Unclaimed Money Lookup - Texas

Free Texas Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

(advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Texas Unclaimed Money -

The Ultimate Guide 2026

- UPDATED February 2026

Acquire insights on reclaiming your valuable assets and funds with our comprehensive guide to unclaimed money in Texas. This definitive resource outlines the systematic steps required to facilitate the retrieval process.

Your Guide to Unclaimed Property in Texas

You’re probably familiar with the concept of unclaimed money and property, perhaps dismissing the idea because you assumed it didn’t pertain to you. However, as of April 2021, the state of Texas has successfully returned over $3 billion in assets to individuals whose properties were held by the state. In accordance with Texas regulations, holders of various types of accounts and assets are required to reach out to the State Comptroller when communication with an owner ceases for a period ranging from one to three years or longer. Subsequently, the comptroller grants owners the opportunity to reclaim their abandoned assets through an online database.

Introducing Your Comprehensive Guide to Unclaimed Property in Texas

Gaining insights into unclaimed property through real-life examples can provide a clearer understanding of the types of assets that might be retrieved. Additionally, familiarizing yourself with the necessary information for filing a claim in Texas and adhering to the state’s prescribed steps is crucial. It’s worth noting that residing in a major urban center like Houston or Dallas isn’t a prerequisite. Our ultimate guide to unclaimed money in Texas caters to anyone who has lived in or currently resides in the Lone Star State, equipping them with the knowledge and steps needed to successfully reclaim their assets.

What is Unclaimed Money?

In 1963, the Texas State Comptroller initiated a requirement for holders to report abandoned and unclaimed assets, resulting in the establishment of the Texas Unclaimed Property Division responsible for overseeing these assets. This division collaborates with government agencies, financial institutions, and various organizations. Among the examples of recoverable funds are payroll checks, issued by employers to employees for various reasons such as business trip expenses or final paychecks after changing jobs.

Utility companies across Texas have the authority to collect new customer deposits when setting up accounts. While many of these deposits are eventually applied to the account balance after approximately a year, individuals might be eligible to request a refund. Refund checks not received by customers may be discoverable within the Texas system, particularly if the utility provider operated within the state.

Another category of accessible funds involves royalty payments for landowners, both individuals and families. Landowners who have agreements with companies extracting natural resources, like gas, from their land are entitled to royalty payments. These agreements, often linked to the land itself, extend their benefits to future owners. Texas facilitates the online search and modification of royalty agreements’ listed owners. Furthermore, the right to claim agreements held by deceased individuals applies to estate settlements.

The Texas system also encompasses other types of accounts. For instance, if you overfunded an escrow account while selling a property, any balance would typically be returned by the lender before reaching the comptroller. Likewise, court deposits that weren’t returned, often associated with cases where expensive property is held by the court until a decision is made, can also be found in the system. Those facing criminal charges might need to make a court deposit known as bail.

Varieties of Unclaimed Property

A single search is all it takes to reveal the assets held by Texas on your behalf. This search extends to assets lost by friends and loved ones, as well as diverse types of property left behind by deceased individuals. Beyond checking and savings accounts, the scope encompasses safe deposit boxes and insurance payments. By utilizing our guide, you can effortlessly navigate the comptroller’s database within minutes, uncovering a wealth of valuable information.

How to Find Unclaimed Money in Texas

If you’re seeking to locate unclaimed money in Texas under the jurisdiction of the Texas State Comptroller’s Unclaimed Property Division, here’s a step-by-step guide to assist you:

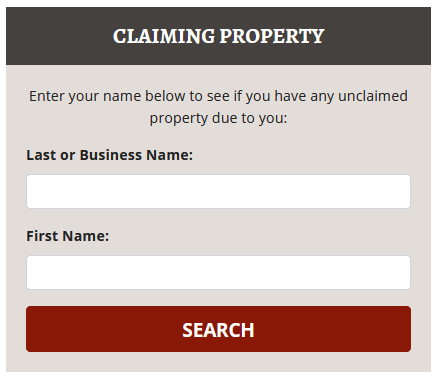

Step 1: Start by visiting the official website of the Texas Unclaimed Property Division. Locate the section labeled “Claiming Property,” which prompts you for your information.

Step 2: Input your first and last names, or alternatively, just your last name into the provided search box. Alternatively, you can click the “Get Started” button, which will redirect you to a new page where you can input your details.

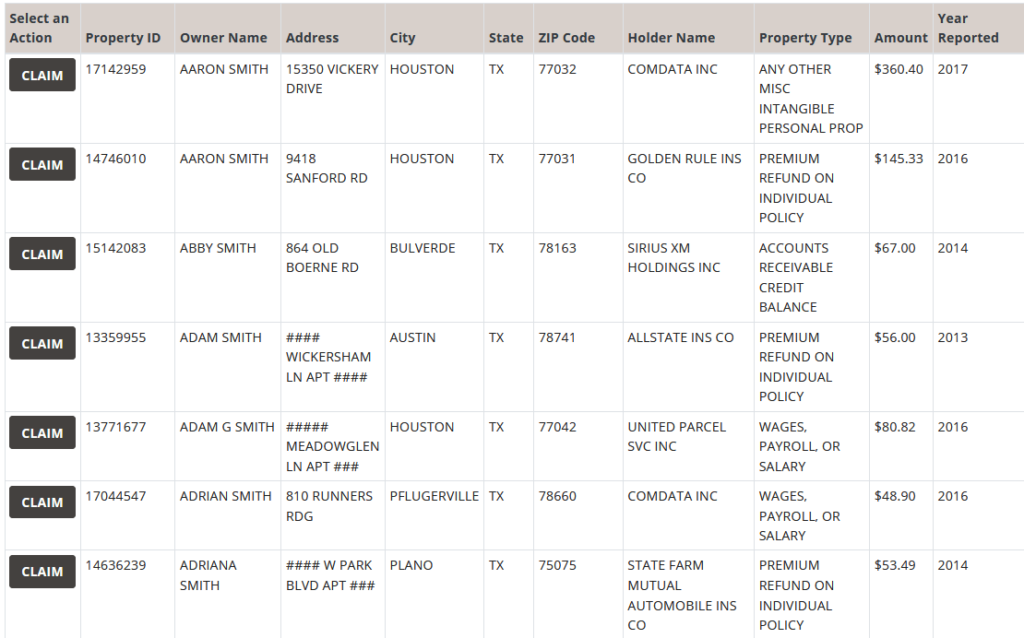

Step 3: Review the list of assets displayed on the site to identify items that you are eligible to claim. The Texas Unclaimed Property Division presents information such as the owner’s name and address, the name of the holder, and the nature of the property (e.g., insurance premium refund or payroll check). Additionally, the precise value of each asset is provided, indicating the account’s worth.

Step 4: To initiate the claiming process for a specific property, click the black “Claim” button. If you happen to click on an incorrect property, you can click the button again to deselect it. It’s recommended to thoroughly examine all listed assets and claim each one for which you are eligible. This approach allows you to enter your information only once and use it across all the required forms. As you proceed, don’t forget to click the “Claim” button located at the bottom of the page to advance through the process.

By following these steps, you can efficiently navigate the Texas Unclaimed Property Division’s website and potentially reclaim funds or assets that rightfully belong to you.

How to Claim Your Texas Property

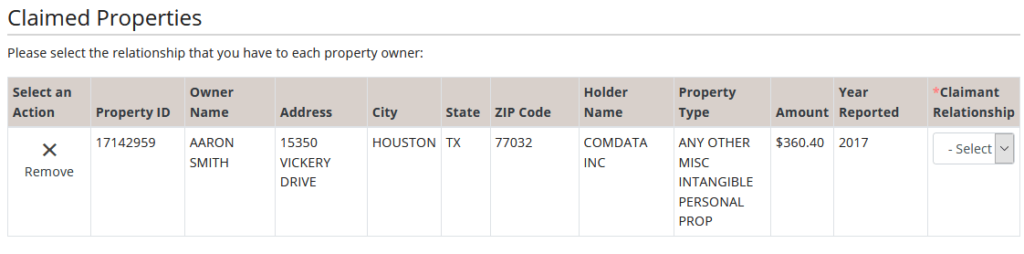

Step 1: Review all the assets you have claimed. As the owner, it’s crucial to ensure that your name and your current or former address match the information associated with the property.

Step 2: Utilize the “Claimant Relationship” section to indicate whether you’re filing as the owner or under one of the other specified relationships. Click the “Next” button to proceed with your claim.

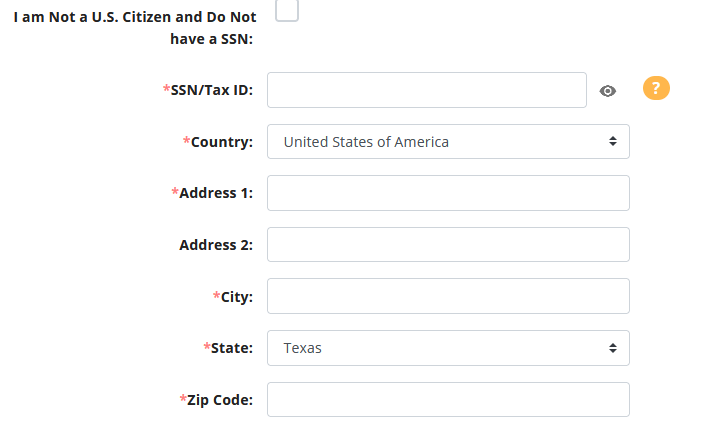

Step 3: Complete all the required fields on the claim form, which are marked accordingly. If you lack a social security number, Texas allows you to bypass this requirement by checking a designated box. After filling out each field, click the “Next” button. The website will prevent you from progressing if any mandatory field is left blank.

Step 4: Review a preview of your Texas claim, confirming that you’ve provided accurate information and successfully completed all necessary steps. Once satisfied, click the red “Submit” button to forward your claim to the Unclaimed Property Division.

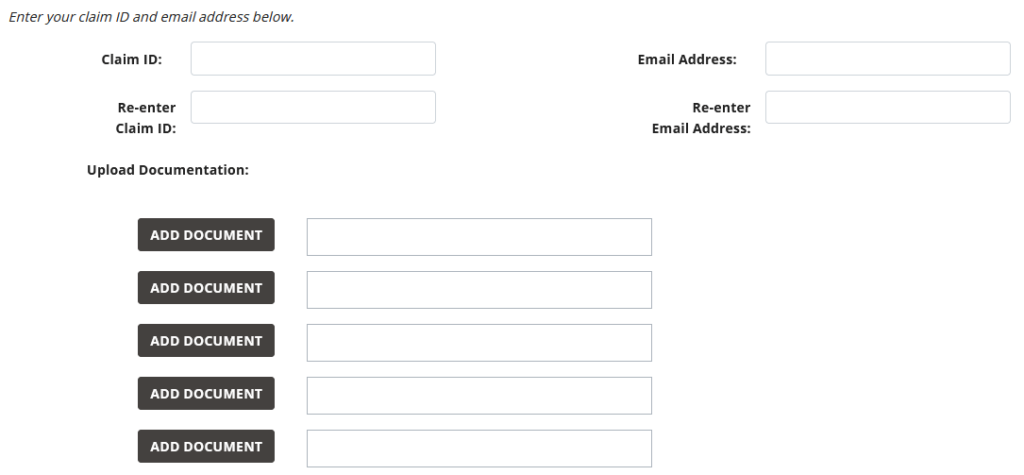

Step 5: Compile photographs or copies of all the necessary documents and information pertinent to your claim. Visit the Texas upload page and input your claim number along with your email address. The website will then enable you to select and upload the required documents from your device.

Step 6: Await an email from the Texas Comptroller confirming the receipt of your claim by the division. Depending on the completeness of your submission, you might receive an email indicating that the state has received all necessary information and will process your claim, or you may be notified if additional information is required.

By carefully following these steps, you can ensure a thorough and effective process for claiming your unclaimed property in Texas through the Texas Unclaimed Property Division.

Who Can Claim Property in Texas?

In Texas, the capacity to file a claim for abandoned assets extends beyond the listed owner. The state recognizes the eligibility of individuals holding power of attorney over another person, trustees acting on behalf of estate assets, and those serving as executors or administrators of a deceased individual’s estate during the probate process. Additionally, official officers of businesses and parents of children can also initiate claims. Notably, Texas frequently honors claims made by the heirs of deceased individuals.

For further exploration of unclaimed property, consider investigating other online platforms that facilitate these searches.

https://www.claimittexas.gov/app/faq-ucp

- Department of Veterans Affairs: Veterans can acquire life insurance policies through the VA, which can aid in estate settlement, covering funeral expenses, and addressing other financial needs. The VA also facilitates searches for insurance policies and allows beneficiaries to claim policies that are rightfully theirs.

- Department of Housing and Urban Development (HUD): If you received government assistance for your home loan, HUD can help you check for any related unclaimed funds or checks, and also provide information about potential scams in this context.

- Pension Benefit Guaranty Corporation:

- This organization focuses on pensions and retirement benefits. You can use their website to search for pensions that loved ones had and claim any remaining funds.

- U.S. Railroad Retirement Board:

- For those who worked in the railroad industry, this site assists in finding pensions and funds related to railroad retirement benefits.

- Federal Deposit Insurance Corporation (FDIC): If you had a bank account that went unclaimed due to bank closure, the FDIC offers the opportunity to reclaim those funds.

- U.S. Federal Investments: This site is useful for locating and claiming matured treasury bonds that are owed to you or others.

- Missing Money: This website allows you to search for unclaimed property across multiple states. While the claim process might be directed to a specific state, the site often enables you to file claims online.

- Internal Revenue Service (IRS):

- Use the IRS to keep track of your tax refunds and ensure swift receipt. You can also set up automatic deposits using your social security number and account details.

- National Credit Union Administration: If you dealt with a credit union that has since closed, this site assists in locating old accounts and enables you to claim them.

How Much Unclaimed Property Does Texas Have?

Millions of dollars in unclaimed property await potential claimants in Texas, encompassing bank accounts, utility deposits, refunds, and valuables stored in safe deposit boxes. Objects of value are deposited into the state’s General Revenue Fund until rightfully reclaimed. Texas residents can search for unclaimed property dating back decades by inputting a name or business online. Notably, a 2021 bill authorizes the Comptroller’s office to follow other states’ lead, automatically distributing checks to owners of properties worth less than $5,000, although the implementation timeline is pending. As of 2022, Texas holds over $7 billion worth of unclaimed property, with recent data showing $1.01 billion brought in and $309 million paid out in the same year, highlighting the potential for substantial reclamation.

Unclaimed Property Laws in Texas

For a comprehensive understanding of the unclaimed property regulations in Texas, most of the relevant laws are readily accessible online for review. These statutes encompass a range of scenarios, including the handling of abandoned physical property, such as items left behind in hospitals or jails. It’s advisable to explore the specifics of how long holders are required to report abandoned property, as well as the protocols that banks follow for accounts that owners no longer utilize. Delving into these laws provides insight into the processes and procedures surrounding unclaimed property in the state.

Texas Unclaimed Money FAQs

What is the Texas Match the Promise Foundation?

The Texas Match the Promise Foundation is a program designed to provide scholarships to local students. To benefit from this initiative, students and their parents are required to enroll and set aside funds for future college expenses. The foundation awards scholarships that match the amount families save for their children’s education. When claiming property via the database, the option to contribute to the foundation’s cause is presented. Donations can range from any amount up to the total sum that you are eligible to claim.

How Long Does it Take to File a Claim in Texas?

In terms of the duration required to file a claim in Texas, the process typically takes around 10 minutes or less. It involves locating the asset within the database and completing the necessary claim steps. While uploading documents might take a bit longer, particularly with slower internet connections, the timeline could also extend if the comptroller requests additional information. Texas generally takes up to eight weeks to release funds and issue a check to the address provided in the claim. The state’s status checker allows you to monitor the progress and estimated duration of the process, requiring your claim number that is found on your original claim form. This claim number can be obtained through email or phone communication with the comptroller.

What Does Texas do with Unclaimed Safe Deposit Boxes?

The Texas Comptroller permits banks to surrender the contents of safe deposit boxes after just one year of owner inactivity, starting from the final rental payment. Should the owner or any legitimate claimant remain untraceable, and if the bank and state are unsuccessful in locating them, Texas may proceed to sell the contents of the abandoned boxes. Notably, items valued at $50 or less, as well as documents and papers of negligible worth, are excluded from the sale. Moreover, most weapons are not sold. Auctions for abandoned property are accessible to eBay account holders, with the proceeds being placed into trusts for owners and their heirs.

Assets Showing No Value

When perusing the Texas system, you may come across properties labeled with no value or $0. This signifies that the state possesses a form of physical property under your name, such as a stock or bond. In cases of securities, the comptroller receives the property from traders or similar entities. If your claim involves such a security that is still in the state’s possession, you need to involve a trader. This trader can transfer the funds into your stock account, ensuring your retrieval. While Texas may sell certain stocks and bonds through traders and reserve the proceeds, you are entitled to file a claim for the full value of the sold stocks as well as any accrued dividends. If heirs file claims for stocks or bonds, the state typically divides them equally among all beneficiaries.

Duration of Holding Abandoned Property

Texas retains all received property until a rightful claimant emerges. This can encompass the original owner, their children, or other heirs such as a spouse. Holders can transfer property to the state after one year but may be obligated to retain it for up to five years. Once a claim is initiated through the comptroller’s website, a 30-day window is provided for submitting required documents and responding to any mailings. Failure to complete the claim within this timeframe results in the claim reverting back to the online database.

Efforts to Locate Property Owners

Texas actively seeks property owners through various measures. The comptroller releases a new list annually, encompassing individuals with property in the system and recent additions over the past year. While local newspapers might post notices about new lists, direct letters or notifications from the comptroller are rare. Organizations holding assets typically send notices to the last known address. Swift action on your part could enable you to claim your property before it is handed over to the comptroller.

Texas Fee Finders Charges

When a loved one passes away, you might receive letters from fee finders operating in Texas. Engaging with a fee finder can be convenient if you’re short on time, even though it may entail a partial loss of funds. Although Texas doesn’t mandate contract signing, fee finders are capped at charging fees up to 10% of the claimable amount. For instance, if your state-held property is valued at $5,000, the finder can charge up to $500. While using the online system is free, Texas doesn’t impose any charges. The state also offers free resources, and you can contact the comptroller for further assistance.

Preventing Property from Becoming Unclaimed

To avert your property from becoming unclaimed, inform organizations and companies holding your assets if you’re relocating. Additionally, consider visiting the UPS or using their online form to change your address. This service forwards your mail from your old residence to your new one. Texas advises prompt opening of letters and notices and periodic manual checks of your financial accounts. Keeping a record of account numbers and passwords can prove helpful for your loved ones.

Conclusion

Uncovering your unclaimed assets in Texas need not be arduous. A single visit to the Unclaimed Property Division’s website allows you to search for your name, upload necessary documents, and monitor your claim’s status. Utilizing the ultimate guide to unclaimed money in Texas, in conjunction with available resources, empowers you to efficiently reclaim your assets.

Quickly Search For Unclaimed Money

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.