Unclaimed Money Lookup - Oregon

Free Oregon Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

(advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Oregon Unclaimed Money -

The Ultimate Guide 2026

- UPDATED February 2026

Use our ultimate guide to Oregon unclaimed money to find out where to look for unclaimed property that you own.

Contents

- Find Unclaimed Money in Oregon

- Types of Unclaimed Property in Oregon

- How to Use the Oregon Unclaimed Property Database

- Who Can File Claims in Oregon?

- Filing a Claim for Unclaimed Property in Oregon

- Checking the Status of Your Claim

- Are There Other Sites That Help You Find Unclaimed Property?

- What is a Licensed Finder and Do You Need One?

- Claiming Physical Property

- Oregon Unclaimed Property Laws

- Does Oregon Have a Lot of Unclaimed Property?

- Is There Any Way to Protect Your Property?

- How Long Does It Take to Get Your Money?

- Does all Unclaimed Property Appear on the Website?

- What Type of Information Does Oregon Require for Claims?

- Does Oregon Hold Onto Investments?

- Can You Claim Money in Oregon for a Deceased Person?

Find Unclaimed Money in Oregon

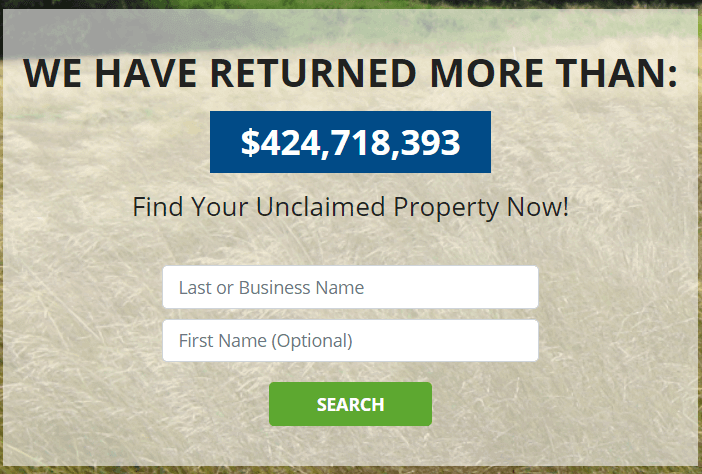

Known as The Beaver State, Oregon is home to many state and national parks that highlight its natural beauty. Whether you live in a big city such as Portland or Salem or reside in a small town, you can easily search for unclaimed money in Oregon. The Oregon Department of State Lands is the government organization responsible for keeping track of unclaimed money and property. As of March 2021, this department returned more than $424 million to people since it launched. You can use this site to search for any unclaimed money that you believe is out there.

Types of Unclaimed Property in Oregon

A big question that you might have is about the type of unclaimed property that Oregon holds. Oregon acts as the official custodian for any funds turned over by the holder. You need to understand what the terms “holder” and “owner” mean. While owner refers to the person who has a legal right to the money, the holder is the organization that holds those funds for the owner. An example is a bank where you have a savings account. If the holder sends one or more letters to your noted address and does not get a response, they will then give the funds to the Department of State Lands.

Refunds are just one example of unclaimed money. Have you ever had power or water turned on at your home and put down a deposit for that service? Many utilities will credit your account with that deposit when you make your payments on time for a period of 12 months or longer. If you moved before getting back your deposit, the utility company may have money for you that it sent to the state. Refunds can also include checks that you got back from companies that you ordered from and accounts that you forgot to close.

Oregon also lists unclaimed wages in its database. Have you ever started working a new job and found that it wasn’t right for you? Maybe you walked out in the middle of your first shift or during a training shift when you realized the job wasn’t the best fit. Employers must pay you for all of the hours that you worked but do not need to go to extreme lengths to get that money to you. The unclaimed property database maintained by the state will hold those funds until the employee files a claim. Other examples of unclaimed money include bank accounts, safe deposit boxes and stocks.

How to Use the Oregon Unclaimed Property Database

Though some states share one database for their unclaimed funds, Oregon has a database maintained by the Department of State Lands. It gives you an easy way to search for unclaimed property owned by a business or individual.

Step 1: Visit the Oregon Unclaimed Money website.

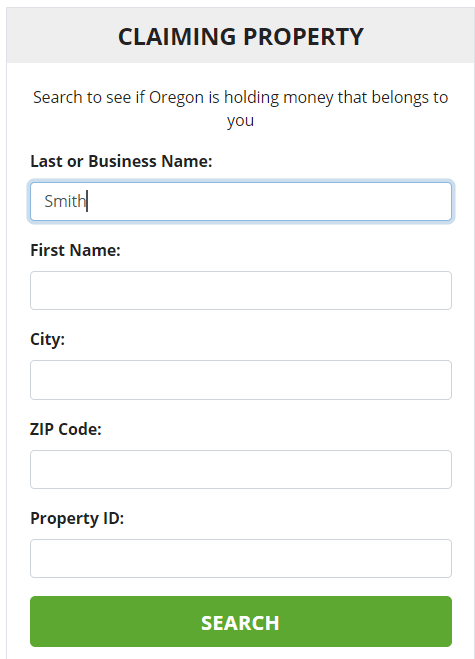

Step 2: Scroll down to find the search box located at the bottom of the page that asks for your information. The minimum that you need to search for unclaimed property in Oregon is your last name or the name of your business. Once you enter the name, click the “search” button.

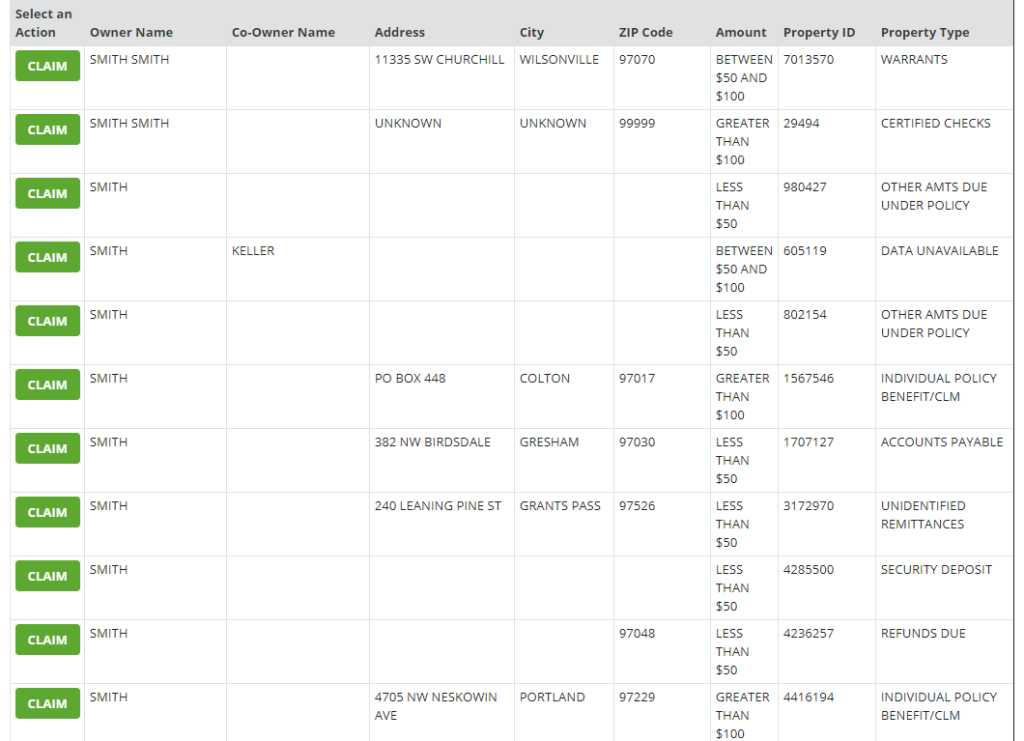

Step 3: Wait for the results of your Oregon search to load on a new page. Though you may find multiple pages of results, you should focus on those that match both your name and address. Oregon lists the full name on the property and their address as well as the property ID number and type of property. This helps you see it is a refund check or another type of payment. You can also view the general amount that you can claim.

Step 4: Click to claim any of the accounts that belong to you. Once you finish selecting claims, look for the button on the bottom of the page and click on it to begin the process.

Step 5: You will then need to confirm that you selected the right accounts and pick an option from a drop-down box. This box asks if the claim belongs to you or if you are filing for another person and your relationship with that person.

Who Can File Claims in Oregon?

Oregon refers to you as the owner if you are the person listed on the property. A joint owner is someone who co-owns the property with another person. You can claim as a joint owner and get the full property if the other person passed away. If you want to file and the other co-owner is still alive but does not have contact with you, you can file for half of the property. Oregon lets you file on behalf of a business if you are listed as the owner. If the business closed, your name must appear as the former owner and that you retain the assets of the business. You can also file a claim as a legal representative of the individual’s estate if you have permission from the court such as documents that show you have the power of attorney or guardianship of the person.

There are also three ways in which heirs can file claims on the behalf of an estate. The first is if you are the heir of a small estate. A small estate must have a low value when you factor in its debts and assets. This allows you to file claims in the name of a deceased person and use the money to cover their bills. Heirs of an open estate can file while the estate is in probate.

This usually allows the family to add the accounts to the estate’s assets and get money to pay the mortgage and other expenses. Oregon offers heirs of closed estates to file claims as long as the case already went through probate. Those listed as the administrators of trusts can file claims through the state’s system, too.

Filing a Claim for Unclaimed Property in Oregon

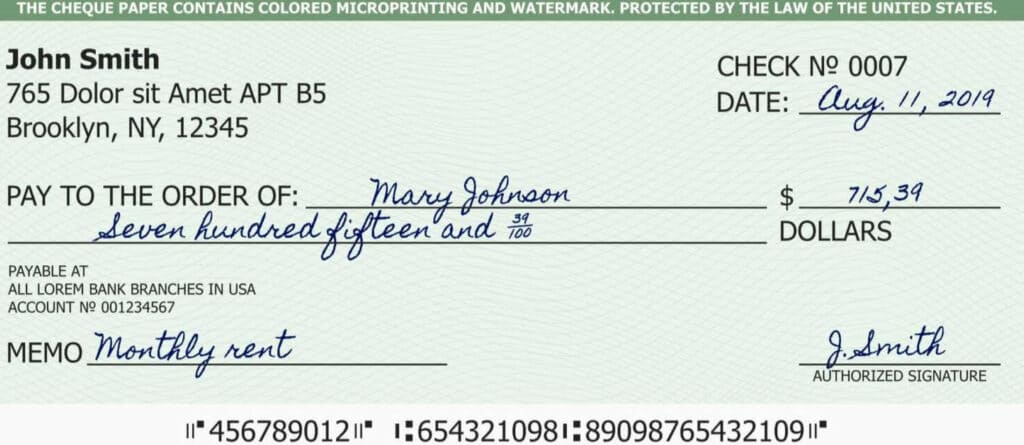

Now that you know how to search for unclaimed property in Oregon, you need to know how to file a claim. Once you select a claim, you need to enter your information, including your address and full name. If the site cannot find your address in the database, it will show the one that best matches and let you pick it. You will then need to gather all of the documents that you need and submit them to the department. Oregon will send you an email that lists the required documents. You usually need to upload your photo ID and social security card along with a utility bill or other proof of your home address. Oregon also has laws about the documents that you can use, which we included below.

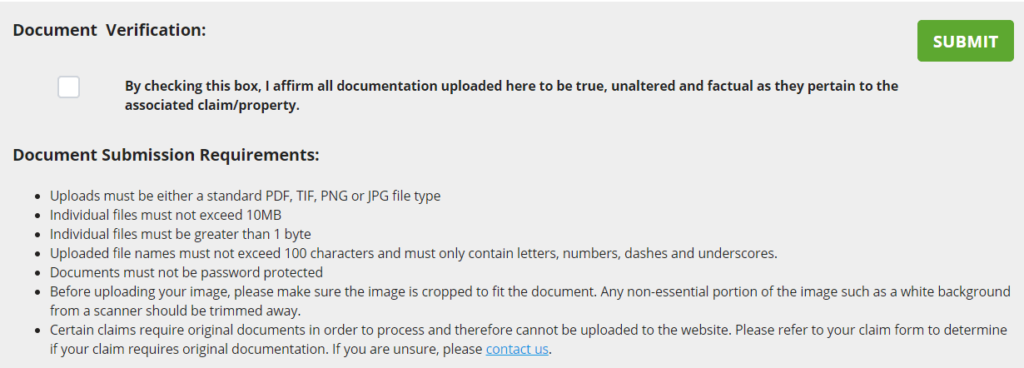

You then need to visit this website to upload your documents. Oregon only accepts five documents per claim. If you need to submit more documents, you must reload the page and enter both your name and claim number again. Depending on your internet speed, it may take just a few minutes to upload everything.

Checking the Status of Your Claim

Though Oregon lets you complete all steps to file a claim online, it doesn’t update you about the process. You may find that you wait weeks without hearing anything back. Search Your Claim’s Status is a free website from the Department of State Lands. This site lets you enter the property ID on your form and see where you are in the process. You may find that the state needs more information for you or that your check is on the way. Oregon also provides contact information if you need help finding your property ID.

Are There Other Sites That Help You Find Unclaimed Property?

The Oregon database is not your only option for finding unclaimed property. Did you ever work in a different state or spent time living in another state? Even if you only went to college in another state for a year or two, that state might have money for you. Other resources can help you find unclaimed money held by the federal government and other organizations.

- Department of Veterans Affairs: You should turn to the VA if anyone in your family had a life insurance policy through the government. Even if the person passed away years ago, their heirs can still claim the policy.

- Department of Housing and Urban Development (HUD): HUD mortgages help those who normally could not afford to buy a home. Not only does HUD help you find mortgage refunds, but it includes information on common scams associated with those refunds.

- Pension Benefit Guaranty Corporation: Through this corporation, you can request information about pension accounts that your loved ones had. It also provides support for those who inherited a pension.

- National Credit Union Administration: If you ever banked with a credit union that closed its doors, check with the administration to see if your funds are still available. You may find that the money moved to another institution.

- U.S. Federal Investments: Treasury bonds are available for kids and reach maturity as they age. If you believe that you have a bond that you lose, this site can help you find it.

- Federal Deposit Insurance Corporation: No matter where you lived or banked, this website can help you find funds held by banks that no longer exist. This includes banks that closed permanently and those that other banks acquired.

- U.S. Railroad Retirement Board: Those who worked for the railroad may have pensions or retirement accounts that their heirs can claim. You can use this site to find out if your parents or grandparents had accounts that still exist.

- Internal Revenue Service (IRS): The IRS has a tool that makes it easy for you to find missing refund checks. It even offers support if you never received a stimulus payment.

- Missing Money: Go beyond Oregon with Missing Money, which is a website that partnered with multiple states. You can search all of those states for unclaimed money.

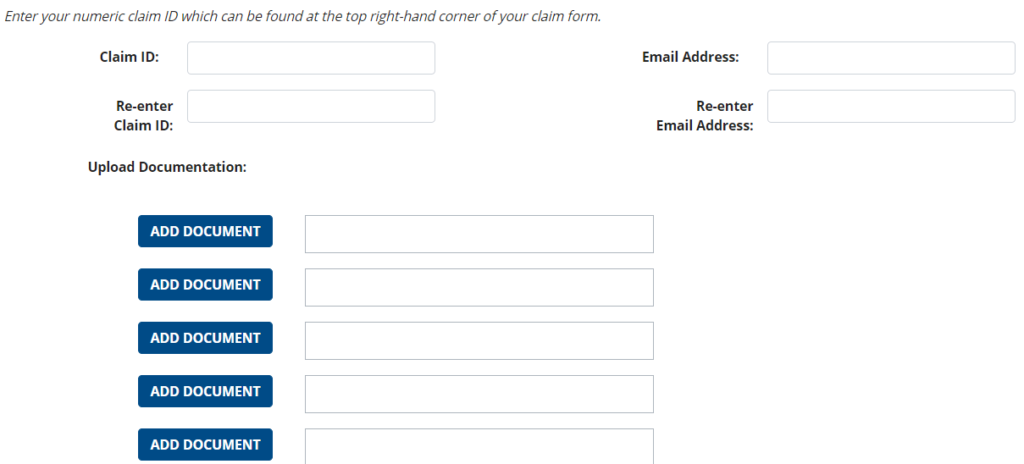

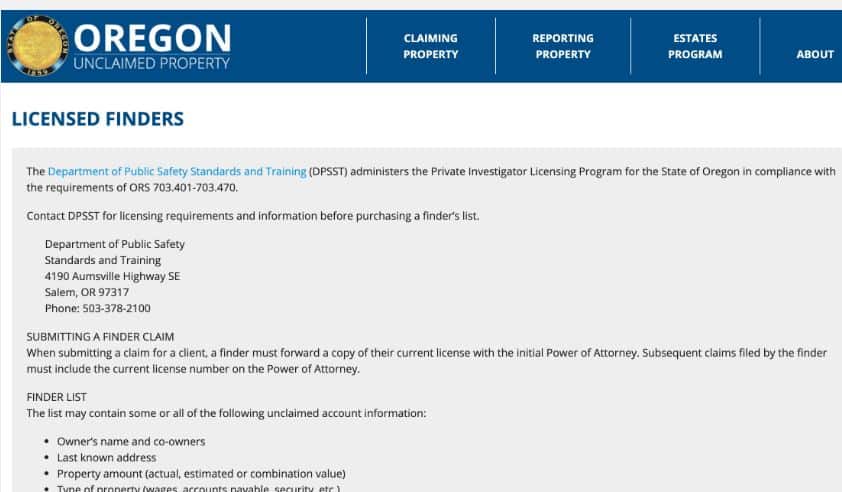

What is a Licensed Finder and Do You Need One?

A licensed finder is someone who finds money for other people. The Oregon Department of Public Safety Standards and Training offers licenses for finders. A finder may contact you after a loved one passes away and offer to search public databases to find money in their name. Oregon has several rules that require finders to present several things to file a claim, including:

- the signature of the claimant on the form

- proof that the owner gave them permission to claim the property

- the last known address of the claimant

Oregon makes it harder for finders to file claims than other states do. To make up for the time that it takes to file claims, most finders charge high fees for this service. As we covered all the steps that you need to take to file a claim online, you may find that your family doesn’t need professional help.

Claiming Physical Property

You generally need to go through the same steps to claim physical property. Though you cannot claim a home that someone in your family owned, you can claim a safe deposit box that a loved one abandoned. The bank that holds that box will send letters to the registered address and then give Oregon the contents of the box. Depending on when you file, you may have the chance to get those contents back. In most cases though, Oregon will sell the contents and put the proceeds in an account for the owner or their heir.

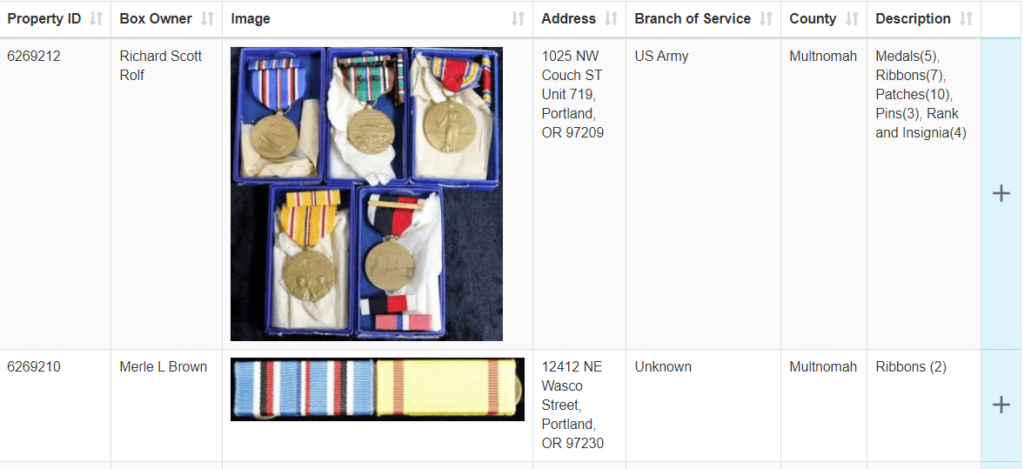

The Department of State Lands has a database that includes military medals and other decorations that you can search. When you visit the site, you can view all the available decorations. Oregon will remove those decorations from all the safe deposit boxes that it receives. You can view the name and address of the owner along with photos and a short description. The site also lists the branch that the individual served. If you are the heir of the person who lost their military decorations, you can file a claim through the site to get them back.

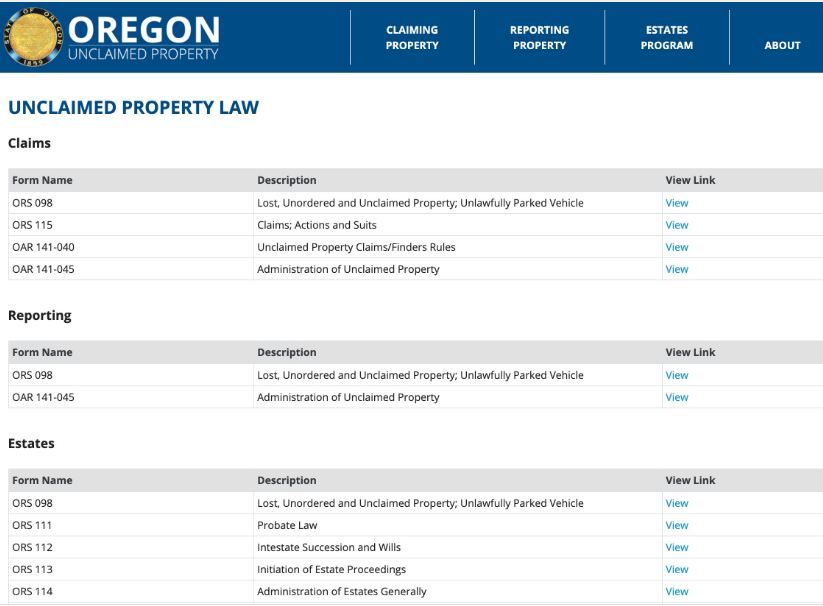

Oregon Unclaimed Property Laws

Before filing a claim in The Beaver State, you may want to check out the unclaimed property laws in Oregon to get an idea of what to expect. Oregon has different laws that apply to finders and holders as well as heirs filing claims during and after probate.

Does Oregon Have a Lot of Unclaimed Property?

Holders hand over more than $50 million in unclaimed funds to Oregon every year. Some of the interest that the property incurs goes to a fund that pays for updates and other needed items for local schools. The state will keep most of the interest for the owners though, which may result in you getting more than you expected for your claim. All of the states in the nation have more than $40 billion in unclaimed funds. Looking at other state databases and resources can help you see if there are other claims that you can file.

Is There Any Way to Protect Your Property?

A big question that we get is whether there are ways that readers can protect their property and keep it from ending up in a state database. We recommend that you keep track of checks issued in your name and take them to the bank as soon as possible. If you have a check coming to you, make sure that you watch the mailbox for it and contact the business that issued it if it doesn’t arrive. It’s also helpful to conduct a review at the end of the year where you check your accounts and make sure that your contact information is up to date. Also, make sure that you tell at least one of your heirs where you keep all of your financial information in the event that you pass away.

How Long Does It Take to Get Your Money?

Thanks to the online system, Oregon lets you file a claim in just a few minutes. You will often find that it takes longer before a check arrives. Depending on how many claims the state receives and the steps that owners take, it can take up to six months from the time that you file before you get a check. The status checker gives you the option of seeing where you are in the process, which can give you an idea of when you’ll get your money. Oregon does not offer electronic deposits and will only issue paper checks for the amount owed to you.

Does all Unclaimed Property Appear on the Website?

Though you might expect to see multiple claims waiting for you, you may find one or more missing from the site. Though Oregon updates the site at least once a month, not all accounts appear on it. Each claim handed over by a holder must go through a review process before going live. If you think that you have property but can’t find it on the site, contact the Department of State Lands. The department offers both email and phone assistance.

What Type of Information Does Oregon Require for Claims?

To file a claim in Oregon, you need some type of photo ID issued by the government. The most common form of ID is a driver’s license. Oregon asks for proof that you lived at the address associated with the claim such as a piece of mail that lists both your name and the address. If you do not have this type of proof, you can write a short letter to explain that the evidence is no longer available. You also need to provide proof of your current address along with your social security number. Oregon accepts both a photocopy of your social security card or tax records that list it.

Does Oregon Hold Onto Investments?

When you buy stocks and bonds, you can sell them later in the hopes of making a profit. Many types of investments will appear in the Oregon database. You should keep in mind that some types of investments follow a schedule that requires the holder to liquidate the stocks and send the value of them to the state. If this happens, the state will let you claim the full value of your investments at the time of the liquidation but will not let you get the stocks back. You may need the original certificates given to you when you bought the stocks as part of the claim process.

Can You Claim Money in Oregon for a Deceased Person?

Like most states, Oregon allows you to file a claim for a deceased person. You can search the database for accounts that your parents or close relatives owned. Keep in mind that you can only claim that property if you have proof that you are the direct heir or the person who inherited the estate. Oregon will accept different forms of proof that the person passed away such as an obituary that lists you as the next of kin or the official death certificate. You can also submit an affidavit that lists you as the person who inherited a small estate that did not go through probate or a copy of your birth certificate.

Conclusion

Would getting an unexpected check in the mail change your life for the better? No matter how much you get, it’s money that can pay your bills or help you cover the cost of a family vacation. Our ultimate guide to Oregon gives you all the steps and information needed to find unclaimed property in The Beaver State and claim it.

Quickly Search For Unclaimed Money

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.