Copyright © 2024 · OurPublicRecords.org · All Rights Reserved

Free North Dakota Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Learn the easiest ways to find unclaimed money in North Dakota in our ultimate guide to the Peace Garden State.

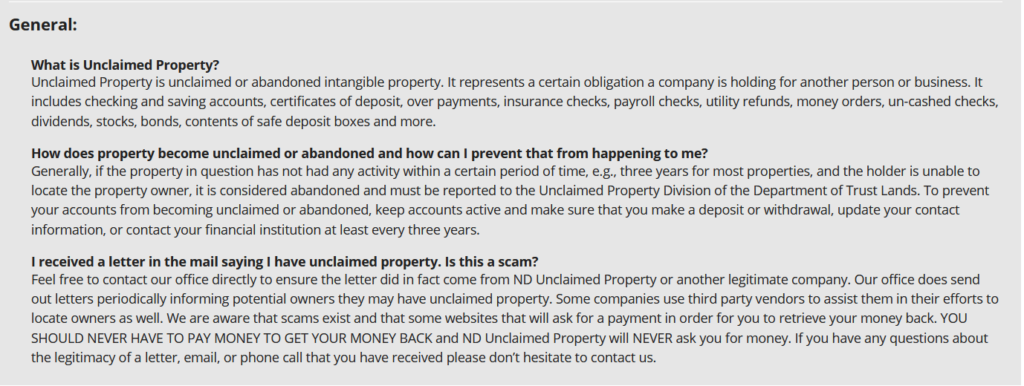

North Dakota is one of many states that worked with Missing Money to help owners find all of their unclaimed property. Not only can you use the Missing Money website, but you can also use the database available from the North Dakota Unclaimed Property Division to find all of your missing or lost assets. The site also allows you to upload any documents or certificates that you need and get up to date information on your claim after you file it.

Since creating its website, the Peace Garden State returned more than $84 million in abandoned assets. Though you might think that the state only gets an asset when the owner willingly walks away, North Dakota gets money from holders for a variety of other reasons. As long as you lived in North Dakota at some point in the past or did business there, it’s worth checking the system because you never know what you might come across. We’ll go over some different types of property that the state holds and how to find unclaimed assets in our ultimate guide to North Dakota.

North Dakota considers unclaimed property as any type of asset with which the holder and owner no longer have any contact. The holder is the company or organization that you trust to handle your money such as a bank where you opened a checking account or a utility company that provided gas to your home or apartment. Holders are responsible under state law to contact the owner when they have money or assets that belong to them. Only if the holder cannot find the owner will they consider the property as abandoned and transfer it to the Unclaimed Property Division in North Dakota.

The Peace Garden State is home to Fargo but also has a number of rural areas where people operate farms and ranches. If someone in your family owned a piece of land in North Dakota, the Unclaimed Property Division can help you find unclaimed royalty deals. Many of these deals relate to the natural gas and oil resources found across the state. The company that wants to access those resources must sign a contract with the owner of the land. You may discover that your grandparents had a contract that is still in effect but that no one in your family claimed the money.

Unclaimed property held by the State of North Dakota can include payroll checks, too. Your employers must pay you all the money that you made or risk fines from the government. A company may send a check to the address you had when you took the job, even though you moved years ago.

If the employer cannot find your current location and gets your check back, they must then send the money to the Unclaimed Property Division. Those checks can include any vacation or sick time that you had at the end of your contract and any expenses due to you.

North Dakota has many bank accounts held within its system for people who never claimed them. A good example is a bank account that you opened and didn’t close. No matter how much money was left in the account, it still belongs to you. Banks will send the money that you had to the state along with the interest that your money earned. You may find an account that you thought you closed but didn’t or one that your parents opened when you were a child and never told you about.

You’ll also find some types of property known as physical property such as stocks and bonds. North Dakota ensures that you can claim the stocks and bonds that you once bought or at least get their total value on the open market. Gift cards are available for some but usually only include those bought for a specific person. The gift certificate or card must show that you bought the item or that someone bought it for. You may find the value of the contents from safe deposit boxes and traveler’s checks listed in the North Dakota database, too.

There are two reasons why North Dakota created an unclaimed property database. The first is that it wanted to connect owners with their money and give people across the state an easy way to claim their abandoned property. North Dakota has such harsh winters that you might find yourself trapped at home and unable to reach a government department. As long as you can still connect to the internet, you can file your claim online. North Dakota also holds unclaimed property as a way to fund local schools. Until the owner claims the property, the money and any interest that it uses will go towards supporting the Common Schools Trust Fund and provide money to K-12 schools in the Peace Garden State.

As of April 2021, North Dakota estimates that the Unclaimed Property Division holds around $30 million for others. When you consider that fewer than 800,000 people live in the state, this comes to quite a bit of cash for each person. Through the ND database and the other resources that you can use, you have the chance to file claims for any of the $42 billion in unclaimed assets held by states and organizations across the country.

The North Dakota Unclaimed Property Division helps you find your assets and file your claims. You can also check your claim after you file.

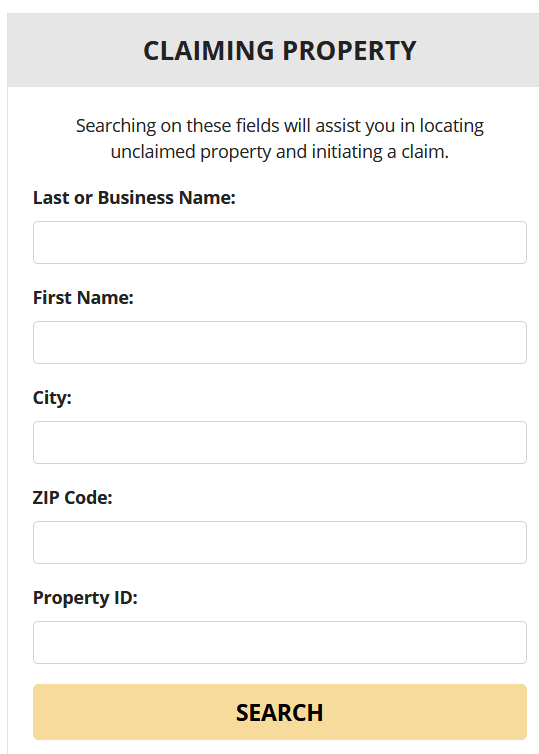

Step 1: Visit the North Dakota Unclaimed Property Division website to see what the division does. Look for the “Claiming Property” box, which is at the bottom of the page.

Step 2: Use your first and last names to make sure that you find assets in North Dakota that belong to you. You can also use the name of a business and add more information if you want to see fewer results.

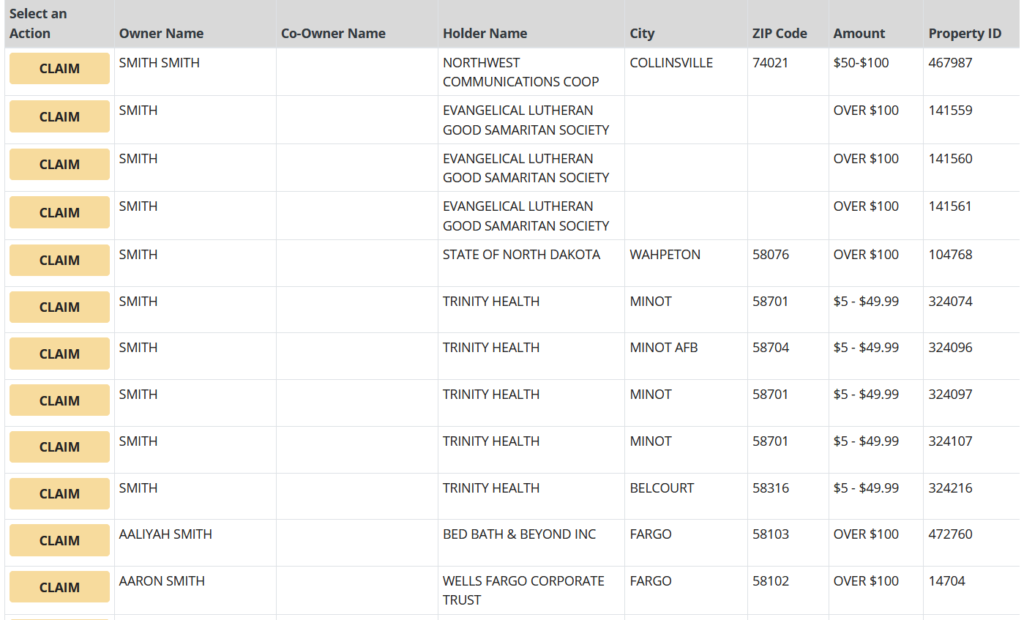

Step 3: Find the assets that you can claim with a look at your search results. You can see the name of the holder and the amount that they reported as well as the owner’s full name and last known address. North Dakota lets you know if the asset is worth $5-49.99, $50-100 or more than $100.

Step 4: Click on the two Claim buttons to file in North Dakota. You will first click on the button in the “Select Action” column and then select the second claim button at the bottom of the page.

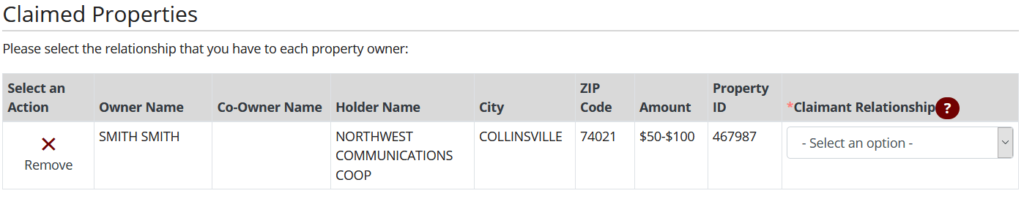

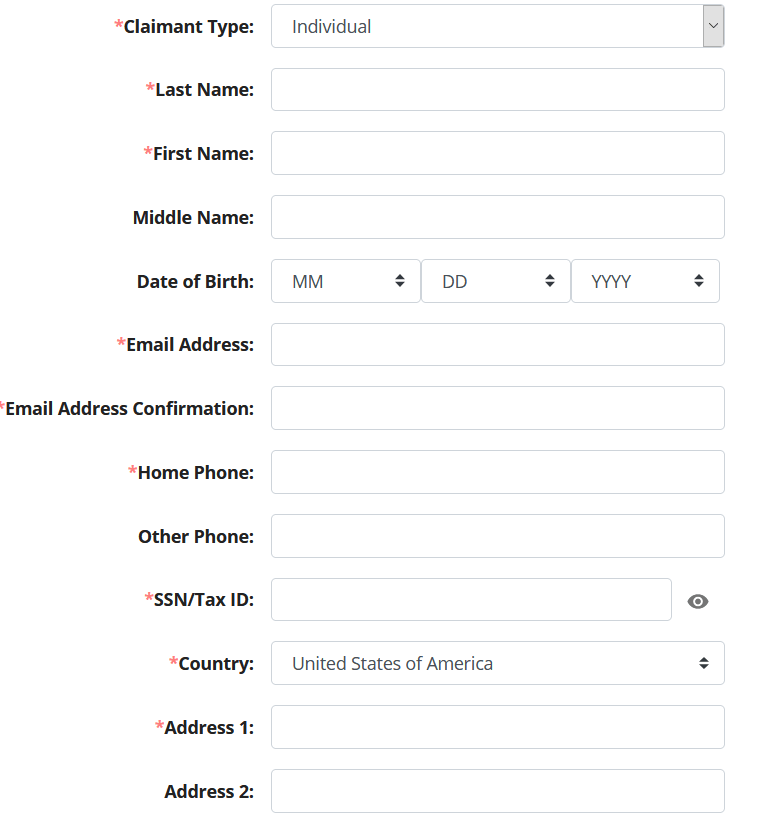

Step 1: Check out the Claimed Property page that appears after you complete the above steps. You need to make sure that you have a valid and legal right to the property. North Dakota also has a drop-down menu that lets you select your claimant relationship. In addition to claiming as the property owner, you can claim as an heir during the estate process or as a business owner. There is another option designed for the legal representatives of adults and children.

Step 2: Fill out all of the boxes marked with an asterisk to submit your claim. The system may find a different address or a version of your address that it needs to use in place of the one you entered.

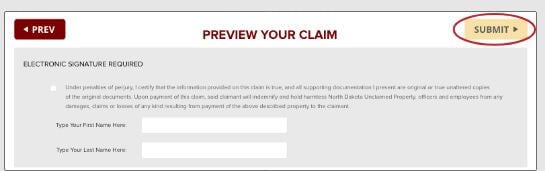

Step 3: Use the “Preview Your Claim” page to verify that you entered the required and correct information. Once you click the “Submit” button, your claim will go to the North Dakota Unclaimed Property Division.

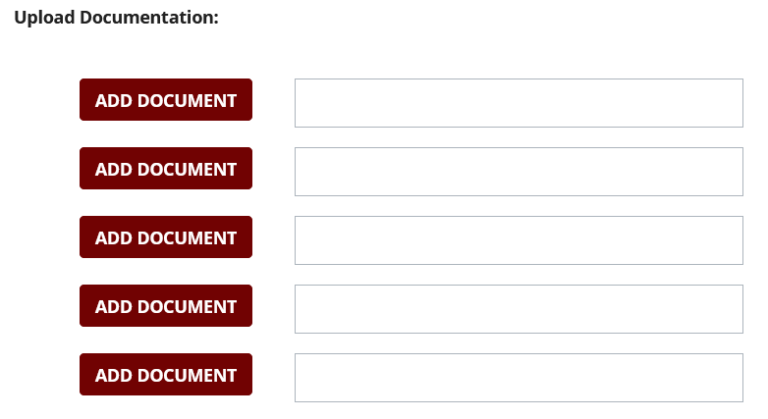

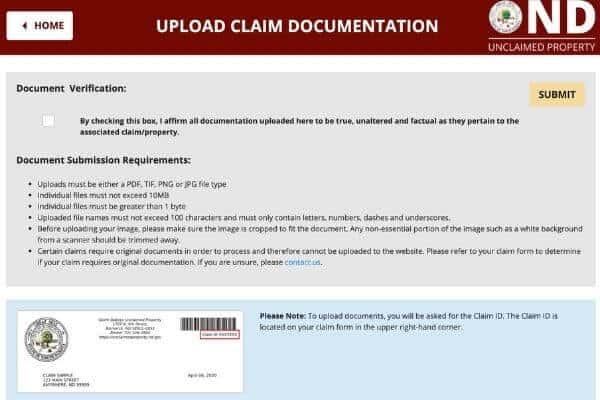

Step 4: Collect all the documents that your claim needs before visiting the upload claim documents page.

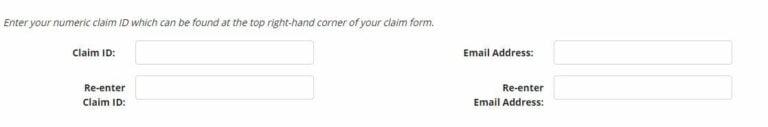

Step 5: Type both the email address you listed on your claim with the claim ID number in the boxes shown on this page. If you lost your claim number, contact the Unclaimed Property Division to obtain it.

Step 6: Click on the “Add Document” button and search your computer for the right file. You may need to upload multiple documents to confirm your claim. The “Submit” button at the top of the page sends your information to the division.

Step 7: Visit the Claim Status Checker once you submit a claim. This site allows you to enter your claim ID number to see where it is in the process. You can also use this site to find out if the Unclaimed Property Division sent a letter to detail any other information that it needs before the division will process your claim.

Don’t assume that doing one search in the North Dakota database will reveal all the abandoned assets in your name. The best sites to use will depend on what you hope to find. For example, you can use the Internal Revenue Service (IRS) to find missing money in the form of tax returns or refunds. Though you only have the option of looking for federal tax returns, the site lets you update your information and even add your bank account.

The Department of Housing and Urban Development (HUD) also has refund checks for some people. You should use this site if HUD ever helped you with your mortgage or kept the bank from taking your home. We also recommend checking with HUD if you got a general notice in the mail about a possible refund. HUD includes a lot of information on some current mortgage scams.

With the Federal Deposit Insurance Corporation, you can claim money that you stored in a bank that unexpectedly closed before you emptied your account. The FDIC guarantees that those who trusted their banks have the chance to get their money. You can perform a similar search through the National Credit Union Administration to see what a credit union did with your money if it closed for any reason.

Those who enlist in the military can get help from the Department of Veterans Affairs when their service ends. The VA helps them find loans if they want to buy a home or launch a new business. Many former soldiers also get life insurance from the VA. Even if they didn’t name someone to claim their benefits or the beneficiary passed away, you may find a policy that the VA can help you claim.

If you need help claiming funds for a retirement account after someone passed away, check with the Pension Benefit Guaranty Corporation. You may also want to work with the U.S. Railroad Retirement Board, which specializes in the retirement funds owned by railroad employees. Both sites help you find any money left in a pension fund and find out the best way to get those funds. We also recommend checking with U.S. Federal Investments for unclaimed treasury bonds.

In addition to the North Dakota database, you’ll also find unclaimed assets held by the state at Missing Money. One reason to use this site is that it allows you to search for claims that you can file in the Peace Garden State and then check other states. Most claims will appear in both databases, but Missing Money may lack some claims found in the North Dakota system. When you file through the Missing Money site, you need to wait for the state to receive your claim before you can upload any added information. Though you should use Missing Money if you want to check multiple states, you may find that it’s better to file through the North Dakota site.

We encourage you to check out the unclaimed property laws in North Dakota if you want to learn more. The Uniform Unclaimed Property Act includes 17 pages and is available as a PDF that you can either view online or download. You can search the code for laws that relate to the specific type of property that you want to claim. The law also covers the actions that holders cannot take, which lets you know when to contact the state.

Some states have a statute of limitations of between 20 and 30 years that allow the state to claim the property when the owner doesn’t within that time period. North Dakota has no such statute. As long as you are either the owner or someone with a right to the property, you can claim it. You might even find assets that the state held since you were in high school or college. Once you file your claim, the Unclaimed Property Division will make sure that you’re the rightful owner and release the asset in the form of a check written to you.

As a way to cut down on fraud, North Dakota will never show the exact value of an asset or the total held in an account. You do get a general idea of the amount though, which tells you if the asset is worth less than $50 or $100 as well as assets that are worth above $100. When the division determines that you are the owner, you will get an update that tells you the total amount, which lets you know how much you’ll get.

North Dakota offers several options for those claiming a deceased’s property. If you open the estate in probate court, the state will require a court order that shows you are the executor or administrator. You may need to provide a copy of the deceased’s last will and testament that shows what they wanted to be done with their property. This is common with assets that are worth a higher amount such as royalties or bank accounts. For estates not probated, North Dakota allows you to fill out paperwork available from the ND Legal Self Help Center to show that you are an heir who deserves the property.

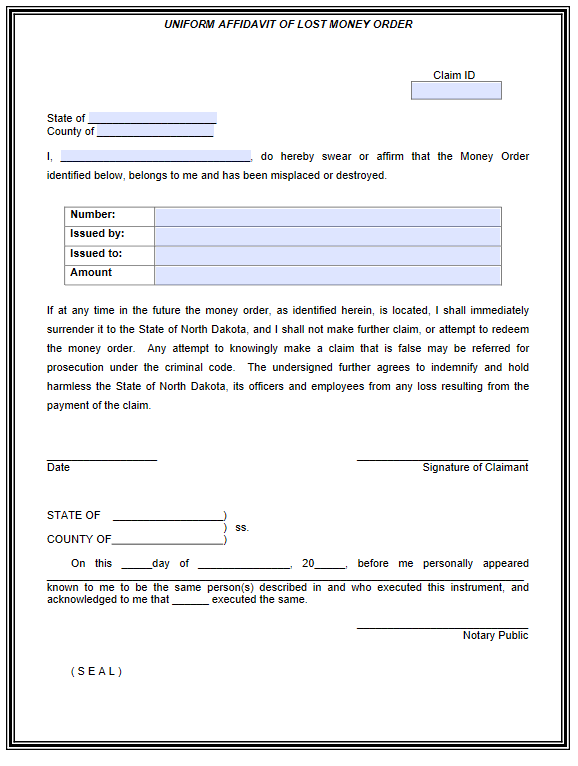

Money orders are available from many stores as well as the post office. It gives you a way to send and receive money in person or through the mail. As long as your name appears in the box as the “Pay to” line, North Dakota allows you to claim a money order that you didn’t cash. You need to print and complete the Uniform Affidavit of Lost Money Order. The affidavit asks for the number and amount of the money order as well as the buyer and seller names. You need to sign the affidavit in front of a notary public before sending it to the Unclaimed Property Division.

North Dakota allows their finders to search for abandoned assets and claim them when they have permission from the owner. The name comes from the fact that many of these people target the heirs of deceased owners. You might like the idea of letting someone else handle the work while you focus on other things. North Dakota only allows licensed private investigators to work as heir finders. Finders can only file claims for assets held by the state for a minimum of 24 months and can only charge a fee equal to 10% of the total property value.

When holders hand property to the North Dakota Division of Unclaimed Property, the state will keep the property safe and make sure that it’s valid before listing it in the system. You may see workers from the division at fairs and other festivals. They often bring information about the database and may even let you search the system on the spot. If you find an abandoned property that belongs to you, the workers can help you file your claim. You may get a letter from the state, too. North Dakota often sends notices when it receives new assets and can locate either the owners or their next of kin. The letter should have a claim number on it, which you can enter in the search box to find that specific piece of property without searching for your name. You may receive letters from heir finders, but the state itself will not charge you to claim your property.

We often hear from readers who want to know what steps they can take to prevent their property from appearing in the system as abandoned. You need to access all of your financial accounts at least once a year, even if you do a simple thing such as transfer money to another account or deposit a few dollars. You should also update all of your information on a regular basis, including changing your email address or phone number. If you go through a divorce or get married, make sure that your account holders note your name change.

Though North Dakota will often use some of the assets that it gets, it allows you to claim the full value of any property held by the Unclaimed Property Division. You have the option of going through the Missing Money website or using the state’s database, which also allows you to upload added information and keep an eye on your claim. We recommend that you go through our steps to finding and claiming unclaimed money in North Dakota before checking other states and resources.

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.

Copyright © 2024 · OurPublicRecords.org · All Rights Reserved