Mississippi also uses the nickname of the Hospitality State due to the friendly faces there. The State Treasury of Mississippi is responsible for reuniting owners with their abandoned and unclaimed property. Though you won’t find houses and land or boats and cars in the state’s database, it does include other types of property that list you or a loved one as the rightful owner.

Finding unclaimed property in Mississippi is easy because the Magnolia State lets you search online for your property. You’ll also find that all the documents you might need are available in PDF formats that you can easily print. We will go over those documents and when you might need them in our ultimate guide to unclaimed money in Mississippi. Before you get to that section though, find out more about the property that you might find and how to complete the claim process.

The Mississippi Treasury’s Unclaimed Property Division states that unclaimed property is any asset that an organization oversees or holds for a person. All institutions in the state must hold onto the property for five years as they attempt to reach the original owner. Property often becomes lost and abandoned or unclaimed when the owner passes away or moves without updating their contact information. Once the treasury receives the asset, the division will hold it for the owner or heir and try to find who can claim it.

One type of unclaimed property that you may not expect to find is an asset held by a retail store. Many stores offer layaway programs that allow you to put down a deposit when buying a product. The store will then hold the item as you make payments on it. Once you make your last payment, you can take home the item. Stores can charge a restocking fee if you do not return but must return the rest of the money you paid to you.

The Mississippi system may include refund checks for products that you returned through online stores, too.

Credit unions and banks also list abandoned assets in the system. Many people in Mississippi evacuated their homes because of Hurricane Katrina, but not all of them returned after seeing the damage that the storm caused. Thanks to the internet, you can now access your bank account without visiting a local branch. If you had an account with a regional branch and moved after losing your home, you might find that you forgot about some of the money that you had in that account. All banks and credit unions must inform the state about abandoned accounts after five years.

Hurricane damage might also result in an insurance company having a check for you. This check might cover the total cost of repairing all the damage done to your home or vehicle. Even if you already received a check for storm damage, you may find one or more checks from your insurer in the system. Insurance checks also go to the heirs of people who listed them on their life insurance policies. In many cases, the families do not know that they have money coming to them after someone dies because they don’t find the policy. As long as the insurer has your name, they are responsible for getting the proceeds of the policy to you.

Don’t forget about the refunds that utility companies owe you, too. Even if you have perfect credit, a company may charge a deposit just to give you power or gas at your home. You often get the money back in the form of a credit on your account after making your payments on time for six months to a year. Some companies will send checks for the total deposit amount rather than giving you a credit. With the Mississippi system, you can find out about the deposits given to you and claim all the money.

According to the Office of the State Treasurer, Mississippi has around $31 million in unclaimed property. You may find a different amount listed when you search, which shows you that the treasurer added and removed funds as holders and owners filed claims. Mississippi returned nearly $200 million in assets since starting an unclaimed property website. Between this site and others, you’ll find more than $40 billion listed online.

The Mississippi Office of the State Treasurer gives you the chance to search online for abandoned property in the state. You can also find and save any of the documents that your claim needs.

Step 1: Visit the search page of the State Treasury of Mississippi.

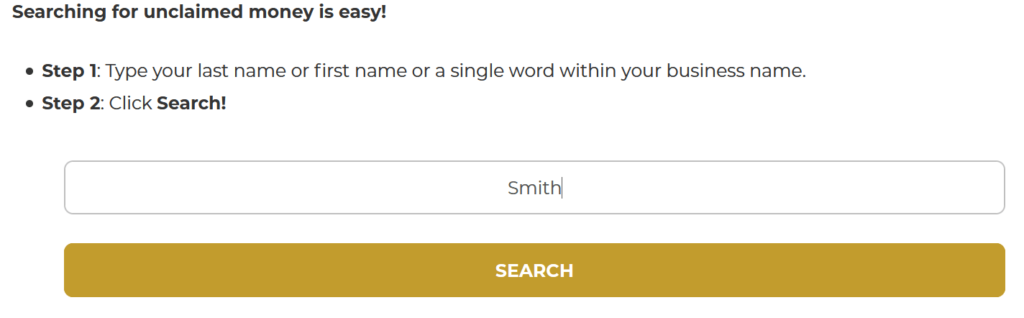

Step 2: Type your name in the Mississippi search box, using either just your last name or both your last and first names. If you want to search for business assets, you only need to use one of the names used by your business.

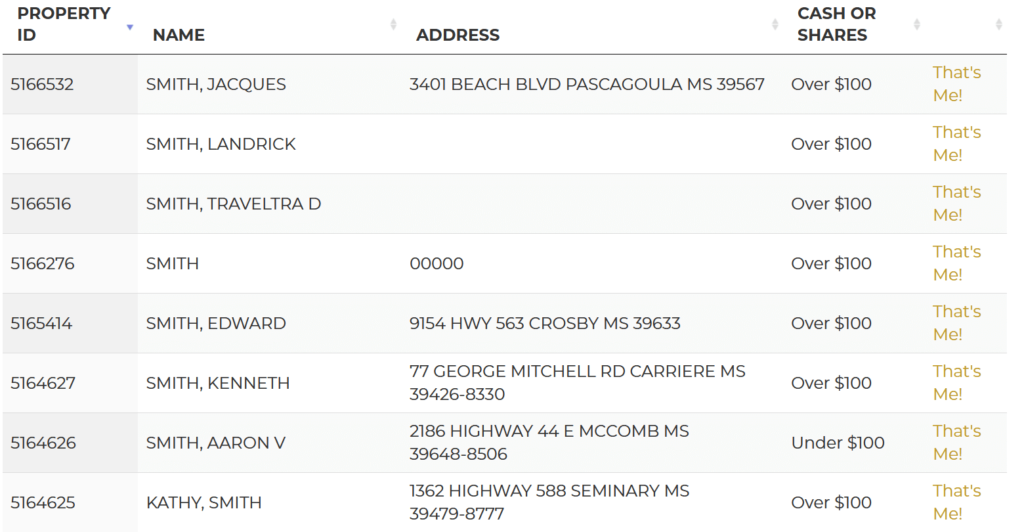

Step 3: View all the assets the Mississippi system found that match your name. The system lists the owner’s full name and middle initial as well as their last known address. Though you won’t see the name of the holder who reported the asset, you can see if the property is worth more or less than $100.

Step 4: Click on the “That’s Me!” button when you find an asset that you want to claim. This button is in the right column and next to the property value.

Mississippi has four steps that you need to follow to claim property. When you click on the “That’s Me!” link, the system will direct you to the claims process.

Step 1: Click “yes” or “no” to the question of whether you want to file for one or more assets at the same time. You also need to let the system know whether you will work with a claim finder before clicking on the yellow “Next” button. If you do not answer both questions, the system will issue an error message that stops you from moving forward.

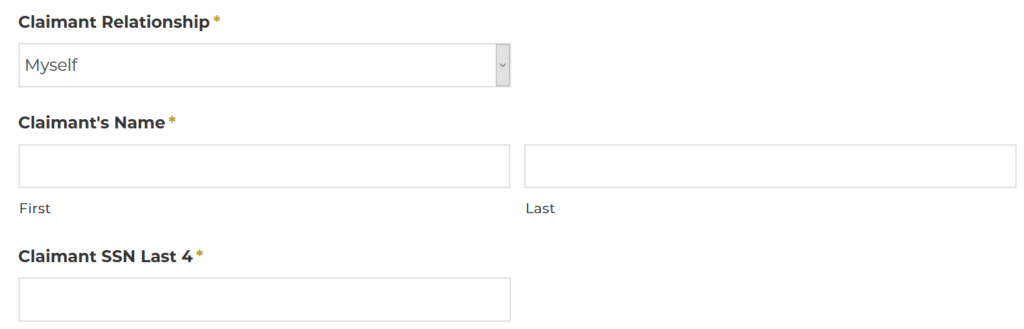

Step 2: Fill out all the boxes on your form. If the system finds that any of your information does not match the claim, you’ll receive an error message. This gives you the chance to fix any mistakes that you made and file your claim.

Step 3: Read through the form that the site creates with your information. You need to match all the information on the claim for the state to process it and issue a check.

Step 4: View all the documents that your claim needs. You can find all the forms that you might need online.

Step 5: Download and complete all the required forms. You will then mail the forms along with your claim to the Office of the State Treasurer in Jackson, Mississippi.

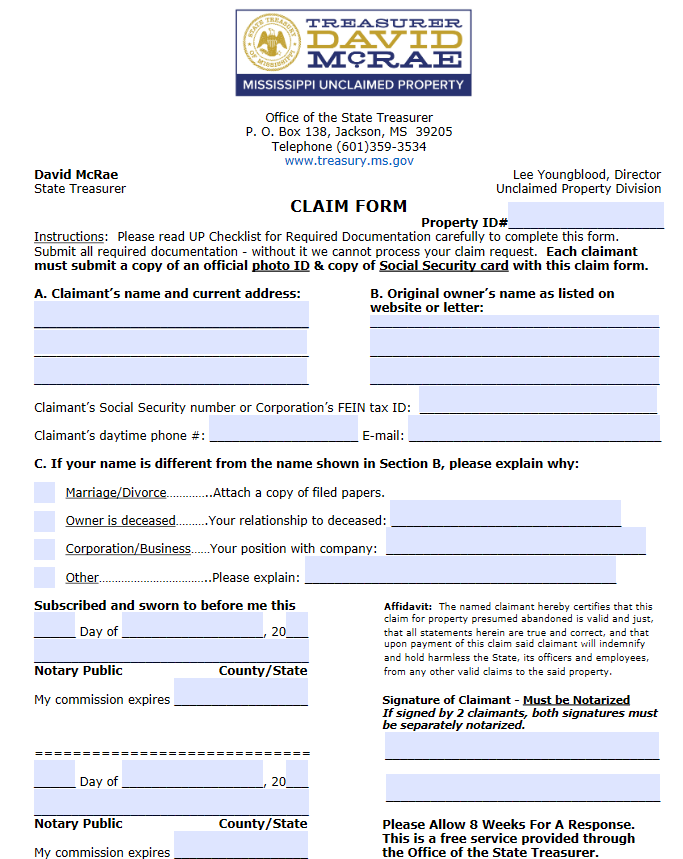

Mississippi requires different forms depending on how you plan to file. The most common is the Claim Form. It asks for your current address and name along with the address shown on the asset and your old name if you had one. You also need to have the document notarized after you present your photo ID. This main form is available for anyone who can prove that they legally own an asset held by the state.

The stock liquidation form is required of anyone claiming stocks or bonds who want the value of the asset. Signing this form gives the Trustmark National Bank the right to liquidate the stocks in exchange for a $25 fee. You need to list the name of the stock and how many shares you want to sell. Mississippi will only accept a notarized version of this form.

Mississippi requires proof that you lived at the address attached to your asset. The easiest way to do so is with a utility bill. Many companies can provide a copy of your last bill if you do not have one. You can also try logging into an old utility account and printing a copy of your old bill or showing a printed letter from someone who sent it to your old address. Mississippi needs your social security number to verify your identity, too.

Some of the assets that Mississippi owns belong to people who passed away. You can still file and become the legal owner of the deceased’s assets, but you need to use the right forms to file. Mississippi asks for a Claim Form that lists the original owner’s name. You need to submit a copy of the death certificate and a will. If the deceased did not have a will, you can provide a copy of their obituary or an affidavit of death. Mississippi asks for an affidavit from each heir. You also need to note whether the estate is open or closed. For closed estates, Mississippi will divide the fund into equal portions for each heir. If the estate is still open, the state will only release the assets to the named executor.

Keep in mind that you may have the option of filing with an Affidavit of Death and Heirship. Mississippi will accept this form if the deceased did not leave a will and all of their heirs agree to divide their property without going through the court system. You need a witness to sign the form and have it notarized. The witness must have a relationship with the deceased and list details about their death along with their assets. This form allows you to transfer property without talking to a judge first.

Though you can use the same Claim Form for individuals when filing for property in Mississippi, you need information about the business, too. The Magnolia State requires the official tax number given to the business and proof that you either own the business or have the right to its assets. If the business is still open, the state will issue a check in the name of the company. In a case where the business closed, Mississippi will send checks to all listed owners. You get a percentage of the assets based on how much you owned of the business. Only if the state lists you as the sole owner will you qualify for the full amount of the asset.

All states have a missing or unclaimed property database that you can search, but not all states run these sites. Many choose to let Missing Money handle the needs of those looking for abandoned money. This site has the benefit of letting you choose each state that you want to search and find all assets listed under a specific name in that state. You can easily switch to a different state and see how to file your claim, too.

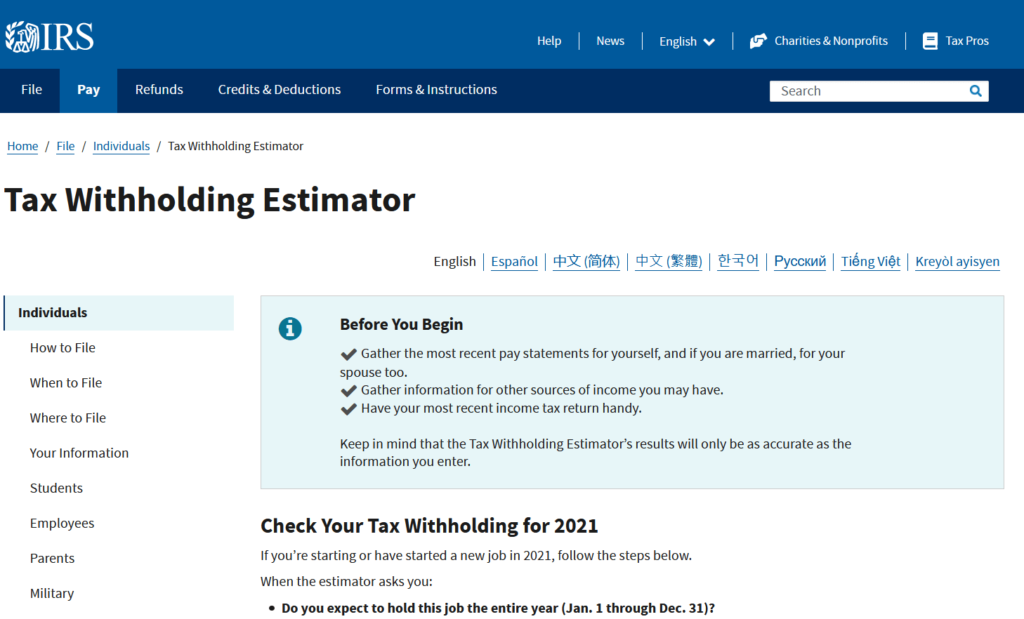

We also like the help available from the Internal Revenue Service (IRS), which lets you create a new account if you never used the site before. Your account lets you view your past tax returns and how much you paid or got back. It also lets you track your most recent refund and get a check that you didn’t cash. If you are still waiting for a stimulus check, the site offers information about those checks, too.

Some other databases and websites that you might use include:

All laws relating to unclaimed property in Mississippi are Real and Personal Property Laws. Chapter 12 covers the Uniform Disposition and serves as the Unclaimed Property Act. The Act covers what the state can do when it obtains investments in your name along with how long holders have to report abandoned property.

Mississippi claim finders are people who use the state’s system to claim assets for others. They also use other names such as heir finder and money finder. Mississippi only allows finders to file claims on assets that the state held for a minimum of seven months. Finders can charge a maximum fee of 10% of your property. You risk losing a lot of money by working with one of these finders. Mississippi requires that finders sign deals with individuals, too. Though you can work with a claim finder, you can complete the same steps that they can through the online system.

Both abandoned and dormant are terms that refer to assets that the state holds. Holders can attempt to track down owners through phone calls and mail notices along with emails. They can only state that the property is abandoned if they had no contact with the owner for a minimum of five years. Some holders will wait longer to contact the treasurer in the hopes that an heir might come forward. Heirs who can show they have the right to claim the asset are often responsible for paying rental fees or other charges before the holder will transfer the ownership rights.

Many states hold safe deposit auctions in which they sell the contents of abandoned boxes after getting reports from the holders. Mississippi does not hold auctions and will not become the custodian of the contents found in abandoned boxes. It allows the holder to file a report that includes a full list of the items found inside a box after five years with no contact from the owner. Holders can also contact the treasurer five years after getting one last payment from the owner. Mississippi allows owners to sell the valuable items in the box to pay back any money that the owner owed as well as late fees or other charges that they added. The Mississippi State Treasurer will then hold the remaining money in a trust for those who can claim the cash.

Mississippi takes an average of eight weeks to release funds after processing filed claims. It will process all claims as they arrive and make sure that the information shared on the forms matches the information attached to the asset. You should get a letter in the mail that lets you know you filed a claim, which also shows you that the state removed the asset from the database. Mississippi may request more information after processing your claim. This may occur because you missed filling out a section or checking a box on your form. In some cases, the treasurer will determine that you need to complete additional paperwork, especially when you file for someone else.

There are several things that you can do to protect all the valuable assets and reduce the risk of holders turning to the Mississippi State Treasurer. You should keep all uncashed checks in a safe place and make sure that you check them within six days of you getting them. Write down any of the login information that you use and your account numbers, keeping copies in safe places in your home and one on your computer. You also need to update any of the information that you share with your asset holders and notify them of changes.

With close to $200 million in unclaimed assets available, there is a good chance that Mississippi has at least one asset that belongs to you. You don’t need to live in the Magnolia State or have the same name that you did when you obtained that asset to file your claim. The state lists all the forms that you need and lots of tips on filing your claims. Use our ultimate guide to unclaimed money in Mississippi to find the easiest way to claim your money.

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.

Copyright © 2024 · OurPublicRecords.org · All Rights Reserved