Unclaimed Money Lookup - Utah

Free Utah Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

(advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Utah Unclaimed Money -

The Ultimate Guide 2026

- UPDATED February 2026

Learn the easy steps on how to conduct the unclaimed property search, how to launch a claim, and how to follow up on it until it gets settled.

Utah Unclaimed Money

Every year, millions of US dollars in unclaimed or lost money are remitted to the state of Utah. These funds usually come from old stock certificates, dormant bank accounts, uncollected insurance settlement checks and other such like sources. Utah has an official government website (My Cash) specially designed to manage and return these unclaimed funds to their rightful owners.

Over the last five years, the state’s ‘Unclaimed Property’ Division has tripled the annual claims settled and nearly quadrupled claims launched annually. This success story follows efficiency and modernization initiatives from the state treasury, including: comprehensive advertising (through digital, television, radio, and social media platforms), an upgraded and highly searchable website, integration of digital imaging in during claims reporting and processing, as well as the implementation of the ‘Quick Track’ claims technology. Every year, Utah continues to record success stories when it comes to returning funds to their rightful owners.

What exactly are Unclaimed Funds?

Unclaimed money/ property refers to any type of financial asset that has had zero activity from the owner for a long period of time. The duration in question depends on the specific property type. Examples of these assets include unclaimed savings and checking accounts, wages, commissions, insurance proceeds, stocks, dividends, credit balances, underlying shares, safe deposit box contents, refunds, credit balances, and certificates of deposit.

Usually, the organization that is in possession of these unclaimed funds tries as best as they can to contact the asset’s owners. They establish any kind of activity through written correspondence, online login, a deposit or withdrawal, or even updates to the personal information provided. In case all these attempts are unsuccessful, the property gets reported as unclaimed to the legal owner’s address (last known).

The unclaimed assets laws in the United States were set as a type of consumer-protection initiative. These laws have since evolved to not only protect property owners, but also their estates and heirs. As soon as a given asset gets into state custody and the given state’s unclaimed funds program, there is an aggressive and rather rigorous initiative to get in touch with the property owner. This outreach is done through mailings, advertisements, social media platforms, as well as local media coverage. Until the legal owner or heir files a claim to the property, the state of Utah will continue maintaining custody of the asset in perpetuity.

The State of Ohio has mechanisms for finding the owners of unclaimed funds in the state. However, these solutions locate only a fraction of the beneficiaries. Consequently, most of the people with unclaimed funds don’t know about it, and some funds go unclaimed for generations. This is why it is advisable to personally check whether you are entitled to any unclaimed funds.

This is the easiest platform to use to find out whether you have unclaimed funds in Ohio (and other states). Our platform has a comprehensive and up-to-date database of unclaimed funds in Ohio. You can use the search boxes at the top of this page – simply put in your first and last names in the first and second boxes respectively, and then select Ohio as your intended search location/state. You can also narrow your search down to a city or zip code.

Our platform also has a national database, so feel free to search for unclaimed funds in any state on the list. You can also search unclaimed funds for your relatives, especially if you have deceased relatives who may have left behind undisclosed financial assets. The platform also supports queries for funds owed to businesses using the company’s name.

Other platforms that you can use to search for unclaimed funds and property in Ohio include:

Conducting the Search for Unclaimed Property

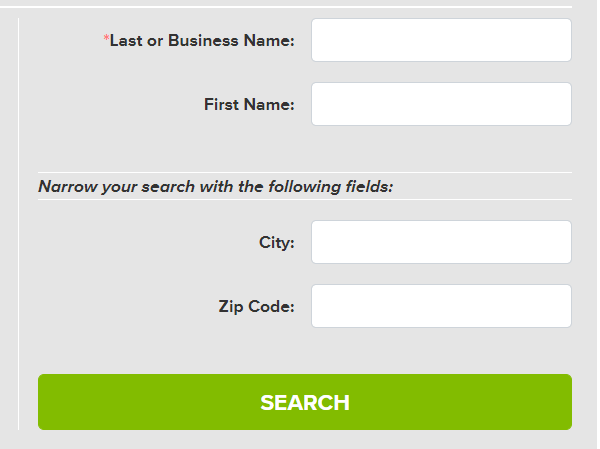

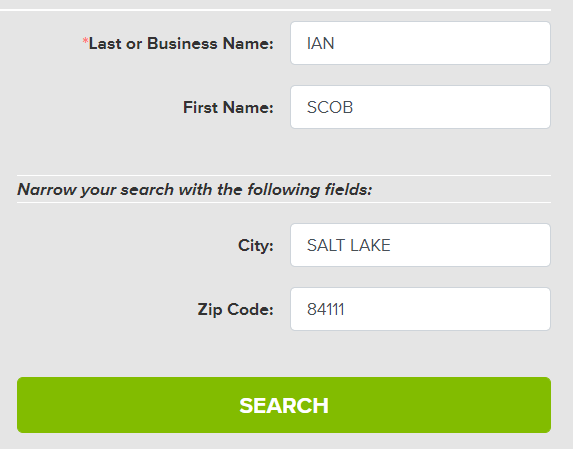

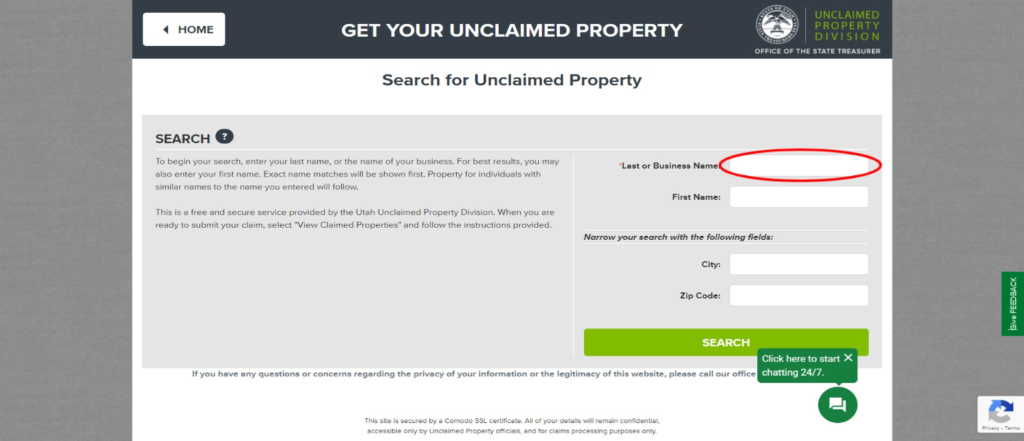

Conducting the unclaimed assets or property search in Utah is as easy and straightforward as it can get. Here, you are only required to provide your last name/business name in the appropriate field, and give your first name in the field that says ‘First Name’. The exact name matches will appear first. Assets belonging to individuals that have similar names to the one you entered then follow.

In order to ensure that the search is a bit more precise, it would be great to provide the city name and zip code. For the purpose of this guide, we have used ‘Jacob Ian’ as an example.

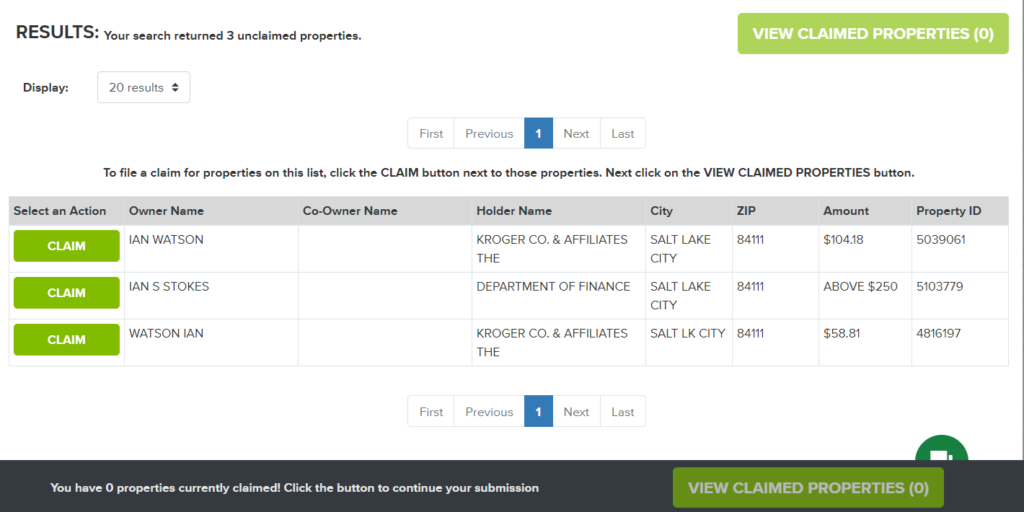

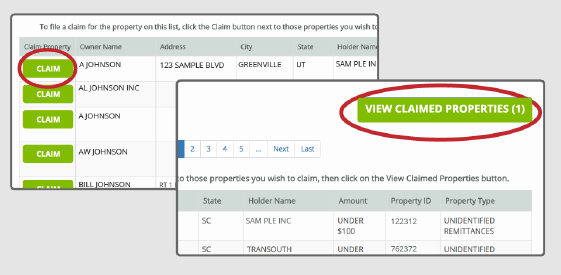

Next, select the property (properties) that you wish to lay claim on. At this stage, you can initiate a new search for assets that could be owed to you, but have been registered using a different name. As such, make use of maiden names, nicknames, and common misspellings to exhaust all options.

Once you make a selection of all the assets that you’d like claim, click on ‘View Claimed Properties’.

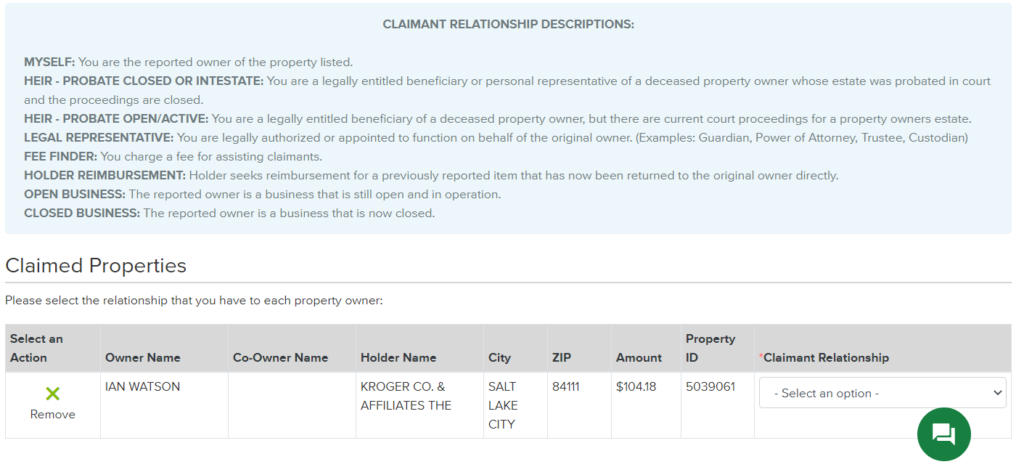

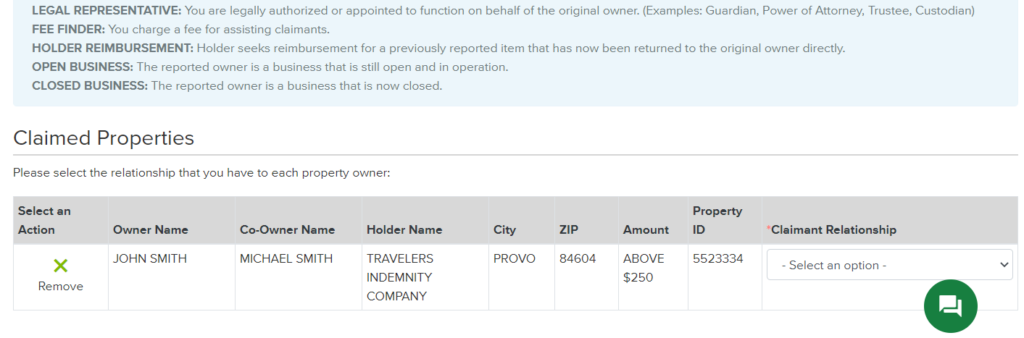

Ensure that you categorically state your relationship to every property owner on the list.

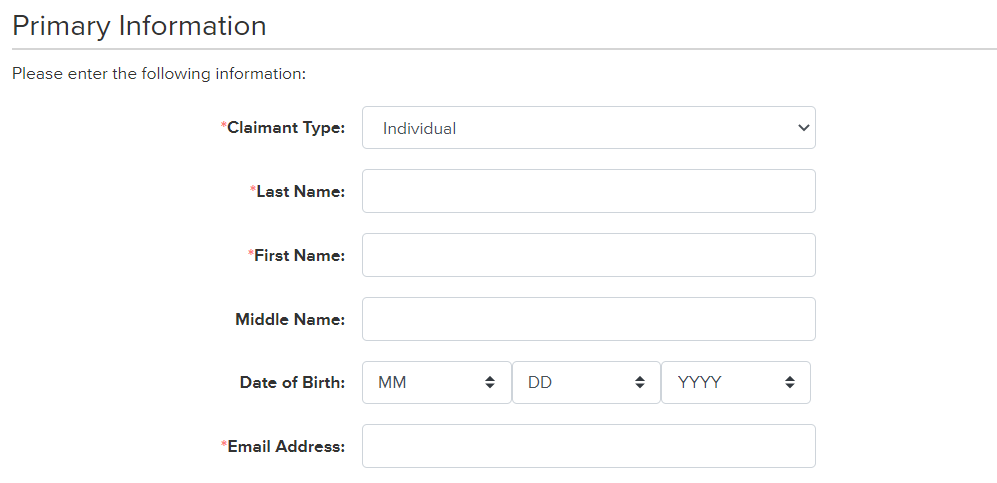

Click on the ‘Next’ icon and proceed to key in the required information as shown below:

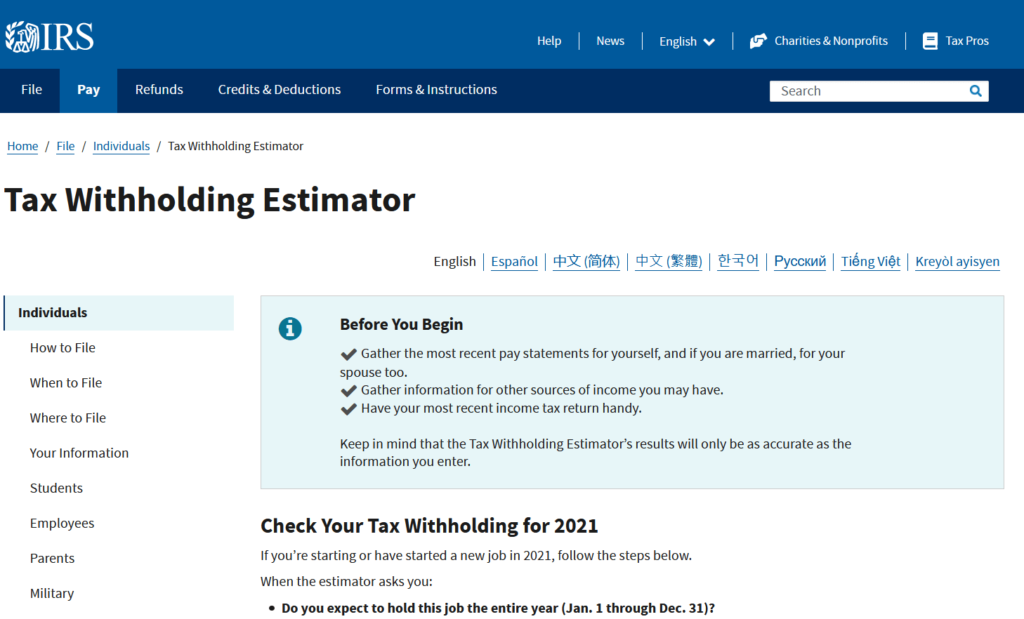

The IRS also has billions worth of unclaimed money, mostly worth of tax refunds. The agency also has an easy-to-use platform, including a My Refund page that only requires the users’ names for refund searches. State departments of taxation also have unclaimed money and property in the form of state tax refunds and other financial assets.

How to Claim Unclaimed Property in Utah

Step 1: Search for Property

1. Go to the ‘Property Search’ Page

The ‘Property Search’ page can be accessed from the home page. You just need to hover over the ‘Claiming Property’ sub-menu, then selecting the ‘Search Unclaimed Properties’ option. Alternatively, just click the conspicuous ‘Search’ button on the home page’s very middle.

2. Key in your name to initiate the search

Provide your first name, your last name, or both in the field labelled Name/Business, then click on ‘Search’. Narrow the search down by providing a zip code or specific city.

3. Click ‘Claim’ to select your property

As soon as you find an asset that is lawfully yours, select it and click on the ‘View Claimed Properties’ icon to initiate the claims process.

Step 2: Submitting Your Claim

1. Make a review of all the assets that you have chosen

Make sure to review the property or properties that you have selected before you proceed to click on the ‘File Claim’ button and proceeding to the claimant’s information page

2. Provide your information

Here, you are required to key in accurate details of yourself as the claimant. This information includes your present mailing address, your relationship to the property owner (if you are the owner, select ‘Myself’, if you are an heir, select ‘Heir’, etc.)

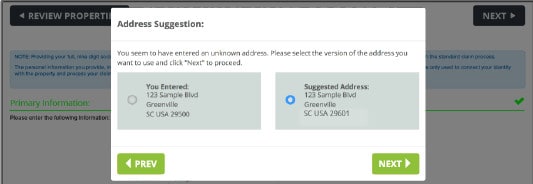

3. Confirm your address

You will be taken to another screen asking you to verify the provided address. This is just to ensure that the state does not end up mailing the check to a wrong address.

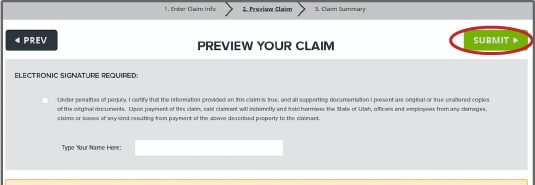

4. Submit the claim

This is quite a crucial stage in which you are required to preview all the assets that you are claiming while verifying the current information. As soon as you confirm that all details are accurate, click on ‘Submit’. This officially creates your claim and generates a unique claim number.

Step 3: Completing your Claim

1. Review and gather all the documents required

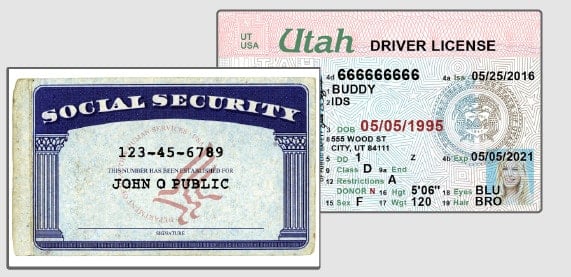

Every unclaimed assets claim required certain documentation. At the very least, you will need a completed claim form (signed), a copy of your Social Security Number, and a copy of Photo Identification. At claim launch stage, an email will be sent to you stating all the documentation that you might need.

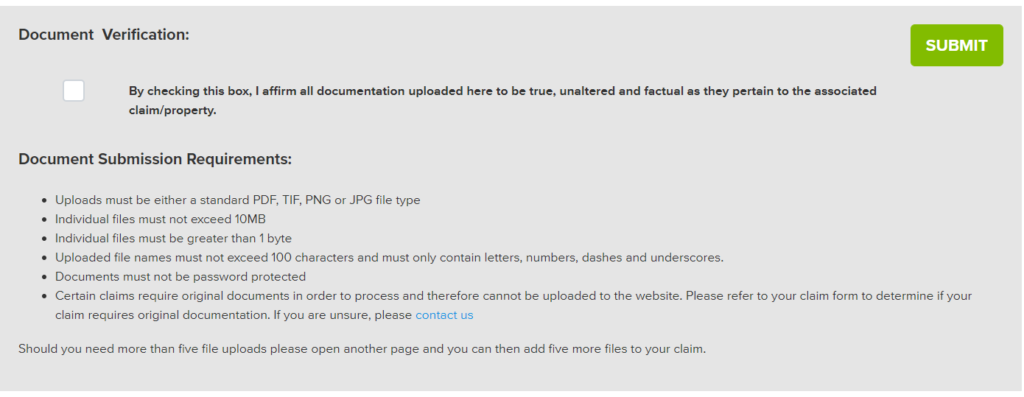

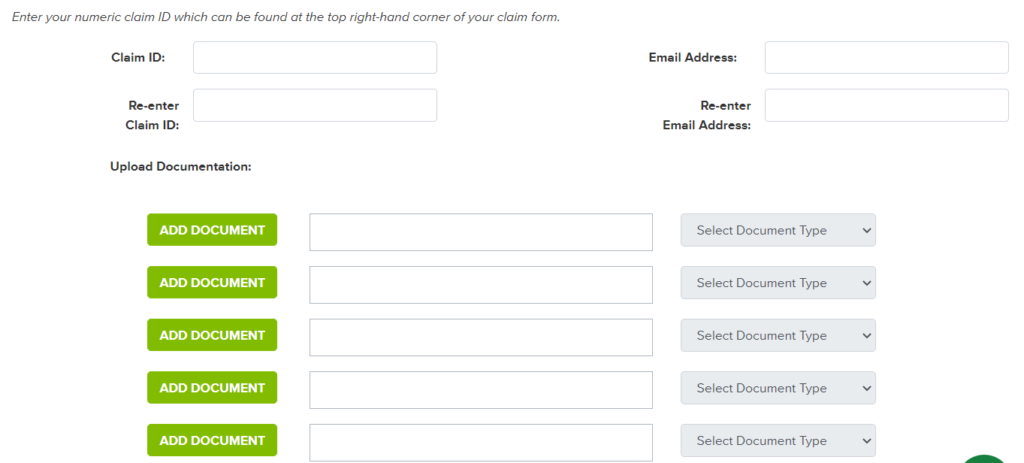

2. Submit the documents to Utah state

Here, you can either upload the documents via the state website’s secure link or send them to the following physical address:

Unclaimed Property Division

PO Box 140530

168 N 1950 W Suite 102

Salt Lake City, UT 84116

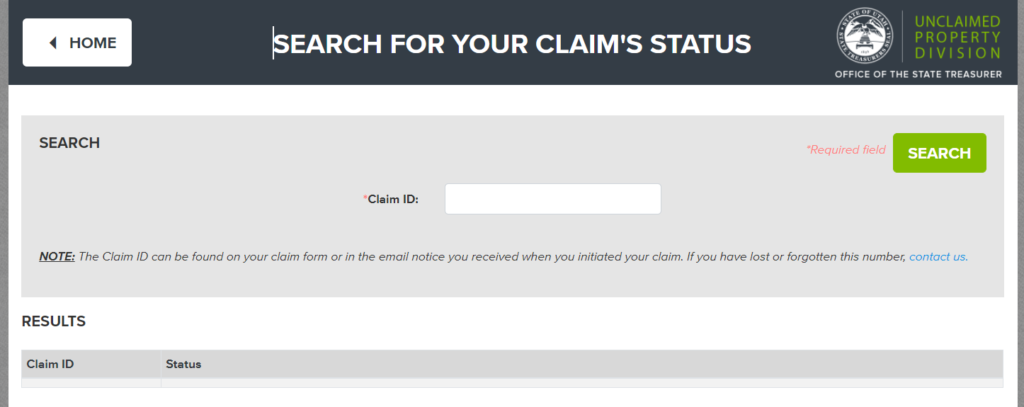

Step 4: Track the Progress of your Claim

You can key in the unique claim number at the Utah State website’s ‘Claim Status Page’ in order to get your claim’s most recent status. The claim number is usually indicated on the claim form’s top and also on the email that was sent to you at the time of claim submission.

Holder Reporting

Step 1: Submitting a Holder Report

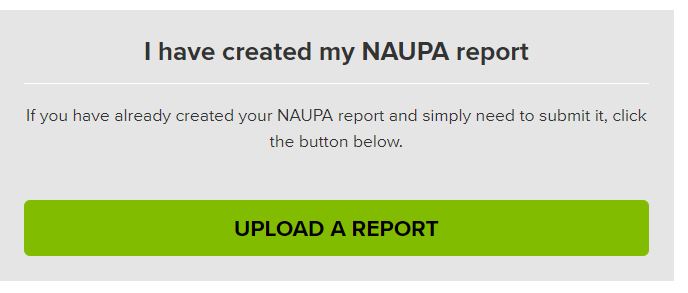

If you have successfully created the NAUPA report in advance and you simply need to submit the file, you only need to click on the ‘Upload a Report’ button as below:

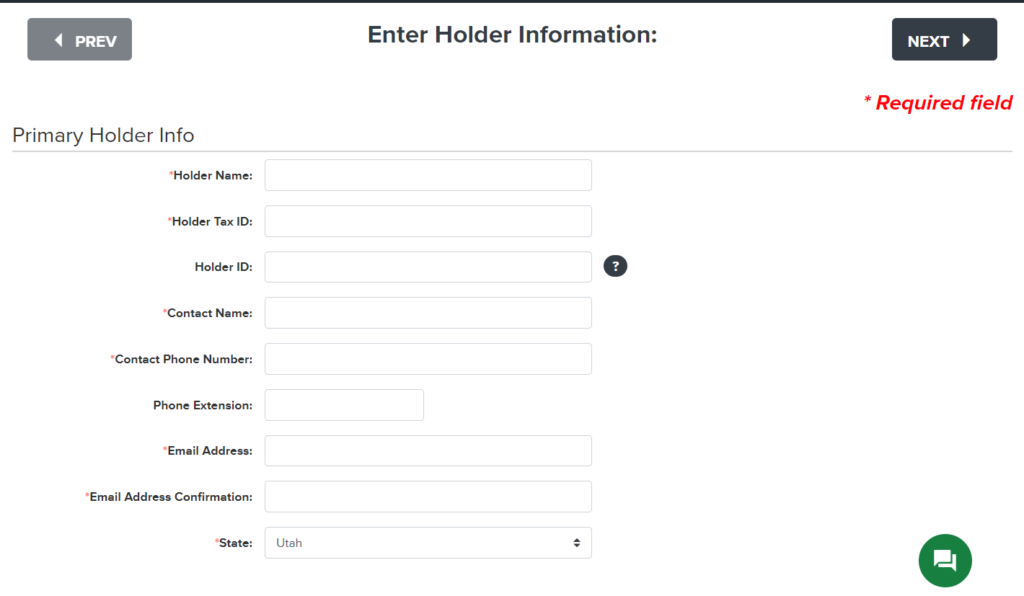

Step 2: Provide the holder information

Fill in the fields provided with accurate information. Be sure to complete all the fields that are compulsory, and most importantly, check to confirm that all information provided is correct.

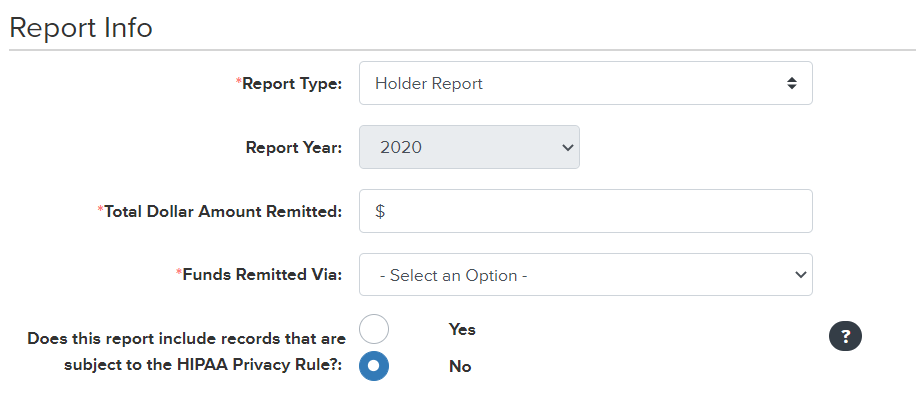

Step 3: Key in the Report Information

Note:

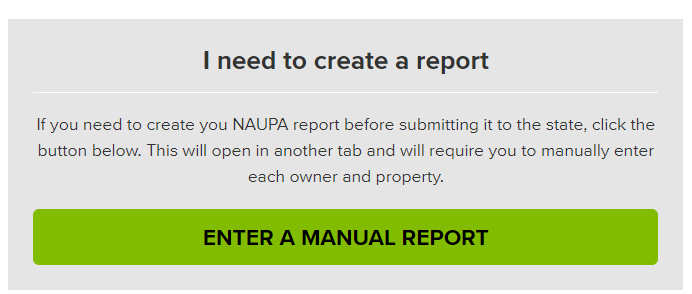

Should you need to create your NAUPA report before submission, you will be required to manually key in the details of each asset owner and the specific property details.

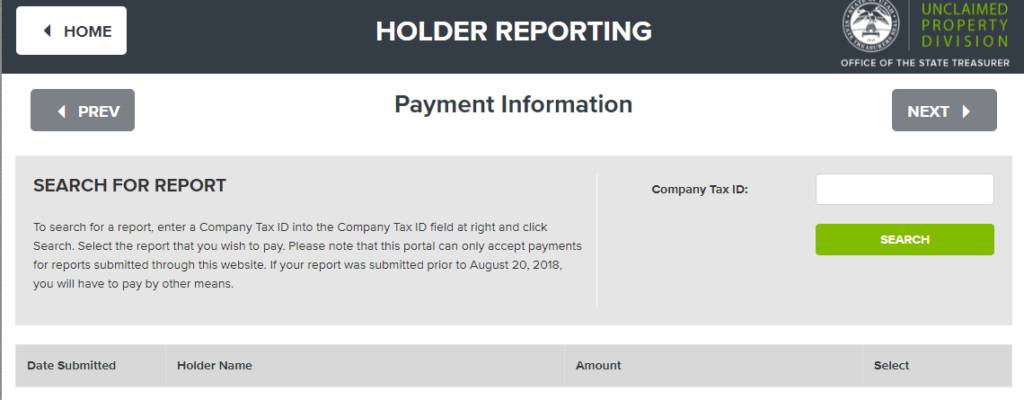

Step 4: Making a Payment

To pay for a report, enter the Company Tax ID in the ‘Company Tax ID’ field and click on the search button. Select the report you’d like to pay for. The Utah state website only accepts payments for the reports that had been submitted specifically through the website. For any other reports, a different mode of payment would be recommended.

Voluntary Disclosure Agreement

Every year, property holders are required to report all unclaimed assets. In the case where your business has never filed an unreported property claim, or if you missed a set deadline to a property due, then the Voluntary Disclosure Agreement allows you to report the past-due asset (provided your business or organization is eligible), without incurring any penalty or fee.

Eligibility

You need to meet the following criteria in order to participate in the VDA:

- You should not be undergoing any current audit by the Utah State treasury office or any of their contracted auditors

- There should be no recent notification of an upcoming audit from the state’s treasury office

- You need to be a first time participant into the program. If the asset type is new or has any association with a merger or company acquisition, the provision gets automatically waived

Requirements

In addition to the holder report, Voluntary Disclosure Agreement participants need to provide:

- Full account charts relate to the business

- The procedures used in determining unclaimed assets due. This includes the specific types of assets reviewed, dates of property review as well as the techniques used in estimating the unclaimed property’s liability

- Estimated calculations pertinent to the review and subsequent approval of the Unclaimed Property Program, alongside a signed affidavit by the company’s officer in case an estimation was used. The affidavit should categorically state that estimation was inevitable following inadequacy or unavailability of the required records

In order to make a request to take part in the Voluntary Disclosure Agreement, the property holder should complete and sign the VDA form to Utah’s Unclaimed Property Division. As soon as the application is received, the state officials will review it to ensure that the applicant is eligible. The VDA form is then signed, dated and sent back to the holder upon approval. The application can be sent in via email address [email protected]. Make sure that you include the business’ name, mailing address, federal tax ID, as well as the contact person’s details (name, phone number and email address).

Enhanced Website: the New Unclaimed Property System in Utah

In 2018, David Damschen, Utah State Treasurer, announced that there would be a new management system for unclaimed property that would be launched. In addition to this, there would be an enhanced website to incorporate the latest technological advancements, in order to provide claimants and property holders with the simplest, yet most secure process possible.

“The newly redesigned website makes it even easier for Utahns to search for unclaimed property and for holders to report unclaimed property to the State. Some of the new features include an enhanced search function for more comprehensive searches, the ability to upload claim documentation directly to the website, improved online payments, manual online reporting for small reports and stronger protections to ensure security of personal information,” David stated.

Before the launch of this new system, Utah State’s Unclaimed Property Division had returned $24.5 M to their rightful owners, having processed approximately 19,705 claims, accounting for 4 times as much claims a decade ago. In the recent years, the State Division has paid out over 50% of the claims sent, in only a week! With the new system, these numbers are expected to take an even steeper upsurge trend.

Can Heirs Claim for Unclaimed Property in Utah?

All the lost/ unclaimed property that gets reported to the Unclaimed Property Division in Utah is usually held perpetually for the benefit of the legal owners. Even if an owner dies without laying claim to the assets, their heirs have the right to claim those possessions. If the sole reported asset owner is deceased for at least 3 years, and their will was never probated in any district court, then their heir(s) can collect the unclaimed funds via Utah State’s intestacy rules.

Getting to understand all these intestacy provisions could be somewhat daunting, seeing as most are described using a computer program kind of language (‘if’, ‘then’ statements). However, an ‘if’ statement can give you an insight into who gets how much. For instance, ‘if only the surviving spouse outlives the legally reported owner, the individual gets the unclaimed asset in full’. ‘If only the reported owner’s children survive, they get the property in full (100%), but it will have to be split among them in equal measure. ‘If the children belong to the surviving spouse, the spouse gets the property in full’. ‘If the children belong to another person other than the surviving partner, the partner gets half of the unclaimed funds. The other half is given to the children, having been shared equally among them’. ‘If only the parents of the deceased owner survive, they get the property in full’. ‘In any other case where no spouse, children or parents survive, the unclaimed money will go to the siblings/ their issue or the owner’s grandparents/ their issue’.

Good Evidence for Fast Claim Settlement

It is Utah State Unclaimed Property Division’s primary mission to return all unclaimed/lost funds to their legal owners. However, this department does not just pay out funds based on a match on name or asset type; they have to do due diligence to ensure that the property gets into the right hands. One crucial document that helps to verify ownership is a complete claim form, alongside other evidence items.

Proof that you are the original property owner

Be sure to submit the following documents in order to lay further support to your claim:

- A clear copy of an official Photo ID (alternatively, have the claim form notarized)

- Proof of your national Social Security Number

- Any proof that you as the original owner, once received mail or once lived at the physical address that is listed on the state’s website. This could be an Auto Registration, a Driver’s License, Birth/Marriage/ Death certificate, Income Tax returns, Bank/Utility Statement, Medical Card, Insurance Policy, Postmarked envelope previously addressed to you, Credit Report, court documents, or school transcripts.

Claiming on Behalf of a Living Property Owner

The following documents are required in order to back up your claim:

- A clear copy of an official Photo ID (alternatively, have the claim form notarized)

- Proof of your national Social Security Number

- Any proof that the original owner, once received mail or once lived at the physical address that is listed on the state’s website

- Recent evidence of the authority that you have to claim on behalf of the rightful owner. If you are taking the position of the owner’s attorney, be sure to provide their official photo ID (clear copy). In case the owner doesn’t possess their official photo ID given some form of incapacity, be sure to give a statement of identity (notarized) from the caregiver on an official company letterhead

Claiming on behalf of a deceased owner

- Proof of a valid will in case it is in existence

- Proof that the appointed personal representative’s application is pending

- Proof that there has been a personal representative appointed

- Proof that the deceased estate or property is valued at $100,000 and above

- A competed and valid affidavit that confirms that you are authorized to collect the unclaimed property on behalf of the deceased. When filling in the claim form, it is highly imperative that you answer each and every question and subsequently provide supporting documents for any question whose answer is ‘Yes’

- Your photo identification (clear copy) or notarize the claim form

- Proof of the deceased property owner’s Social Security number. Usually, this information can be derived from the Death Certificate. While giving out the Social Security Number is not compulsory, choosing to omit this evidence could result in there being inadequate information that is available to sufficiently determine the asset ownership. As such, your claim could stand a chance of being denied. Provision of this information is not an unsafe thing to do. The information is only disclosed to the relevant ‘Section Staff’ that are specifically involved in processing your claim and also to the federal government as the law dictates

- Verification that the property owner (deceased) whose assets you are claiming for once received mail or lived at the address that is reported by the unclaimed property’s original holder. Visit www.mycash.utah.gov to check the last known address from the property listed therein

Claiming on Behalf of a Business Entity

Be sure to provide the following evidence if any of the answers provided on the claim form is a ‘YES’

- That the business is a sole proprietorship

- That the business is a partnership

- That the business is a corporation

Further evidence that helps support your claim includes:

- Clear copy of your photo identification (you can have the claim form notarized as an alternative)

- Proof of your official Federal Employees Identification Number (FEIN)

- Proof that the business was once located at the address listed on the state website

Unclaimed Money FAQs in Utah

How are my unclaimed funds protected in the US?

In the United States, all states have the responsibility of reuniting all lost, abandoned or unclaimed property with its legal owners. In 1951, there was a Supreme Court case involving Standard Oil Co. against the State of New Jersey. In the hearing, the court stated, “Property thus escapes seizure by would-be possessors and is used for the general good rather than the chance enrichment of particular individuals or organizations.”

What provisions exist to address the issue of ‘Lucrative Silence’?

When the holder of abandoned, lost or unclaimed property remains silent for a period of time, the property holder should turn it over to the state. This provision follows the 1954 Unclaimed Property Act that was promulgated by the Uniform Law Commission. This legislation allows for a legal system through which all unclaimed funds can be transferred to the state. The state then is faced with the responsibility of tracking down the lawful asset owner and remitting the funds to them. The State of Utah adopted its first ever version of this act in 1956, receiving its first unclaimed money report in 1957.

How is it that property ends up becoming abandoned, lost or unclaimed?

Usually, in case an asset remains dormant in a given duration of time (in most cases 3 years), and the property holder can’t seem to get a hold of the rightful owner, then that said asset is said to be abandoned. This property should be turned over to the Utah State Unclaimed Property Division.

Conclusion

Unclaimed money and property in Ohio is worth more than $3 billion. All this money is lying idle, as the state has no authority to use it. However, you can claim this money and use it however you like by following the claims process outlined above.

Quickly Search For Unclaimed Money

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.