Unclaimed Money Lookup - Florida

Free Florida Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

(advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Florida Unclaimed Money -

The Ultimate Guide 2026

- UPDATED February 2026

Find out how you can claim some of the millions in unclaimed property held by the Florida Department of Financial Services.

Contents

- Florida Unclaimed Property Search

- What is Unclaimed Property in Florida?

- Finding Unclaimed Money in Florida

- How to Claim Florida Funds

- Can You Look for Unclaimed Property in Other States?

- What Do You Need to File a Claim in Florida?

- Checking Your Claim

- Unclaimed Property Auctions in Florida

- Why Does Florida Have an Unclaimed Property Division?

- How Long Do Organizations Have to Hold Onto Funds?

- Do You Need to Pay to Claim Property in Florida?

- Can You File an Online Claim?

- Does Florida Let Professional Finders Claim Property and Should You Use One?

- How Do You File a Claim if the Owner is Deceased?

- When Will You Get Your Money?

- Florida Unclaimed Property Laws

- Can You Keep Your Property from Appearing on the Florida Treasure Hunt Site?

Florida Unclaimed Property Search

Though some think of Florida in terms of the gorgeous beaches and fun amusement parks, it has just as many big cities and rural communities where residents live. Known as The Sunshine State, Florida also has millions of dollars in unclaimed property that belongs to past and current residents. It doesn’t matter if you live in one of the larger or smaller counties because you can search for unclaimed property online. The Department of Financial Services can help you find everything from utility refunds and insurance payments to uncashed paychecks and money orders. Our ultimate guide to unclaimed property in Florida gives you links to the state’s search and helps you file all of your claims.

What is Unclaimed Property in Florida?

The two terms that you need to know before looking for unclaimed property in Florida are holder and owner. An owner is anyone who legally owns a piece of tangible or intangible property, while the holder is the organization responsible for overseeing the property. Did you work with a local power or water company to get service at a former address? Not only can you look for the refund of your deposit, but you can search for overpayments that you made on one of your accounts. Unless you filled out a change of address form when you moved, one or more Florida utility companies may have checks for you.

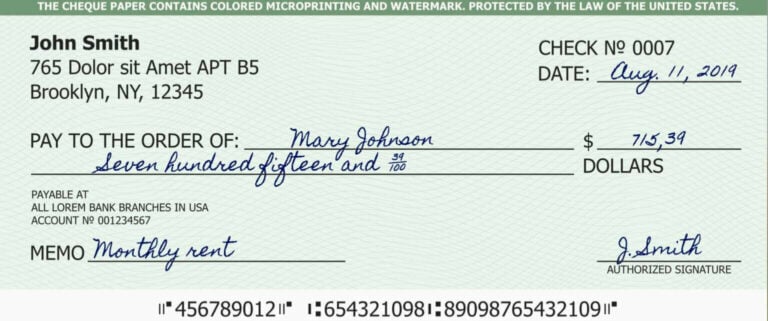

Another type of unclaimed property that you should consider is a check. The most common checks come from past employers. The chances are good that you changed jobs at least once in the past few years.

You never know when your employer might have a check that includes your last few days of work or some of the paid time off due to you. Checks can also come from stores that issued you refunds when they canceled your orders and payments for the balances due on your accounts. Though some checks might have a value of $20 or less, there’s a chance that you might find checks valued at $100-250 or more.

Dormant bank accounts also fall under the banner of unclaimed property in Florida. Most banks do not require that you use your account every day but do ask that you use it at least once a year.You might transfer money between accounts or take out a small amount. Even making a small deposit will keep your account active.

Banks mark accounts as inactive 12 months after your last activity and list them as dormant after 24 months. This will lead to the bank turning the account over to the Department of Financial Services. The bank can only hand over a dormant account if it has proof that it tried to inform you of the money.

There are also insurance payments listed in the Florida database. Did you live in The Sunshine State during one of the major hurricanes and suffered some damage to your home? Your insurer may have an old check that it tried to send you to cover some of that damage. Both auto and life insurers use the Florida Division of Unclaimed Property when they cannot reach their customers. Auto insurance checks often go to those who were in accidents caused by other drivers. Life insurance providers may have checks for the beneficiary of the policy or the person who took out the policy.

Finding Unclaimed Money in Florida

The Florida Treasure Hunt is a website designed by the Division of Unclaimed Property with help from the Department of Financial Services. This site helps you search for money that bears your name or the name of your business.

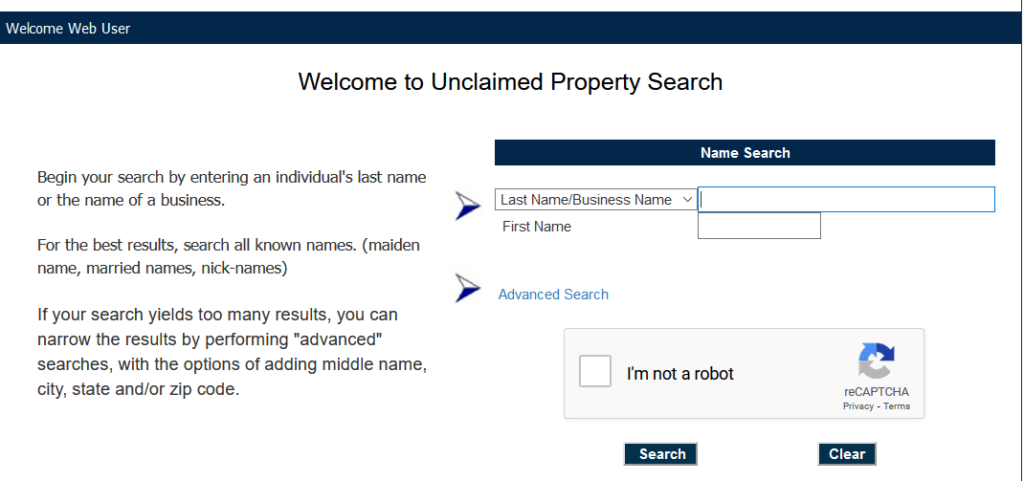

Step 1: Visit the Florida Treasure Hunt website to search for unclaimed property.

Step 2: Look at the search box on this page. You will want to add your last name to search for property in your name. If you own a business in Florida, you can also search by your business name. Florida recommends that you search for any aliases or other names that you used as the database may have money listed under your maiden name or nickname. You also need to click the box below the search function to show that you aren’t a robot.

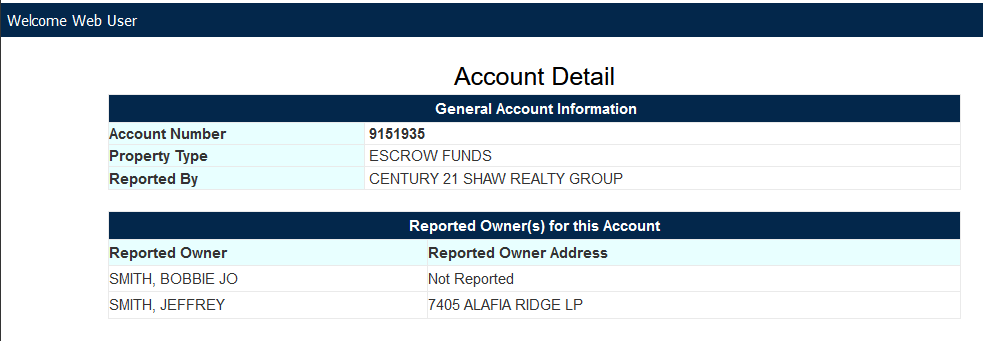

Step 3: Look at the search results shown on the next page. When we searched for the last name “Smith,” the database found more than 200 results that covered nine pages. Florida will give you the account name and reported name and address of the owner. It does not show you the amount in the account.

Step 4: Scroll through the pages until you find an account that belongs to you. You then want to click on the account number and load a page such as the one below. This will tell you the property type such as a checking account or insurance check and who reported it.

How to Claim Florida Funds

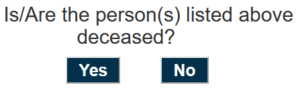

Step 1: Once you find an account, scroll to the bottom of the page. This is where you’ll need to click “Yes” to show that you want to claim it.

Step 2: Click “Yes” to the next question, which asks if the owner is still alive.

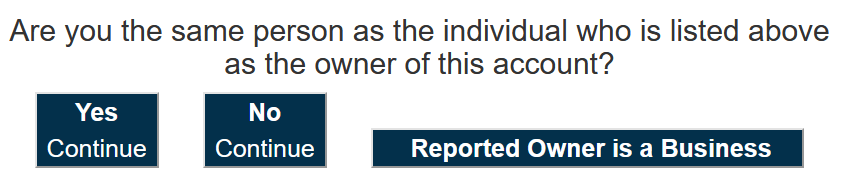

Step 3: Select “Yes, Continue” on the next question to show that you are the individual who owns the account. This allows you to file your claim.

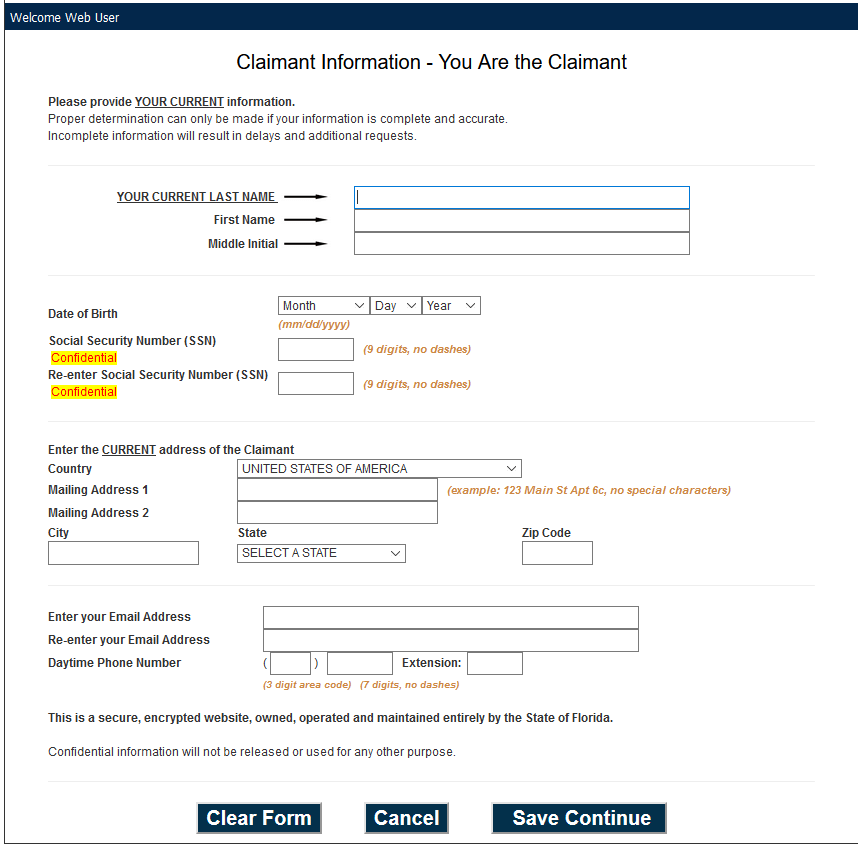

Step 4: Complete the form found on the next page to file a claim with the Division of Unclaimed Property. As soon as it processes your claim, you should receive a check for the full amount due to you.

Can You Look for Unclaimed Property in Other States?

The Division of Unclaimed Property is the best place to look for property in Florida. Not only can you look for money in specific states, but you can also search for funds held by either the federal government or government agencies. Some of our favorite ways to search for unclaimed property include:

- Federal Deposit Insurance Corporation: The Federal Deposit Insurance Corporation keeps track of accounts when the banks that oversee them shut down. It can help you find any money that those banks had that belonged to you.

- Department of Veterans Affairs: The VA offers life insurance policies that help veterans support their families after they pass away. You may find a policy that can help you cover some of the expenses that you face.

- U.S. Federal Investments: Did your family often talk about bonds that they bought for you that you never saw? This website helps you find those bonds and get the money attached to them.

- Department of Housing and Urban Development (HUD): HUD offers help to those who need mortgages and may issue them refunds. The department’s website helps you avoid HUD scams and claim your refund.

- Missing Money: To search multiple states for unclaimed money at the same time, try Missing Money. All you need is a last name to search and other information to file.

- Pension Benefit Guaranty Corporation: Don’t let the pensions owned by your loved ones go unclaimed when they pass away. You can easily find pensions through this site and see if you can claim the funds.

- Internal Revenue Service (IRS): Check with the IRS to see if one of your past tax returns had a refund that you never claimed. You can also check on the status of your next stimulus check.

- U.S. Railroad Retirement Board: Use this website to see if a loved one who worked for the railroad had a retirement fund. If the fund belongs to you, you can get help claiming it.

- National Credit Union Administration: The money that credit unions hold do not go away when those institutions shut down. This administration helps you find missing money held by those institutions.

What Do You Need to File a Claim in Florida?

Florida requires that you share your current information when filing a claim. The biggest reason why money goes unclaimed in the state is that the owners fail to update their contact information when it changes. You need to list both your first and last names along with your middle initial. The site asks for your social security number but will keep it confidential to ensure that no one can steal your identity. You also need to add your phone number and email address along with your home address. Florida will send claims to those with an international address, too.

Checking Your Claim

The hardest part of filing for unclaimed property in Florida is the waiting. Not only do you need to wait for the Division of Unclaimed Property to receive your claim, but you also need to wait for the department to process the claim. If you missed one of the sections on the form or need to provide additional information, it can take even longer. The division has a claim checker that can help you keep track of your claim’s progress. This page only asks for the ID number of your claim, which you’ll see on the top of the claim. You then need to search for your claim and click on it. Florida will show you what stage you are in and how long it will take to complete your claim.

Unclaimed Property Auctions in Florida

Please keep in mind as you look for unclaimed property in Florida that the state doesn’t have the space necessary to hold the physical property turned over by organizations. That is why it offers an unclaimed property auction that it holds a few times a year. Any property that the state receives that is not in the form of funds will go into the auction. The money raised from the auction will go into an account listed in the name of the owner. Florida allows both the owner of the property to file a claim as well as their heirs. Experts who work for the department will determine the market value of the items and help set the opening bid price.

If you want to attend an unclaimed property auction, you can register in advance. The auction starts on Friday, which is the Preview Day that allows bidders to view all the items that will go up for sale. Bidders need to put down a $100 deposit that the state will put towards anything that they buy or refund if they do not buy anything. One month before the date of the auction, a catalog will appear online that allows you to view all the items found in the auction. You can contact the state if you see items that belong to you or a loved one in the auction. To get those items back before the auction, you need to both prove that you’re the owner and pay any amount due to the holder.

Why Does Florida Have an Unclaimed Property Division?

Florida created the Division of Unclaimed Property as a way to help owners find their missing funds. Companies and organizations cannot legally hold onto your money for years. It costs them too much money to hold those funds until the owner steps up. The Florida department gives those organizations a place to send the funds. It keeps the money safe and ensures that no one can spend it unless they are the legal owner of it or the heir of the legal owner.

How Long Do Organizations Have to Hold Onto Funds?

A big question that you might have is how long a Florida organization can hold onto your property before the state takes over. In Florida, those organizations have up to five years to hold the funds and attempt to find the owner. Though some companies may wait less time before contacting the states, most will wait the full five years. The Department of Financial Services will then become the legal holder of the funds. This department uses state tax boards and other resources to locate owners and will send them notices. It generally does not look for those who reside in different states.

Do You Need to Pay to Claim Property in Florida?

When the state receives funds and property, the money will go to the Public School Fund. Any interest that the money earns will go towards the support of schools across the state. Though you do not get back any of the interest added to your funds, you will get the full value of the original funds. This means that if you had a dormant bank account with a balance of $275.35, the check issued by the state will be for that full amount. Florida will never charge a fee for you to file a claim for your property.

Can You File an Online Claim?

Though some states accept electronic records, Florida does not let you complete the entire claim process online. You can use the site to find claims and learn what information you need to proceed. Once you fill out the form for the claim, Florida will print a copy and mail it to the address that you listed. You need to submit that form along with all of your required information to the address that appears on the bottom of the form. The Florida Treasure Hunt website helps you save money, too. If you find multiple accounts that belong to you, you can have them all sent to you and submit just one copy of your information.

Does Florida Let Professional Finders Claim Property and Should You Use One?

Florida law allows finders to file claims but only if they are attorneys working on behalf of their clients or private investigators with licenses to work in the state. Finders can charge fees of 20%, which means that if you have an account worth $1,000, the finder can legally take up to $200 as their payment. Florida caps the maximum that they can charge at $1,000 per account. If you hire a finder who locates multiple accounts, they have the legal right to take 20% of the value of each account. You should never pay a finder until the professional finds your accounts and shows you the total value of those accounts. As the Florida database is free to search and use, you can file claims without help from anyone else.

How Do You File a Claim if the Owner is Deceased?

As you search the Florida database, you might feel tempted to search for your parents or grandparents. Even if they are no longer with you, you may have the option of filing a claim for them. Florida requires a completed claim form that shows the deceased individual is the legal owner of the property. You will also need to submit other forms that show you have a claim to the property as the heir to your loved one. If you file while the person’s estate is open and going through probate, you need to provide court documents that show you are a legal and official representative of the estate. Florida will also accept proof that you are the heir of someone with a closed estate.

When Will You Get Your Money?

Florida attempts to get a check to you within 90 days of receiving your claim. Keep in mind that the process does not start when you fill out the online form but when the state department receives your completed form and other information. If you miss even one line on the claim form, the state will return the form to you and make you start the process over again. You can often catch any mistakes on the status checker website we linked to above. This will help you get your claim processed quickly.

Florida Unclaimed Property Laws

The Florida Unclaimed Property Reporting Instructions Manual is a good place to get a look at some of the laws that state organizations must follow. It lists the rules that govern how and when organizations can contact the state and the limits on the property they can submit. You’ll also find that Florida requires holders to report an account that has a value of $50 or more. They do not need to report smaller accounts. Florida requires that holders give owners a minimum of 180 days to claim their property before they report it, too.

Can You Keep Your Property from Appearing on the Florida Treasure Hunt Site?

As Florida gives holders up to five years before they need to report abandoned property, you might think that you have loads of time to claim your property before it goes missing. Not all organizations follow this rule though. Some will send a letter to your old address after just a year or two and then contact the state. You need to make sure that all of your accounts show some form of activity every year. While you may just want to deposit a few dollars into some accounts, others allow you to log in and check your balance to keep it active. It’s also helpful to keep track of the checks that you receive and deposit them within the week. The longer that you leave the checks sitting around your home, the greater the chances are that you’ll forget about cashing them.

Conclusion

Do you live in Florida and sometimes wonder if the state has any money in your name? The Division of Unclaimed Property created the Florida Treasure Hunt website to help you find those funds. You can access and use the site when you live in a different state and even if you live overseas. We hope that our ultimate guide to Florida unclaimed property helped you find all of your accounts.

Quickly Search For Unclaimed Money

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.