Unclaimed Money Lookup - Georgia

Free Georgia Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

(advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Georgia Unclaimed Money -

The Ultimate Guide 2026

- UPDATED February 2026

With our guide to unclaimed property in Georgia, you can easily find out how to track down and claim your money.

Contents

- The Ultimate Guide to Unclaimed Property in Georgia

- What is Unclaimed Money in Georgia?

- How to Find Georgia Unclaimed Property

- How to File Georgia Unclaimed Property Claims

- Keeping Track of Your Claims

- Where Else Can You Find Unclaimed Property?

- Does Georgia Keep All Types of Unclaimed Property?

- Unclaimed Property Laws in Georgia

The Ultimate Guide to Unclaimed Property in Georgia

Millions of dollars are just waiting in The Peach State for the owners to come forward and file claims. The Georgia Department of Revenue acts as the custodian of any property when the owner abandons it. Though you might think that you’re careful and keep track of all the accounts that you have, mistakes can happen to the best of us. If you have money held by an organization or company, the company must contact the state after five years pass with no activity on that account. The Georgia Department of Revenue is also responsible for securities that holders turn over, which it will liquidate on behalf of the owner.

Georgia makes it easy for anyone who thinks they might have money held by the state to look for their accounts. You can also check on the status of a claim that you filed and see what you need to do to file if you are not the only owner attached to an account. In our ultimate guide to unclaimed money in Georgia, we’ll show you where to go to find your property and how to file a new claim along with how to find money in other states.

What is Unclaimed Money in Georgia?

Unclaimed money in Georgia refers to any type of property in which the owner abandons or does not use it. The organization that holds the money may include an insurance company a loved one used to buy a policy or a bank that oversaw an account you opened. Georgia can act as the custodian for escrow funds, too. When you get a mortgage, your mortgage servicer will open an escrow account in your name that it uses to pay your property taxes and other expenses. If you sell your home and have a positive balance in that account, the insurer will need to contact the Department of Revenue and let you file a claim for the remaining money.

Lost wages are another type of unclaimed money found in Georgia. Your employer may have a final paycheck waiting that you never picked up or one that they sent to your home that the post office returned. Paychecks often include more than just the wages that you made from working such as paid time off that you never used. You’ll also find customer refunds listed in the Georgia database. Have you ever bought an item online and returned it for a full refund but forgot that you never got your money back? There’s a good chance that the check might appear in your search results.

We also see many bank accounts listed in the database. When you change banks, it’s often easy to forget about your old account, especially if it only had a few dollars left in it.

The bank will continue letting interest grow on your balance until it contacts the Department of Revenue. Even if you take out all of your money, you might find that the bank deposited a refund check from a company into the account that you never heard about. You may find bank accounts in the database that list your name with someone else, too. This is common among people who had youth accounts with their parents. Insurance payments and stocks are other examples of unclaimed property held by Georgia and available in the database.

How to Find Georgia Unclaimed Property

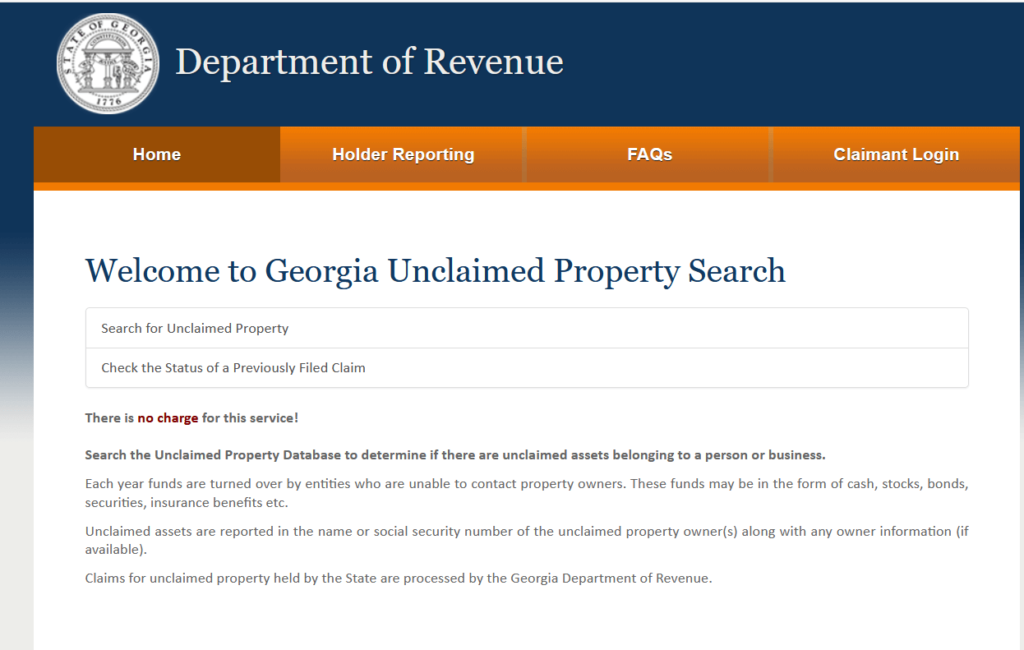

To find unclaimed property in Georgia, you want to start at the website of the Department of Revenue. This database includes all types of property that the department oversees.

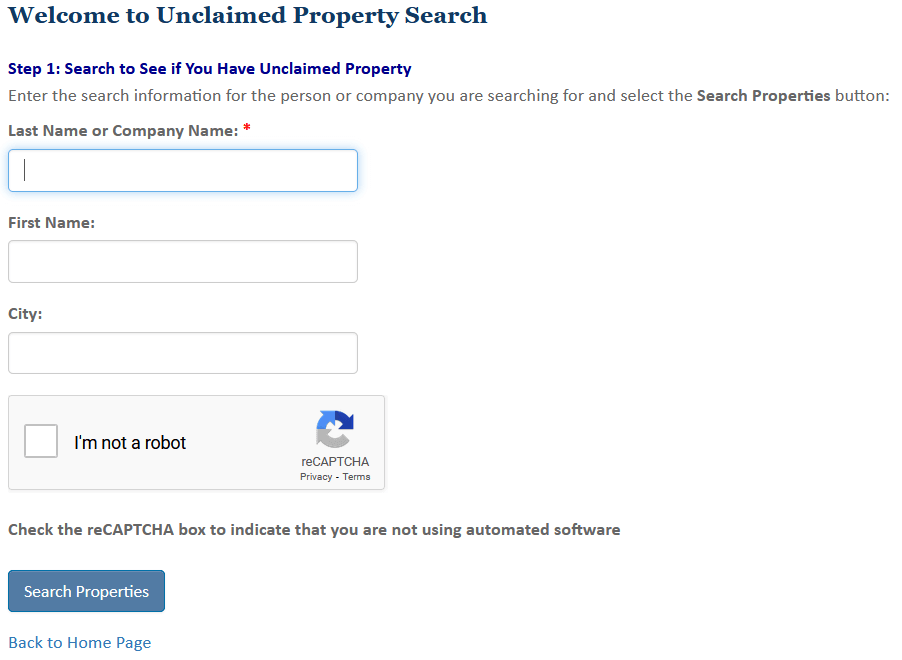

Step 1: Visit the Georgia Unclaimed Property Search website that the department operates. You will want to click on the “search for unclaimed property button” found on the top of the page. There is another link that lets you check on your status once you file.

Step 2: Add your last name to the search box to look for money in Georgia. You can enter a business name in this box and look for results for certain cities. The Georgia website requires that you click a captcha box before it will do a search for you.

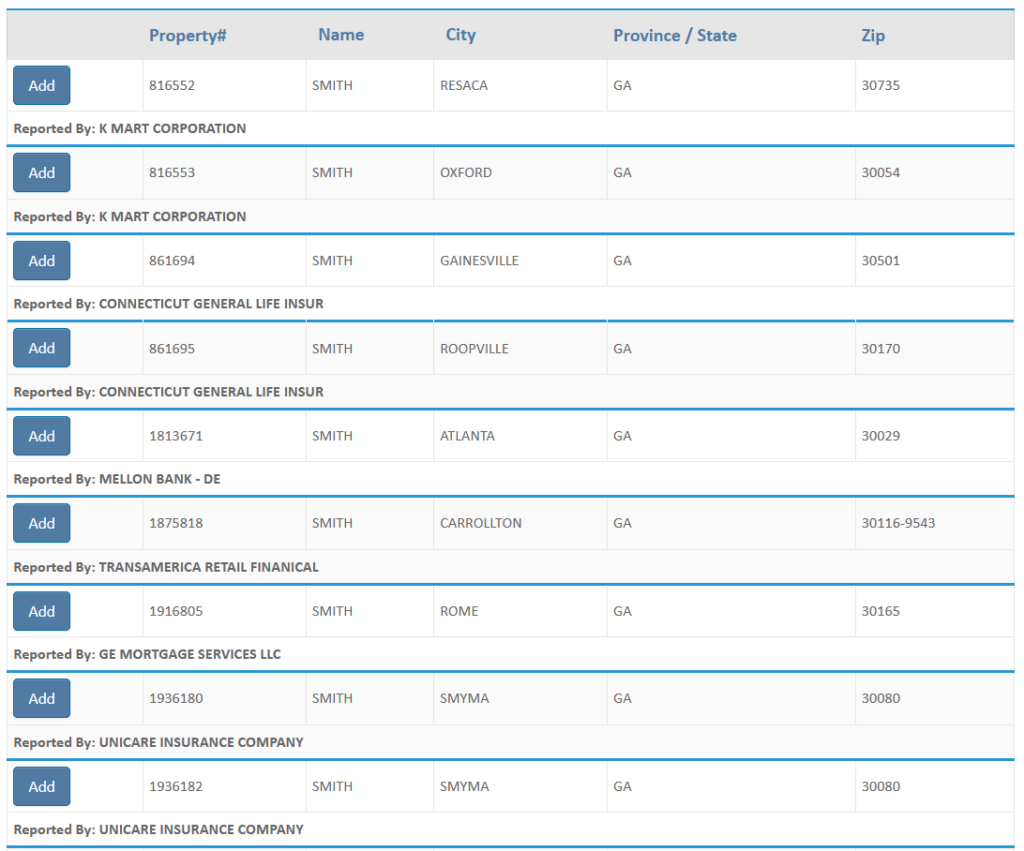

Step 3: Use the search results to find any property that you can claim. The Georgia database shows both the city and zip code associated with the property along with the name of the owner and the name of the holder.

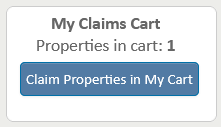

Step 4: Look for the “Add” button next to each claim and click on it when you find a property that belongs to you. This will bring up a new window that shows your claim cart. You need to click on it to start your claim.

How to File Georgia Unclaimed Property Claims

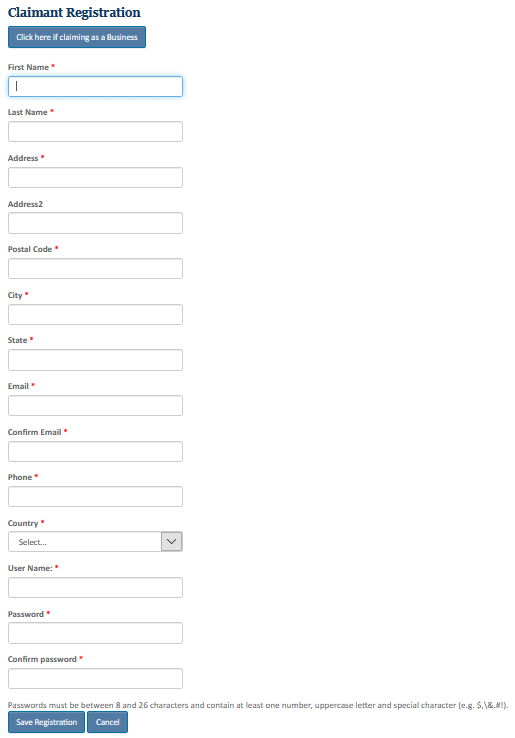

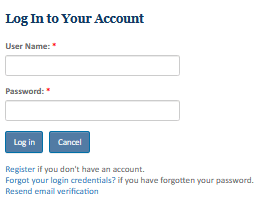

Once you access your claim cart, you can view all the accounts that you own and file a claim. You need to first answer a relationship question, which explains why you can file. Georgia lets you file as the primary owner or if you owned the business associated with the claim. There is also an option for those filing as an executor of an estate or an heir. You can then log in to an existing account that you have with the site or register for a new account. One of the nice features of the Georgia database is that it will keep the property in your cart as you navigate through different pages until you either close the window or leave the site.

To create an account, you need to provide the state with contact information. Georgia asks for your home address with your city and zip code along with your full name. Even if you live outside Georgia, you can still create an account to file claims as long as you have the right to those claims. You’ll also need to add your phone number and email address before picking a username and password.

Keeping Track of Your Claims

With all the things on your to-do list, you may not want to spend even more time waiting for a check to arrive. Georgia allows you to visit the database and click the option to check on the status of an existing claim. This will take you to a page that asks for your username and password. Once you log in with the right information, the database will list all the claims that you filed. Clicking on the claim number lets you see if the Department of Revenue accepted your claim and will send a check or if your claim is still in the process stage.

Where Else Can You Find Unclaimed Property?

Georgia is not the only state that has an unclaimed property database. Many states list these databases through their Department of Revenue or Treasurer Office. You may want to check Missing Money, too. Missing Money functions as a one-stop spot for many states and serves as their public databases. The site asks for just the name of the person and the state that you want to search. You can also get PDF copies of your claims through this site.

Among the other sites that are worth your time include:

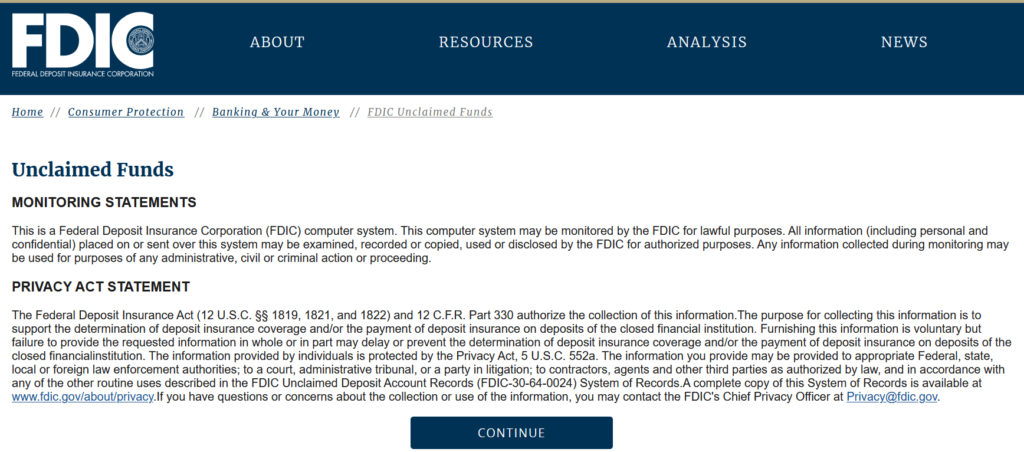

- Federal Deposit Insurance Corporation (FDIC): Through the FDIC, you can find bank accounts that you opened and lost track of over the years as well as accounts that you thought you lost due to the bank closing.

- Department of Veterans Affairs (VA): If you have a close friend or loved one who served in the military, you may want to check with the VA for life insurance policies that they bought. The VA allows heirs to file claims for those policies years later.

- U.S. Federal Investments: Don’t assume that the bonds given to you as a child disappeared because you lost the official certificates. This website helps you find the bonds bought in your name and file a claim for them.

- Department of Housing and Urban Development (HUD): If you have or had a mortgage through HUD, you should check with the department. It often releases refund checks for mortgage holders.

- Pension Benefit Guaranty Corporation: To find information about the pensions held by living and deceased persons, check with this corporation. You’ll also find easy-to-follow instructions on how you can claim an account as an heir.

- Internal Revenue Service (IRS): The money that you get back on your taxes is money that belongs to you. The IRS lets you check online for missing refund checks.

- U.S. Railroad Retirement Board: The U.S. Railroad Retirement Board helps the loved ones of former workers find any retirement funds that belong to the family and file claims to transfer the funds to new accounts.

- National Credit Union Administration: You can work with the National Credit Union Administration to find money that went missing when you had an account with a credit union that closed. It offers records for both national and local credit unions.

Does Georgia Keep All Types of Unclaimed Property?

As you search the Georgia database and see all the different types of unclaimed property, you might assume that the state holds all of that property. Georgia only has a limited amount of space through the Department of Revenue, which is why it allows the department to sell some types of property. A good example is a safe deposit box. When you open a box, you must pay the bank for at least the first month of your rental. If the owner does not pay rent for a minimum of one year, the bank will send a certified letter to the last known address of the owner. The owner then has 30 days to pay the past due balance before the bank has the right to open the box and sell the contents. Georgia law allows the bank to take any funds that pay the remaining balance before sending the rest of the money to the Department of Revenue.

Georgia has similar laws that cover what holders can do about securities. The holder must send a certified letter to the owner as their listed address and give them time to respond. If they do not receive a response, they will turn the securities over to the Department of Revenue. The securities will then go up for sale to the general public. Georgia will take the money raised from the sale and hold it in an account for the owner.

Unclaimed Property Laws in Georgia

You may want to check out the unclaimed property laws in Georgia to make sure that you understand what the state lets you do. The Peach State has laws about what hospitals can do when patients pass away and leave property behind or when they have balances due to their families. There are also laws about how holders can report any abandoned accounts that they oversee and what they can do with those accounts as well as how long they have to report the money.

Georgia Unclaimed Money FAQs

When Does Georgia Consider Property as Abandoned?

In most cases, Georgia will consider property as abandoned after five years of no activity on the part of the owner. This includes both bank accounts and uncashed checks as well as stocks and bonds. Any gift cards or certificates issued in the name of a specific person also become abandoned after five years of inactivity. If you have a money order that you never cashed, you can claim it after seven years. Georgia regards travelers’ checks as abandoned after 15 years. Employers can turn over paychecks and other payments if they cannot locate the workers after just one year.

Do You Need to Hire an Unclaimed Money Finder?

Unclaimed money finders look for those who do not realize how easily they can find unclaimed property on the web. Many of these servicers charge high fees and take a large portion of your money. They promise to do all of the hard work and file claims. Once they get the money, they take their fees and send you the balance. You usually do not need to deal with money finders. Even if you no longer live in Georgia, you can easily check with the Department of Revenue and file claims for any money that you find.

Can You File Claims in Georgia as an Heir?

When you search for your last name in the database, you’ll likely come across money that belongs to someone in your family. While you can send living relatives a link to the site and tell them what you found, you might worry about what you can do when you find a deceased relative listed. If you are the legal heir of the deceased, Georgia lets you claim the money. You need to state that you are the person’s heir on the form and then submit proof of your relationship. This often means a birth certificate that shows the deceased was your parent or a marriage certificate that lists you as the individual’s spouse. Georgia also lists an option for estate executors. As the executor of an estate, you have the legal right to liquidate the estate as needed and claim accounts or property that belonged to the deceased.

Does Georgia Let You Claim Abandoned Real Estate?

No, the Georgia Department of Revenue does not include abandoned real estate in the database. You may have a piece of land that belonged to someone in your family who passed away without a will. If your family did not go through probate, that property might sit for years with the deceased still listed as the original owner. You should check with the Tax Commissioner of the county where the property sits. The Tax Commissioner can let you know if there are back taxes due and what you need to do to become the rightful owner. This often requires paying all of the past due property taxes and filing court documents that show you are the heir to it.

What Steps Does Georgia Take to Find Property Owners?

Georgia is one of several states that will not take any special steps to find the owners of abandoned property. It leaves this up to the holders, which can send multiple certified letters to the owner and attempt to contact them by phone. Some holders work with agents who are responsible for tracking down the owners of abandoned accounts, but many only use agents if the accounts are worth a lot of money. If you receive a message from an agent, you can usually complete some paperwork and pay any money due to get the account before the state does. Georgia also releases a list at the beginning of July every year that shows the names of anyone added to the database.

How Long Does It Take Georgia to Deliver Your Money?

The biggest question on your mind is likely how long it takes to get your cash, especially if you find a large account. We can’t give you an exact amount of time because it often depends on how many other people filed claims and whether you submit all of the required information and paperwork. Georgia tries to release claims within six weeks of receiving all information but can take longer.

Do You Need a Lot of Information to File a Claim?

Some assume that they need tons of paperwork and documents to file a claim in Georgia. To search for your money, you just need your last name. You also need an internet connection to use the database. When you find money that shows you as the owner, you just need to click a button to claim it and then create an account. That account lets you fill out all of the required steps to get Georgia to release the money to you. As of 2021, Georgia will only send your money in a check that you will then need to cash or deposit in your bank account.

How Much Does It Cost to File an Unclaimed Property Form?

You never need to pay to file for any type of unclaimed property in Georgia. As long as the property shows up in the Department of Revenue database, it is available. You may need to pay some fees if you need to submit more paperwork such as a copy of a court document or a legal certificate. It can cost $25 or more to get a copy of one of those documents.

Can You Stop the Georgia Department of Revenue from Holding Your Money?

The Georgia Department of Revenue will only take control of your property when you do not use it for a period of time that ranges from one year to more than a decade. As long as you keep your accounts from becoming inactive, you don’t need to worry about the state becoming the custodian. Using electronic records is often helpful because you can store files on your computer that you share with others when needed. We also recommend that you cash checks as soon as they arrive instead of putting them off for a few days. The longer that you wait to cash a check, the greater the risk is that you’ll forget about it or lose it.

Conclusion

The Peach State doesn’t list the total amount of unclaimed money that it has, but given the totals found in other states, it’s likely worth $500 million or more. That money can include paychecks and other checks that you didn’t cash as well as gift certificates and insurance payments. Claiming your money is much easier than you might think because the online system lets you find your money and file in just a few minutes. Check with the Department of Revenue today to find your unclaimed property.

Quickly Search For Unclaimed Money

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.