Unclaimed Money Lookup - Delaware

Free Delaware Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

(advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Delaware Unclaimed Money -

The Ultimate Guide 2026

- UPDATED February 2026

If you think that you might have unclaimed money waiting for you in Delaware, use our ultimate guide to learn how to claim it.

Contents

- Unclaimed Money in Delaware

- Types of Unclaimed Money in Delaware

- Claim Unclaimed Property in Delaware

- Filing Your Delaware Claim

- Checking Your Delaware Claim Status

- Where Can I Look Other Than the Delaware Database?

- Can I File a Delaware Claim if I'm Not the Listed Owner?

- Filing a Claim as an Heir

- How Does the Delaware Money Match Program Work?

- Delaware Unclaimed Property Laws

Unclaimed Money in Delaware

Every year, millions of dollars owned by people in The First State go unclaimed. This includes both money that their employers owe to them and funds from their old bank accounts. You might be one of those people and not know it because you didn’t know that Delaware offers an easy way to search for any type of unclaimed property. The state returned more than $300 million to worthy residents through the Money Match program but has even more money waiting for them. Use our ultimate guide to unclaimed money in Delaware to find out what you need to find your money.

Types of Unclaimed Money in Delaware

The Delaware Office of Unclaimed Property maintains a database designed for those who believe that they have missing money in the state. We’ll go over this database later and help you see the best way to file a claim, but we wanted to talk about the types of unclaimed property that you might find first. Delaware lists all money that it receives from holders. Holders usually contact the Office of Unclaimed Property when they failed in their attempts to find the legal owners. When this happens, the state will step up and become the legal custodian, which means that it is responsible for the money until it notifies the owner by mail or sees the owner come forward.

Many people find the process confusing because they think of property in terms of physical property such as real estate. Property in this case means anything that belonged to a person who later abandoned it. The only physical property that you might find is a safe deposit box. The holder of that box does not need to keep it for years until the owner returns. Delaware allows the holder to contact the Office of Unclaimed Property and turn over the contents. As the office has limited space available, it will often sell the items in the box and return the money to the owner. Before the state sells your property, it will make sure that the holder sent you a notice and then send one of its own to your most recent address.

Bank accounts are a common type of property that goes unclaimed in Delaware. Did you ever open a bank account and assumed that it closed because you had a negative balance? There’s a chance that the bank made a mistake and later credited your account. That account can sit there and pick up interest for months before it goes to the state. Delaware ensures that you get all the money held in the account as well as the interest that the bank added to it. You may even find a bank account in the database that you had as a child.

Checks are – without a doubt – the most common type of unclaimed property in Delaware. Far too many people get small checks that they never cash. The holder who issued the check must try to find the person to take the amount off of their books. Even a check as small as a few dollars might appear in the database under your name. Checks can also come from those who provided utilities for a former home. If you had a positive balance after closing the account, the utility provider will try to find you and pay you back. Refunds and life insurance policies are some of the other examples of unclaimed property found in Delaware.

Claim Unclaimed Property in Delaware

To find any type of unclaimed property in Delaware, you need to start at the Office of Unclaimed Property. Delaware updates the unclaimed money database as more information becomes available.

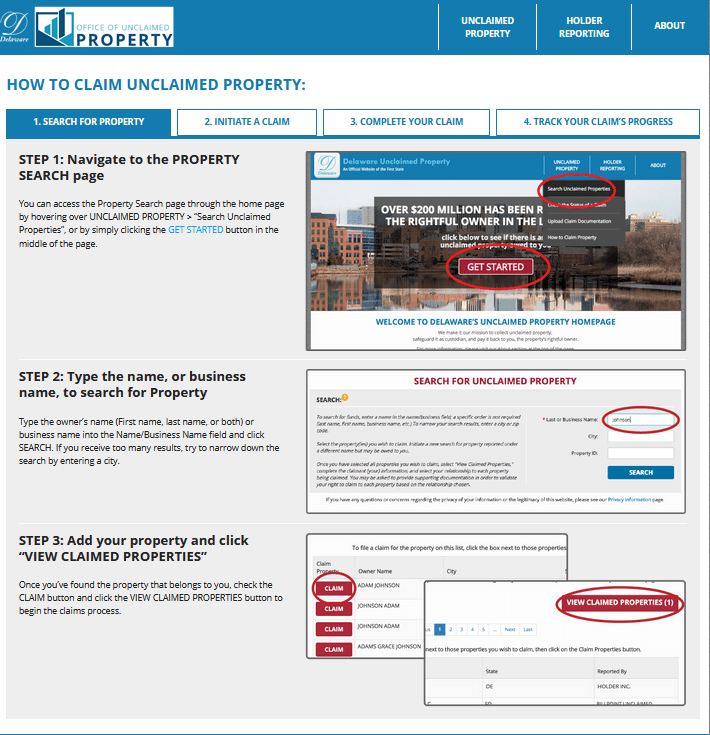

Step 1: Visit the Delaware Office of Unclaimed Property. Once the page loads, scroll down until you see the boxes shown below. Click on the “Search for Unclaimed Property” to begin looking for money.

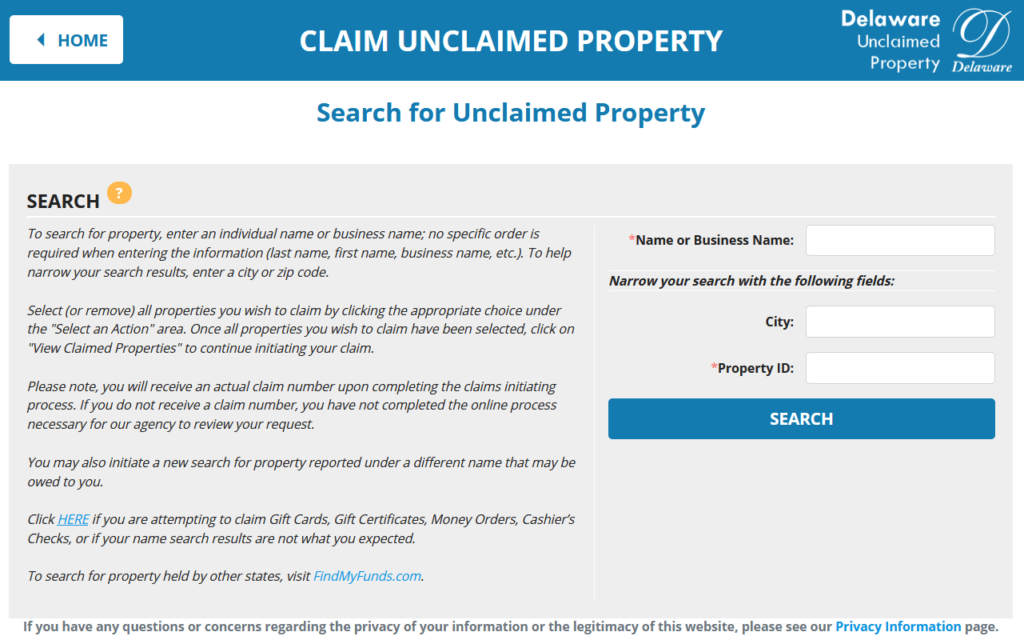

Step 2: Use the form on the page that loads to enter your search parameters. Delaware requires that you enter your last name or the name of your business. You can add the property ID if you have it or enter the zip code of your current/former city to find accounts listed in that area.

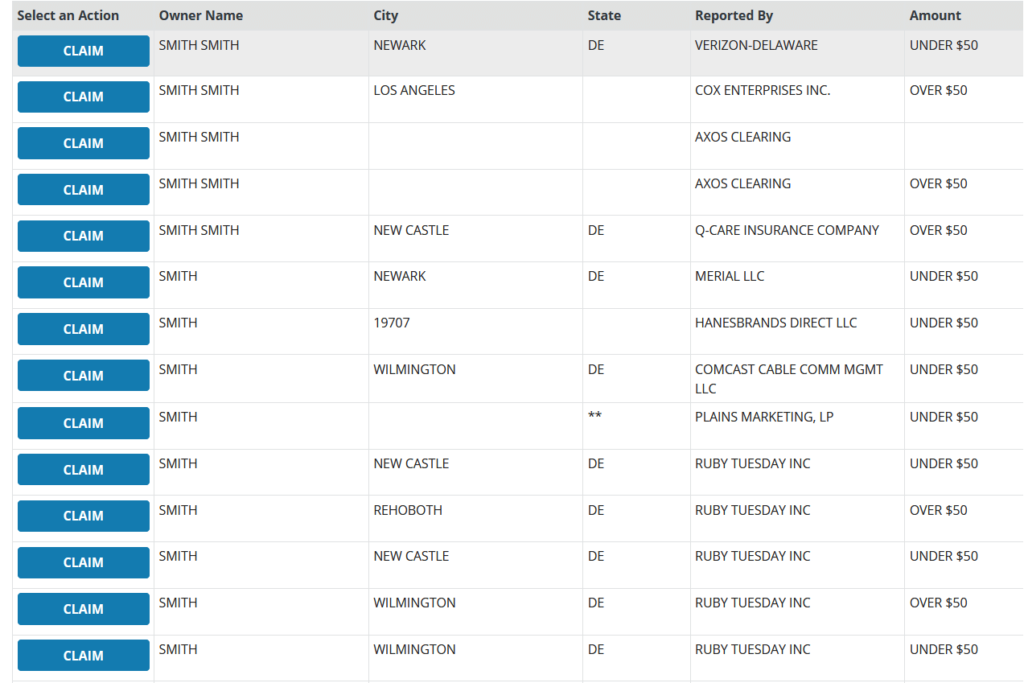

Step 3: Check out the results, which may cover multiple pages. Not only can you see the full name and last known address of the owner, but you can see who held the account and the amount reported. Though Delaware doesn’t list the exact amount, it does state whether it is over or under $50.

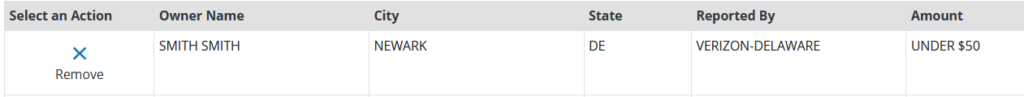

Step 4: Click on all of the accounts that you want to claim. You need to use the blue “Claim” button in the far left column. After finding what you want, press the other “Claim” button located at the bottom of the page.

Filing Your Delaware Claim

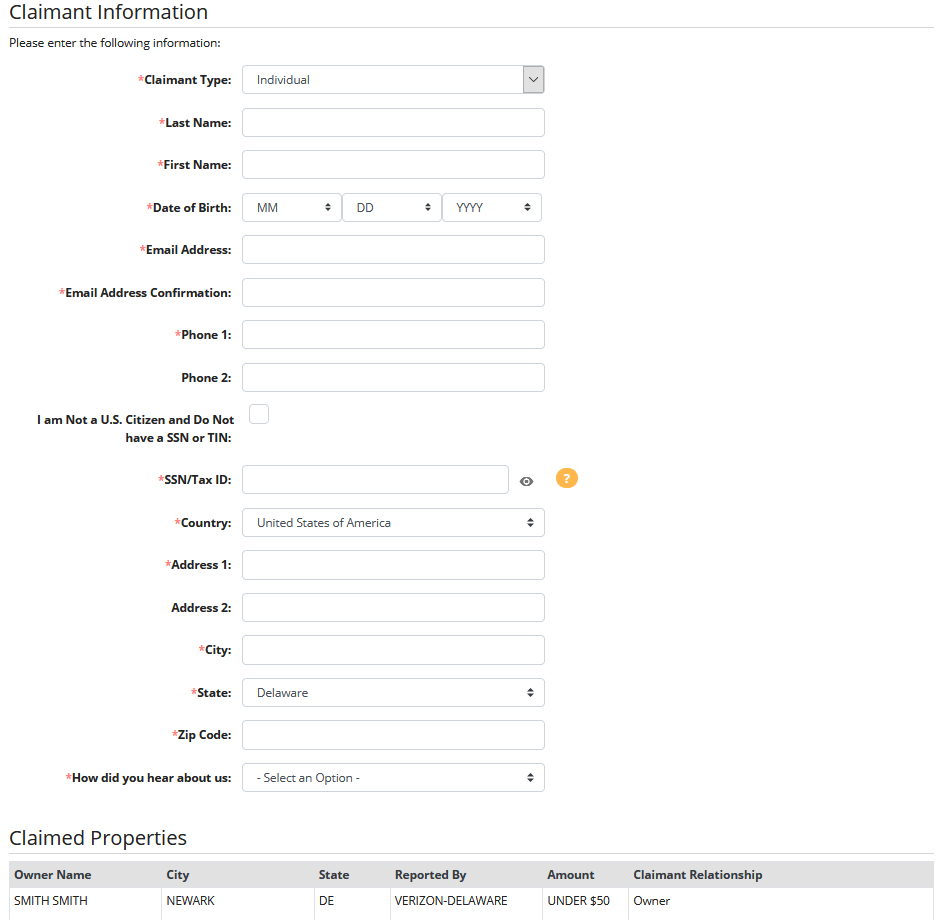

Once you claim property, you need to fill out the claim form. The Delaware website takes you to a new page that asks for your claimant relationship. In addition to showing that you want to file for yourself, you can also file as a fee finder or a representative of the owner. You need to pick the answer that best describes you to continue with the process.

Next is the claimant form, which asks for information to prove that you own the account. You’ll start with your full/legal name and date of birth before adding your email address and phone number. Delaware requires your social security number or proof that you do not have one along with your home address. Once you complete the form, the site will tell you what else you need to do.

Most types of claims require that you upload documents to prove that you are both who you say you are and that you have the right to the property. Delaware will only accept documents in PDF, JPEG and similar formats that are 10MB or smaller in size. You also need to make sure that the documents include all the required information and are easily visible. If the Office of Unclaimed Property cannot accept one or more of your documents, it will contact you. You need both the email address you listed on your claim form and the claim ID to upload your documents. Delaware also asks that you choose the type of document from a drop-down box when you upload it.

Checking Your Delaware Claim Status

Playing the waiting game is hard, especially when you are waiting for money. Delaware gives you a convenient way to check the status of your claim. The Office of Unclaimed Property will send you a claim receipt when you file that shows the claim ID. You need to enter that ID on this page and then choose your claim to see more. If your claim is in the process stage, the site will let you know that you do not need to do anything else. It will also tell you if the state sent a check to your home or if you need to add anything else before it can release the check. You can usually find information on this site within a few days of filing.

Where Can I Look Other Than the Delaware Database?

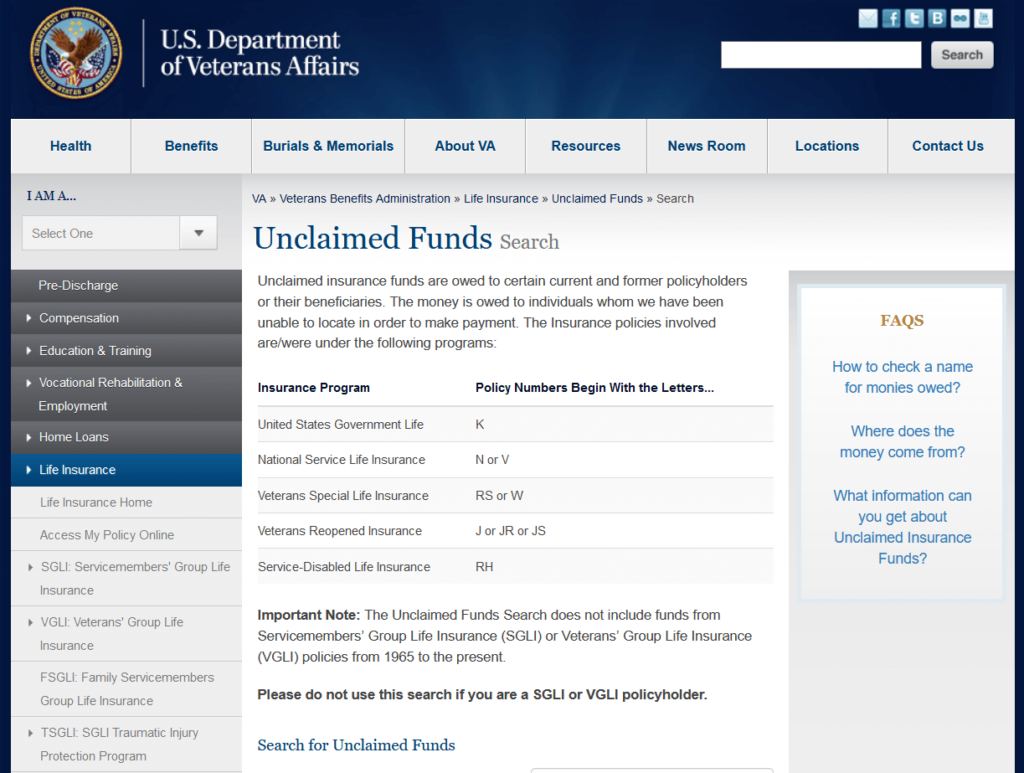

You might focus so much on looking for unclaimed money in Delaware that you don’t realize there are other places to look. The Department of Veterans Affairs is a good place to start, especially if you have loved ones who served in the military. Any life insurance policies purchased through the VA are available years after the holders passed away. Any beneficiary listed on the policy can file a claim for the insurance proceeds, too. Many people do not realize that Department of Housing and Urban Development (HUD) holds onto funds for mortgage holders who went through the government department. Not only can you find out what you need to do to claim your refund, but you can see why you earned the refund.

Another place to check is the Pension Benefit Guaranty Corporation. Unless you have a pension, you might not know that you can designate one or more people to take over the account when you pass away. The Pension Benefit Guaranty Corporation offers help for those who want the pension funds owned by a deceased owner. If you are the relative of a former railroad worker, the U.S. Railroad Retirement Board can provide some help. It keeps track of all the retirement accounts held by those workers, including the remaining amount and whether you can inherit the funds.

Some of the other sites that can help you find unclaimed money outside of Delaware include:

- Federal Deposit Insurance Corporation, which helps users search for bank accounts that they thought went missing when the original banks closed.

- U.S. Federal Investments that gives you the chance to search for treasury bonds that list you as the owner.

- Missing Money, which works with a handful of states and let you search multiple databases from any device connected to the internet.

- Internal Revenue Service (IRS) to find refund checks from the federal government that you never cashed.

- National Credit Union Administration, which lets you find money you had in a credit union that shut down.

Can I File a Delaware Claim if I'm Not the Listed Owner?

Delaware law allows you to file a claim for unclaimed property in one of six ways. The first is as a representative of the deceased’s estate. When you go to probate court to open an estate, you need to present the deceased’s will and let the court assign an executor. The executor is the legal representative who has the right to claim a property that belongs to the estate. If you are an heir to someone with an estate that does not need to go through probate, you can also file. Many estates do not go through probate because they are not worth enough to justify the court costs. You may need to file as the spouse of someone who passed away if you inherit the entire estate.

Other representatives can file claims in Delaware, including both business and legal representatives. A business representative is someone who owned a business listed in the database and has the legal right to any accounts due to that business. You may find that the state has one or more checks that came from a former supplier you used before shutting down your business. A legal representative is someone who has court permission to file claims for the person they represent. One example is a child who has power of attorney over a parent who lives with them. Those with legal guardianship of children under the age of 18 can also file claims in Delaware.

Filing a Claim as an Heir

Delaware lets you claim any type of property if you are the heir of the original owner. You may find that your father has an old paycheck that he never cashed or that your mother received a refund from her old power company. If the individual lived and died in Delaware, you need to request a copy of their death certificate from the Delaware Office of Vital Statistics. You need to upload both that certificate along with a certified document that proves your relationship with the deceased. Delaware will accept a birth certificate that lists the individual as your parent or a marriage license that shows you are the surviving spouse. You can also submit court records that list you as the heir or the person responsible for administering the estate.

How Does the Delaware Money Match Program Work?

After noticing that millions of dollars went unclaimed every year, Delaware launched the Money Match program. Designed to give people back the money that they lost, the program works with people who file taxes in the state. When you file taxes, your information goes into a database that will then compare it to the information available from the Office of Unclaimed Property. If your social security number, name and address match one of the accounts, Delaware will automatically release the funds and send you a check. You do not need to do anything special beyond filing your taxes every year.

While this might make you think that you don’t need the database, not all accounts will automatically go to you. Delaware may not send some funds to you because you moved and your current address not match the one found on the account. You may miss some money because you changed your name after marrying or going through a divorce, which prevents your information from matching the account. Once the check arrives, you can cash it or deposit it in the bank. You should still check the database for any other accounts that might belong to you.

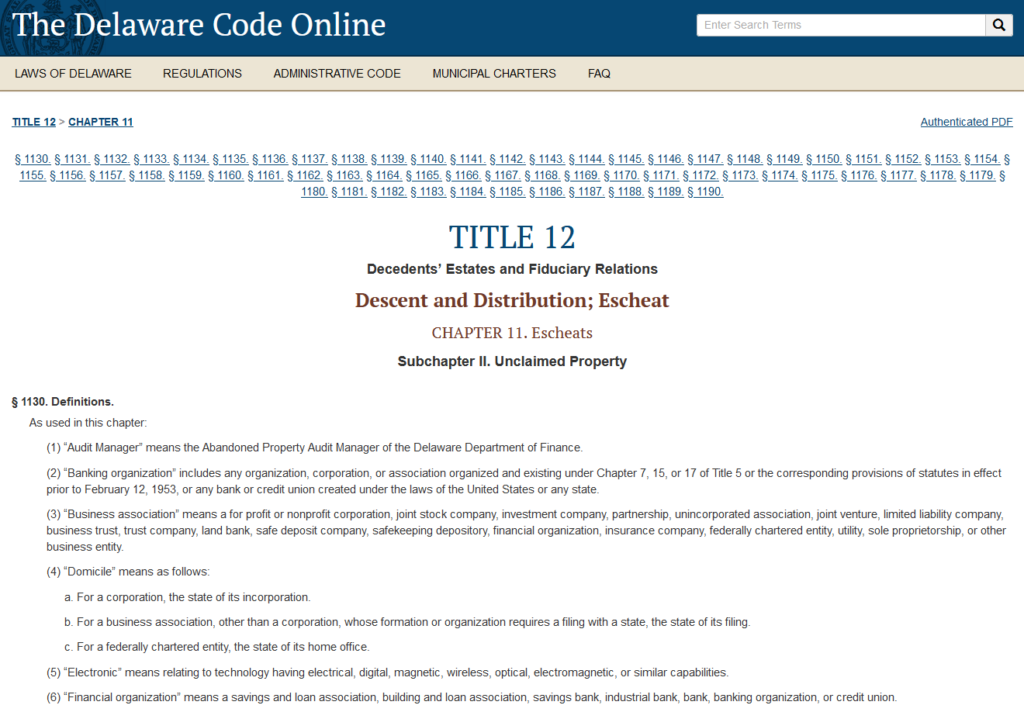

Delaware Unclaimed Property Laws

We don’t have enough time or space to go over all of the unclaimed property laws in Delaware, which is why we recommend that you check out this site. It provides links to pages with information on the laws that cover what holders do when they have unclaimed money and how owners can get their property. Delaware has no statute of limitations on how long owners have to file claims or how long the states will keep accounts open. There are laws regarding how long the holder has before they can release the funds though.

Delaware Unclaimed Money FAQ

Can I Get a Wire Transfer or Automatic Deposit?

You might like the idea of filling out a form and letting the Office of Unclaimed Property send a wire transfer or automatically deposit the money in your account. Unfortunately, the state doesn’t have the time or resources to use either of these methods. The only way that you can get your money is in the form of a paper check. It may arrive via a courier service or through the post office.

Do I Need to Pay Taxes on My Unclaimed Property?

The answer to this question is that it depends. Delaware will liquidate securities and place the proceeds in an account that it can turn over to you. If the account earned dividends of at least $10, you will receive a 1099 form. You also receive this form if the state liquidated any stocks or bonds that you owned. This form allows you to show how much you earned when you file your taxes at the end of the year. Most accounts do not require that you pay taxes on your money.

How Do I Claim Property Owned by a Business?

To file a claim for property held in the name of a business, you need to prove that you are the person who owned the business. If the business lists two or more co-owners, the state will only release funds in the form of a check that includes all of their names. This can cause hassles if you bought out an old owner or one of the other owners passed away. You can have a document notarized that shows you are the sole owner, but only if the co-owners sign in front of the notary. If you are the only owner due to the death of others, you can provide documents that show they are deceased.

What Does Delaware Do with Abandoned Safe Deposit Boxes?

In Delaware, a holder can only consider a safe deposit box abandoned after five years. This period begins when the terms of the contract expire. Let’s say that your mother rented a safe deposit box and paid for a one-year rental. If the holder cannot find her or charge her for the box, it will begin the countdown process. After five years pass, the holder can give the box to the Delaware Office of Unclaimed Property. The office then has the right to remove the contents and put them up for sale. If you learn about the box while it’s still in the possession of the holder, you can often pay the fees that the holder incurred to reclaim it. Delaware has similar laws in place regarding gift certificates and money orders. Even if those funds do not show up in the database, you can use an online claim form to get them. You need to share your social security number and date of birth along with your full name to use the online form.

How Do I Keep My Property from Going to the Delaware Office of Unclaimed Property?

Any account that the holder deems as abandoned will eventually go to the Delaware Office of Unclaimed Property. This usually takes three to five years but can happen in as little as one year. If any of the information attached to your accounts changes, you must update them. This includes changing your name when you get married or divorced and moving to a new address in the same city. You’ll also want to perform an account audit every year in which you make sure that your accounts are in good standing with each holder. If you have close family and friends, you should also choose someone to handle your estate and give them all the information that they need in case you unexpectedly pass away.

Conclusion

Our ultimate guide to unclaimed money in Delaware walks you through the steps of using the state’s online database to find all of your money. Once you see how quickly and easily you can file claims, you may want to encourage your family and friends to check for their names. Make sure that you check out links to other databases to find all of your property.

Quickly Search For Unclaimed Money

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.