Unclaimed Money Lookup - Wyoming

Free Wyoming Unclaimed Money Lookup

We receive referral fees from partners (advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

(advertising disclosure)

The information we provide you is free of charge and a result of extensive research by our home warranty experts. We use affiliate links on our site that provide us with referral commissions. While this fact may not influence the information we provide, it may affect the positioning of this information.

Wyoming Unclaimed Money -

The Ultimate Guide 2026

- UPDATED February 2026

Thinking of retrieving your share of the million dollars unclaimed money lying with the Wyoming State Treasury? Our guide can help you access the state database and claim your money.

Contents

- What is Unclaimed Property / Money?

- Which property is considered unclaimed in Wyoming?

- How Much Does New York Have in Unclaimed Assets?

- What is the extent of Unclaimed Property available in Wyoming?

- How to track down your Unclaimed Money / Property in Wyoming?

- What is the required dormancy period for Unclaimed Property in Wyoming?

- How to claim your Unclaimed Money / Property in Wyoming?

- Is it necessary to hire a Wyoming Unclaimed Property Finder?

What is Unclaimed Property / Money?

Unclaimed properties essentially refer to those properties that have been forgotten by their owners. Any financial asset including unpaid wages or commissions, uncashed dividends, customer deposits or overpayments, unclaimed savings and checking accounts, refunds, credit balances, travelers’ checks, paid-up life insurance policies, etc can be an unclaimed property.

Wyoming statutes determine what falls under the unclaimed property division in this state. These statutes also stipulate how long a property should remain in an abandoned state before it can be considered unclaimed. Here, the period of abandonment refers to the amount of time for which the holder was unable to get in touch with the property owner.

The Office of the State Treasurer handles the unclaimed property program in Wyoming, and the law governing this matter is elucidated in the Uniform Unclaimed Property Act, Chapter 24 Title 34 of 2011 Wyoming Statutes. The primary goal of the program is to reunite the property owners with their lost and abandoned property. The program also serves as a method of income generation for the state.

Which property is considered unclaimed in Wyoming?

An unclaimed or abandoned property does not arise out of assets intentionally left behind by people when they relocate to another state because not many people willingly do that. In reality, unclaimed money refers to neglected tangible and intangible property that can be easily converted into cash, and it results from forgetfulness or disregard for minuscule amounts of money.

Unclaimed money is generated when customers do not claim a refund or banks/government institutions fail to locate the owner because of an address change. It can also occur if employees forget to collect their last paycheck or avoid using electronic transfers. Wyoming acknowledges different types of properties as unclaimed assets if the holder reports them to the program after the stipulated period.

However, the rightful owner can retrieve their property anytime by filing a claim to it. In the case of businesses and relevant institutions, they need to submit unclaimed property reports on a regular basis to the State of Wyoming.

How Much Does New York Have in Unclaimed Assets?

As of May of 2021, New York has more than $16.5 billion in unclaimed assets. This is due to the large number of people who live in the Empire State along with the large number of employers located there. More than $1 million of that money goes back to locals every day. We recommend checking some other databases on the web as there are more than $42 billion in unclaimed assets available through other states and sites.

What is the extent of Unclaimed Property available in Wyoming?

Wyoming has over $60 million in unclaimed property, and the Wyoming State Treasurer makes a concerted effort to return to the citizens of Wyoming. In the last three decades, the unclaimed property program of Wyoming has returned more than $54 million, and it still has $85 million to return to property owners.

This figure is a paltry sum compared to the $42 billion available in unclaimed property in the entire United States of America, as estimated by the National Association of Unclaimed Property Administrators (NAUPA).

In 2017, Wyoming received $8 million, of which $6.5 million was returned to the citizens successfully. In 2019, the State received $9.138 million and paid out $6.857 million to 6,084 individuals and businesses. In 2020, the amount rose to $9.460 million, whereas $5.125 million was paid out to 8,062 recipients.

How to track down your Unclaimed Money / Property in Wyoming?

If you are a present or past resident of Wyoming, you can track down your share of unclaimed property or money in this state easily.

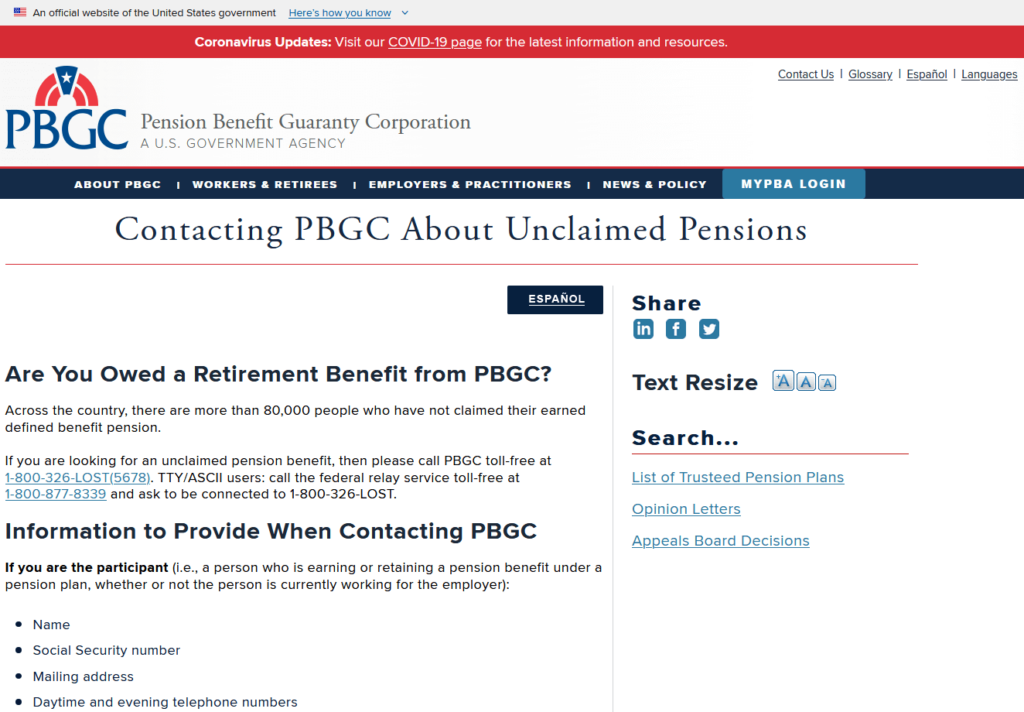

If you want to track down your money owed from your employers, like unpaid wages, the Department of Labor (DOL) may help you to recover back your wages if your employer violated the labor laws. You can search DOL’s database of workers to see if you owe any money from your employer. You might also search for any unclaimed pension from your former employers that either ended a defined pension plan or went out of business.

If you want to claim any unclaimed money available in your name from insurance, you can find it in the U.S. Department of Veterans Affairs (VA) database for unclaimed insurance funds. You might also be eligible for a refund if you had an FHA-insured mortgage. The U.S. Department of Housing and Urban Development (HUD) issues these insurance refunds. You can search the HUD database with your FHA case number to track your unclaimed money.

If you have unclaimed or undelivered Federal Tax Refunds Checks, search the Internal Revenue Service (IRS) website for more information.

For unclaimed money originating out of Banking and Investments when a financial institution is closed by a regulatory agency, you can search the Federal Deposit Insurance Corporation (FDIC) website that lists them.

You can track your unclaimed deposits from credit unions by logging into the National Credit Union Administration website.

Enforcement cases where a company/person owes investors money are listed by the Securities and Exchange Commission (SEC), and you can find them from the US SEC website.

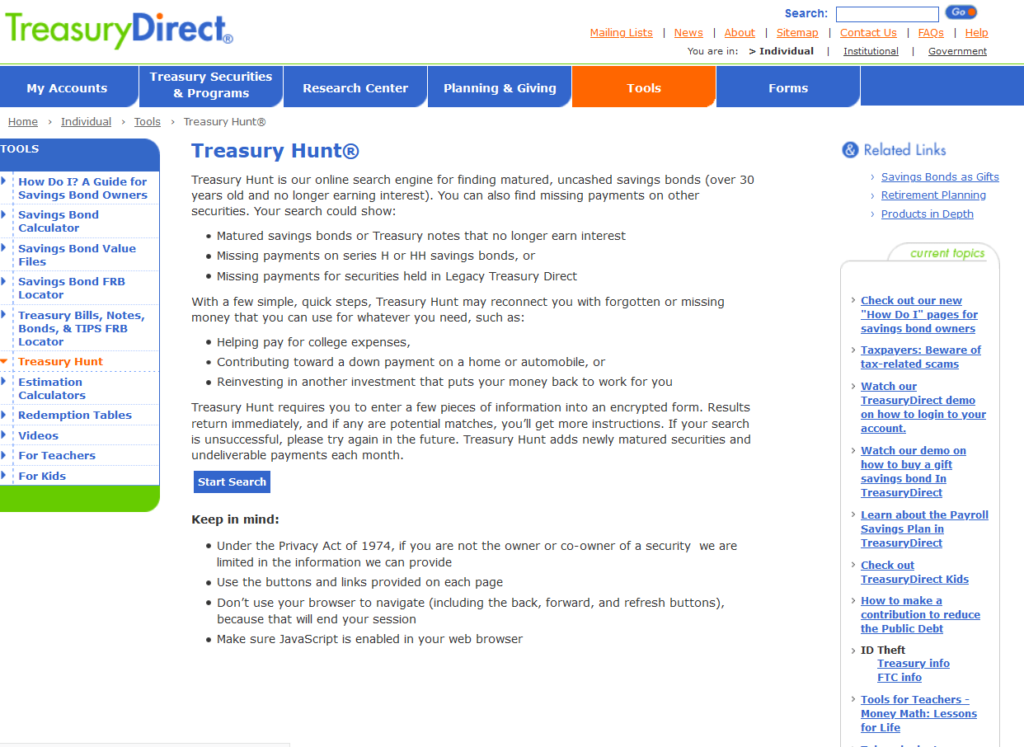

You can track your matured, uncashed savings bonds that are no longer earning interest from TreasuryHunt.gov.

You can also request to replace or reissue a paper bond that is either stolen, lost, mutilated, destroyed, or never received in electronic form from TreasuryDirect.

You can learn more about unclaimed money in bankruptcy from the US Courts website and search the U. S. Bankruptcy Unclaimed Funds Locator to check if you are entitled to any funds.

You can also find money owed to you from foreign governments if you have suffered a covered loss in a foreign country. You can put a claim for your loss through the unpaid foreign claims program. However, the Foreign Claims Settlement Commission reviews and decides if your claim is valid.

What is the required dormancy period for Unclaimed Property in Wyoming?

Every state has its own rules regarding the amount of time that needs to elapse for an unclaimed property to be considered abandoned. The dormancy period of an asset depends on its type. After the expiration of this period, the asset is enlisted in the State Treasurer’s registry under the owner’s name, and he/she can reclaim it at any point. Once the abandoned property is turned over to the state, it is the responsibility of the owner to reclaim it from the state.

The relevant dormancy period specified by the state law for most common unclaimed assets are:

Dormancy Period

Asset Type

15 years

Traveler’s checks

7 years

Non-bank money orders

5 years

- Savings accounts

- Checking accounts

- Deposits, refunds, and advances

- Safe deposit boxes

- Bank checks, drafts, and money orders

- Casualties

- Financial institutions shares

- Property held by fiduciaries

- Life insurance or annuity policies

3 years

- Stocks, dividends, and distributions

- Securities

- Bonds

- Gift cards, certificates, or credit memos

- Mineral proceeds and property originated or issued by an entity in the state

- IRAs, SEPs, and other similar plans

1 year

- Utility deposits and refunds

- Wages or salaries

- Property held by courts or public agencies

6 months

- Litigation awards or settlements

- Proceeds from class-action suits

- Property distributable by a business association in the course of dissolution

No specific provision

Demutualization proceeds

How to claim your Unclaimed Money / Property in Wyoming?

In order to make a valid claim, you have to furnish the Unclaimed Property Division of the State Treasurer’s Office with information about yourself. There are a set of rules for proving your identity as the owner and claiming the money. You need to submit certain documents like a copy of the driver’s license if the property is in the name of the claimant.

In case the claim is made by an heir or a business, they might have to provide some additional documents, depending on the property type and level of information provided about the owner. Until the claim is made, the State must hold all unclaimed properties perpetually, as per the law in Wyoming.

Every year, millions of dollars worth of unclaimed property are reported by The Wyoming State Treasurer’s Office, and you might be lucky enough to own some of it. It has now become easier to verify how much unclaimed property is available in your name, and you can claim it at any point in time by following these steps.

Step 1: You can initiate your search by clicking on the CLAIM PROPERTY under the UNCLAIMED PROPERTY tab on the Wyoming State Treasurer’s website.

Step 2: You will then be taken to the UNCLAIMED PROPERTY page, where you have to hit the SEARCH UNCLAIMED PROPERTY button.

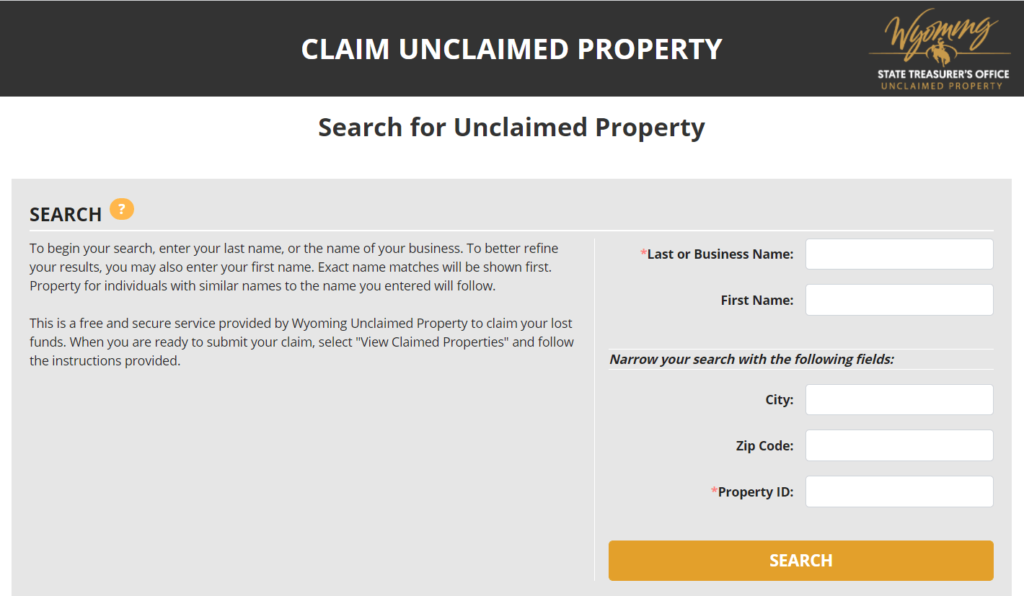

Step 3: Once you hit the SEARCH UNCLAIMED PROPERTY button, you will be redirected to the page where you have to put your details and run your search.

Step 4: In order to find your unclaimed property in Wyoming, it is mandatory to provide your last name to start the search. If you are a business, then you have to put the name of your business instead of your last name. If you want to narrow down the search further, you can key in your first name, city, zip code, and your property ID in the search box.

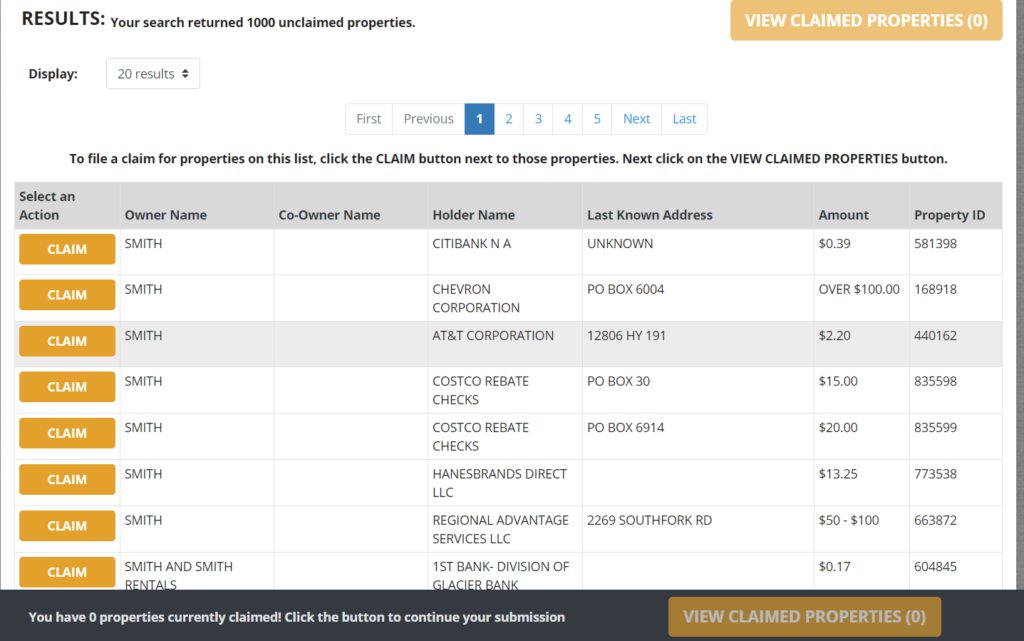

If your name is Leona Smith, then you have to put Smith in the Last Name column and search. Since this name is very common, too many listings can come up in the search result when you search with this name. This is the time when you need to add the additional parameters to make the search results manageable.

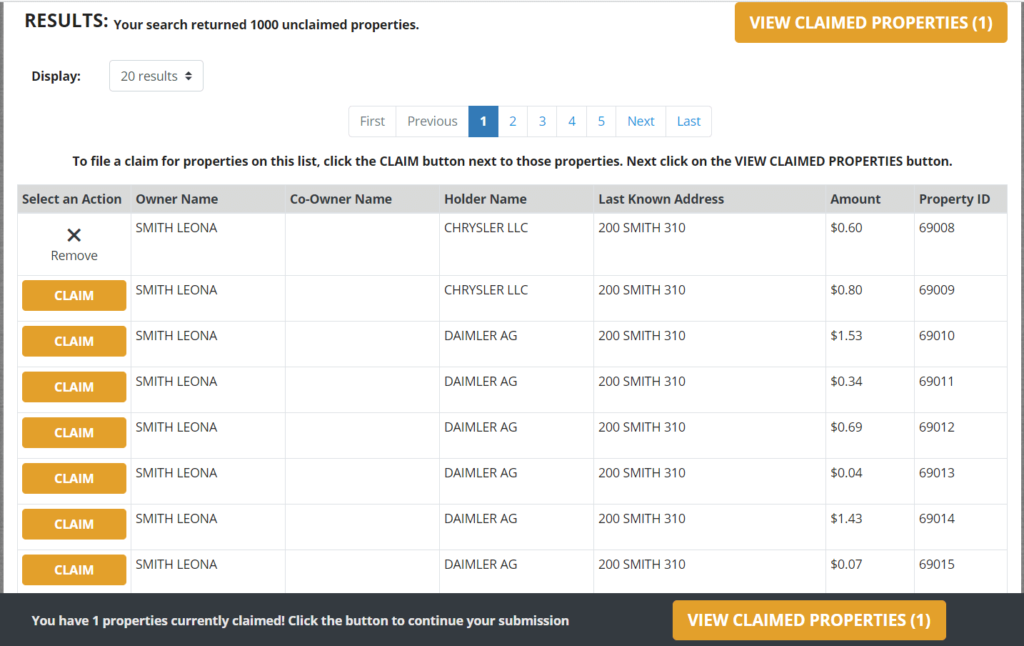

Some states in the US limit the number of potential results to 1000, and Wyoming belongs to this category. When you search for your last name Smith, you can see that only 1,000 results are being shown. However, there is no way to know if there are exactly 1,000 results or 1 million results.

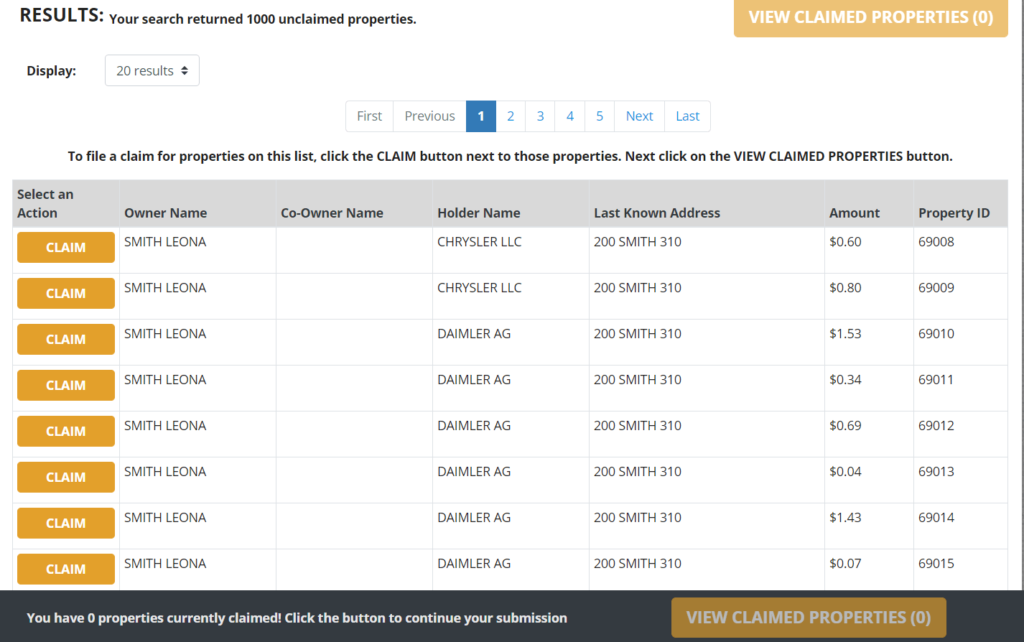

Step 5: Therefore, the next thing you have to do to limit your search result is add in your first name Leona. At first, it might seem that this has not limited your search because it is still showing 1,000 results.

However, going through the results will reveal that all ‘Leona Smith’s are listed first, and then all the names close to ‘Leona Smith’ are listed. Further on, you will see that the last few pages of the search result show the listings for all Smiths. Therefore, in the first few pages of the search results, you will be able to find all the actual matches for Leona Smith.

If, after adding your first name, you still find the number of search results unmanageable, then you can include the remaining search parameters to narrow down the results further. For instance, you can enter your zip code or the city of your last known addresses.

Step 6: Once you have found the potential properties listed in the name of Leona Smith, you can verify which property belongs to you from the information available for every property. The information includes the name of property owners, name of the co-owners, the holder’s name, last known address, claim amount, and the property ID.

There is a claim button on the extreme left of the row, which you have to hit to make the claim when you find the actual property in your name. However, the claim button might not be available for some properties. Instead, they might have an info button. Highlighting the button will give you some extra information about the property, like the property is still being held by the holder and has not come into the state’s custody yet.

Step 7: Once you have picked your property and hit the claim button, it will show that the property has been claimed and will give you the option to remove it from the list.

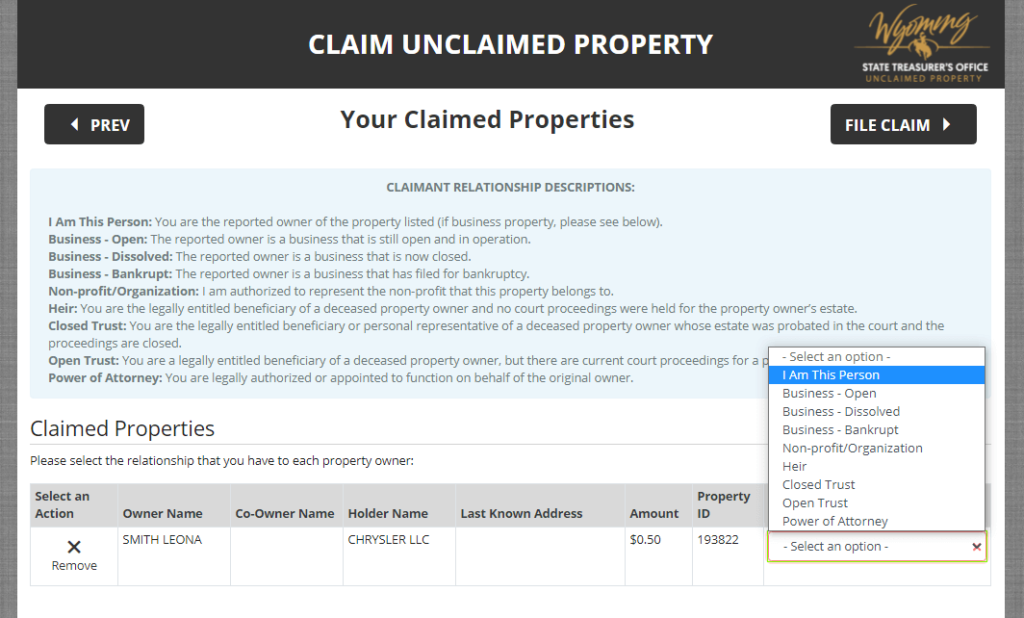

Step 8: After selecting the properties, you have to hit the view claimed properties button. Once you do that, you will be asked to provide a claimant relationship by choosing an option from the dropdown in the extreme right column. The available options are owner, business-open, business-dissolved, business-bankrupt, non-profit organization, heir, closed trust, open trust, and power of attorney.

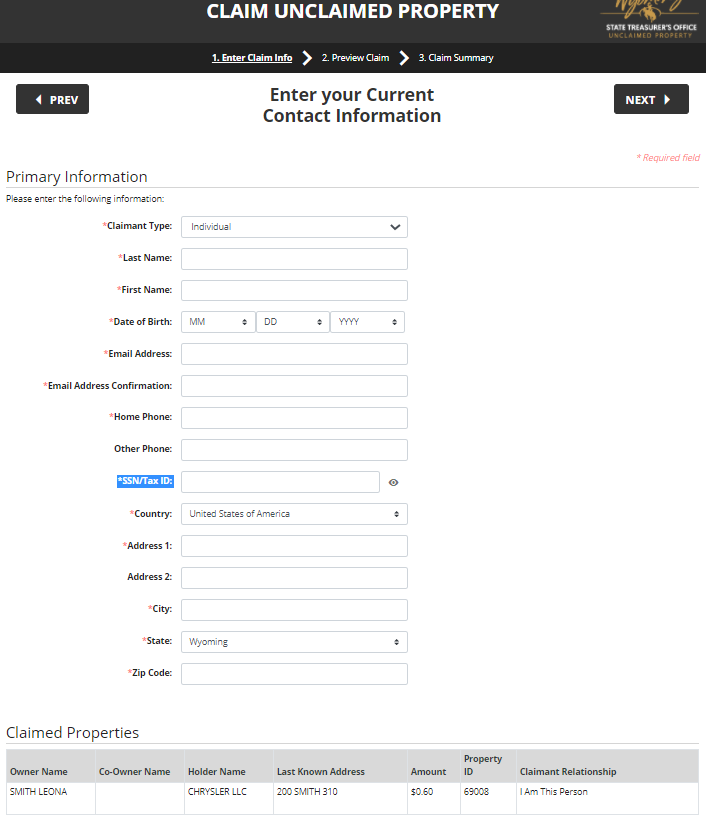

Step 9: Then you have to click on the file claim button. You will be taken to the page where you have to enter your current contact information.

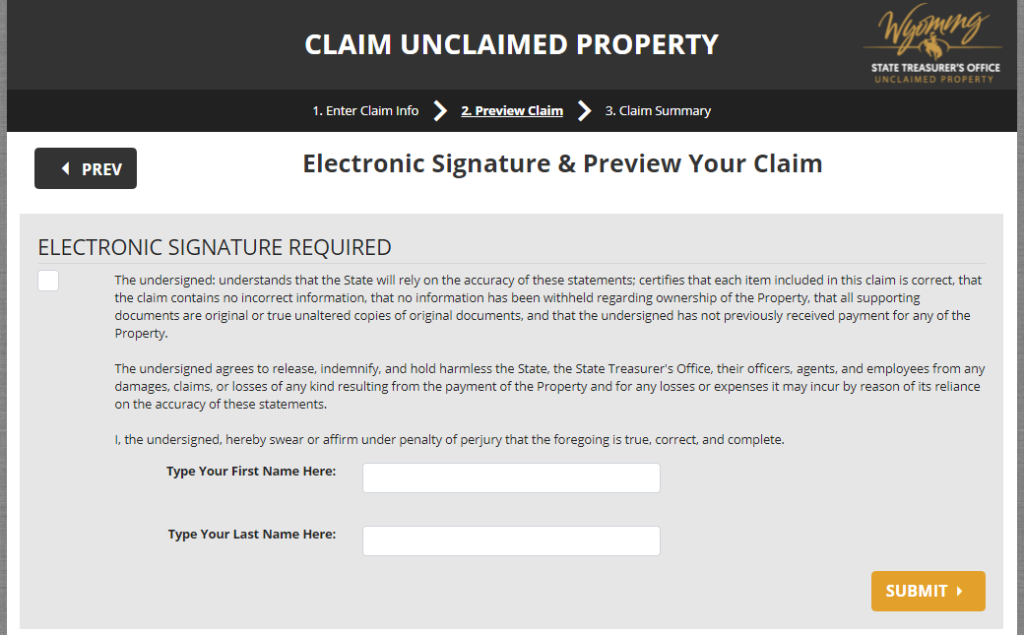

Step 10: Once you fill in your details and click next, you will be asked for an electronic signature, after which they will preview your claim. Once you submit the electronic signature, you will be able to register your claim successfully.

Is it necessary to hire a Wyoming Unclaimed Property Finder?

An unclaimed property finder is a third-party tracer who helps you find and claim your unclaimed property for a fee. These third-party tracers usually charge a percentage of the property recovered, and Wyoming does not have any cap on the percentage fee charged by the finders.

Therefore, signing an agreement to hire such a third-party tracer to recover your unclaimed property might entail paying substantial fees, and it is entirely up to you whether you want to get into such an agreement or not.

However, it is not possible to enforce such an agreement if it covers property that has been in the state’s custody for less than 24 months. The agreement might also become unenforceable if the property is scheduled to end up with the State within 12 months, irrespective of whether the property remains in the company’s or the holder’s possession until the reporting date.

An unclaimed property finder does not need any license to operate in Wyoming, though they must follow certain regulations. Finders from outside also have to abide by Wyoming standards and laws as they are applicable for all finders when the property is scheduled to come to Wyoming or Wyoming is the custodian of the unclaimed property.

Also, it might so happen that a finder contacts you of their own accord. You must be very cautious about signing any agreement to avoid any scam associated with unclaimed property. Paying an advanced fee for researching services is not advisable. If your property is in the custody of the Unclaimed Property Division, it is available to you for free.

Wyoming Unclaimed Property FAQ

Who can claim unclaimed property?

The rightful owner, an executor/executrix, or the direct heir of the estate when the owner is deceased can claim the property.

For what period does Wyoming hold the unclaimed property?

As is the case in most states and territories, Wyoming also holds unclaimed properties in perpetuity until the original owners or their heirs make a claim for the money.

What happens to unclaimed property that has not been claimed?

All unclaimed assets that are being remitted to Wyoming every year are held in custody indefinitely until the rightful owner or their heirs come forward to claim them. The owner has the right to claim the property at any point in time, and this right is never lost.

What is the duty of the Unclaimed Property Division?

The Unclaimed Property Division administers the Uniform Unclaimed Property Act. This law is a major part of the consumer protection legislation in Wyoming. It was created to collect, safeguard and return properties that are forgotten or lost to their rightful owners. No cost is involved in the process of inquiring or receiving unclaimed property in Wyoming.

Does Wyoming make a concerted effort to locate the actual owners?

Though some states in the US have extensive outreach programs for locating the original property owners, Wyoming is not equipped with a well-developed outreach program. Instead, it relies more on the property owners accessing the information on the unclaimed property database.

However, Wyoming State Treasurer Curtis E. Meier said that owing to some software upgrades and procedure implementation at the end of 2018, his department has been able to operate more efficiently in recent years. They have been able to return nearly 85% of the unclaimed money reported to them over the last few years.

How can you prevent your property from becoming unclaimed or lost?

Your property can become unclaimed, or abandoned, or lost if you lose all contacts with the holder. You can easily prevent such a situation from happening by keeping detailed account records with yourself. Contacting your property holders at least once a year is a must.

Also, make sure to inform your holders about any change in your contact information that you might have undergone, like a modification or change in name, address, phone number, or even marital status. That way, they would be aware of whom to contact and how to contact.

How to ensure your heirs know where your assets are in case of your death?

If you die, your property can become abandoned if your heirs are unaware of the property. To prevent such things from happening, you must keep detailed account records. You should also assign a trusted person to safeguard those records so that your heirs can make a claim on your property in the event of your death or incapacitation.

Why does the State take possession of all the unclaimed property in Wyoming?

The Wyoming state legislature realized that it was unfair to allow a company or an individual holding unclaimed property to make profits by using money that belonged to the original property owner. That is why the State takes over all the unclaimed property in Wyoming to protect the interests of the consumers. Unclaimed property laws are essentially consumer protection statutes that benefit the States that exercise them. These states can use the money lying in unclaimed property funds to build up their revenue.

Conclusion

Getting extra money, whether you need it or not, is always pleasurable. It can give you the freedom to do that little extra for yourself or your family that you always wanted to but could not. Wyoming might be a tiny state having a small population. Even then, it has returned millions of dollars worth of property to their rightful owners. Currently, it has millions more in possession, and you can qualify for a part of it if you have ever lived in Wyoming. You must check right now to see if you are about to get any of it. Use our ultimate guide to unclaimed property in Wyoming to see how you can file for money and other types of property in the Cowboy State.

Quickly Search For Unclaimed Money

Disclaimer: OurPublicRecords mission is to give people easy and affordable access to public record information, but OurPublicRecords does not provide private investigator services or consumer reports, and is not a consumer reporting agency per the Fair Credit Reporting Act. You may not use our site or service or the information provided to make decisions about employment, admission, consumer credit, insurance, tenant screening, or any other purpose that would require FCRA compliance.