Unclaimed Money Lookup - Kentucky

Free Kentucky Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

(advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Kentucky Unclaimed Money -

The Ultimate Guide 2026

- UPDATED February 2026

Use our guide to unclaimed money in Kentucky to find the funds that you own and claim all of your missing money today.

Contents

Your Guide to Unclaimed Property in Kentucky

Known as The Bluegrass State, Kentucky has millions of dollars in property that go unclaimed every year by locals. You might have money that comes from a utility provider in Louisville or an employer in Pikeville. The state has set laws that list the holder as an organization that handles any type of money or property for a person called the owner. If the holder has no contact with the owner, it must contact the Kentucky State Treasurer. The treasurer is responsible for making sure that the property goes in the database and that the owner can claim it.

One thing that you should know about Kentucky is that it doesn’t have a database that the treasurer oversees. Kentucky works with the Missing Money website, which also partners with other states, including Michigan, Ohio, Virginia and Alaska. Some of those states still maintain separate databases and give users two ways to find their money. Kentucky lists all the funds that belong to its residents on the Missing Money website. Our ultimate guide to unclaimed money in Kentucky will show you how to use that site and go over the most important things that you need to know.

Types of Unclaimed Money in Kentucky

You may want to learn about the different types of unclaimed money in Kentucky before you search to see the property that you might find. One example is a security deposit. Let’s say that you rented an apartment in Lexington and later moved to Tennessee for a new job. Kentucky law requires that the property owner return the deposit to you minus any money they used for repairs. If the landlord or owner has no way to contact you, they cannot return your deposit. They will need to hand over the money to the treasurer if you do not claim the deposit within a year. The deposits that utility providers charged and did not return are also available.

Another example of the unclaimed property found in Kentucky is a bank account. Though some people can’t imagine walking away from an account that has money in it, this can happen for any number of reasons.

You might forget that you and a former spouse opened a joint checking account, or you might lose track of a bank account your parents opened for you. Bank accounts in Kentucky become inactive after one year and dormant the following year. Any money in that account along with the interest that it earned belongs to you. One search of the Missing Money website can help you find your account.

Insurance payments that belong to Kentucky residents also appear on the site. Let’s say that you bought a policy that covered your home and paid for a year in advance but then changed to a different insurer. The original insurance company is responsible for sending back the money that you paid when you cancel your policy.

You may find similar funds that relate to auto insurance or renters insurance that you bought. Missing Money can also help you find money as an heir or beneficiary listed on a policy bought by a loved one who died without keeping track of the policy. Checks and lost wages are other types of unclaimed property.

As Kentucky is home to many coal mining companies, you may find mining royalties listed online, too. A mining royalty deal is a contract between the owner of the property where the mine is and the mining company.

The company agrees to give the owner a set amount of money based on the coal found in the active mine. This often ranges from 6.2 to 8.2%. Many contracts allow the owner to name a beneficiary who is the person who will inherit the deal when the owner passes away. If a loved one in Kentucky had a royalty agreement, you might find that you are now the owner of that contract.

How to Find Unclaimed Property in Kentucky

To find unclaimed money and different types of property in Kentucky, you need to start on the Missing Money website.

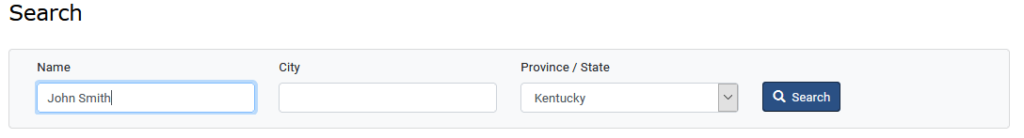

Step 1: Visit the Missing Money website and click on the “Search” button to start.

Step 2: Use the drop-down menu to select Kentucky as the state you want to search and enter your full name in the name box. Though you can use just your last name, using both your first and last names will help you see only the claims that belong to you. Missing Money also allows you to add the name of a city.

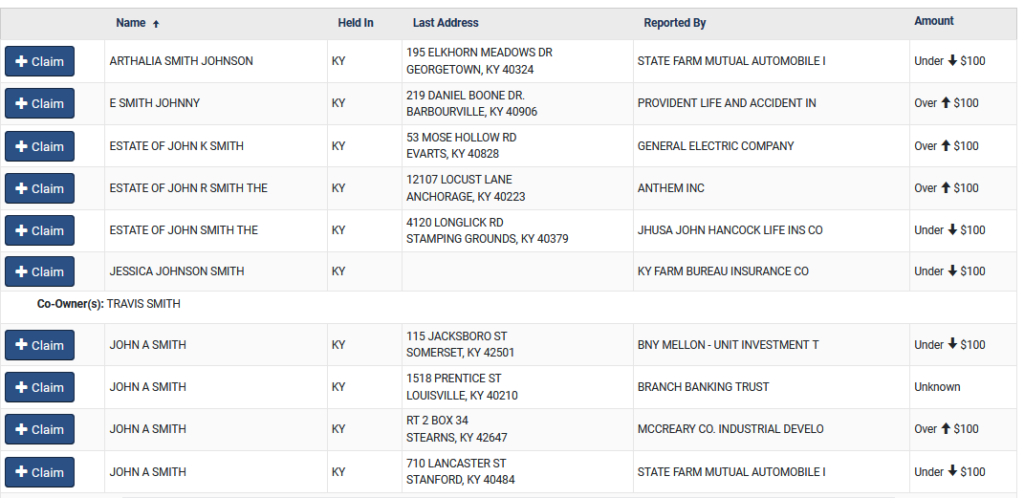

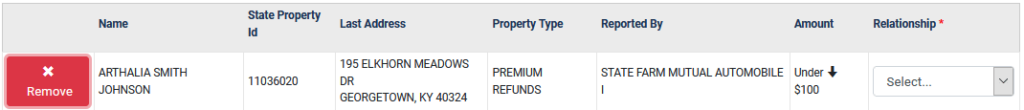

Step 3: Check out the alphabetical list of results to see all of the accounts that match your name. Missing Money lists the name of the person shown as the owner and their address as well as who reported the account and its general worth. You can see if the amount is worth more or less than $100. If the account has a co-owner, that person’s name will also appear.

Step 4: Find the blue “Claim” button that sits on the right side of the account. You need to click on this button if you believe that you can claim the account. Missing Money allows you to click one or more claims on each page before you file.

Step 5: Look for the “My Claims” button in the upper left corner when you find all of your accounts. You need to click this button to start the process of filing for unclaimed property in Kentucky.

Claiming Property Online in Kentucky

One of the nice things about the Missing Money website is that it lets you file without waiting for forms to come to your home. As long as you follow the steps that we laid out above, you can file in a few steps.

Step 1: Check the name and other information shown on the account to make sure that it belongs to you. You must be the name on the account or have the right to file for that person. If you file as the owner, you need to verify that you lived at the address shown.

Step 2: Click on the Relationship drop-down menu to select whether you want to file as the owner or a representative of the owner. The Missing Money has an “other” option for those who do not meet any of the listed relationships.

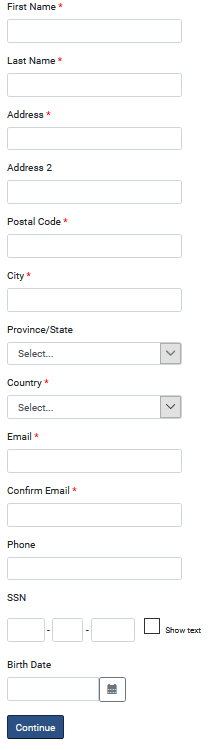

Step 3: Fill out all the blank spots on the form to file. Missing Money asks for your current address and first name as well as your email address. You can add other information, including your last name, phone number, date of birth and social security number.

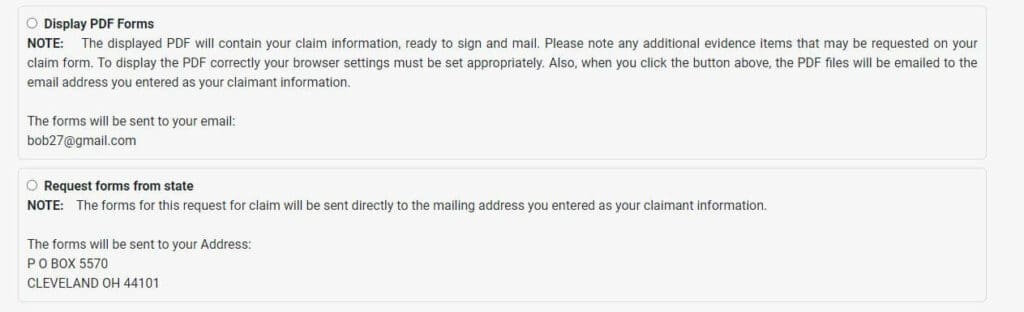

Step 4: Choose how you want to complete your forms. The PDF option allows you to view your forms and complete them online. Missing Money will also send copies to the email address that you entered. If you choose the option to get the forms by mail, Missing Money will send the forms to your current address.

How to File Your Forms

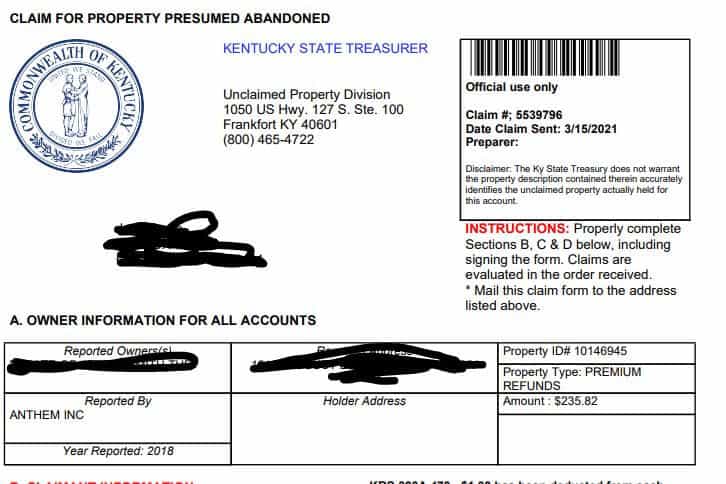

To help you file for property in Kentucky online, we’ll go over the forms that you need to submit and the information you need. Called the Claim for Property Presumed Abandoned, it features the address of the Unclaimed Property Division at the top. You can also see the name of the reported holder and their address along with the name of the reported holder and their address. This form also lists the exact amount of money in the account. The second section lists the name and contact information for the claimant.

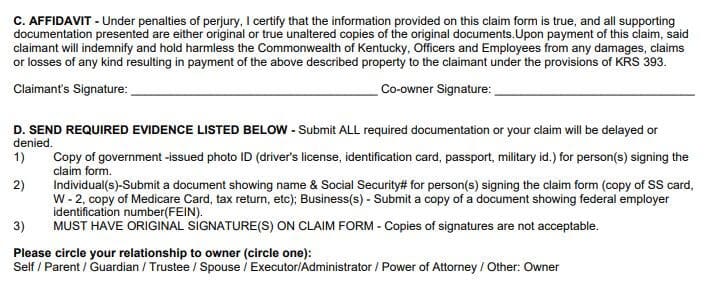

Section C of the form serves as the legal affidavit. Signing this line shows that you agree all the information you shared is correct. Section D shows what documents you need to submit with the form. One benefit of using the Missing Money site is that it fills out the forms with all the important information. You just need to print a copy and gather any of the documents that you need before sending a packet to the Kentucky Unclaimed Property Division in Frankfort, Kentucky.

Are There Other Places to Find Unclaimed Property Outside of Missing Money?

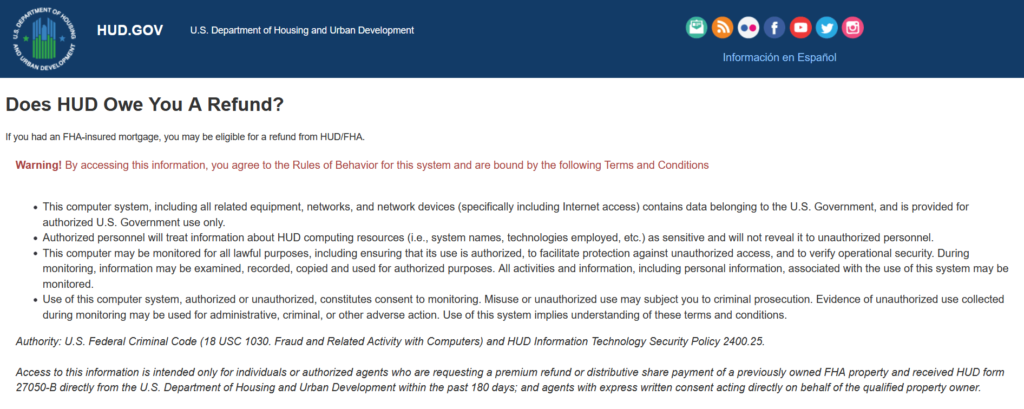

There are some amazing places online to look for unclaimed money such as the Department of Housing and Urban Development (HUD). HUD offers help for those looking for homes as well as support to help owners avoid losing their homes. You can also find out if HUD has a refund check associated with your mortgage. The Department of Veterans Affairs also offers help for those looking for missing money. You can search for life insurance policies and other benefits that belong to anyone you know, including those who passed away.

Many employers offer retirement accounts that help employees put money back for their golden years. Not everyone who opens one of these accounts will use all the money though, which is why you should check resources such as the U.S. Railroad Retirement Board, which keeps track of the accounts opened by railroad employees. You can easily find out if your grandparent or parent had a pension account that their heirs can claim. The Pension Benefit Guaranty Corporation offers similar support for retired workers and their families who want to find pensions they once had.

The Federal Deposit Insurance Corporation insurers the funds that banks keep on behalf of others. This corporation ensures that people who banked with certain institutions find their money. You can claim accounts held by banks that closed years ago. Similar help is available from the National Credit Union Administration, which tracks credit unions across the country. Whether the credit union merged with a major bank or completely closed down, you can still claim the money held in a closed account.

U.S. Federal Investments gives you the chance to look for treasury bonds that you bought for a child and those purchased for you. You can file a claim with the name listed on the bond, even if you do not have the bond in your hand. We also recommend checking with the Internal Revenue Service (IRS). You never know when you might find a refund check sent to your old address after the IRS amended a previous return.

Unclaimed Property Laws in Kentucky

Kentucky law protects both the holders of money and accounts as well as the owners who have the right to the property. All of the laws relating to unclaimed property in the state is part of KRS Chapter 393A, which you can view online.

Kentucky Unclaimed Money FAQs

What Do You Need to Claim Money in Kentucky?

The Kentucky Treasurer requires a minimum of a photo ID issued by the government of the claimant. If multiple people need to sign the form, you need a copy of each person’s photo ID. Kentucky will accept your driver’s license or state ID as well as a copy of your passport or a military ID. You also need proof that each person who signs the form has a social security number. Though you can send a copy of your official card, you can also use your W9 form or past tax returns. Kentucky also asks that you sign and date the bottom of the form. It will not accept a copy of the form.

If you want to file for Kentucky money that belongs to a minor, you need both the child’s birth certificate and social security number. It’s easier to file a claim if you appear on the birth certificate at the child’s parent. Guardians and those with legal custody need the same information along with paperwork that shows their relationship with the child. Kentucky also lets you file on the behalf of a trust. You need both a copy of the official trust and the tax number of it. If the original owner of the trust passed away, you also need their death certificate.

Can You Claim Property if You No Longer Live in Kentucky?

Yes. Kentucky does not block you from claiming the property that belongs to you just because you moved across the state or country. If your current address is different from the one attached to the account, you can submit any type of proof that you lived there in the past. You may want to check your email for an old utility bill that lists the address. The IRS also allows you to print copies of a past return that shows the reported address as your former home.

How Can You File for a Deceased Person?

It’s easy to file for a deceased’s money as long you had a relationship with the individual. You may want to file as the administrator or executor of the estate or just as the deceased’s next of kin. Kentucky requires both a copy of the death certificate and the deceased’s social security number. If the person’s name changed since the holder reported the account, you need documents that show the deceased’s original and later names. When filing for an open estate, you need court paperwork that lists your position within 60 days. To file on the behalf of a closed estate, Kentucky asks for proof of your position within the estate and documents that show you can legally claim the property. In cases where the heirs do not open an estate, Kentucky requires proof that they are heirs and that the deceased passed away. The treasurer will then determine what other information you need to supply.

What Should You Do if You Find Business Assets Listed?

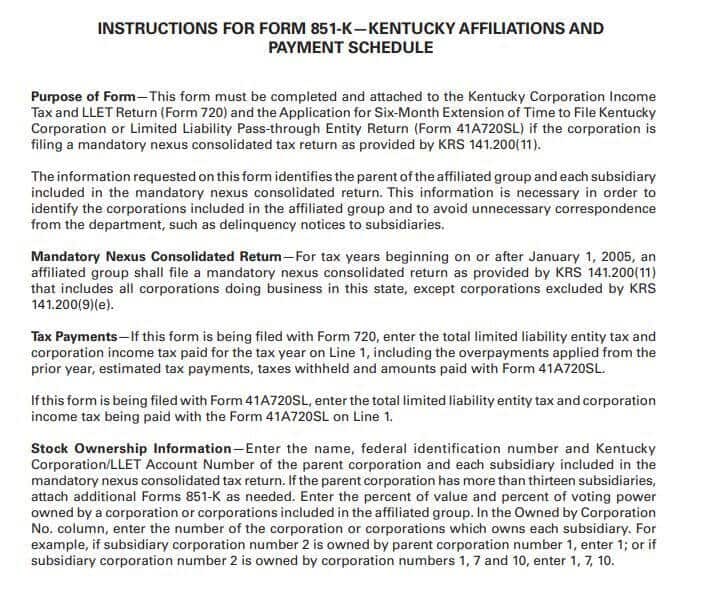

Business assets refer to any type of property that a business owns. When a business closes down, the holders may have a hard time finding the owners and turning over the assets, which will lead to them showing up in the Missing Money database. If you were the owner of the business, you can still file a claim. The site lets you pick this option before you file. You need official paperwork that shows you were the owner along with Form 851, which you can request from the state. The state may also require an affidavit that shows the business no longer exists and that you have the legal right to any property owned under the business’s name.

How Long Can Holders Hold Your Property?

Though you might think that organizations can hold your property for years, Kentucky law gives them the right to turn over that property in as little as three years. This keeps them from wasting time and money as well as space on things that belong to others. Holders can contact the treasurer about most forms of property three years after the owner abandons it. This is true of any property that the holder retains in exchange for a rental fee such as a storage unit or safe deposit box. They can turn over money orders after seven years and traveler’s checks after 15 years.

Can You Claim Race Winnings?

The Kentucky Derby is one of the largest and most famous horse races in the world, but the state hosts other racing events, too. When you bet on a horse and have a winning ticket, you have two years to claim your winnings before the track will contact the treasurer. If you used your name when placing the bet, the treasurer will list the ticket as a type of unclaimed property in the Missing Money database. Once the ticket appears in your searches, you can claim it in the same way you would any other property.

How Much Unclaimed Property is in Kentucky?

According to the State Treasurer, The Bluegrass has more than $490 million in unclaimed property owned by current and past residents. Though the chances of finding an account with $10,000 or more in it are very small, many people find funds that they forgot they owned that are worth smaller amounts.

What Does a Money Finder Do?

You might hear the term fee finder or money finder used to describe the same type of people. Finders can contact you out of the blue or when a loved one dies. They offer to find missing money that belongs to you or someone who passed away. Not only will they do all the legwork, but they’ll even send a check to you. The biggest problem with fee finders is that they charge high fees for their services. Thanks to the Missing Money site, you can file a claim for any situation without paying any fees. A finder must have the owner’s social security number and a contract that shows they have an official agreement with the owner.

What Steps Can You Take to Keep Your Money Safe?

The Kentucky Treasurer recommends that you keep track of all the accounts that you open and do a checkup at least once a year. Taking a few minutes to log into your accounts will let the holders know that you’re still around and stop them from counting down until you abandon the account. You should also keep track of certificates of deposit and other physical property that you own as well as tell your loved ones about them.

Conclusion

As Kentucky doesn’t have a statute of limitations on unclaimed money, you don’t need to worry that the state will take your money before you can claim it. That doesn’t mean you should leave your property in the database though because you never know when someone might attempt to claim it on your behalf. The Missing Money database helps you find everything from uncashed paychecks and insurance payments to bank accounts and winning race tickets. With our ultimate guide to unclaimed money in Kentucky, you can learn everything you need to know about the process.

Quickly Search For Unclaimed Money

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.