Copyright © 2024 · OurPublicRecords.org · All Rights Reserved

Free Arkansas Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Discover how Arkansas handles unclaimed property upon receipt and learn the process of claiming it in our comprehensive Arkansas guide.

Arkansas, often referred to as the Land of Opportunity, safeguards unclaimed funds and property until reunification with their rightful owners or until owners access the state’s database. Given that approximately one in four state residents has funds within this system, there’s a considerable chance that you could be among them. It’s conceivable that you possess a reimbursement from a past utility provider or an outstanding payment from a previous employer. We advise familiarizing yourself with the various categories of unclaimed funds in Arkansas before embarking on your search through the system.

With the convenience of the online system, residents of bustling cities like Little Rock or Hot Springs, as well as those residing in other states, can effortlessly search for their unclaimed funds. Arkansas makes this process accessible with just an internet connection. Furthermore, if you provide your current address, you can opt to have your claim form sent directly to your residence. Once your claim is processed, Arkansas will issue a check for the owed amount to the address of your choosing. Overseeing the funds and assets that find their way into the state database falls under the purview of the Arkansas State Auditor. Our comprehensive guide to unclaimed assets in Arkansas offers insights into locating and claiming various types of assets.

Arkansas utilizes the term “unclaimed money” to characterize assets that have been abandoned. This designation does not imply that you willingly relinquished your entitlement to these funds; rather, it signifies a disconnection from the entity overseeing your property. Consider the scenario of a bank account, for instance. Many individuals are unaware that banks do not close accounts if they remain inactive. Instead, these accounts are held for a minimum of one year before being classified as abandoned. Even during this time, your funds may have continued to accrue interest until the account’s closure. Subsequently, the Arkansas State Auditor may have a check prepared, encompassing the complete balance of your account, awaiting your claim. The lapse of three years without any communication from the account owner prompts banks to classify accounts as abandoned.

Additional instances of unclaimed money encompass utility deposits and refunds. A deposit refers to the initial sum paid when initiating a utility service for your residence, usually equating to at least one month’s worth of utility usage. As long as bill payments remain timely, the utility company affords the choice of receiving your deposit back as a check or applying it as a credit to your account.

Conversely, a refund signifies the utility company owing you money. This can arise after installing solar panels or overpayment of bills. If the company is unable to reach you or if the refund is returned to them, they forward the funds to the auditor.

Arkansas distinguishes itself by maintaining a system that encompasses court-related funds. An illustrative example includes court deposits – a predetermined sum submitted in good faith until a court renders a decision in a specific case. Should you relocate without notifying the court, they will forward your funds to the auditor. Similarly, in probate cases, executors are required to post a bond to signify adherence to probate court regulations following a person’s demise. Courts also reimburse bond money deposited during criminal trials.

One thing to keep in mind is that Arkansas only accepts assets when the organization contacts the auditor. The term “holder” describes the organization that oversees your account. You often have the chance to speak to the holder and make arrangements to get your cash back before the auditor gets it. Once the auditor receives information about your account, you must go through the state database and complete a claim form. We’ll show you how to use the system and complete a claim below.

The Arkansas State Auditor safeguards your funds and assets until you’re ready to claim them, a process that typically takes just a few minutes.

Here’s a simple guide to finding unclaimed property in Arkansas:

Step 1: Begin by visiting the Arkansas Search for Unclaimed Property page. While you can locate other links leading to the official website, our provided link takes you directly to the state’s search page.

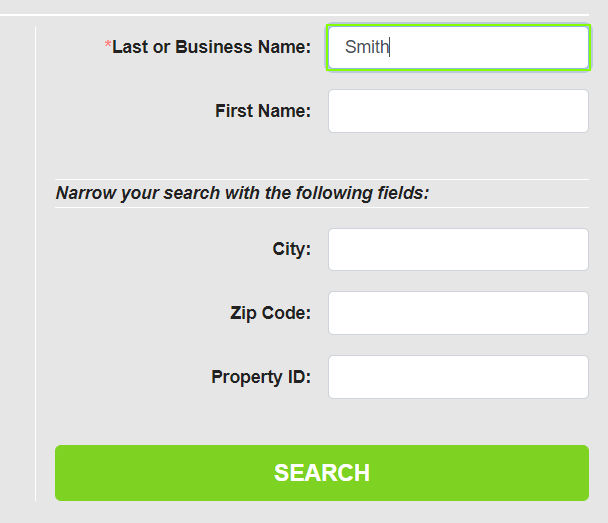

Step 2: On the right side of the page, you’ll find the Arkansas search box. Look for a red asterisk next to the “last name” box, indicating that you need to input your last name. Additionally, you have the option to include your city, zip code, first name, or property ID number. After entering the necessary details, click the green “Search” button.

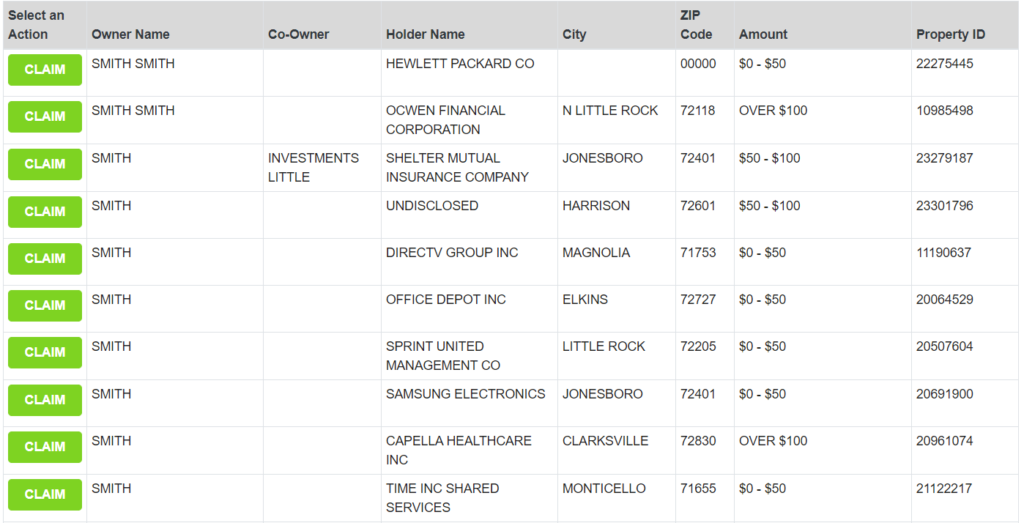

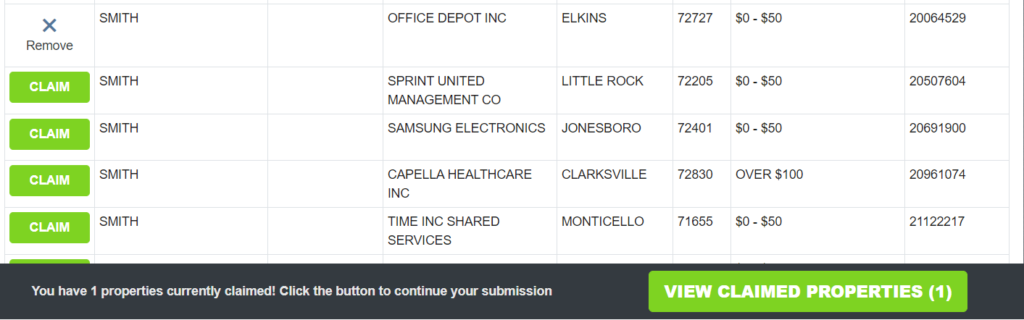

Step 3: Examine the matching assets that Arkansas holds, displayed in the search results. The “Amount” column lets you identify properties valued above $100 or below $50. Equally important is the “Holder Name” column, which reveals the company or organization that held the money. This helps you verify if it’s an entity you’ve dealt with previously.

Step 4: Initiate the claim process by clicking two buttons. Start with the green “Claim” button located next to an asset. You can proceed to identify and claim any other funds if applicable. Towards the bottom of the page, you’ll find another green “Claim” button that initiates the claim process for your funds.

Step 5:

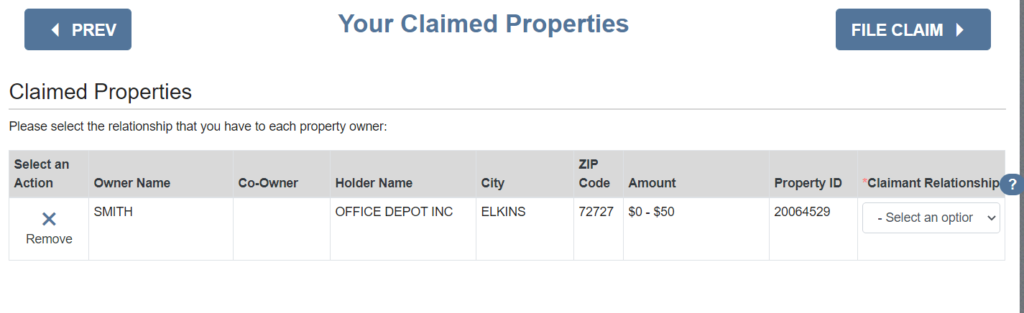

Look for the “Claimant Relationship” column and select the appropriate option. If you’re the owner, choose “Myself” or explore other available choices. It’s advisable to verify your claim details before clicking the blue “File Claim” button.

Arkansas presents various avenues for individuals seeking to claim an asset even if direct ownership cannot be established:

Step 1: Begin by entering your current contact details as a means of verifying your entitlement to an Arkansas asset. This includes your tax or social security number, home or mobile phone number, email address, home address, first name, and last name. After providing this information, proceed by clicking the blue “Next” button.

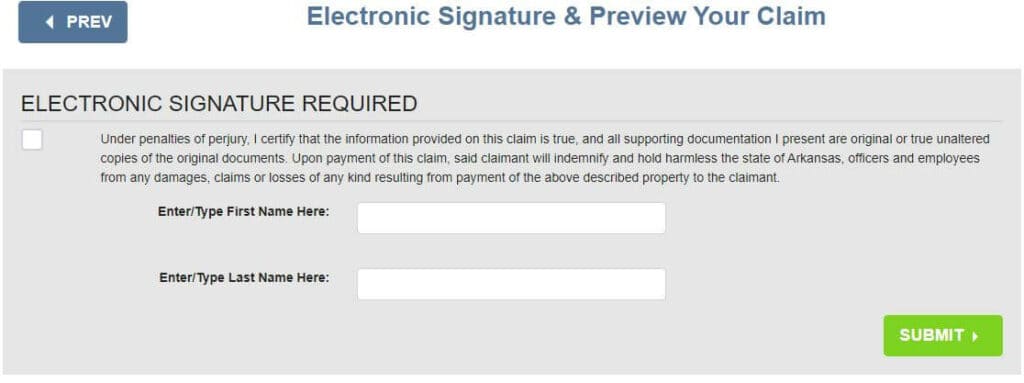

Step 2: On the “Preview Claim” page, input both your first and last names into the provided boxes. It’s advisable to carefully review your details for accuracy before moving forward. Your name serves as your electronic signature, and once it’s entered, the state will consider it valid. To submit your claim to the auditor, click the green “Submit” button.

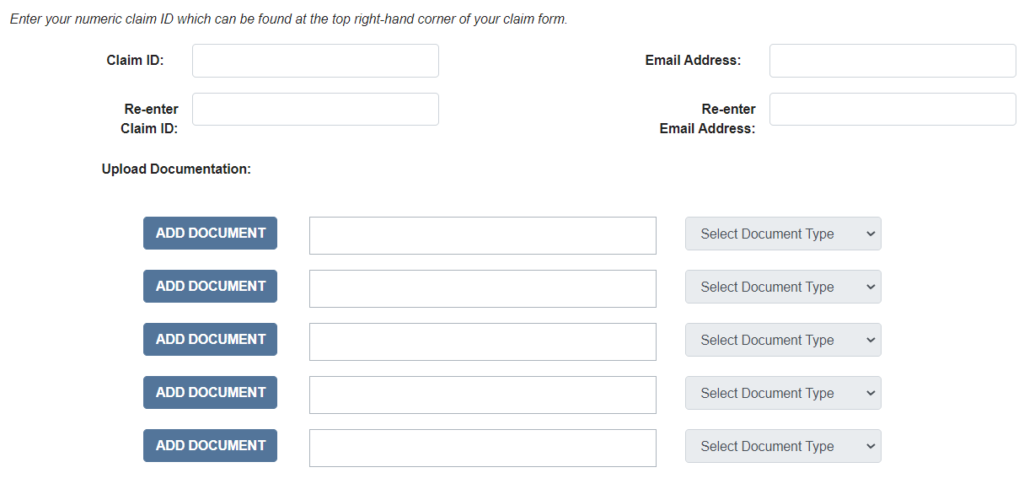

Step 3: Acquire all necessary information and documents required for verifying your claim. The auditor will send you an email outlining the specifics. Once obtained, take photographs of these documents and save electronic copies on your computer.

Step 4: Proceed to the Arkansas claim upload page in order to attach the relevant documents to your claim. Look for the “Add Document” buttons situated at the bottom of the page. Select one of these buttons to initiate the uploading process. You’ll be prompted to specify the document type, provide your email address, and include your claim number.

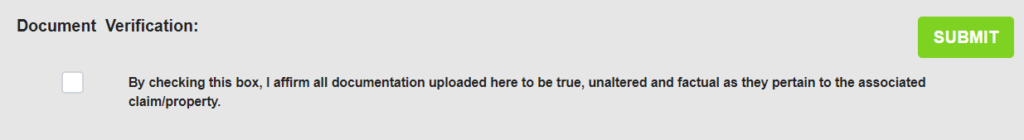

Step 5: Navigate to the “Document Verification” section at the top of the page. Mark the adjacent checkbox to confirm that you’ve adhered to the stipulated guidelines, and then proceed to submit your information. https://www.nwahomepage.com/

Consider exploring these avenues for reclaiming unclaimed funds and benefits:

While Arkansas lacks an official webpage detailing its unclaimed property laws, you can access these regulations by visiting the provided link. This resource outlines the obligations for holders to report abandoned assets annually in the autumn and stipulates their responsibilities concerning owners before contacting the auditor. It’s recommended to ensure that the holders adhered to Arkansas laws when they lost contact with you, verifying the compliance with the necessary protocols.

Assets in Arkansas are classified as dormant or abandoned after a specific duration, usually three years. Bank accounts and life insurance checks become dormant after three years. Utility deposits and refunds valued at $50 or more become dormant after just one year. Checks worth $50 or less are considered abandoned after three years. The longest dormancy period is for abandoned safe deposit boxes, which is five years.

No, Arkansas doesn’t mandate filing claims online. You can choose to call the unclaimed property office at (800) 252-4646. A representative will assist you in checking the system for any listed accounts and gather your information over the phone to add to your claim form. However, using the online system is just as efficient as the phone option and may prove faster, as phone lines might be busy or the office closed.

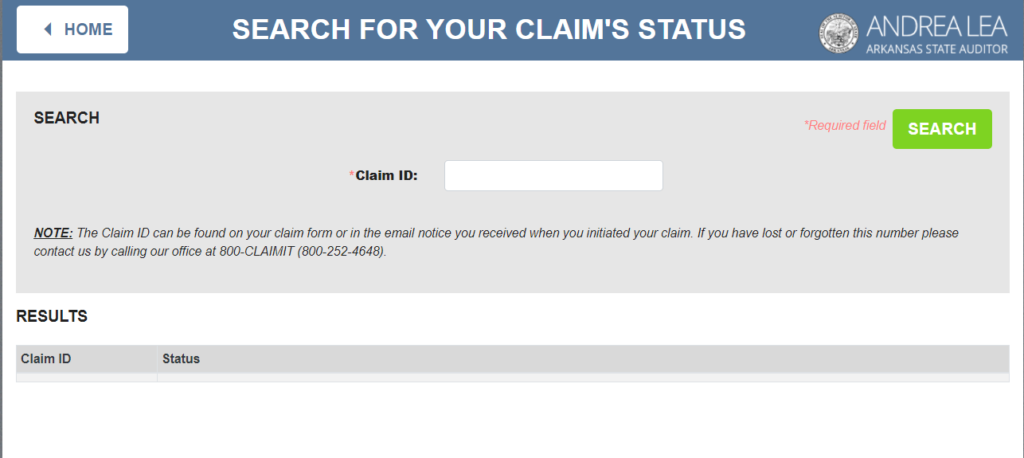

Once you file a claim, a designated representative will be assigned to your case. This representative reviews your information and ensures it matches the asset’s owner details. They will contact you through email or phone if additional information is needed. Arkansas provides a status checker on their website, allowing you to track your claim’s progress. By using your ID number, you can easily confirm whether the Arkansas State Auditor accepted your claim and ascertain the estimated arrival date of your check.

Recent assessments indicate that the accumulated sum of unclaimed funds in Arkansas surpasses $400 million. This comprehensive amount encompasses various unclaimed sources, such as overdue wages and commission checks from employers, in addition to unclaimed bank accounts and insurance disbursements. Insurance companies, for instance, hold life insurance policies that name specific beneficiaries, along with checks tied to accidents or home-related claims. Expanding the scope, utilizing alternative online resources opens the potential to search for over $40 billion in unclaimed funds maintained by diverse states and government entities.

In Arkansas, regardless of the nature of your filing, you must provide both your name and social security number. Alternatively, you can utilize a tax identification number if applicable. When submitting claims for business assets, you’ll need documentation validating your legal entitlement to those assets. This might involve court documents reflecting the dissolution of your company or tax records listing you as the owner. For heirs, proof of identity and the relationship with the deceased is essential. Arkansas also mandates a copy of the deceased individual’s death certificate, which can be obtained online if not available.

Regrettably, Arkansas doesn’t allow you to request an alternative form of payment for claimed abandoned property. While some states offer direct deposit, expediting the process by transferring funds to your bank account, Arkansas exclusively issues paper checks. These checks will bear your name or your business’s name on the front. Even in cases where you file as an heir and acquire property that belonged to a deceased individual, Arkansas will release a check in your name as the new owner.

The processing time for Arkansas to mail checks typically spans approximately six weeks from the moment you utilize the Arkansas system to the date you receive your check. Should you delay your claim submission or document upload after the initial filing, this will inevitably prolong the process. Additionally, if the auditor determines that more information is required from you, it could further extend the processing time.

To safeguard your assets in Arkansas and prevent them from becoming dormant, consider these proactive measures:

An Arkansas money finder is an individual or entity that assists others in locating unclaimed funds. They often target the heirs of deceased individuals by sending letters that promise substantial returns or claim to uncover more funds than individuals can find on their own. While Arkansas lacks specific laws governing money finders, the state auditor encourages people to conduct searches independently, without relying on money finders. If you need assistance or have inquiries, you can contact an unclaimed money representative over the phone for guidance.

Given its moniker as the Land of Opportunity, Arkansas naturally holds a wealth of prospects for you. This extends to the realm of unclaimed money and assets accessible through the Arkansas online database. Here, you can conduct searches not only for the names of deceased loved ones but also for assets that rightfully belong to you. Subsequently, you can complete the process by uploading necessary documents and monitoring your claim’s progress while awaiting a check. Leverage the insights provided in our comprehensive guide to unclaimed money in Arkansas to unearth forgotten funds and assets that may be rightfully yours.

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.

Copyright © 2024 · OurPublicRecords.org · All Rights Reserved