Unclaimed Money Lookup - Maine

Free Maine Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

(advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Maine Unclaimed Money -

The Ultimate Guide 2026

- UPDATED February 2026

Find out how quickly you can claim any of the millions of dollars of unclaimed property held in Maine in our ultimate guide.

Contents

- Your Guide to Finding Unclaimed Money in Maine

- What is Unclaimed Property?

- How to Find Unclaimed Money in Maine

- Steps to Filing a Claim in Maine

- Finding Unclaimed Property Via the Map Search

- Who Can Claim Abandoned Property in Maine?

- Are There Other Online Databases That You Can Search?

- How Much Unclaimed Money is in Maine?

- Unclaimed Property Laws in Maine

Your Guide to Finding Unclaimed Money in Maine

What would you do if you got a letter that said you had unclaimed property and just needed to fill out a form to claim it? If you’re like most people, you would just laugh and throw the letter away because you thought it was a scam. Maine often sends similar letters to residents to inform them of the state’s unclaimed money database and encourage them to search it. This database helped people just like you claim several million dollars over the last few years and has even more money waiting for the owners today.

We know that you might wonder about how the site works and what you need to do to claim a property, which is why we created the ultimate guide to unclaimed money in Maine. Our guide to the Pine Tree State covers the different ways to use the site and what you need to file as well as how much money Maine has and where else you can find missing money on the web.

What is Unclaimed Property?

Maine considers unclaimed property as any type of financial asset that has a missing owner. Owners can go missing for any number of reasons. In many cases, the original owner passed away and did not notify the co-owners that they had property in their names. You may also appear as a missing owner because you moved without updating your contact information, or you changed your name after your marriage. The holder who has your property may attempt to find your current location and have no luck because they used your maiden name.

Refund checks are a common example of the unclaimed property found in the Maine database. When you buy products from some stores, you receive a form that lets you get some of your money back when you file it. If you never got the check for that refund for any reason, the state should have the money and put it in the database. Refund checks can also come from utility companies that drafted checks for the balance on your account when you turned off the service. Many utility companies will send checks to your last known address and make no other attempt to find you.

You can search the Maine database for unpaid wages, too. Employers must keep track of the money that workers earn and pay them for their time. If they do not pay their workers, they face steep fines from both the state and the federal governments.

You may find a check that pays you for a few hours that you worked at an old job or one that covers some of the overtime that you worked. Maine also keeps track of checks issued for those who quit their jobs without picking up their last payments and those who earned expense checks from their employers.

We recommend that you use the database if you ever had a bank account in Maine. Even if the bank closed the branch that you used, your money is still out there. Banks usually need to follow some set laws that tell them how long they need to keep accounts open with no contact from the owner. This allows your money to pick up some interest before it goes to the state. All banks in Maine must follow the same laws and eventually turn over abandoned accounts to the state.

You can also find certain types of physical property held by the state. Stocks are just one example. When you add stocks to your investment portfolio and then lose track of them, you may find that the state database shows dividends that you can claim. You can claim those dividends, even if you no longer have the stocks in your hand. Maine will hold the contents of abandoned safe deposit boxes, too. Depending on how quickly you find the box and file your claim, you might receive the full contents. In some cases, you only get the value of what the contents sold at auction.

How to Find Unclaimed Money in Maine

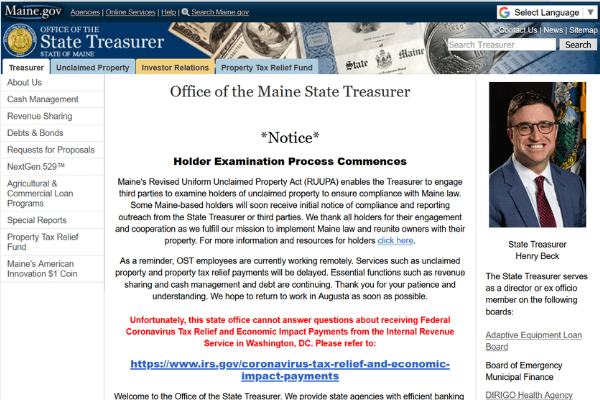

To find unclaimed money in Maine, you need to check with the Unclaimed Property Website created by the Maine State Treasurer. This website offers two ways for you to find your money.

Step 1: Visit the Maine Unclaimed Property Website, which offers information on the amount of money that the treasurer holds for others and the types of unclaimed property in the state.

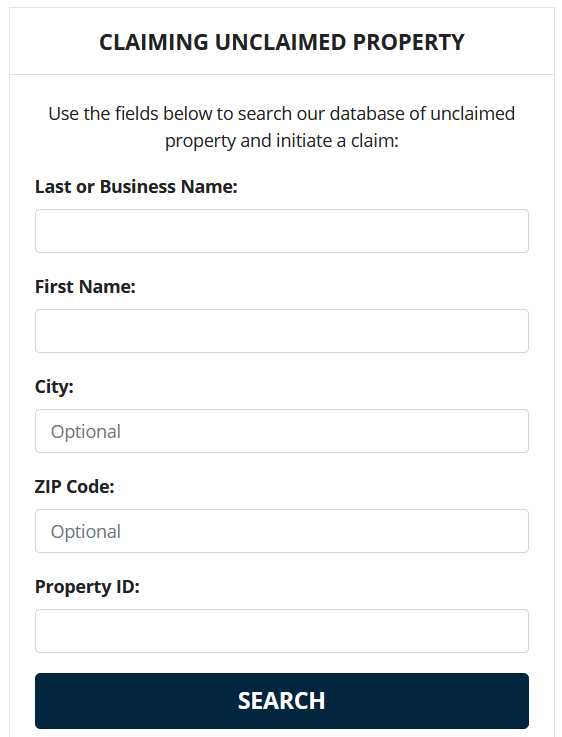

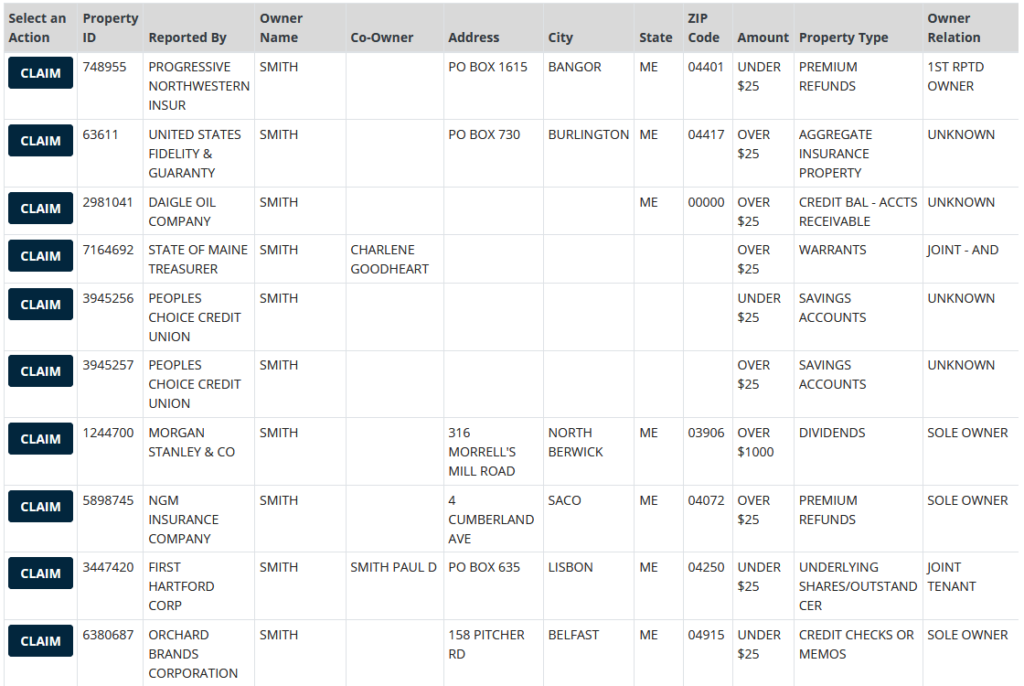

Step 2: Locate the box titled “Claiming Unclaimed Property” near the bottom of the site. You will enter as much information as you want to use for your search. Though you need a minimum of your last name, you can add your first name, the property ID number and the name and/or zip code of your city.

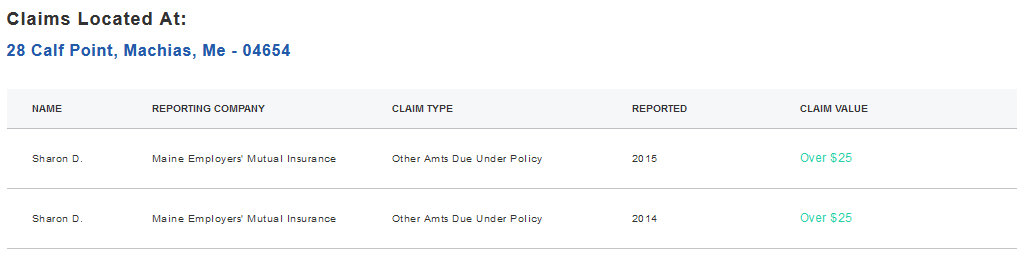

Step 3: Look for the claims that you can file via the search results page. As long as you are the owner listed on the property and lived/live at the address shown, you can file a claim in Maine. You may want to check the type of property and the holder’s name to make sure that you had dealings with that holder. Maine will also show whether the value of the property is over or under a certain amount such as $25 or $1,000.

Step 4: Click two buttons to start the claim process. The first is the “Claim” button on the left side of the screen next to the account. You also need to click the “Claim Available Property” button at the bottom of the page.

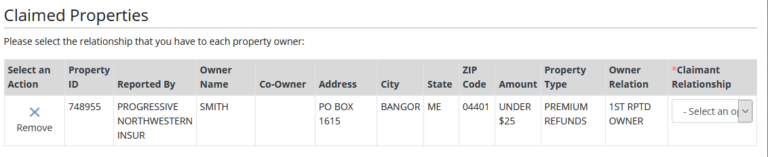

Step 5: Verify that your information matches that shown on the claim, which means that you have the right to it. You also need to select the “Owner” option when filing a claim for your property or use one of the other choices if you file for someone else.

Step 6: Click the “File Claim” option to go through the filing steps.

Steps to Filing a Claim in Maine

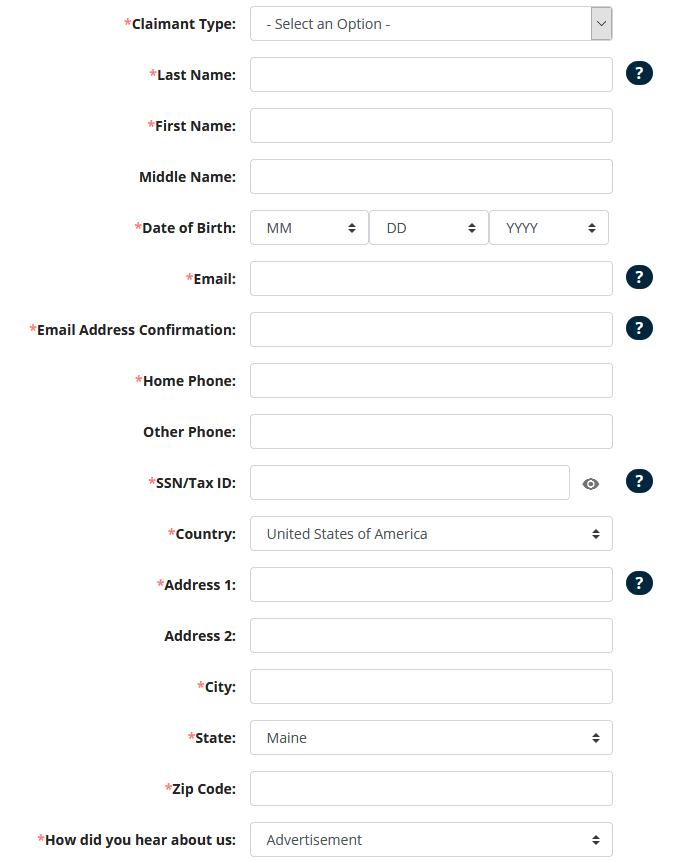

Step 1: Fill out your contact information on the form found on the next page to show Maine that you want to claim the property. You will see a pop-up window that finds your address in the state’s system, which ensures that you get any necessary letters or documents.

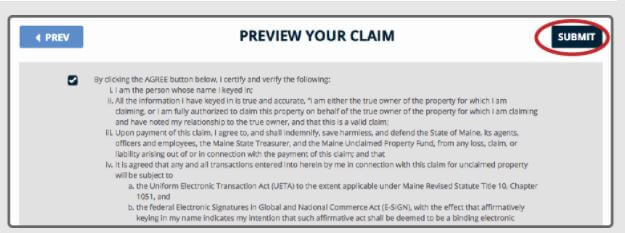

Step 2: Look over the information on the page to make sure that everything is correct. Once you click on the “Submit” button, your claim will go to the treasurer for processing.

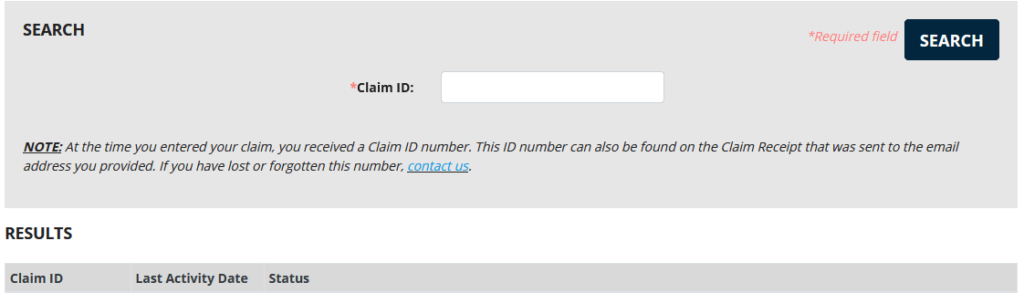

Step 3: Check your inbox for an email from the Maine State Treasurer that shows you filed. You’ll want to find the claim ID number on this form.

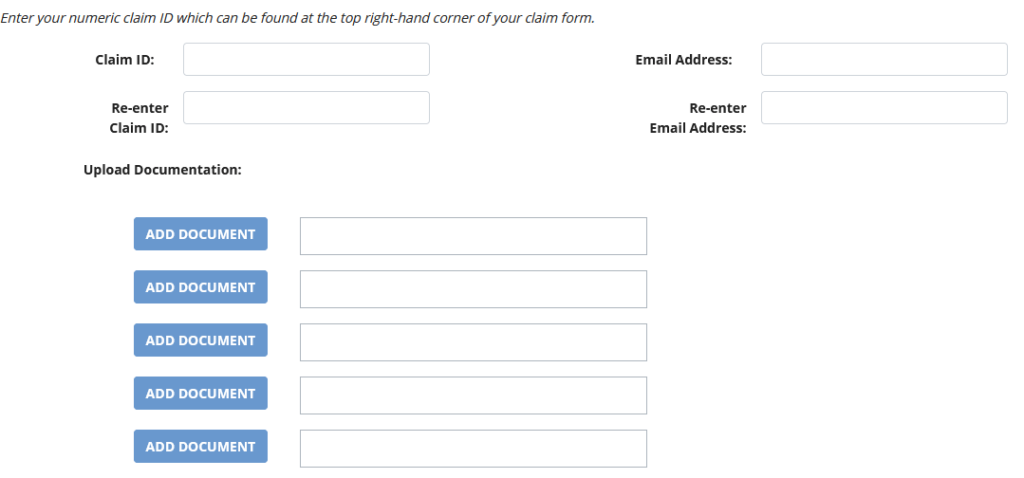

Step 4: Visit the upload claim documents page to add all of your required documents. Maine will accept up to five documents and requires that you add the claim number and your email address before you upload them.

Finding Unclaimed Property Via the Map Search

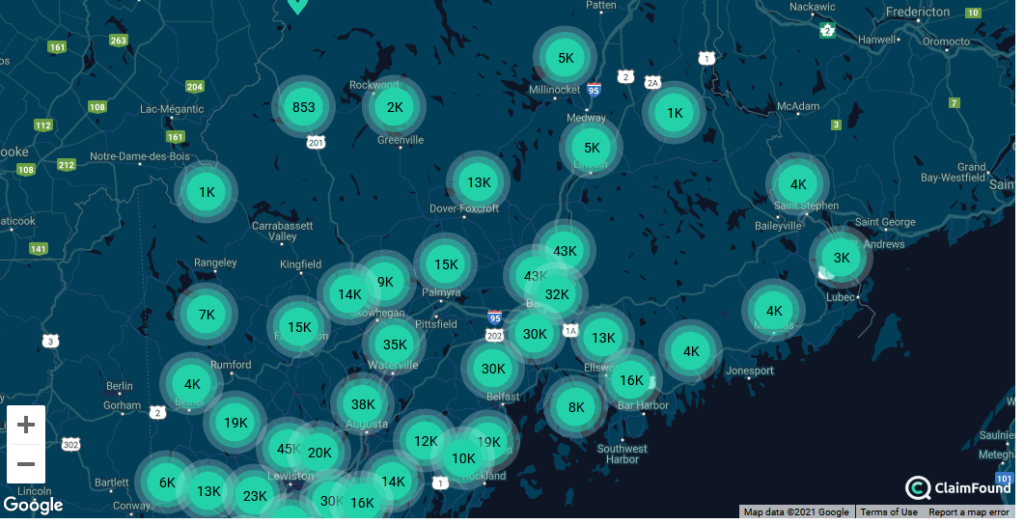

Maine introduced the map search as an easier way for locals to find their missing money. Available on the homepage, the map shows the amount of money found in each city or region of the state. You can click on any of the circles shown on the map to zoom in and find your home listed. The map also lets you enter your current or former address in the search box and find your money that way.

Once you find a specific address, the database will list all claims located at that address. You can see the name of the owner and who reported it as well as the value of the property. When you click on the claim value, the site will direct you to the form found through the previous method and ask you to go through the same steps.

Who Can Claim Abandoned Property in Maine?

The Pine Tree State allows you to file as the sole owner if you are the owner shown on the account, and it does not list any co-owners. Joint owners can file in one of three cases. The first is for the full value of the property. You can only choose this option if you plan to file paperwork with the listed owner. If you appear as the owner or co-owner and will not file with anyone else, Maine allows you to claim half of the value of the property. You also have the right to file as the surviving owner if the co-owner is deceased.

Maine has a personal representative option for those filing on behalf of a deceased person. You need to open a probate case for the deceased’s estate and have paperwork that shows the court appointed you as the executor. With the heir option, you can file without going through probate as long as you can show that you are a legal heir. Maine also has filing options available for trustees and those named as guardians of minor children.

You may need to file a claim to obtain assets owned by your business, too. If the business is still open, you must be the listed owner and have the legal right to claim assets in the name of the company. Maine lets you also file if your business closed. You need to submit paperwork that shows you were the owner of the business and that you are the owner of any assets that it once owned.

Are There Other Online Databases That You Can Search?

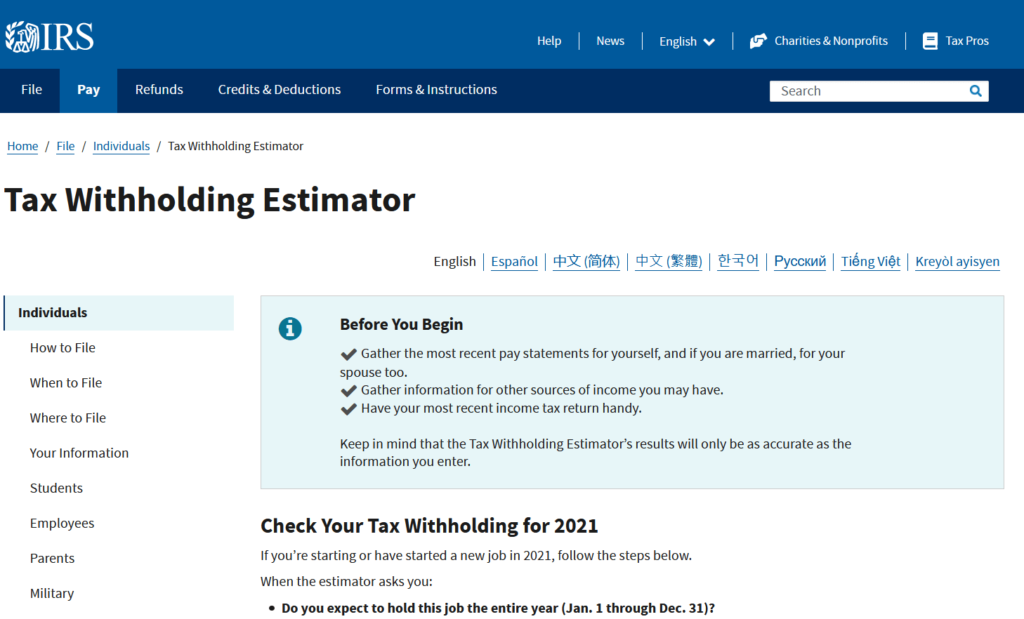

While you may want to start with the Maine Unclaimed Property Website database, it’s not the only place where you can search for money. The Internal Revenue Service (IRS) is a great place to start because nearly everyone files taxes. You can set up a direct deposit for future refunds and find out what happened to refunds that never reached you. The IRS helps you track refunds every year as well as stimulus payments.

The Department of Veterans Affairs is a good place to look for benefits that the veterans in your family had and never used. As the child of a vet, you might qualify for benefits that you never heard about, too. You’ll also want to look for life insurance policies that a vet took out and no one claimed. The Federal Deposit Insurance Corporation lets you view records of banks that closed and file claims for accounts held by those banks years after they shut down. You’ll find similar records through the National Credit Union Administration, which focuses on credit unions rather than banks.

There is also U.S. Federal Investments. Many families make investments in the form of treasury bonds that they buy for kids. Those bonds mature as the children age and let them get cash later. You can claim your bonds through this site and find those that you didn’t know existed. With the Department of Housing and Urban Development (HUD) database, you can find out if the government has a refund check that relates to your mortgage.

We also recommend using other online databases such as Missing Money that has information for many states across the country. The site gives you the option of adding all the information that your claim needs through the web. For pension and retirement accounts, you should check with both the Pension Benefit Guaranty Corporation and the U.S. Railroad Retirement Board. Both sites offer help for those worried about what happened to the retirement funds owned by deceased people and what their families/heirs can do to claim the money.

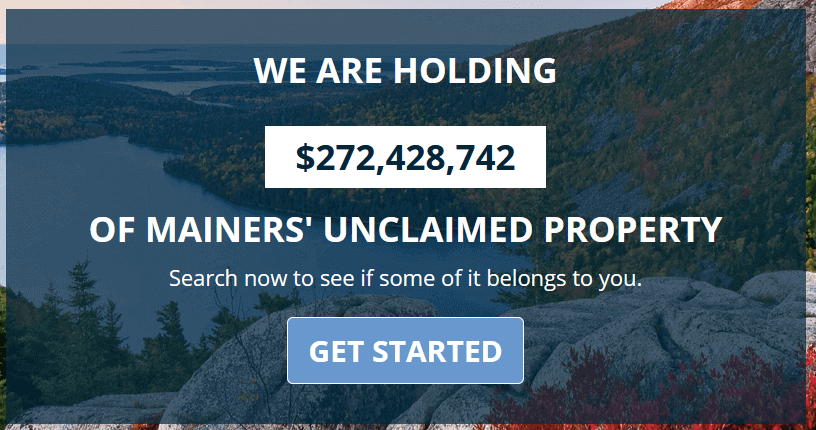

How Much Unclaimed Money is in Maine?

As of March of 2021, the Maine Unclaimed Property Website claims that the state has more than $270 million worth of unclaimed assets. You can search the database with your name or the name of your loved ones. The Maine State Treasurer encourages users to share the site with others and help them find their missing money. Millions of dollars in new accounts go into the database every year, which is why you’ll want to search for your name at least once a year.

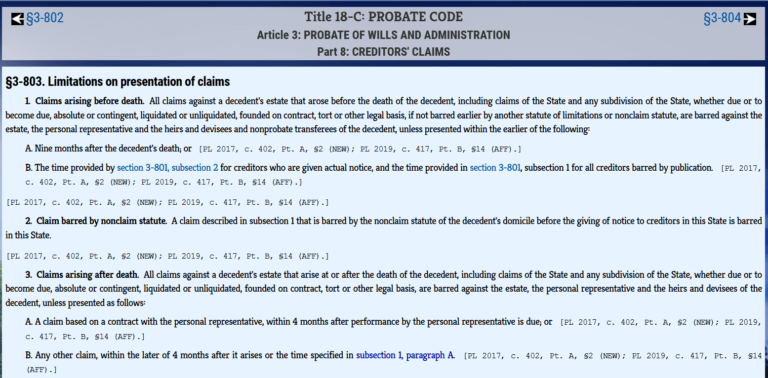

Unclaimed Property Laws in Maine

The Maine Revised Unclaimed Property Act is available online and the best place to learn about the unclaimed money laws in the Pine Tree State. This act shows how long holders have to retain accounts and what attempts they can make to find the original owners before notifying the treasurer. You can also learn more about specific types of property and what the state does with those items.

Maine Unclaimed Property FAQs

How Long Does It Take Maine to Process Claims?

Though Maine works hard to process claims quickly, it cannot guarantee that you’ll get your money by a certain date. In most cases, locals get checks from the treasurer in six to eight weeks after filing. It depends on how many other people filed claims at the same time and if you provided all the necessary information. We recommend using the Maine status checker to find out where your claim is in the process. You need both the email address you listed on the claim and your specific ID number to check your status.

Does Maine Require Any Special Forms?

Maine will occasionally require that you fill out and submit other forms, which you can view online. One form goes over how you can file from home without using the internet. This form also shows you everything that you need when you file through the mail. You may need the Affidavit of Small Estate in Maine, which you will use as a personal representative of an estate. This form also allows you to file claims owned by someone who passed away if you don’t need to probate the estate. Maine also has forms for those filing as legal or business representatives.

Will Maine Give You Any Interest Earned on Your Accounts?

One of the nice things about the Maine State Treasurer is that the office typically lets your accounts earn interest when holders turn them over. If the state receives a certificate of deposit or savings account, it will allow the property to accumulate interest for up to a full decade. When you file a claim, you receive the original value of the account along with all of your interest. In the case of stocks held by the state, the treasurer will pay any dividends or interest earned by the stocks. Maine will eventually sell stocks and other securities and pay you the amount that they raised along with the interest.

Who Can File Claims as an Heir?

Maine law defines the heirs as the closest living relatives to a deceased person. This often refers to the spouse of the individual. If the spouse passed away, the heirs are any children of the deceased. You may have the right to file a claim as a spouse if the deceased died without a spouse or any children if you are their parent or sibling. Maine laws also allow the grandchildren of the deceased people to file claims for their property.

Do You Need to Pay Taxes on Your Claims?

Most of the unclaimed property listed in the database does not require that the owners pay taxes when they file claims. You often need to pay taxes on securities that earned interest before you filed. Maine will usually send a 1099 form that shows you need to pay taxes on that property when you file the following year. These letters typically go out around the end of January to give you time to prepare. You can also talk with a tax expert to see if you owe any taxes. This will help you estimate how much you owe, too.

What is a Maine Money Finder?

Maine money finders are companies and individuals who operate both in the state and other states. They agree to locate abandoned money and accounts for others but charge for these services. Even if you move away from the Pine Tree State, you don’t need to hire a finder or respond to any letters that they send you. Maine offers an online search and has forms that you can download when needed to file your claims.

Can Maine Residents Keep Their Accounts from Becoming Abandoned?

There are some easy things that you can do to keep the property that belongs to you out of the state database. You should keep track of any bank or investment accounts that you open and write down both your account numbers and the contact information of the holders. If you have a safe deposit box, make sure that you pay the rent each month. Some banks let you set up automatic payments, but you need to make sure that the card you use is valid. It’s also helpful to link all of your accounts to a personal email address that you can access whenever you want. This helps you avoid missing emails that go to your other addresses.

Conclusion

Maine wants to help residents find their money, which is why the treasurer and Unclaimed Property Website makes attempts to find owners and tell them about the accounts in the database. You don’t need to keep checking the mailbox and hoping that you get a letter from the treasurer though because the website is so easy to use. Not only does it let you search for money found under any name, but it now has a map option that lets you search for money associated with any of your old addresses. Use our ultimate guide to unclaimed property in Maine to see how you can file for money and other types of property in the Pine Tree State.

Quickly Search For Unclaimed Money

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.